https://www.sohu.com/a/341525350_115495?_f=index_businessnews_0_6

中国经济时报

2.8万文章 1.4亿总阅读

查看TA的文章>

0

防返贫致贫 中再集团超百亿保险保障将落地

2019-09-18 00:50

本报记者 姜业庆

如何有效解决因病因灾、因意外返贫的问题和痛点?日前,中再集团发布了“防返贫保险方案”,目的是为青海省循化县7万余循化百姓提供累计超百亿元的保险保障,在脱贫攻坚战中构筑起坚实的防范致贫返贫的“拦水坝”和“防火墙”。据悉,作为全国第一个整体脱贫的少数民族,青海省循化撒拉族自治县在2018年9月29日成功脱贫摘帽。

中再集团自2002年定点帮扶循化县以来,立足专业优势,开创性推出以保险扶贫为核心,以产业扶贫、教育扶贫、结对帮扶等为配套的“1+N”精准扶贫模式,累计投入扶贫款8185万元,为贫困群众提供保险保障总计数十亿元。

据介绍,“防返贫”保险方案具有四大特点:一是突出保障返贫风险的核心需求,在原有保障疾病、灾害、意外风险基础上,扩展保障因校园意外、家庭财产损失等返贫的风险,进一步扩大保障范围,覆盖循化县7万余人,风险保障额度超过百亿元;二是突出支持循化支柱产业,加强人员保障、支持产业升级,通过防返贫保险将分散在全国的3万余名循化拉面产业人员纳入保险保障范围,从2018年起连续三年每年投入1000万元,引入撬动金融资金1.5亿元,支持循化撒拉族全国7500余间拉面店面提档升级,并应用5G技术实现数据集中化和远程管理;三是可复制可组合易推广,防返贫保险在保险责任组合上能够根据不同地区和不同人群特点进行调整,在承保方式上将原来10余个险种简化为2个,更便于推广;四是企业与政府紧密配合,建立健全扶贫项目的会商机制,保险扶贫具有强大的组织保障。

中国投资有限责任公司党委副书记、监事长杨国中指出,中投公司正探索创新金融扶贫方式,推动建立稳定的防返贫机制。中再集团“防返贫”保险方案的目的就是建立稳定脱贫、防止返贫的长效机制。返回搜狐,查看更多

http://www.netsend.cn/showinfo-28-120434-0.html

防返贫致贫 中再集团超百亿保险保障将落地

2019-09-18已围观 95 次来源:互联网编辑:热点新闻网

本报记者 姜业庆

如何有效解决因病因灾、因意外返贫的问题和痛点?日前,中再集团发布了“防返贫保险方案”,目的是为青海省循化县7万余循化百姓提供累计超百亿元的保险保障,在脱贫攻坚战中构筑起坚实的防范致贫返贫的“拦水坝”和“防火墙”。据悉,作为全国第一个整体脱贫的少数民族,青海省循化撒拉族自治县在2018年9月29日成功脱贫摘帽。

中再集团自2002年定点帮扶循化县以来,立足专业优势,开创性推出以保险扶贫为核心,以产业扶贫、教育扶贫、结对帮扶等为配套的“1+N”精准扶贫模式,累计投入扶贫款8185万元,为贫困群众提供保险保障总计数十亿元。

据介绍,“防返贫”保险方案具有四大特点:一是突出保障返贫风险的核心需求,在原有保障疾病、灾害、意外风险基础上,扩展保障因校园意外、家庭财产损失等返贫的风险,进一步扩大保障范围,覆盖循化县7万余人,风险保障额度超过百亿元;二是突出支持循化支柱产业,加强人员保障、支持产业升级,通过防返贫保险将分散在全国的3万余名循化拉面产业人员纳入保险保障范围,从2018年起连续三年每年投入1000万元,引入撬动金融资金1.5亿元,支持循化撒拉族全国7500余间拉面店面提档升级,并应用5G技术实现数据集中化和远程管理;三是可复制可组合易推广,防返贫保险在保险责任组合上能够根据不同地区和不同人群特点进行调整,在承保方式上将原来10余个险种简化为2个,更便于推广;四是企业与政府紧密配合,建立健全扶贫项目的会商机制,保险扶贫具有强大的组织保障。

中国投资有限责任公司党委副书记、监事长杨国中指出,中投公司正探索创新金融扶贫方式,推动建立稳定的防返贫机制。中再集团“防返贫”保险方案的目的就是建立稳定脱贫、防止返贫的长效机制。

分享到0

上一篇:听说房价要降了,什么时候买合适呢?

https://www.thepaper.cn/newsDetail_forward_7938490

巩固提升脱贫攻坚成果!全市将实施防止返贫致贫保险工作

2020-06-21 08:28 来源:澎湃新闻·澎湃号·政务

字号

香格里拉发布

关注

在脱贫攻坚关键时期,为进一步巩固提升脱贫攻坚成果,香格里拉市全面贯彻落实习近平新时代中国特色社会主义思想和党的十九大精神,以习近平总书记关于扶贫工作的重要论述为指导在抓好精准扶贫精准脱贫,减少贫困存量的同时,积极探索精准防贫机制,进一步创新金融扶贫、创新保险保障机制,完善保险扶贫方式,控制贫困数量,从源头上筑起“截流闸”和“拦水坝”,着力提升贫困群众生活保障水平,减少因病、因学、因灾等原因造成脱贫返贫问题发生,切实巩固脱贫成果,确保与全国、全省、全州同步全面建成小康社会。出台了《香格里拉市防止返贫致贫保险工作实施方案》等措施助力脱贫攻坚战。

往下看!

带你具体了解

《香格里拉市防止返贫致贫保险工作实施方案》

中共香格里拉市委办公室香格里拉市人民政府办公室

关于印发

《香格里拉市防止返贫致贫保险工作实施方案》的通知

各乡(镇)党委、政府,市委各部委,市级国家机关各委办局,各人民团体,市级各企事业单位,省属驻市各单位《香格里拉市防止返贫致贪保险工作实施方案》已经二届市委114次常委会议研究同意,现印发给你们,请结合实际认真贯彻落实《香格里拉市防止返贫致贫保险工作实施方案》。

为进一步巩固提升脱贫攻坚成果,经市政府研究,决定在全市范围内实施防止返贫致贫保险工作,现提出如下实施方案:

一、总体要求

全面贯彻落实习近平新时代中国特色社会主义思想和党的十九大精神,以习近平总书记关于扶贫工作的重要论述为指导在抓好精准扶贫精准脱贫,减少贫困存量的同时,探索精准防贫机制,进一步创新金融扶贫、创新保险保障机制,完善保险扶贫方式,控制贫困数量,从源头上筑起“截流闸”和“拦水坝”,着力提升贫困群众生活保障水平,少因病、因学、因灾等原因造成脱贫返贫问题发生,切实巩固脱贫成果,确保与全国、全省、全州同步全面建成小康社会。

二、基本原则

(一)服务群众。以建档立卡贫困户和边缘户为主的特殊困难群体为对象,进行精准防贫,防范因病、因学、因灾等因素返贫致贫。

(二)整合资源。财政部门、挂包部门、挂包干部和参保对象共同承担参与,参保具体事宜由市扶贫办牵头,市级各主责行业部门、各乡(镇)配合,协调保险公司做好查勘、定损理赔、防灾防损等各项工作,确保精准赔付。

(三)创新模式、精准聚焦赔付类别,着力体现精准,在现有民房受灾险的基础上,增加因病、因学、因灾等防贫险种,做到保险助力脱贫攻坚,巩固脱贫成果。

(四)市场运作。充分发挥市场配置资源的作用,建立风险预警管控机制,积板运用市场化手段防范和化解风险。

(五)自主自愿,积板开展防止返贫致贫保险宣传推广活动,引导群众积极投保。

三、承保机构确定及有关事项

(一)承保公司由市扶贫办会同市财政局商讨确定,并签订承保合同。

(二)承保公司提供的防贫保险相关产品需符合保险业务监管规定并在保险监管部门备案。

(三)承保公司确定后,在双方无异议的情况下,承保合同一年一签(保期为2020年5月15日至2021年5月15日止),具体合同条款由市扶贫办和承保公司协商确定,到期续签事宜应提前30个工作日协商确定。

(四)承保公司必须经银保监部门批准在香格里拉市设立并发经营保险业务许可证的公司,具有相关项目经验获得国家相关部门认可并支持推广。

(五)防贫保险业务属于保障性险种,根据国办系统中确认的贫因规模适当调整,但调整户数不纳入当年保险,次年纳入保险并根据贫国人口实际人数调整保费。

(六)承保合同签订后,保险公司和投保主体应严格执行《保险法》,切实履行双方约定的责任和义务,双方中任何一方提出终止合同须在下一年度合同签订前3个月向对方发文提出明确的终止意向,当年合同必须执行完成。

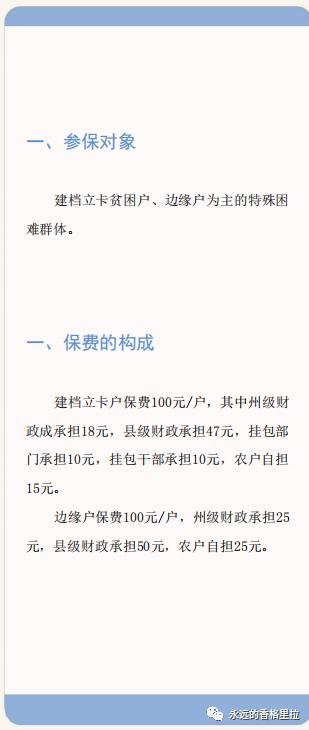

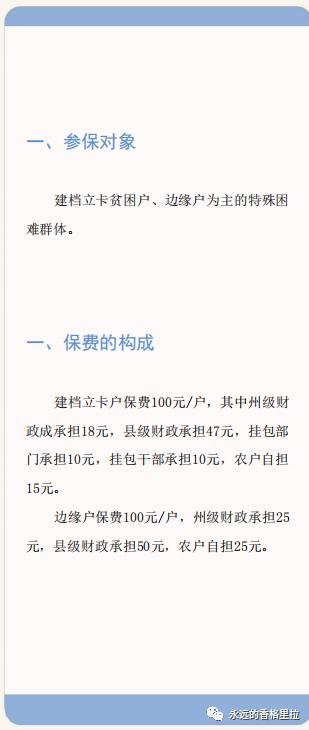

四、参保对象及内容

(一)参保对象,建档立卡贫困户、边缘户为主的特殊困难群体。贫困户以2019年末建档立卡户4649户为基准(含脱贫监测户);边缘户以2019年末“两摸底一排查”确定的收入在5000元以下的154户为基准,最终数据以国办系统中的最新数据为准。

(二)参保内容,因病(意外)住院医疗、因灾、因学农民工收入不稳定补偿、收入保障线补助、特殊救助,可在双方协商一致的情况下,增加或减少保险项目,并对保费进行调整。

五、保费构成及缴纳比例标准

(一)保费构成。建档立卡贫困户、边缘户参保费用标准100元/户/年,投保人根据合同约定,向承保公司支付保险费。

(二)保费缴纳比倒标准。建档立卡贫困户保费(含脱贫检测户)筹集方式为挂包部门代出资10%、挂包干部承担10%、被保险人承担15%(因此方案2020年试行,被保险人承担部分由承保公司承担),州财政承担18%,市财政承担47%,边缘户保费筹集方式为被保险人缴纳承担25%(因此方案2020年试行,被保险人承担部分由承保公司承担),州级财政承担25%,市级财政承担50%,(具体保费筹措计划表附后)。

六、参保方案

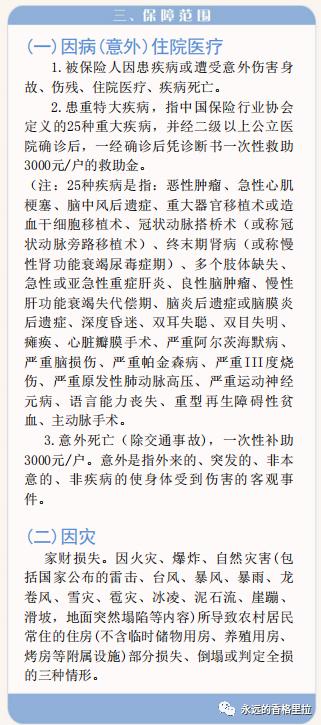

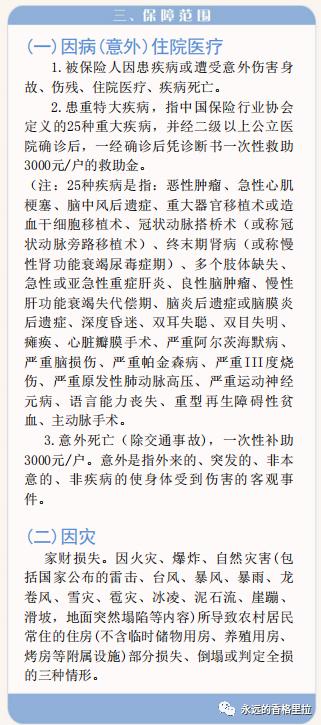

(一)因病(意外)住院医疗

1.被保险人因患疾病或遭受意外伤害在医保定点医疗机构住院治疗(不涉及第三方赔付),按城乡居民基本医疗保险、大病保险医疗救助等取得医疗费用报销后,建档立卡贫困户(含监测户)扣除起付线5000元/户/年,赔付比例为70%,年度累计最高不得超过8000元/户/年;边缘户扣除起付线8000元/户/年,赔付比例为70%,年度累计最高不得超过10000元/户/年

2.患重特大疾病,指中国保险行业协会定义的25种重大疾病,并经二级以上公立医院确诊后,一经确诊后凭诊断书一次性救助3000元/户的救助金

3.意外死亡,指外来的、突发的、非本意的、非疾病的使身体受到伤害的客观事件(除交通事故),一次性补助3000元/户。

(二)因灾

家财损失。因火灾、爆炸、自然灾害(包括国家公布的雷击、台凤、暴凤、暴雨、龙卷风、雪灾、電灾、冰凌、泥石流、崖崩、滑坡、地面突然塌陷等内容)所导致农村居民常住的住房(不含临时储物用房、养殖用房、烤房等附屬设施)部分损失、倒塌或判定全损的三种情形(由承保公司定损),住房总受损金额经农村民房灾害保险赔付后的剩余部分,赔付保险金标准为,部分损失的情形扣除起付线10000元/户/年,赔付比例70%,年度累计最高不得超过8000元/户/年;倒塌或判定全损的情形扣除起付线1000元/户/年,赔付比例70%,年度累计不超过10000元/户。

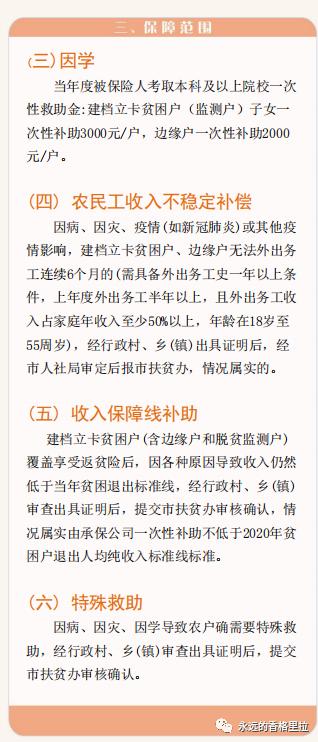

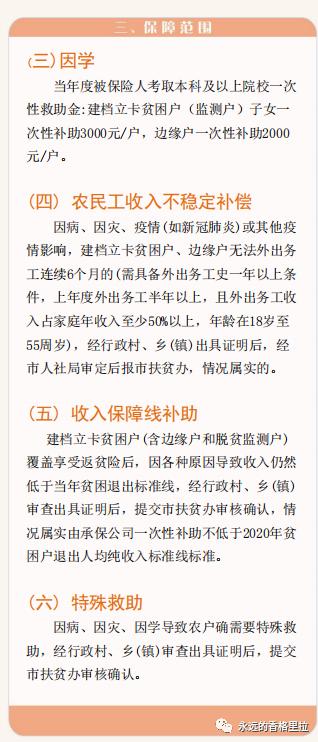

(三)因学

当年度被保险人考取本科及以上院校一次性救助金:建档立卡贫困户(监测户)子女ー次性补助3000元/户;边缘户ー次性补助2000元/户。

(四)农民工收入不稳定补偿

因病、因灾、疫情(如新冠肺炎)或其他疫情影响,建档立卡贫困户、边缘户无法外出务工连续6个月的(需具备外出务工史一年以上条件,上年度外出务工半年以上,且外出务工收入占家庭年收入至少50%以上,年龄在18岁至55周岁),经行政村、多(镇)出具证明,经市人社局审定后报市扶贫办,情况属实本年度一次性赔付4000元/户

(五)收入保障线补助

建档立卡贫困户(含边缘户和脱贫监测户)覆盖享受返贫险后,因各种原因导致收入仍然低于当年贫困退出标准线,经行政村、乡(镇)审查出具证明后,提交市扶贫办审核确认情况属实由承保公司一次性补助不低于2020年贫因户退出人均纯收入标准线标准

(六)特殊救助

因病、因灾、因学导致农户确需要特殊救助,经行政村乡(镇)审査出具证明后,提交市扶贫办审核确认,可适当提高赔付限额及范围,防止农户返贫致贫(说明:此项特殊救助视其赔款情况,特殊救助毎年每个乡(镇)1户,救助资金不得超过4000元;致贫原因重复家庭,最多不得享受两种,超过两种的家庭由市扶贫办和承保公司协商确定上限)

以上六项保险责任合计年度赔付累计限额为12,000元/户

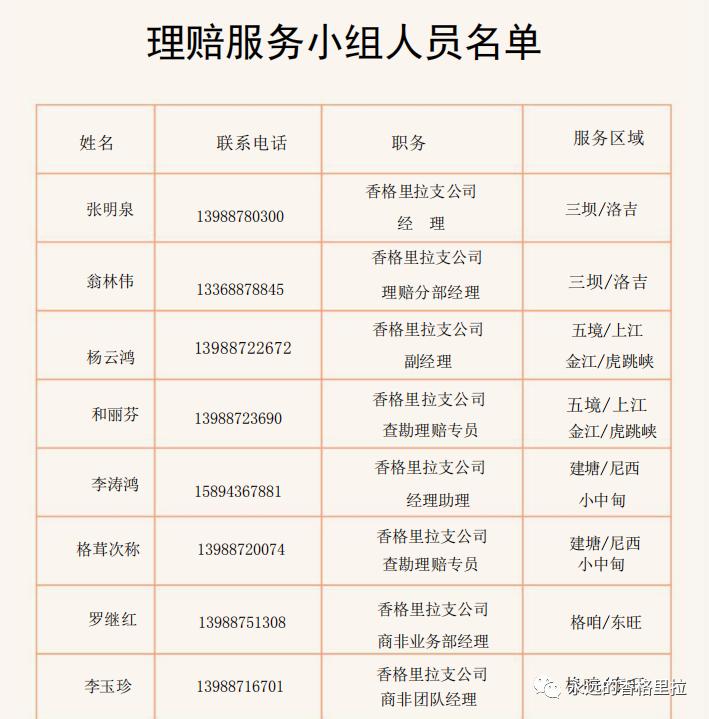

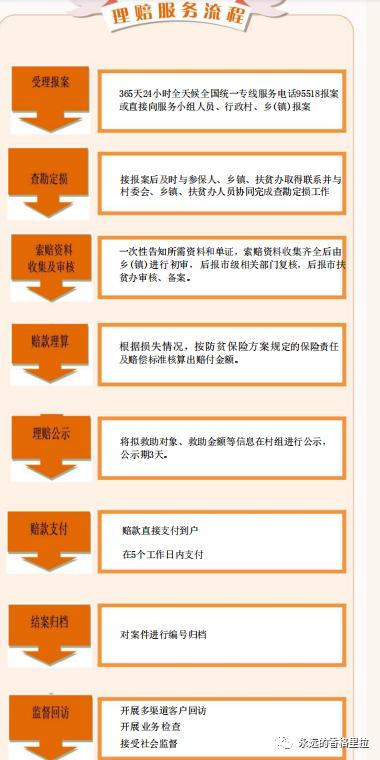

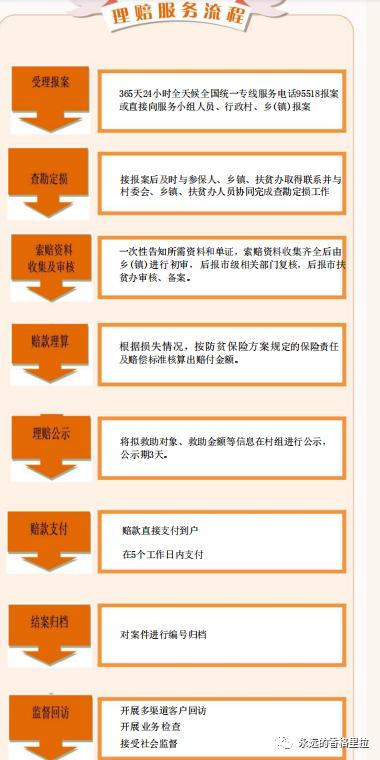

七、理赔流程

(一)发生保险责任范国内的事件时,参保人(农户)应及时向所在的行政村、乡(镇)报告,由乡(镇)进行初审初审后报至市级各相关行业部门复核,复核后报市扶贫办,由市扶贫办及时对接承保公司,保险公司理赔人员在村委会、乡(镇)及相关工作人员陪同下按照理赔规定进行定责定损工作相关资料收集进行理算核赔,将赔款及时划转到受灾农户卡(二)承保公司在收到市扶贫办提供的完整索赔材料后,在5个工作日内(法定节假日顺延)将赔款支付到农户(家属)银行卡

八、运营成本与风险调节

政府救助防贫保险作为由政府组织实施、筹措资金来源的与普惠性保险项目业务,保险经营机构应遵循“保本微利”的原则开办保险项目。为使项目承办保险机构实现“保本微利”的同时使政府的保险需求得到全面、可持续性的保障。

1.承保公司可计提15%作为运营成本,用于防止返贫致贫保险工作相关必要的开支。

2.风险调节

(1)盈余处理:若年度总赔付率〈85%,由市扶贫办、市财政局与承保公司协商处理;

(2)亏损处理:当年度总赔付率〉85%时,由市扶贫办、市财政局补缴保险费,补缴金额=年度总赔款+运营成本(固定为年度总保险费的15%,含补缴部分)-已缴纳保险费。

九、组织保障

(一)成立工作专班

组长:宋青云,市委常委、市委副书记

常务副组长:松萍,市人民政府副市长

副组长:赵军,市财政局局长

陈永生,市扶贫办主任

和正清,市政府办副主任

成员:

牛盈春,市教育体育局局长

扎史培楚,市民政局局长

李辉,市人力资源和社会保障局局长

李正山,市住房和城乡建设局局长

张正光,市卫生健康局局长

王成,市医疗保障局局长

彭震东,市财政局副局长

申国美,市扶贫办副主任

和耀忠,市金融办主任

领导小组下设办公室在市扶贫办,由陈永生同志担任主任,负责协调各职能部门共同推进防贫致贫保险工作。各乡(镇)要及时成立相应的工作领导机构,由乡(镇)长牵头,分管扶贫的副乡(镇)长、扶贫专干具体负责,细化工作方案,进步明确任务目标,政策措施、实施步骤、责任分工等,稳步推动防贫致贫保险工作。

(二)强化责任落实

市财政局:积极争取资金,强化资金整合,定期或不定期开展保费资金使用情况的监督检查;上报年度保费资金申请计划,及时纳入年度预算;及时拨付保险费及亏损时产生的补缴部分。

市扶贫办:扶贫办要确定专人负责,及时与财政和承保公司对接,强化处理日常事务、统计参保对象、筹集保费并完成对出险农户的核实与索赔材料收集,确保案件的真实性。

市教育体育局:开展业务指导,积极与财政、扶贫和承保公司对接沟通,定期共享资源,做好因学致贫的理赔基础工作。

市民政局:全面排査特殊困难群体,开展业务指导,积极与财政、扶贫和承保公司对接沟通,做到贫困户(含边缘户和脱贫监测户)不漏一人一户,全覆盖参保。

市人社局:指导农民工所在地村委会进行农民工务工排查,确定因特殊原因6个月无法外出务工农民工(贫困户、边绿户和脱贫监测户),出具相关证明,并积极与财政、扶贫和承保公司对接沟通,定期共享资源,做好理赔基工作。

市住建局:在发生灾害时,积板配合承保公司,重点围绕住房部分损失、倒期或全损三种情形进行鉴定,定期共享资源,做好理赔基础工作。

市医保局:积极配合承保公司,按投保年度提供贫困户边缘户和特殊群体因病住院城乡居民基本医疗保险、大病保险医疗救助等取得医疗费用报销后的具体名单,做好理赔基础工作。

承保公司:承保公司要负责拟定定损和理赔办法,制定工作方案和操作规程,坚持规范经营,确保保险经营数据真实准确,坚决防止出现虚增保险数量套取资金等严重违法违规行为要做到保险数量公开、保险情况公开、理赔结果公开、服务标准公开、监管要求公开和保险到户,要严格履行保险合同义务加强对防止返贫致贫保险的宣传工作,严禁恶意拖赔、无理拒赔等损害群众切身利益,确保及时将理赔资金支付到户,要加强信息沟通和汇报工作,建立沟通联系机制。

各乡(镇各乡(镇)扶贫办要确定专人负责,尽快整理参保人员名单信息,做好保费收的协调工作,若农户发生保险范围内的事件及时与承保公司、市级各相关行业部门和市扶办对接

十、有关要求

(一)明确投保对象,在参保前市扶贫办与各乡(镇)要做好对象的确定、统计与清单登记,认真核实,确保对象真实准确。

(二)签单投保。市扶贫办、市财政局要进一步强化业务指导,乡镇牵头,村为单位,负责编制及提供投保人保险项目清单,明确投保人基础材料(姓名、身份证号、家庭住址等)。

(三)保费管理,各级财政承担的保费不得从中央、省和州统筹整合资金中安排使用,资金使用和来源渠道要符合相关规定,市扶贫办负责做好统筹协调工作;市财政局负责将财政部门承担的承保资金找付至市扶贫办,由扶贫办统一将财政资金找付至承保公司;各乡(镇)负责将省、州、市、乡(镇)挂包部门、挂包干部、农户承担的部分统一协调收缴,并汇数至承保公司,各单位找付资金所需据由承保公司统一出具。

(四)理赔管理。保险合同签订后,由市扶贫办与承保公司对六项保障责任的理启服务流程、档案管理进行细化明确。

(五)加强监督检查。加强制度建设,着力构建制度约東的长效机制,进一步完善防止返贫致贫保险管理制度和业务流程,坚决杜绝贫困群众返贫。

编辑:何维龙

审稿:和金莲 解大钦

https://www.sohu.com/a/341525350_115495?_f=index_businessnews_0_6

China Economic Times

28,000 articles 140 million total reading

View TA's article>

0

share to

Anti-poverty and poverty reduction China Re Group's insurance guarantee of more than 10 billion yuan will be implemented

2019-09-18 00:50

Our reporter Jiang Yeqing

How to effectively solve the problems and pain points caused by illness, disaster and accidental return to poverty? A few days ago, China Re Group released the "Poverty Prevention Anti-Poverty Insurance Plan", which aims to provide more than 70 million Xunhua people in Xunhua County of Qinghai Province with a cumulative insurance protection of more than 10 billion yuan, and build a solid prevention against poverty and poverty in the fight against poverty "Dams" and "firewalls". It is reported that Xunhua Salar Autonomous County, Qinghai Province, as the first ethnic minority in the country as a whole to get rid of poverty, successfully got rid of poverty on September 29, 2018.

Since the relocation of Xuanhua County in 2002, China Re Group has established a “1+N” precision poverty alleviation model based on professional advantages, pioneering the insurance poverty alleviation, supporting industry poverty alleviation, education poverty alleviation, and pairing poverty alleviation. A total of 81.85 million yuan has been invested in poverty alleviation, and a total of several billion yuan has been provided for the poor.

According to reports, the “anti-poverty prevention” insurance plan has four major characteristics: First, it highlights the core needs to protect the risk of returning to poverty. On the basis of the original protection of diseases, disasters, and accidental risks, it expands the protection of the risk of returning to poverty due to campus accidents and family property losses. Further expand the scope of protection, covering more than 70,000 people in Xunhua County, and the risk protection amount exceeds 10 billion yuan; second, highlight the support of Xunhua’s pillar industries, strengthen personnel protection, and support industrial upgrades, and will be scattered across the country’s 30,000 through anti-poverty insurance More than Xunhua ramen industry personnel have been included in insurance coverage. Starting from 2018, they have invested 10 million yuan each year for three consecutive years, introduced 150 million yuan in financial funds, and supported the upgrade and upgrade of more than 7,500 ramen stores in Xunhua Salars nationwide. Apply 5G technology to achieve data centralization and remote management; third, it can be copied, combined and easily promoted, and the insurance liability portfolio of anti-poverty insurance can be adjusted according to the characteristics of different regions and different groups of people, and the original more than 10 insurance types are simplified in the underwriting method Two are more convenient for promotion; the fourth is that enterprises and the government work closely together to establish and improve a consultation mechanism for poverty alleviation projects, and insurance and poverty alleviation have strong organizational guarantees.

Yang Guozhong, Deputy Secretary of the Party Committee and Chairman of the Board of Supervisors of China Investment Corporation, pointed out that China Investment Corporation is exploring innovative financial poverty alleviation methods and promoting the establishment of a stable anti-poverty mechanism. The purpose of China Re’s “anti-poverty return” insurance program is to establish a long-term mechanism to stabilize poverty alleviation and prevent poverty return. Back to Sohu, see more

http://www.netsend.cn/showinfo-28-120434-0.html

Anti-poverty and poverty reduction China Re Group's insurance guarantee of more than 10 billion yuan will be implemented

2019-09-18 has been onlookers 95 times Source: Internet Editor: Hot News Network

Our reporter Jiang Yeqing

How to effectively solve the problems and pain points caused by illness, disaster and accidental return to poverty? A few days ago, China Re Group released the "Anti-Poverty Return Insurance Program", with the purpose of providing insurance protection for more than 70,000 Xunhua people in Xunhua County, Qinghai Province with a total of over 10 billion yuan, and building a solid prevention against poverty and returning to poverty in the fight against poverty. "Barrier Dam" and "Firewall". It is reported that Xunhua Salar Autonomous County, Qinghai Province, as the first ethnic minority in the country as a whole to get rid of poverty, successfully got rid of poverty on September 29, 2018.

Since its designated assistance to Xunhua County in 2002, China Re Group has pioneered the “1+N” targeted poverty alleviation model with insurance as the core and supporting poverty alleviation through industry, education and paired assistance based on its professional advantages. A total of 81.85 million yuan has been invested in poverty alleviation, providing insurance protection for the poor in total billions of yuan.

According to reports, the "anti-poverty" insurance program has four major characteristics: First, it highlights the core needs of protecting the risk of returning to poverty. Based on the original protection against diseases, disasters, and accident risks, it expands to cover the risks of returning to poverty due to campus accidents and family property losses. Further expand the scope of coverage to cover more than 70,000 people in Xunhua County, with a risk protection limit of more than 10 billion yuan; second, highlight support for Xunhua’s pillar industries, strengthen personnel protection, support industrial upgrading, and spread 30,000 across the country through anti-poverty insurance More than Xunhua ramen industry personnel have been included in insurance coverage. Starting from 2018, they have invested 10 million yuan each year for three consecutive years, introduced 150 million yuan in financial funds, and supported the upgrade and upgrade of more than 7,500 ramen stores in Xunhua Salars nationwide. Apply 5G technology to achieve data centralization and remote management; third, it can be copied, combined and easily promoted, and the insurance liability portfolio of anti-poverty insurance can be adjusted according to the characteristics of different regions and different groups of people, and the original more than 10 insurance types are simplified in the underwriting method Two are more convenient for promotion; the fourth is that enterprises and the government work closely together to establish and improve a consultation mechanism for poverty alleviation projects, and insurance and poverty alleviation have strong organizational guarantees.

Yang Guozhong, deputy secretary of the party committee and chief supervisor of China Investment Corporation, pointed out that CIC is exploring innovative financial poverty alleviation methods and promoting the establishment of a stable anti-poverty mechanism. The purpose of China Re’s “anti-poverty return” insurance program is to establish a long-term mechanism to stabilize poverty alleviation and prevent poverty return.

Share to 0

Previous post: I heard that housing prices are going to drop, when is it right to buy?

https://www.thepaper.cn/newsDetail_forward_7938490

Consolidate and improve the results of poverty alleviation! The city will implement insurance against poverty and poverty

2020-06-21 08:28 Source: The Paper · The Paper · Government Affairs

Font size

Shangri-La release

attention

In the critical period of poverty alleviation, in order to further consolidate and enhance the results of poverty alleviation, Shangri-La City fully implemented the Jinping New Era Socialism Thought with Chinese Characteristics and the spirit of the 19th National Congress of the Communist Party of China. It is guided by General Secretary Xi Jinping’s important expositions on poverty alleviation work. Targeted poverty alleviation Targeted poverty alleviation and reduction of the stock of poverty, while actively exploring targeted poverty prevention mechanisms, further innovating financial poverty alleviation, innovating insurance protection mechanisms, improving insurance poverty alleviation methods, controlling the number of poverty, and building "blocking gates" and "dams" from the source "Strive to improve the living standards of the poor, reduce the incidence of poverty alleviation and return to poverty due to illness, school, and disasters, and consolidate the results of poverty alleviation to ensure that the country, the province, and the whole state will be synchronized with the country, the province, and the state to build a well-off society. Measures such as the "Shangri-La City’s Implementation Plan for the Prevention of Poverty-Returning to Poverty Insurance" have been introduced to help fight poverty.

Look down!

Take you to understand

"Shangri-La City's Implementation Plan for Preventing Poverty Back to Poverty Insurance"

Shangri-La Municipal Committee Office of the Communist Party of China Shangri-La Municipal People’s Government Office

About printing

Notice of "Shangri-La City's Implementation Plan for Preventing Poverty Back to Poverty Insurance"

All township (town) party committees and governments, municipal party committees and ministries, municipal government agencies, commissions and bureaus, people’s organizations, municipal enterprises and institutions, and provincial units in the city "Implementation Plan of Shangri-La City on Preventing Poverty and Corruption Insurance Work "The 114th meeting of the Standing Committee of the Second Municipal Party Committee has studied and approved it. It is now printed and distributed to you. Please carefully implement the "Shangri-La City's Implementation Plan for Preventing Poverty and Poverty Insurance."

In order to further consolidate and improve the results of poverty alleviation, the municipal government has studied and decided to implement the insurance against poverty and poverty reduction within the city. The following implementation plans are now proposed:

1. General requirements

Fully implement the practice of Jinping's new era of socialism with Chinese characteristics and the spirit of the 19th National Congress of the Communist Party of China. Guided by General Secretary Xi Jinping's important work on poverty alleviation, while exploring accurate poverty alleviation and poverty alleviation, reducing poverty stocks, and exploring precise anti-poverty mechanisms , To further innovate financial poverty alleviation, innovate insurance protection mechanisms, improve insurance poverty alleviation methods, control the number of poverty, build "closure gates" and "dams" from the source, and strive to improve the living standards of the poor, and reduce disease, etiology, and As a result of disasters and other reasons, the problem of poverty alleviation and return to poverty has occurred, and the results of poverty alleviation have been consolidated to ensure that the whole country, the whole province, and the whole state will be synchronized with the whole country to build a well-off society.

2. Basic principles

(1) Serve the masses. Targeted at the special needy groups such as poor households and marginal households with established registration cards, precision prevention was carried out to prevent poverty due to illness, school, disasters and other factors.

(2) Integrate resources. The financial department, the bagging department, the bagging cadres and the insured parties shall jointly participate in the participation. The specific matters for insurance participation shall be led by the Municipal Poverty Alleviation Office. The municipal-level responsible industry departments and the townships (towns) shall cooperate with each other to coordinate the insurance company’s investigation, Various tasks such as loss determination and compensation, disaster prevention and loss prevention, ensure accurate compensation.

(3) Innovative model, precise focus on the types of compensation, and focus on embodying precision. On the basis of disaster insurance of existing residential houses, we will increase poverty prevention insurances such as disease, academics, and disasters, so that insurance can help alleviate poverty and consolidate poverty alleviation achievements.

(4) Market operation. Give full play to the role of the market in allocating resources, establish a risk early warning management and control mechanism, and the Board uses market-based means to prevent and resolve risks.

(5) Independently and voluntarily, the accumulated board will carry out publicity and promotion activities for preventing poverty from returning to poverty, and guide the masses to actively purchase insurance.

3. Determination of the underwriting agency and related matters

(1) The underwriting company shall be determined by the Municipal Poverty Alleviation Office in consultation with the Municipal Finance Bureau, and the underwriting contract shall be signed.

(2) The anti-poverty insurance-related products provided by the underwriting company must comply with the insurance business supervision regulations and be filed with the insurance supervision department.

(3) After the underwriting company is determined, under the condition of no objection between the two parties, the underwriting contract shall be signed once a year (the insured period is from May 15, 2020 to May 15, 2021). The underwriting company shall negotiate to determine, and the matter of renewal due due shall be negotiated and confirmed 30 working days in advance.

(4) The underwriting company must be approved by the Banking and Insurance Regulatory Department to establish a company with a license for concurrently operating insurance business in Shangri-La, and have relevant project experience to be recognized by the relevant state departments and support promotion.

(5) The anti-poverty insurance business is a protection insurance category, which is appropriately adjusted according to the scale of poverty factors confirmed in the state-run system, but the adjusted number of households is not included in the current year's insurance, and the insurance is included in the next year and the premium is adjusted according to the actual number of people in poor countries.

(6) After the underwriting contract is signed, the insurance company and the insured body should strictly implement the "Insurance Law" and effectively fulfill the responsibilities and obligations agreed by both parties. Any one of the parties who proposes to terminate the contract must send a document to the other party three months before the contract is signed in the next year. With a clear intention to terminate, the contract for the current year must be executed.

4. Insured objects and contents

(1) Insured objects, special hardship groups mainly for poor households and marginal households. The poor households are based on the 4649 households with registered cards at the end of 2019 (including the poverty alleviation monitoring households); the marginal households are based on the 154 households whose income is less than 5,000 yuan determined by the “two investigations and one investigation” at the end of 2019. The final data is based on the state administration The latest data in the system shall prevail.

(2) Insured content, hospitalization due to illness (accident), compensation for unstable income of migrant workers due to disaster or school, income guarantee line subsidy, special assistance, and insurance items can be increased or decreased upon mutual agreement. And adjust the premium.

5. Premium composition and payment ratio standard

(1) Premium composition. The insurance cost standard for poor households and marginal households who establish a card is 100 yuan/household/year, and the insured pays the insurance premium to the underwriting company according to the contract.

(2) The premium payment is lower than the standard. The method of raising premiums for poor households (including poverty alleviation testing households) for establishment and registration is that the contracting department contributes 10%, the contracting cadres bear 10%, and the insured bears 15% (so the plan will be implemented in 2020, and the insured will bear part of the Underwriting company), the state finance bears 18%, the city finance bears 47%, and the marginal household premium collection method is that the insured pays 25% (so the plan is piloted in 2020, the insured bears part of the insurer's responsibility), state level The financial responsibility is 25%, and the municipal financial responsibility is 50%, (the specific insurance premium financing plan is attached).

6. Participation plan

(1) Hospitalization due to illness (accident)

1. The insured is hospitalized at a designated medical institution for medical insurance due to illness or accidental injury (not involving third-party compensation), and after the medical expenses are reimbursed according to the basic medical insurance for urban and rural residents and medical assistance for serious illness insurance, the file is established and the card is poor. Households (including monitoring households) deduct the threshold of 5000 yuan/household/year, the compensation ratio is 70%, and the annual cumulative maximum shall not exceed

中国经济时报

2.8万文章 1.4亿总阅读

查看TA的文章>

0

- 分享到

防返贫致贫 中再集团超百亿保险保障将落地

2019-09-18 00:50

本报记者 姜业庆

如何有效解决因病因灾、因意外返贫的问题和痛点?日前,中再集团发布了“防返贫保险方案”,目的是为青海省循化县7万余循化百姓提供累计超百亿元的保险保障,在脱贫攻坚战中构筑起坚实的防范致贫返贫的“拦水坝”和“防火墙”。据悉,作为全国第一个整体脱贫的少数民族,青海省循化撒拉族自治县在2018年9月29日成功脱贫摘帽。

中再集团自2002年定点帮扶循化县以来,立足专业优势,开创性推出以保险扶贫为核心,以产业扶贫、教育扶贫、结对帮扶等为配套的“1+N”精准扶贫模式,累计投入扶贫款8185万元,为贫困群众提供保险保障总计数十亿元。

据介绍,“防返贫”保险方案具有四大特点:一是突出保障返贫风险的核心需求,在原有保障疾病、灾害、意外风险基础上,扩展保障因校园意外、家庭财产损失等返贫的风险,进一步扩大保障范围,覆盖循化县7万余人,风险保障额度超过百亿元;二是突出支持循化支柱产业,加强人员保障、支持产业升级,通过防返贫保险将分散在全国的3万余名循化拉面产业人员纳入保险保障范围,从2018年起连续三年每年投入1000万元,引入撬动金融资金1.5亿元,支持循化撒拉族全国7500余间拉面店面提档升级,并应用5G技术实现数据集中化和远程管理;三是可复制可组合易推广,防返贫保险在保险责任组合上能够根据不同地区和不同人群特点进行调整,在承保方式上将原来10余个险种简化为2个,更便于推广;四是企业与政府紧密配合,建立健全扶贫项目的会商机制,保险扶贫具有强大的组织保障。

中国投资有限责任公司党委副书记、监事长杨国中指出,中投公司正探索创新金融扶贫方式,推动建立稳定的防返贫机制。中再集团“防返贫”保险方案的目的就是建立稳定脱贫、防止返贫的长效机制。返回搜狐,查看更多

http://www.netsend.cn/showinfo-28-120434-0.html

防返贫致贫 中再集团超百亿保险保障将落地

2019-09-18已围观 95 次来源:互联网编辑:热点新闻网

本报记者 姜业庆

如何有效解决因病因灾、因意外返贫的问题和痛点?日前,中再集团发布了“防返贫保险方案”,目的是为青海省循化县7万余循化百姓提供累计超百亿元的保险保障,在脱贫攻坚战中构筑起坚实的防范致贫返贫的“拦水坝”和“防火墙”。据悉,作为全国第一个整体脱贫的少数民族,青海省循化撒拉族自治县在2018年9月29日成功脱贫摘帽。

中再集团自2002年定点帮扶循化县以来,立足专业优势,开创性推出以保险扶贫为核心,以产业扶贫、教育扶贫、结对帮扶等为配套的“1+N”精准扶贫模式,累计投入扶贫款8185万元,为贫困群众提供保险保障总计数十亿元。

据介绍,“防返贫”保险方案具有四大特点:一是突出保障返贫风险的核心需求,在原有保障疾病、灾害、意外风险基础上,扩展保障因校园意外、家庭财产损失等返贫的风险,进一步扩大保障范围,覆盖循化县7万余人,风险保障额度超过百亿元;二是突出支持循化支柱产业,加强人员保障、支持产业升级,通过防返贫保险将分散在全国的3万余名循化拉面产业人员纳入保险保障范围,从2018年起连续三年每年投入1000万元,引入撬动金融资金1.5亿元,支持循化撒拉族全国7500余间拉面店面提档升级,并应用5G技术实现数据集中化和远程管理;三是可复制可组合易推广,防返贫保险在保险责任组合上能够根据不同地区和不同人群特点进行调整,在承保方式上将原来10余个险种简化为2个,更便于推广;四是企业与政府紧密配合,建立健全扶贫项目的会商机制,保险扶贫具有强大的组织保障。

中国投资有限责任公司党委副书记、监事长杨国中指出,中投公司正探索创新金融扶贫方式,推动建立稳定的防返贫机制。中再集团“防返贫”保险方案的目的就是建立稳定脱贫、防止返贫的长效机制。

分享到0

上一篇:听说房价要降了,什么时候买合适呢?

https://www.thepaper.cn/newsDetail_forward_7938490

巩固提升脱贫攻坚成果!全市将实施防止返贫致贫保险工作

2020-06-21 08:28 来源:澎湃新闻·澎湃号·政务

字号

香格里拉发布

关注

在脱贫攻坚关键时期,为进一步巩固提升脱贫攻坚成果,香格里拉市全面贯彻落实习近平新时代中国特色社会主义思想和党的十九大精神,以习近平总书记关于扶贫工作的重要论述为指导在抓好精准扶贫精准脱贫,减少贫困存量的同时,积极探索精准防贫机制,进一步创新金融扶贫、创新保险保障机制,完善保险扶贫方式,控制贫困数量,从源头上筑起“截流闸”和“拦水坝”,着力提升贫困群众生活保障水平,减少因病、因学、因灾等原因造成脱贫返贫问题发生,切实巩固脱贫成果,确保与全国、全省、全州同步全面建成小康社会。出台了《香格里拉市防止返贫致贫保险工作实施方案》等措施助力脱贫攻坚战。

往下看!

带你具体了解

《香格里拉市防止返贫致贫保险工作实施方案》

中共香格里拉市委办公室香格里拉市人民政府办公室

关于印发

《香格里拉市防止返贫致贫保险工作实施方案》的通知

各乡(镇)党委、政府,市委各部委,市级国家机关各委办局,各人民团体,市级各企事业单位,省属驻市各单位《香格里拉市防止返贫致贪保险工作实施方案》已经二届市委114次常委会议研究同意,现印发给你们,请结合实际认真贯彻落实《香格里拉市防止返贫致贫保险工作实施方案》。

为进一步巩固提升脱贫攻坚成果,经市政府研究,决定在全市范围内实施防止返贫致贫保险工作,现提出如下实施方案:

一、总体要求

全面贯彻落实习近平新时代中国特色社会主义思想和党的十九大精神,以习近平总书记关于扶贫工作的重要论述为指导在抓好精准扶贫精准脱贫,减少贫困存量的同时,探索精准防贫机制,进一步创新金融扶贫、创新保险保障机制,完善保险扶贫方式,控制贫困数量,从源头上筑起“截流闸”和“拦水坝”,着力提升贫困群众生活保障水平,少因病、因学、因灾等原因造成脱贫返贫问题发生,切实巩固脱贫成果,确保与全国、全省、全州同步全面建成小康社会。

二、基本原则

(一)服务群众。以建档立卡贫困户和边缘户为主的特殊困难群体为对象,进行精准防贫,防范因病、因学、因灾等因素返贫致贫。

(二)整合资源。财政部门、挂包部门、挂包干部和参保对象共同承担参与,参保具体事宜由市扶贫办牵头,市级各主责行业部门、各乡(镇)配合,协调保险公司做好查勘、定损理赔、防灾防损等各项工作,确保精准赔付。

(三)创新模式、精准聚焦赔付类别,着力体现精准,在现有民房受灾险的基础上,增加因病、因学、因灾等防贫险种,做到保险助力脱贫攻坚,巩固脱贫成果。

(四)市场运作。充分发挥市场配置资源的作用,建立风险预警管控机制,积板运用市场化手段防范和化解风险。

(五)自主自愿,积板开展防止返贫致贫保险宣传推广活动,引导群众积极投保。

三、承保机构确定及有关事项

(一)承保公司由市扶贫办会同市财政局商讨确定,并签订承保合同。

(二)承保公司提供的防贫保险相关产品需符合保险业务监管规定并在保险监管部门备案。

(三)承保公司确定后,在双方无异议的情况下,承保合同一年一签(保期为2020年5月15日至2021年5月15日止),具体合同条款由市扶贫办和承保公司协商确定,到期续签事宜应提前30个工作日协商确定。

(四)承保公司必须经银保监部门批准在香格里拉市设立并发经营保险业务许可证的公司,具有相关项目经验获得国家相关部门认可并支持推广。

(五)防贫保险业务属于保障性险种,根据国办系统中确认的贫因规模适当调整,但调整户数不纳入当年保险,次年纳入保险并根据贫国人口实际人数调整保费。

(六)承保合同签订后,保险公司和投保主体应严格执行《保险法》,切实履行双方约定的责任和义务,双方中任何一方提出终止合同须在下一年度合同签订前3个月向对方发文提出明确的终止意向,当年合同必须执行完成。

四、参保对象及内容

(一)参保对象,建档立卡贫困户、边缘户为主的特殊困难群体。贫困户以2019年末建档立卡户4649户为基准(含脱贫监测户);边缘户以2019年末“两摸底一排查”确定的收入在5000元以下的154户为基准,最终数据以国办系统中的最新数据为准。

(二)参保内容,因病(意外)住院医疗、因灾、因学农民工收入不稳定补偿、收入保障线补助、特殊救助,可在双方协商一致的情况下,增加或减少保险项目,并对保费进行调整。

五、保费构成及缴纳比例标准

(一)保费构成。建档立卡贫困户、边缘户参保费用标准100元/户/年,投保人根据合同约定,向承保公司支付保险费。

(二)保费缴纳比倒标准。建档立卡贫困户保费(含脱贫检测户)筹集方式为挂包部门代出资10%、挂包干部承担10%、被保险人承担15%(因此方案2020年试行,被保险人承担部分由承保公司承担),州财政承担18%,市财政承担47%,边缘户保费筹集方式为被保险人缴纳承担25%(因此方案2020年试行,被保险人承担部分由承保公司承担),州级财政承担25%,市级财政承担50%,(具体保费筹措计划表附后)。

六、参保方案

(一)因病(意外)住院医疗

1.被保险人因患疾病或遭受意外伤害在医保定点医疗机构住院治疗(不涉及第三方赔付),按城乡居民基本医疗保险、大病保险医疗救助等取得医疗费用报销后,建档立卡贫困户(含监测户)扣除起付线5000元/户/年,赔付比例为70%,年度累计最高不得超过8000元/户/年;边缘户扣除起付线8000元/户/年,赔付比例为70%,年度累计最高不得超过10000元/户/年

2.患重特大疾病,指中国保险行业协会定义的25种重大疾病,并经二级以上公立医院确诊后,一经确诊后凭诊断书一次性救助3000元/户的救助金

3.意外死亡,指外来的、突发的、非本意的、非疾病的使身体受到伤害的客观事件(除交通事故),一次性补助3000元/户。

(二)因灾

家财损失。因火灾、爆炸、自然灾害(包括国家公布的雷击、台凤、暴凤、暴雨、龙卷风、雪灾、電灾、冰凌、泥石流、崖崩、滑坡、地面突然塌陷等内容)所导致农村居民常住的住房(不含临时储物用房、养殖用房、烤房等附屬设施)部分损失、倒塌或判定全损的三种情形(由承保公司定损),住房总受损金额经农村民房灾害保险赔付后的剩余部分,赔付保险金标准为,部分损失的情形扣除起付线10000元/户/年,赔付比例70%,年度累计最高不得超过8000元/户/年;倒塌或判定全损的情形扣除起付线1000元/户/年,赔付比例70%,年度累计不超过10000元/户。

(三)因学

当年度被保险人考取本科及以上院校一次性救助金:建档立卡贫困户(监测户)子女ー次性补助3000元/户;边缘户ー次性补助2000元/户。

(四)农民工收入不稳定补偿

因病、因灾、疫情(如新冠肺炎)或其他疫情影响,建档立卡贫困户、边缘户无法外出务工连续6个月的(需具备外出务工史一年以上条件,上年度外出务工半年以上,且外出务工收入占家庭年收入至少50%以上,年龄在18岁至55周岁),经行政村、多(镇)出具证明,经市人社局审定后报市扶贫办,情况属实本年度一次性赔付4000元/户

(五)收入保障线补助

建档立卡贫困户(含边缘户和脱贫监测户)覆盖享受返贫险后,因各种原因导致收入仍然低于当年贫困退出标准线,经行政村、乡(镇)审查出具证明后,提交市扶贫办审核确认情况属实由承保公司一次性补助不低于2020年贫因户退出人均纯收入标准线标准

(六)特殊救助

因病、因灾、因学导致农户确需要特殊救助,经行政村乡(镇)审査出具证明后,提交市扶贫办审核确认,可适当提高赔付限额及范围,防止农户返贫致贫(说明:此项特殊救助视其赔款情况,特殊救助毎年每个乡(镇)1户,救助资金不得超过4000元;致贫原因重复家庭,最多不得享受两种,超过两种的家庭由市扶贫办和承保公司协商确定上限)

以上六项保险责任合计年度赔付累计限额为12,000元/户

七、理赔流程

(一)发生保险责任范国内的事件时,参保人(农户)应及时向所在的行政村、乡(镇)报告,由乡(镇)进行初审初审后报至市级各相关行业部门复核,复核后报市扶贫办,由市扶贫办及时对接承保公司,保险公司理赔人员在村委会、乡(镇)及相关工作人员陪同下按照理赔规定进行定责定损工作相关资料收集进行理算核赔,将赔款及时划转到受灾农户卡(二)承保公司在收到市扶贫办提供的完整索赔材料后,在5个工作日内(法定节假日顺延)将赔款支付到农户(家属)银行卡

八、运营成本与风险调节

政府救助防贫保险作为由政府组织实施、筹措资金来源的与普惠性保险项目业务,保险经营机构应遵循“保本微利”的原则开办保险项目。为使项目承办保险机构实现“保本微利”的同时使政府的保险需求得到全面、可持续性的保障。

1.承保公司可计提15%作为运营成本,用于防止返贫致贫保险工作相关必要的开支。

2.风险调节

(1)盈余处理:若年度总赔付率〈85%,由市扶贫办、市财政局与承保公司协商处理;

(2)亏损处理:当年度总赔付率〉85%时,由市扶贫办、市财政局补缴保险费,补缴金额=年度总赔款+运营成本(固定为年度总保险费的15%,含补缴部分)-已缴纳保险费。

九、组织保障

(一)成立工作专班

组长:宋青云,市委常委、市委副书记

常务副组长:松萍,市人民政府副市长

副组长:赵军,市财政局局长

陈永生,市扶贫办主任

和正清,市政府办副主任

成员:

牛盈春,市教育体育局局长

扎史培楚,市民政局局长

李辉,市人力资源和社会保障局局长

李正山,市住房和城乡建设局局长

张正光,市卫生健康局局长

王成,市医疗保障局局长

彭震东,市财政局副局长

申国美,市扶贫办副主任

和耀忠,市金融办主任

领导小组下设办公室在市扶贫办,由陈永生同志担任主任,负责协调各职能部门共同推进防贫致贫保险工作。各乡(镇)要及时成立相应的工作领导机构,由乡(镇)长牵头,分管扶贫的副乡(镇)长、扶贫专干具体负责,细化工作方案,进步明确任务目标,政策措施、实施步骤、责任分工等,稳步推动防贫致贫保险工作。

(二)强化责任落实

市财政局:积极争取资金,强化资金整合,定期或不定期开展保费资金使用情况的监督检查;上报年度保费资金申请计划,及时纳入年度预算;及时拨付保险费及亏损时产生的补缴部分。

市扶贫办:扶贫办要确定专人负责,及时与财政和承保公司对接,强化处理日常事务、统计参保对象、筹集保费并完成对出险农户的核实与索赔材料收集,确保案件的真实性。

市教育体育局:开展业务指导,积极与财政、扶贫和承保公司对接沟通,定期共享资源,做好因学致贫的理赔基础工作。

市民政局:全面排査特殊困难群体,开展业务指导,积极与财政、扶贫和承保公司对接沟通,做到贫困户(含边缘户和脱贫监测户)不漏一人一户,全覆盖参保。

市人社局:指导农民工所在地村委会进行农民工务工排查,确定因特殊原因6个月无法外出务工农民工(贫困户、边绿户和脱贫监测户),出具相关证明,并积极与财政、扶贫和承保公司对接沟通,定期共享资源,做好理赔基工作。

市住建局:在发生灾害时,积板配合承保公司,重点围绕住房部分损失、倒期或全损三种情形进行鉴定,定期共享资源,做好理赔基础工作。

市医保局:积极配合承保公司,按投保年度提供贫困户边缘户和特殊群体因病住院城乡居民基本医疗保险、大病保险医疗救助等取得医疗费用报销后的具体名单,做好理赔基础工作。

承保公司:承保公司要负责拟定定损和理赔办法,制定工作方案和操作规程,坚持规范经营,确保保险经营数据真实准确,坚决防止出现虚增保险数量套取资金等严重违法违规行为要做到保险数量公开、保险情况公开、理赔结果公开、服务标准公开、监管要求公开和保险到户,要严格履行保险合同义务加强对防止返贫致贫保险的宣传工作,严禁恶意拖赔、无理拒赔等损害群众切身利益,确保及时将理赔资金支付到户,要加强信息沟通和汇报工作,建立沟通联系机制。

各乡(镇各乡(镇)扶贫办要确定专人负责,尽快整理参保人员名单信息,做好保费收的协调工作,若农户发生保险范围内的事件及时与承保公司、市级各相关行业部门和市扶办对接

十、有关要求

(一)明确投保对象,在参保前市扶贫办与各乡(镇)要做好对象的确定、统计与清单登记,认真核实,确保对象真实准确。

(二)签单投保。市扶贫办、市财政局要进一步强化业务指导,乡镇牵头,村为单位,负责编制及提供投保人保险项目清单,明确投保人基础材料(姓名、身份证号、家庭住址等)。

(三)保费管理,各级财政承担的保费不得从中央、省和州统筹整合资金中安排使用,资金使用和来源渠道要符合相关规定,市扶贫办负责做好统筹协调工作;市财政局负责将财政部门承担的承保资金找付至市扶贫办,由扶贫办统一将财政资金找付至承保公司;各乡(镇)负责将省、州、市、乡(镇)挂包部门、挂包干部、农户承担的部分统一协调收缴,并汇数至承保公司,各单位找付资金所需据由承保公司统一出具。

(四)理赔管理。保险合同签订后,由市扶贫办与承保公司对六项保障责任的理启服务流程、档案管理进行细化明确。

(五)加强监督检查。加强制度建设,着力构建制度约東的长效机制,进一步完善防止返贫致贫保险管理制度和业务流程,坚决杜绝贫困群众返贫。

编辑:何维龙

审稿:和金莲 解大钦

https://www.sohu.com/a/341525350_115495?_f=index_businessnews_0_6

China Economic Times

28,000 articles 140 million total reading

View TA's article>

0

share to

Anti-poverty and poverty reduction China Re Group's insurance guarantee of more than 10 billion yuan will be implemented

2019-09-18 00:50

Our reporter Jiang Yeqing

How to effectively solve the problems and pain points caused by illness, disaster and accidental return to poverty? A few days ago, China Re Group released the "Poverty Prevention Anti-Poverty Insurance Plan", which aims to provide more than 70 million Xunhua people in Xunhua County of Qinghai Province with a cumulative insurance protection of more than 10 billion yuan, and build a solid prevention against poverty and poverty in the fight against poverty "Dams" and "firewalls". It is reported that Xunhua Salar Autonomous County, Qinghai Province, as the first ethnic minority in the country as a whole to get rid of poverty, successfully got rid of poverty on September 29, 2018.

Since the relocation of Xuanhua County in 2002, China Re Group has established a “1+N” precision poverty alleviation model based on professional advantages, pioneering the insurance poverty alleviation, supporting industry poverty alleviation, education poverty alleviation, and pairing poverty alleviation. A total of 81.85 million yuan has been invested in poverty alleviation, and a total of several billion yuan has been provided for the poor.

According to reports, the “anti-poverty prevention” insurance plan has four major characteristics: First, it highlights the core needs to protect the risk of returning to poverty. On the basis of the original protection of diseases, disasters, and accidental risks, it expands the protection of the risk of returning to poverty due to campus accidents and family property losses. Further expand the scope of protection, covering more than 70,000 people in Xunhua County, and the risk protection amount exceeds 10 billion yuan; second, highlight the support of Xunhua’s pillar industries, strengthen personnel protection, and support industrial upgrades, and will be scattered across the country’s 30,000 through anti-poverty insurance More than Xunhua ramen industry personnel have been included in insurance coverage. Starting from 2018, they have invested 10 million yuan each year for three consecutive years, introduced 150 million yuan in financial funds, and supported the upgrade and upgrade of more than 7,500 ramen stores in Xunhua Salars nationwide. Apply 5G technology to achieve data centralization and remote management; third, it can be copied, combined and easily promoted, and the insurance liability portfolio of anti-poverty insurance can be adjusted according to the characteristics of different regions and different groups of people, and the original more than 10 insurance types are simplified in the underwriting method Two are more convenient for promotion; the fourth is that enterprises and the government work closely together to establish and improve a consultation mechanism for poverty alleviation projects, and insurance and poverty alleviation have strong organizational guarantees.

Yang Guozhong, Deputy Secretary of the Party Committee and Chairman of the Board of Supervisors of China Investment Corporation, pointed out that China Investment Corporation is exploring innovative financial poverty alleviation methods and promoting the establishment of a stable anti-poverty mechanism. The purpose of China Re’s “anti-poverty return” insurance program is to establish a long-term mechanism to stabilize poverty alleviation and prevent poverty return. Back to Sohu, see more

http://www.netsend.cn/showinfo-28-120434-0.html

Anti-poverty and poverty reduction China Re Group's insurance guarantee of more than 10 billion yuan will be implemented

2019-09-18 has been onlookers 95 times Source: Internet Editor: Hot News Network

Our reporter Jiang Yeqing

How to effectively solve the problems and pain points caused by illness, disaster and accidental return to poverty? A few days ago, China Re Group released the "Anti-Poverty Return Insurance Program", with the purpose of providing insurance protection for more than 70,000 Xunhua people in Xunhua County, Qinghai Province with a total of over 10 billion yuan, and building a solid prevention against poverty and returning to poverty in the fight against poverty. "Barrier Dam" and "Firewall". It is reported that Xunhua Salar Autonomous County, Qinghai Province, as the first ethnic minority in the country as a whole to get rid of poverty, successfully got rid of poverty on September 29, 2018.

Since its designated assistance to Xunhua County in 2002, China Re Group has pioneered the “1+N” targeted poverty alleviation model with insurance as the core and supporting poverty alleviation through industry, education and paired assistance based on its professional advantages. A total of 81.85 million yuan has been invested in poverty alleviation, providing insurance protection for the poor in total billions of yuan.

According to reports, the "anti-poverty" insurance program has four major characteristics: First, it highlights the core needs of protecting the risk of returning to poverty. Based on the original protection against diseases, disasters, and accident risks, it expands to cover the risks of returning to poverty due to campus accidents and family property losses. Further expand the scope of coverage to cover more than 70,000 people in Xunhua County, with a risk protection limit of more than 10 billion yuan; second, highlight support for Xunhua’s pillar industries, strengthen personnel protection, support industrial upgrading, and spread 30,000 across the country through anti-poverty insurance More than Xunhua ramen industry personnel have been included in insurance coverage. Starting from 2018, they have invested 10 million yuan each year for three consecutive years, introduced 150 million yuan in financial funds, and supported the upgrade and upgrade of more than 7,500 ramen stores in Xunhua Salars nationwide. Apply 5G technology to achieve data centralization and remote management; third, it can be copied, combined and easily promoted, and the insurance liability portfolio of anti-poverty insurance can be adjusted according to the characteristics of different regions and different groups of people, and the original more than 10 insurance types are simplified in the underwriting method Two are more convenient for promotion; the fourth is that enterprises and the government work closely together to establish and improve a consultation mechanism for poverty alleviation projects, and insurance and poverty alleviation have strong organizational guarantees.

Yang Guozhong, deputy secretary of the party committee and chief supervisor of China Investment Corporation, pointed out that CIC is exploring innovative financial poverty alleviation methods and promoting the establishment of a stable anti-poverty mechanism. The purpose of China Re’s “anti-poverty return” insurance program is to establish a long-term mechanism to stabilize poverty alleviation and prevent poverty return.

Share to 0

Previous post: I heard that housing prices are going to drop, when is it right to buy?

https://www.thepaper.cn/newsDetail_forward_7938490

Consolidate and improve the results of poverty alleviation! The city will implement insurance against poverty and poverty

2020-06-21 08:28 Source: The Paper · The Paper · Government Affairs

Font size

Shangri-La release

attention

In the critical period of poverty alleviation, in order to further consolidate and enhance the results of poverty alleviation, Shangri-La City fully implemented the Jinping New Era Socialism Thought with Chinese Characteristics and the spirit of the 19th National Congress of the Communist Party of China. It is guided by General Secretary Xi Jinping’s important expositions on poverty alleviation work. Targeted poverty alleviation Targeted poverty alleviation and reduction of the stock of poverty, while actively exploring targeted poverty prevention mechanisms, further innovating financial poverty alleviation, innovating insurance protection mechanisms, improving insurance poverty alleviation methods, controlling the number of poverty, and building "blocking gates" and "dams" from the source "Strive to improve the living standards of the poor, reduce the incidence of poverty alleviation and return to poverty due to illness, school, and disasters, and consolidate the results of poverty alleviation to ensure that the country, the province, and the whole state will be synchronized with the country, the province, and the state to build a well-off society. Measures such as the "Shangri-La City’s Implementation Plan for the Prevention of Poverty-Returning to Poverty Insurance" have been introduced to help fight poverty.

Look down!

Take you to understand

"Shangri-La City's Implementation Plan for Preventing Poverty Back to Poverty Insurance"

Shangri-La Municipal Committee Office of the Communist Party of China Shangri-La Municipal People’s Government Office

About printing

Notice of "Shangri-La City's Implementation Plan for Preventing Poverty Back to Poverty Insurance"

All township (town) party committees and governments, municipal party committees and ministries, municipal government agencies, commissions and bureaus, people’s organizations, municipal enterprises and institutions, and provincial units in the city "Implementation Plan of Shangri-La City on Preventing Poverty and Corruption Insurance Work "The 114th meeting of the Standing Committee of the Second Municipal Party Committee has studied and approved it. It is now printed and distributed to you. Please carefully implement the "Shangri-La City's Implementation Plan for Preventing Poverty and Poverty Insurance."

In order to further consolidate and improve the results of poverty alleviation, the municipal government has studied and decided to implement the insurance against poverty and poverty reduction within the city. The following implementation plans are now proposed:

1. General requirements

Fully implement the practice of Jinping's new era of socialism with Chinese characteristics and the spirit of the 19th National Congress of the Communist Party of China. Guided by General Secretary Xi Jinping's important work on poverty alleviation, while exploring accurate poverty alleviation and poverty alleviation, reducing poverty stocks, and exploring precise anti-poverty mechanisms , To further innovate financial poverty alleviation, innovate insurance protection mechanisms, improve insurance poverty alleviation methods, control the number of poverty, build "closure gates" and "dams" from the source, and strive to improve the living standards of the poor, and reduce disease, etiology, and As a result of disasters and other reasons, the problem of poverty alleviation and return to poverty has occurred, and the results of poverty alleviation have been consolidated to ensure that the whole country, the whole province, and the whole state will be synchronized with the whole country to build a well-off society.

2. Basic principles

(1) Serve the masses. Targeted at the special needy groups such as poor households and marginal households with established registration cards, precision prevention was carried out to prevent poverty due to illness, school, disasters and other factors.

(2) Integrate resources. The financial department, the bagging department, the bagging cadres and the insured parties shall jointly participate in the participation. The specific matters for insurance participation shall be led by the Municipal Poverty Alleviation Office. The municipal-level responsible industry departments and the townships (towns) shall cooperate with each other to coordinate the insurance company’s investigation, Various tasks such as loss determination and compensation, disaster prevention and loss prevention, ensure accurate compensation.

(3) Innovative model, precise focus on the types of compensation, and focus on embodying precision. On the basis of disaster insurance of existing residential houses, we will increase poverty prevention insurances such as disease, academics, and disasters, so that insurance can help alleviate poverty and consolidate poverty alleviation achievements.

(4) Market operation. Give full play to the role of the market in allocating resources, establish a risk early warning management and control mechanism, and the Board uses market-based means to prevent and resolve risks.

(5) Independently and voluntarily, the accumulated board will carry out publicity and promotion activities for preventing poverty from returning to poverty, and guide the masses to actively purchase insurance.

3. Determination of the underwriting agency and related matters

(1) The underwriting company shall be determined by the Municipal Poverty Alleviation Office in consultation with the Municipal Finance Bureau, and the underwriting contract shall be signed.

(2) The anti-poverty insurance-related products provided by the underwriting company must comply with the insurance business supervision regulations and be filed with the insurance supervision department.

(3) After the underwriting company is determined, under the condition of no objection between the two parties, the underwriting contract shall be signed once a year (the insured period is from May 15, 2020 to May 15, 2021). The underwriting company shall negotiate to determine, and the matter of renewal due due shall be negotiated and confirmed 30 working days in advance.

(4) The underwriting company must be approved by the Banking and Insurance Regulatory Department to establish a company with a license for concurrently operating insurance business in Shangri-La, and have relevant project experience to be recognized by the relevant state departments and support promotion.

(5) The anti-poverty insurance business is a protection insurance category, which is appropriately adjusted according to the scale of poverty factors confirmed in the state-run system, but the adjusted number of households is not included in the current year's insurance, and the insurance is included in the next year and the premium is adjusted according to the actual number of people in poor countries.

(6) After the underwriting contract is signed, the insurance company and the insured body should strictly implement the "Insurance Law" and effectively fulfill the responsibilities and obligations agreed by both parties. Any one of the parties who proposes to terminate the contract must send a document to the other party three months before the contract is signed in the next year. With a clear intention to terminate, the contract for the current year must be executed.

4. Insured objects and contents

(1) Insured objects, special hardship groups mainly for poor households and marginal households. The poor households are based on the 4649 households with registered cards at the end of 2019 (including the poverty alleviation monitoring households); the marginal households are based on the 154 households whose income is less than 5,000 yuan determined by the “two investigations and one investigation” at the end of 2019. The final data is based on the state administration The latest data in the system shall prevail.

(2) Insured content, hospitalization due to illness (accident), compensation for unstable income of migrant workers due to disaster or school, income guarantee line subsidy, special assistance, and insurance items can be increased or decreased upon mutual agreement. And adjust the premium.

5. Premium composition and payment ratio standard

(1) Premium composition. The insurance cost standard for poor households and marginal households who establish a card is 100 yuan/household/year, and the insured pays the insurance premium to the underwriting company according to the contract.

(2) The premium payment is lower than the standard. The method of raising premiums for poor households (including poverty alleviation testing households) for establishment and registration is that the contracting department contributes 10%, the contracting cadres bear 10%, and the insured bears 15% (so the plan will be implemented in 2020, and the insured will bear part of the Underwriting company), the state finance bears 18%, the city finance bears 47%, and the marginal household premium collection method is that the insured pays 25% (so the plan is piloted in 2020, the insured bears part of the insurer's responsibility), state level The financial responsibility is 25%, and the municipal financial responsibility is 50%, (the specific insurance premium financing plan is attached).

6. Participation plan

(1) Hospitalization due to illness (accident)

1. The insured is hospitalized at a designated medical institution for medical insurance due to illness or accidental injury (not involving third-party compensation), and after the medical expenses are reimbursed according to the basic medical insurance for urban and rural residents and medical assistance for serious illness insurance, the file is established and the card is poor. Households (including monitoring households) deduct the threshold of 5000 yuan/household/year, the compensation ratio is 70%, and the annual cumulative maximum shall not exceed