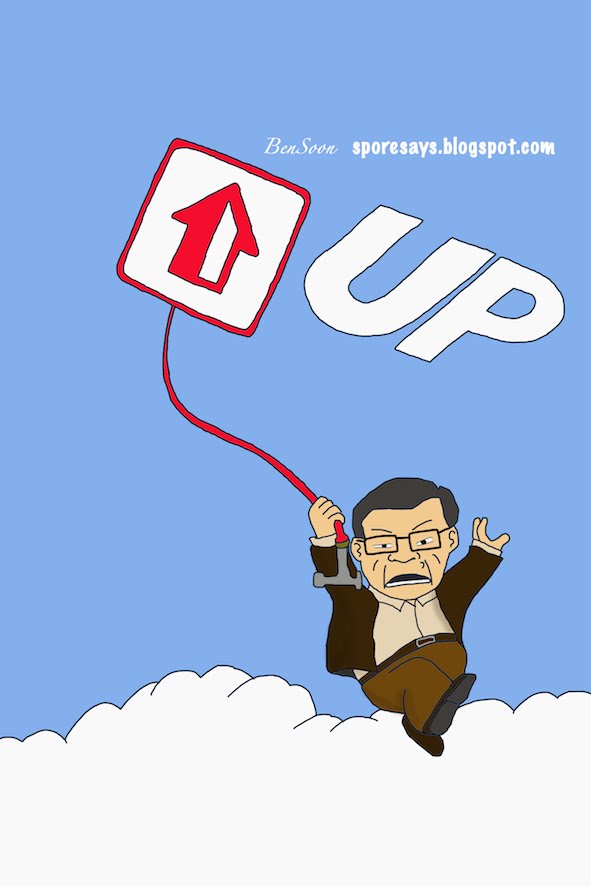

Housing Sector in Singapore Only Getting Hotter

Kevin Lim | March 27, 2011

Singapore. Wendy Cheng, 32, has been trying to buy a home for more than two years without success........

At her last attempt to buy an apartment directly from Singapore’s Housing Development Board,

she was given a waiting-list number of 1,983 for the 200 units offered, which meant she could get a unit only if 1,783 of the people in front of her dropped out.

“It’s like trying to win the lottery,” she said of her efforts to buy her own place,

a predicament shared by an increasing number of young Singaporeans who feel they can no longer afford homes, ......

Private home prices in Singapore rose 17.6 percent last year despite government attempts to cool the market in February and August.......

The city-state’s

median household income rose a much smaller 3.1 percent, or 0.3 percent after adjusting for inflation, to S$5,000 a month last year.....

But the HDB is building fewer apartments and charging more for them.

Prices of both resale HDB apartments and private property have also

soared due to an influx of foreigners in recent years.

“

The high property prices, especially for private homes, is a festering source of disappointment, unhappiness and perhaps anger among voters,” said Eugene Tan, a law lecturer at Singapore Management University. “

Parents are also concerned with how their children are going to afford comparable homes in the future. The angst and anxieties are made worse by the view that foreigners are pushing up property prices.”

Foreigners now make up 36 percent of Singapore’s population of 5.1 million, up from around 20 percent of four million people a decade earlier, after the

government made it easier for foreigners to work in the city-state. ........

Developers such as CapitaLand, 40-percent owned by the government’s Temasek Holdings, have also bid aggressively at land sales, buying sites at prices that require a further increase in home prices for them to break even..........

Reuters

http://www.thejakartaglobe.com/business/housing-sector-in-singapore-only-getting-hotter/431907