-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

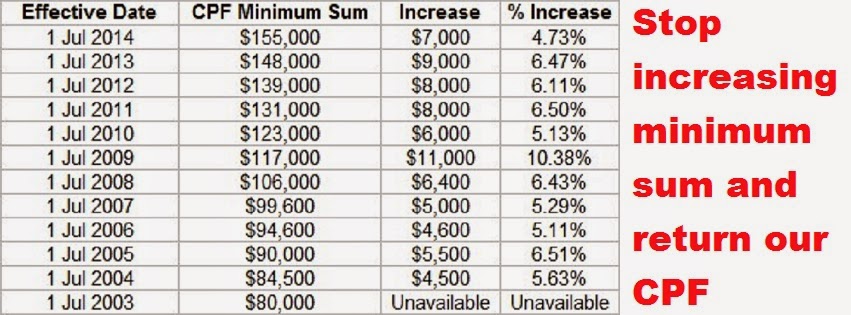

What Do You Prefer? Minimum Sum or Return Me My Money?

- Thread starter Sammy

- Start date

Or else what? Demanding is fine but you must have the firepower to back them up. Otherwise you end up like Lame Duck Obama.

An Ex-CPF Employee Exposes the 3 Biggest Complaints Singaporeans Have About Their CPF Accounts

http://blog.moneysmart.sg/kao-peh/3-biggest-complaints-singaporeans-have-about-cpf/

February 10, 2014

Few questions divide Singaporeans as much as this one – What is CPF used for? As you process your own answer to that question, chances are the words “retirement,” “housing,” healthcare” and maybe “Ponzi scheme” are running through your head. But no matter what function(s) you think CPF serves, everyone faces the reality of having to pay their “dues” to keep the system going. That means contributing 20% of your salary (up to age 50) every month to a scheme that only benefits those who vastly surpass the current minimum balance of $148K. Sadly, more Singaporeans who have money in CPF and need it can’t even touch it. An ex-CPF employee named “Brian” (who wishes to remain anonymous for very obvious reasons), who deals with the valid concerns of Singaporeans daily, was kind enough to help us shed some light on what Singaporeans complain about most when it comes to their CPF accounts. Here are Singaporeans’ 3 biggest complaints about their CPF accounts:

1. It’s Nearly Impossible to Access Your Retirement Account (RA) Funds

The biggest limiting factor people have when it comes to their CPF accounts is the fact that their Retirement Account (RA) funds are about as inaccessible as Area 51 until you reach the drawdown, which varies from 62 to 65 depending on your year of birth. The problem with having an inaccessible RA account is that it leaves Singaporeans still servicing their home loan with their CPF in a helpless situation because:

1.Retrenchment: No income means they can no longer make contributions into their Ordinary Accounts (OA).

2.Contribution level: The contribution level decreases significantly after 55, making it harder to meet the minimum cash component in RA.

“It’s sad, there were several occasions when we had to direct Singaporeans to HDB or the banks because our hands were tied – we couldn’t release their funds to them even though they may have thousands in their RA to help with their home loan repayments,” says Brian. Ironically, the only exceptions for using your RA funds involve purchasing property under the following conditions:

1.You can only use the excess in your RA AFTER setting aside the minimum cash component, which is currently $148K.

2.Of that $148K, you’ll need to maintain $74K in your RA, with the excess (excluding annual interests) being available for the purchase of property.

*Note on property purchases: According to Brian, there is a way for you to use your OA towards purchasing property. If you have booked a BTO flat before turning 55, you can write in to CPF to have funds from your OA reserved for the purchase. In fact, Singaporeans have been successful in having these requests approved.

2. You Can’t Withdraw As Much from CPF at Age 55

Just a few years ago, if you turned 55 before 2009, you could have withdrawn 50% of your combined OA and Special Account (SA) funds! So if you had today’s current minimum sum of $148K, you could withdraw $74,000. Then in 2009, the limit dropped to 40%. And then… well, I think you know where this is going right? Let’s just say that CPF reduced the withdrawal limit faster than an Indonesian palm plantation owner reduces forestland. Today, if you don’t have the full minimum sum of $148K – you ONLY get $5K. The rest gets sent over to your RA, which you probably won’t see for another 7 to 10 years.

The biggest complaints Brian received about the inability of some Singaporeans to get more than $5K were:

•Couldn’t pay off debts: Singaporeans who were financially troubled and had debts to pay off could not pay them even though they had thousands of dollars in their RA.

•In danger of home repossession: Singaporeans who were having trouble keeping up with their home loan repayments due to retrenchment or financial difficulty couldn’t access the money they needed to maintain their repayments even though they might have had $50K in their RA.

•Couldn’t go on pilgrimage: Many elderly Muslims who were waiting till age 55 to use their funds to go on pilgrimage (Hajj) were left disappointed when the amount they could withdraw wasn’t enough.

*Note on pledging your property: Brian points out that if you’ve used your CPF to purchase a home, you can opt to pledge or increase the pledge of your property. So if you just turn 55 this year and you’ve got the full minimum sum of $148K, you can pledge your property up to $74K, freeing up the “excess” $74K in your CPF for withdrawal.

3. There Are Times When You CAN’T Use CPF for Housing

When you buy a home, there’s a limit to how much CPF you can use to purchase a home, called the Valuation Limit (VL). The VL is determined by the lower value of either the market price or the valuation price of a home, and you cannot withdraw more than 120% of the VL, which is called the Withdrawal Limit (WL). So what happens when you reach the VL of your home? If you’re below 55, you’ll need to maintain either half the prevailing minimum sum cash component (Your OA+SA+SA investments) or the minimum sum cash component in your RA if you’re over 55 (and you can only use your RA excess to service your home loan). If you don’t follow these conditions, you CAN’T use your CPF to service your home loan. Not knowing when you can’t use your CPF to service your home loan is a huge reason why people contact CPF, especially when Singaporeans:

•Reach their VL before age 55 and haven’t maintained half of their prevailing minimum sum cash component (OA+SA+SA investments).

•Reach their VL after age 55 and haven’t maintained their minimum sum cash component in their RA (only RA excess can be used!).

•Surpass their WL.

CPF Staff Are There to Help, But They Don’t Make Policy

“We understand that CPF needs to be more flexible in allowing Singaporeans to use their funds. What’s the point of having thousands of ‘untouchable’ dollars set aside for retirement when Singaporeans are dealing with financial difficulty now? But we do our best to help people out as much as possible,” says Brian. Brian also stated that the complaints above made up about 70% of their total communications. That’s A LOT of daily gripes to deal with. Most Singaporeans have their reasons to complain about CPF. If you’ve read Dear CPF: Give Me Back My Money, you know just a few of the many grievances people have with the scheme. But before you call up or email CPF to give them a piece of your mind, please remember that the hard working employees don’t set policy – they’re there to help you as best as they can.

What complaints or praise do you have about CPF? Share your experience on Facebook!

http://blog.moneysmart.sg/kao-peh/3-biggest-complaints-singaporeans-have-about-cpf/

February 10, 2014

Few questions divide Singaporeans as much as this one – What is CPF used for? As you process your own answer to that question, chances are the words “retirement,” “housing,” healthcare” and maybe “Ponzi scheme” are running through your head. But no matter what function(s) you think CPF serves, everyone faces the reality of having to pay their “dues” to keep the system going. That means contributing 20% of your salary (up to age 50) every month to a scheme that only benefits those who vastly surpass the current minimum balance of $148K. Sadly, more Singaporeans who have money in CPF and need it can’t even touch it. An ex-CPF employee named “Brian” (who wishes to remain anonymous for very obvious reasons), who deals with the valid concerns of Singaporeans daily, was kind enough to help us shed some light on what Singaporeans complain about most when it comes to their CPF accounts. Here are Singaporeans’ 3 biggest complaints about their CPF accounts:

1. It’s Nearly Impossible to Access Your Retirement Account (RA) Funds

The biggest limiting factor people have when it comes to their CPF accounts is the fact that their Retirement Account (RA) funds are about as inaccessible as Area 51 until you reach the drawdown, which varies from 62 to 65 depending on your year of birth. The problem with having an inaccessible RA account is that it leaves Singaporeans still servicing their home loan with their CPF in a helpless situation because:

1.Retrenchment: No income means they can no longer make contributions into their Ordinary Accounts (OA).

2.Contribution level: The contribution level decreases significantly after 55, making it harder to meet the minimum cash component in RA.

“It’s sad, there were several occasions when we had to direct Singaporeans to HDB or the banks because our hands were tied – we couldn’t release their funds to them even though they may have thousands in their RA to help with their home loan repayments,” says Brian. Ironically, the only exceptions for using your RA funds involve purchasing property under the following conditions:

1.You can only use the excess in your RA AFTER setting aside the minimum cash component, which is currently $148K.

2.Of that $148K, you’ll need to maintain $74K in your RA, with the excess (excluding annual interests) being available for the purchase of property.

*Note on property purchases: According to Brian, there is a way for you to use your OA towards purchasing property. If you have booked a BTO flat before turning 55, you can write in to CPF to have funds from your OA reserved for the purchase. In fact, Singaporeans have been successful in having these requests approved.

2. You Can’t Withdraw As Much from CPF at Age 55

Just a few years ago, if you turned 55 before 2009, you could have withdrawn 50% of your combined OA and Special Account (SA) funds! So if you had today’s current minimum sum of $148K, you could withdraw $74,000. Then in 2009, the limit dropped to 40%. And then… well, I think you know where this is going right? Let’s just say that CPF reduced the withdrawal limit faster than an Indonesian palm plantation owner reduces forestland. Today, if you don’t have the full minimum sum of $148K – you ONLY get $5K. The rest gets sent over to your RA, which you probably won’t see for another 7 to 10 years.

The biggest complaints Brian received about the inability of some Singaporeans to get more than $5K were:

•Couldn’t pay off debts: Singaporeans who were financially troubled and had debts to pay off could not pay them even though they had thousands of dollars in their RA.

•In danger of home repossession: Singaporeans who were having trouble keeping up with their home loan repayments due to retrenchment or financial difficulty couldn’t access the money they needed to maintain their repayments even though they might have had $50K in their RA.

•Couldn’t go on pilgrimage: Many elderly Muslims who were waiting till age 55 to use their funds to go on pilgrimage (Hajj) were left disappointed when the amount they could withdraw wasn’t enough.

*Note on pledging your property: Brian points out that if you’ve used your CPF to purchase a home, you can opt to pledge or increase the pledge of your property. So if you just turn 55 this year and you’ve got the full minimum sum of $148K, you can pledge your property up to $74K, freeing up the “excess” $74K in your CPF for withdrawal.

3. There Are Times When You CAN’T Use CPF for Housing

When you buy a home, there’s a limit to how much CPF you can use to purchase a home, called the Valuation Limit (VL). The VL is determined by the lower value of either the market price or the valuation price of a home, and you cannot withdraw more than 120% of the VL, which is called the Withdrawal Limit (WL). So what happens when you reach the VL of your home? If you’re below 55, you’ll need to maintain either half the prevailing minimum sum cash component (Your OA+SA+SA investments) or the minimum sum cash component in your RA if you’re over 55 (and you can only use your RA excess to service your home loan). If you don’t follow these conditions, you CAN’T use your CPF to service your home loan. Not knowing when you can’t use your CPF to service your home loan is a huge reason why people contact CPF, especially when Singaporeans:

•Reach their VL before age 55 and haven’t maintained half of their prevailing minimum sum cash component (OA+SA+SA investments).

•Reach their VL after age 55 and haven’t maintained their minimum sum cash component in their RA (only RA excess can be used!).

•Surpass their WL.

CPF Staff Are There to Help, But They Don’t Make Policy

“We understand that CPF needs to be more flexible in allowing Singaporeans to use their funds. What’s the point of having thousands of ‘untouchable’ dollars set aside for retirement when Singaporeans are dealing with financial difficulty now? But we do our best to help people out as much as possible,” says Brian. Brian also stated that the complaints above made up about 70% of their total communications. That’s A LOT of daily gripes to deal with. Most Singaporeans have their reasons to complain about CPF. If you’ve read Dear CPF: Give Me Back My Money, you know just a few of the many grievances people have with the scheme. But before you call up or email CPF to give them a piece of your mind, please remember that the hard working employees don’t set policy – they’re there to help you as best as they can.

What complaints or praise do you have about CPF? Share your experience on Facebook!

i say the garmen hold our hands till we die!!!!

[video=youtube;C-PNun-Pfb4]http://www.youtube.com/watch?v=C-PNun-Pfb4[/video]

[video=youtube;C-PNun-Pfb4]http://www.youtube.com/watch?v=C-PNun-Pfb4[/video]

MAKE IT VERY CLEAR THAT THE FUCKING PAPs ARE SCREWING AND SUEING THE SINGAPOREANS

AND NOT JUST ROY

PAPs ARE ATTACKING SINGAPOREANS BY THIS ATTACK ON ROY

PAPs ARE FIXING THEIR PIANO WIRES AROUND THE NECKS OF SINGAPOREANS

PAPs ARE FIXING THE NECKLACE OF BURNING CAR TYRES ON THE NECKS OF SINGAPOREANS

WILL SINGAPOREANS REMAIN HEAD DOWN DOWN AND ARSEHOLES UP HIGH HIGH FOR PAPs TO FUCK

AND TO TIEW AND TO TIE PIANO WIRES?

TURN UP AT THE RALLY AT HONG LIM TO SUPPORT ROY AND SHOW PAPs WE FIGHT THIS TIME

ENOUGH IS ENOUGH

Hang those PAP maggots cockroaches with piano wires from lamp posts to make them dance before it is too late and we have no more CPF to get back.

BBQ those PAP maggots cockroaches before it is too late and we have no more CPF to get back.

Cut a few more arseholes into those PAP maggots cockroaches to let out their shit before it is too late and we have no more CPF to get back.

Make those PAP maggots cockroaches eat joss sticks and candle wax before it is too late and we have no more CPF to get back.

GET RID OF THE POISON IN SINGAPORE

HANG ALL THOSE FUCKING PAPs AND THEIR COLLABORATORS

BBQ THE BASTARD PAPs

AND SINGAPORE CAN BE AS GOOD IF NOT BETTER THAN SWITZERLAND

OR REMAIN HEAD DOWN DOWN AND ARSEHOLES UP HIGH HIGH TO BE FUCKED TO BE TIEWED TO BE KANNED BY THE PAP MAGGOTS COCKROACHES

Kill them all PAPs

Let GOD sort out the good from the really bad ones

The good PAPs can then eat joss sticks and candle wax from time to time

The bad PAPs like smear of shit on sole of shoe LKY will be raped and tiewed and kanned by legions of ghouls and demons and not ever

get time off to eat joss sticks and candle wax

Hang those PAP maggots cockroaches with piano wires from lamp posts to make them dance before it is too late and we have no more CPF to get back.

BBQ those PAP maggots cockroaches before it is too late and we have no more CPF to get back.

Cut a few more arseholes into those PAP maggots cockroaches to let out their shit before it is too late and we have no more CPF to get back.

Make those PAP maggots cockroaches eat joss sticks and candle wax before it is too late and we have no more CPF to get back.

None of those in PAP work for anyone but that smear of shit on sole of shoe LKY, to help him hold down Singaporeans to screw and fuck hundreds of BILLIONs from us all into smear of shit on sole of shoe LKY stinkapore sovereign funds.

They are there in PAP because LKY know that they are a bunch of self serving greedy bastards and scrapings of scums of society. To call them maggots cockroaches will be to insult real maggots and real cockroaches.

LKY will never allow good decent people into the PAP and good decent people will not want to get into the PAP.

Those in PAP are the most corrupt and moral degenerates and moral bankrupts and moral filths that are being presented to stinkaporeans as moral compasses.

Despite the leeching and fucking of singaporeans by the cheebye PAP and LKY, Singapore still managed to survive to date.

Despite their being hung as a fucking millstones around the necks of Singaporeans and the idiocy and corrupt manipulations of PAP and LKY, Singapore still not dead yet.

WE ALL ARE NOW WAITING FOR THE DEATH OF LKY IN COMING DAYS OR WEEKS.

WE ALL WILL YUM SENG AND YUM SENG AND YUM SENG AGAIN AND AGAIN DANCING SINGING ON TABLE TOPS AND STREETS

WE THEN WILL SEE THOSE IN PAP WITH SHARPENED KNIVES HOOTING ARSEHLOON A DOZEN NEW ARSEHOLES AND THE DEATH OF THE ENTIRE LEE KWA CLAN

WE THEN WILL PICK UP PIANO WIRES AND HANG ALL THOSE REMAINING PAP AND THEIR COLLABORATORS FROM LAMP POSTS AND SEE THOSE BASTARDS AND BITCHES DANCE.

AND HAPPINESS WILL RETURN TO OUR LAND.

AND STINKAPORE WILL BECOME SINGAPORE ONCE MORE.

https://www.torproject.org/about/overview.html.en

Similar threads

- Poll

- Replies

- 125

- Views

- 5K

- Replies

- 6

- Views

- 645

- Replies

- 0

- Views

- 343

- Replies

- 16

- Views

- 815

- Replies

- 1

- Views

- 292