Australian Woman’s Fight to Prove Singapore Fraud

Harassed and vilified by unknown parties, she continues to press case despite bank’s explanations

For six years, an Australian woman named Julie O’Connor (above) has vainly been tilting against the Singapore establishment in an effort to raise claims of fraud and what she calls a cover-up by powerful people over the acquisition of the Singapore and Vietnam assets of an Australia-based firm, Strategic Marine Pty Ltd. She alleges her husband Terry O'Connor, a shareholder, was thwarted in his attempts to acquire a controlling interest via pre-emptive rights he possessed.

For her efforts, O’Connor says she has been

vilified on social media, publicly referred to online as a cockroach, obese, her photographs have been doctored into news articles which falsely showed her family members as being convicted pedophiles, all while she says she has otherwise been ignored by Singapore officials, all of whom repeatedly argue that evidence of any crime in Singapore is lacking.

Facebook attack

O’Connor says she has recently been notified by Facebook (below) that she has been targeted by sophisticated spyware not normally used by individuals but rather intrusive states, along with several other Singaporeans at odds with authorities including independent journalists Terry Xu and Kirsten Han and others. There is no indication of where the attacks are coming from.

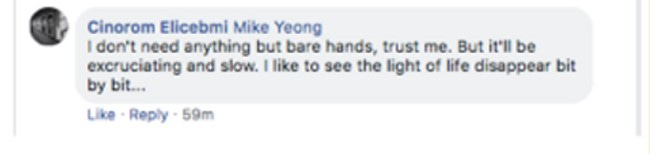

Attempts also have been made to hack O’Connor’s website,

www.bankingonthetruth.com, and intimidating messages have been posted threatening that someone would fly to Australia to kill her, as the screenshots below show.

As far as O’Connor knows, these online attacks/emails have never been investigated by Singapore police, even though some have been sent to her husband and daughter at their place of work. Senior figures from DBS, Singapore Police, and the Singapore Government were copied in, she says.

O’Connor has bombarded DBS Bank, Southeast Asia’s and Singapore’s largest in terms of assets, with emails and letters and has sought help from Marcus Lim, manager of the DBS account for the Monetary Authority of Singapore, Tharman Shanmugaratnam, a Senior PAP minister and chairman of the MAS, Lucien Wong, Singapore’s attorney general, K Shanmugam, the Singapore law minister, and Prime Minister Lee Hsien Loong himself, to no avail.

Enquiries by Asia Sentinel to the Monetary Authority of Singapore, the Ministry of Law, and other agencies were met with minimal comment. A spokeswoman for the MAS said ‘MAS takes all allegations of fraud seriously, and had responded to Ms. O’Connor earlier and followed up on her concerns. Our engagements with members of the public and financial institutions are confidential, and the details of such interactions are not shared with third parties.”

The office of Prime Minister Lee Hsien Loong told Asia Sentinel by email that the office has “corresponded directly with Ms. Julie O’Connor regarding her allegations, and will continue to engage her as necessary. We will not be commenting further on the matter, or responding to the questions you have posed, as it is inappropriate for us to discuss such matters with third parties.”

Allegations against tycoon

O’Connor’s allegations involve Lionel Lee Chye Tek, who at the time was managing director of Ezra Holdings and chairman of its subsidiary Triyards, which were involved in offshore services, ship construction, global offshore, and marine industries. The group at that time was aiming to consolidate its position as one of the largest offshore services players in the Asia-Pacific region and was, at that point, darling on the Stock Exchange of Singapore

Lionel Lee was alleged by others to have caused four forged signatures to be affixed to legal documents on behalf of a no-longer-operating Bahamas company, documents which related to Strategic Marine, the firm Lionel Lee’s company was attempting to acquire. An associate of Lee, the then-CEO of KTL Global,

Tan Kheng Yeow, was allegedly enlisted to enter into an irrevocable option deed to acquire power of attorney for the company. O’Connor charged that was an attempt to defraud her husband by persuading him his claim was worthless and that he should sell his 4 percent shareholding for A$1.

After Lee’s initial attempt to acquire Strategic Marine through Tan – for A$7 – was frustrated due to allegations of forgery, DBS would enter the arena. At issue with DBS, she said, were two letters purportedly from bank officials that were used to downgrade Strategic Marine’s week-old independent valuation by A$30-40 million and retroactively strip away O’Connor’s exercised pre-emptive right, prior to Lee’s attempt to acquire the firm for just A$1.265 million. A request to the DBS law firm Wong Partnership to explain the valuation downgrade was not answered.

DBS’s legal staff, O’Connor alleged, was asked by Australian legal firm Minter Ellison to authenticate the two letters, which she displayed for Asia Sentinel and which she describes as

littered with errors or irregularities that banks aren’t supposed to make, including lack of a bank address on the stationery, absence of reference, and missing or duplicate bullet points. After eight weeks, she says, during which time Lee completed the acquisition, DBS refused to authenticate the letters, citing banking secrecy obligations.

DBS, through Wong Partnership, says its investigations “confirmed that the two letters in question are authentic and originated from our clients. Further, the results of these investigations were provided to Mr. & Mrs. O’Connor on previous occasions and that the O’Connors refused to accept the findings.”

Lee, acting on behalf of Triyards, ultimately acquired the Strategic Marine assets despite the Triyards Board’s awareness of O’Connor’s husband’s exercise of his pre-emptive right, the O’Connors charge. Lee at the time was represented by the high-profile Singapore law firm Allen & Gledhill, which was headed by the current Attorney General Lucien Wong. Lee's personal lawyer was said to be Edwin Tong, now Singapore’s second law minister.

Lee empire capsizes

Lee’s own empire was headed for a figurative iceberg.

KGI Securities Singapore analyst Joel Ng in a research note wrote that Ezra Holdings had been reporting negative free cash flows in the previous 10 years, even when oil prices were above US$100 a barrel.

"Ezra leveraged up too much during the oil boom years, and the low oil price environment over the past two years dealt the final blow," he wrote, adding that the group's persistently weak free cash flows had resulted in a "highly unsustainable" balance sheet.

"Ezra basically wanted to compete against its peers funded with debt rather than equity. I would say it was blinded by its ambition and the fact that credit was readily available during that time," Ng said.

Study highlights mismanagement

According to an exhaustive, five-part analysis of Ezra Holdings and its subsidiaries by National University of Singapore Professor Mak Yuen Teen, titled

EZRA and the Tri-tanic: “Based purely on public information, there were arguably failure to disclose material information on a timely basis, false or misleading disclosures, failure to disclose interests in transactions, insider trading, and failure to discharge directors’ duties.”

There were other questions, Mak wrote, “whether contract wins announced by the companies and the secondary listing of EOL just 15 months before it started reporting quarterly losses lured investors into buying notes, convertible bonds, and shares of the companies.”

Mak, in an email, said he was aware of O’Connor’s objections and said there was good cause to investigate them. Lim Tean, a lawyer and founder of the opposition People’s Voice political party, said O’Connor’s allegations are well known in the opposition political community and bear looking into.

Lee Unreachable

Attempts by Asia Sentinel to reach Lee through an associate got no response. By one report, he has moved to Thailand although that has not been verified.

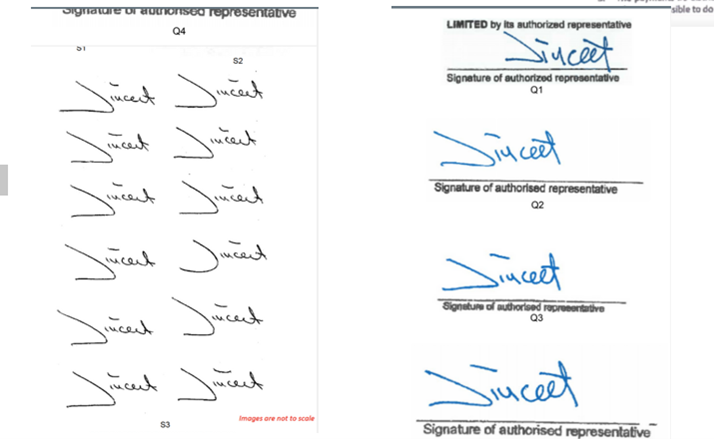

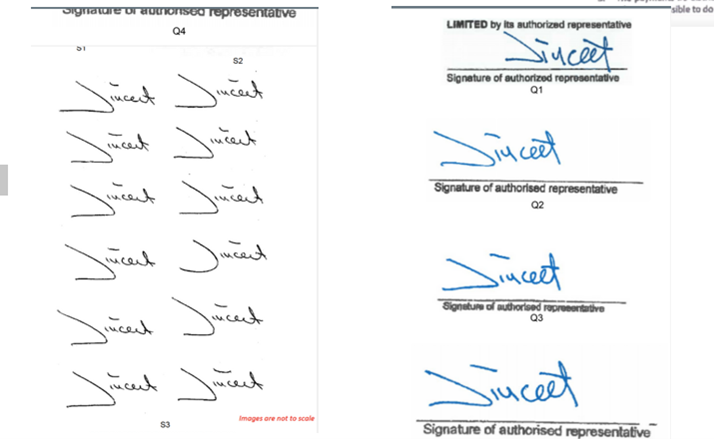

Having paid more than A$300,000 for the shareholding only to be told all other SM shareholders had agreed to sell their shares to Lee’s acquaintance Tan for $1, O’Connor says she became suspicious and began digging. She says she found evidence of four forged signatures on Strategic Marine documents. A handwriting expert hired by the O’Connors analyzed the alleged forged signatures below. The supposedly actual signatures are on the left and alleged forged signatures are on the right. Vincent Lau told the O’Connors he hadn’t signed the documents.

O’Connor possesses a sworn statement from Vincent Lau that he had never seen, signed nor authorized anyone to use his signatures on documents, on behalf of the Bahamas entity which had been wound up 18 months before.

Furious DBS response

DBS Bank answered Asia Sentinel’s queries about the matter with a bristling letter from Wong Partnership, in which the law firm, which represents the bank, demanded that Asia Sentinel repeat the law firm’s letter verbatim in its story and reserved the right to sue.

O’Connor, the letter said, has not been ignored and the couple have raised the matters repeatedly with them. The central issue, according to the law firm, “pertains to the authenticity of the two letters, and investigations confirmed the letters are authentic. The contemporaneous record shows the circumstances under which these letters were sent fully justified their existence. There is no evidence of wrongdoing on the part of DBS or its employees.”

The bank, according to the law firm, “had constantly engaged with Mrs. O’Connor as well as Mr. O’Connor and other third parties. It is unfortunate that Mrs. O’Connor has since been attempting an ex post facto criticism of our client’s investigations as she has simply refused to accept any of the conclusions. Our client, therefore, saw no further purposes in continuing to engage with her.”

Bank refuses further response

A follow-up email with more questions elicited the response that “Unless you are able to furnish any new and relevant information and/or documents to substantiate the allegations made in your emails of 10 December 2021 and 24 December 2021, our clients do not see any purpose in further engaging with you.” It added that Mrs. O’Connor had acted with malice, which seems far-fetched but in legal terms would appear to be preparation for a lawsuit.

O’Connor’s crusade may or may not be valid. The documents show irregularities although even banks could commit errors. At the very least, there is no reason those irregularities and the

many other serious concerns she raises shouldn’t be explained by DBS, the Singapore regulators, and legal bodies.

As she says, “Who is being protected and why?” she asked. “Is it Lee, DBS, Allen & Gledhill, the regulators who failed to act, the Audit Committee who stood down and not up? Who failed to look out for the Ezra Holdings and Triyards shareholders?”