-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Pressure is Mounting on the CPF Issue - Continue and Don't Relent

- Thread starter Froggy

- Start date

- Joined

- Jul 10, 2008

- Messages

- 66,954

- Points

- 113

c p f is the best scheme ever devised on earth

other countries are rushing in to cash on our world class savings scheme

Yes NZ is transitioning from universal superannuation to Kiwisaver which is similar to CPF.

https://www.kiwisaver.govt.nz/

The advantage of Kiwisaver is that you can choose your risk portfolio. Here are the returns thus far :

[TABLE="width: 1"]

<caption style="color: rgb(255, 255, 255); font-size: 12px; font-weight: bold; padding: 7px 10px; text-align: left; text-shadow: rgba(15, 25, 61, 0.74902) 1px 1px 1px; background: url(https://www.bnz.co.nz/static/www/images/0912-template-sprite-dark-blue.png?090414103814760=cb) 0px -340px no-repeat rgb(28, 61, 132);">BNZ KiwiSaver Scheme fund performance to 30 April 2014</caption><tbody>[TR="class: first-child"]

[TH] [/TH]

[TH]1 Month[/TH]

[TH]3 Months[/TH]

[TH]1 Year[/TH]

[TH="class: last-child"]Since inception1[/TH]

[/TR]

[TR]

[TD="class: first-child"]Cash Fund[/TD]

[TD]0.24%[/TD]

[TD]0.74%[/TD]

[TD]3.29%[/TD]

[TD="class: last-child"]3.02% p.a.[/TD]

[/TR]

[TR]

[TD="class: first-child"]Conservative Fund[/TD]

[TD]0.77%[/TD]

[TD]2.23%[/TD]

[TD]4.05%[/TD]

[TD="class: last-child"]3.66% p.a.[/TD]

[/TR]

[TR]

[TD="class: first-child"]Moderate Fund[/TD]

[TD]0.75%[/TD]

[TD]2.71%[/TD]

[TD]5.67%[/TD]

[TD="class: last-child"]4.99% p.a.[/TD]

[/TR]

[TR]

[TD="class: first-child"]Balanced Fund[/TD]

[TD]0.76%[/TD]

[TD]3.26%[/TD]

[TD]7.90%[/TD]

[TD="class: last-child"]6.91% p.a.[/TD]

[/TR]

[TR="class: last-child"]

[TD="class: first-child"]Growth Fund[/TD]

[TD]0.65%[/TD]

[TD]3.74%[/TD]

[TD]10.47%[/TD]

[TD]9.17% p.a.[/TD]

[/TR]

</tbody>[/TABLE]

Considering the fact that the NZD has averaged a risk free 5% return over the last few years, it shows how difficult it is to achieve anything more than a 2 to 3% above the cash rate over the long term while guaranteeing returns at the same time.

- Joined

- Aug 8, 2008

- Messages

- 29,005

- Points

- 113

Boss Leongsam, ask you, this Kiwisaver is it a forced savings? Also do the kiwis have the right to withdraw all if it and use before they are dead? Is there a minimum sum withheld by kiwi government? Also may I know if there is also minimum sum for medical?

I want to know the above so that I can consider more clearly to invest in NZ and eventually settle down there and be my partner's neighbour in Hamilton.

I want to know the above so that I can consider more clearly to invest in NZ and eventually settle down there and be my partner's neighbour in Hamilton.

- Joined

- Aug 12, 2008

- Messages

- 37,364

- Points

- 113

c p f is the best scheme ever devised on earth

other countries are rushing in to cash on our world class savings scheme

Name those country, cashing in our world class savings scheme & had mentioned that, they are following SINgapore... where is the proof?

Enough of talk until government honor their promise of returning our hard earned money at age 55.

Anything less, it is no different from the advert. below.

<iframe width="420" height="315" src="//www.youtube.com/embed/chbjc-XDKLw" frameborder="0" allowfullscreen></iframe>

Anything less, it is no different from the advert. below.

<iframe width="420" height="315" src="//www.youtube.com/embed/chbjc-XDKLw" frameborder="0" allowfullscreen></iframe>

- Joined

- Jul 10, 2008

- Messages

- 66,954

- Points

- 113

Boss Leongsam, ask you, this Kiwisaver is it a forced savings? Also do the kiwis have the right to withdraw all if it and use before they are dead? Is there a minimum sum withheld by kiwi government? Also may I know if there is also minimum sum for medical?

I want to know the above so that I can consider more clearly to invest in NZ and eventually settle down there and be my partner's neighbour in Hamilton.

Kiwisaver is currently voluntary. It is supplementary to the universal pension scheme.

You withdraw all your money at 65.

Medical care is funded via taxes and compulsory accident insurance so kiwisaver has nothing to do with medical care. It is purely for retirement.

If you enjoy Asia, you will die of boredom in NZ unless there comes a point in your life where you want a total change of lifestyle.

- Joined

- Jul 31, 2011

- Messages

- 4,480

- Points

- 113

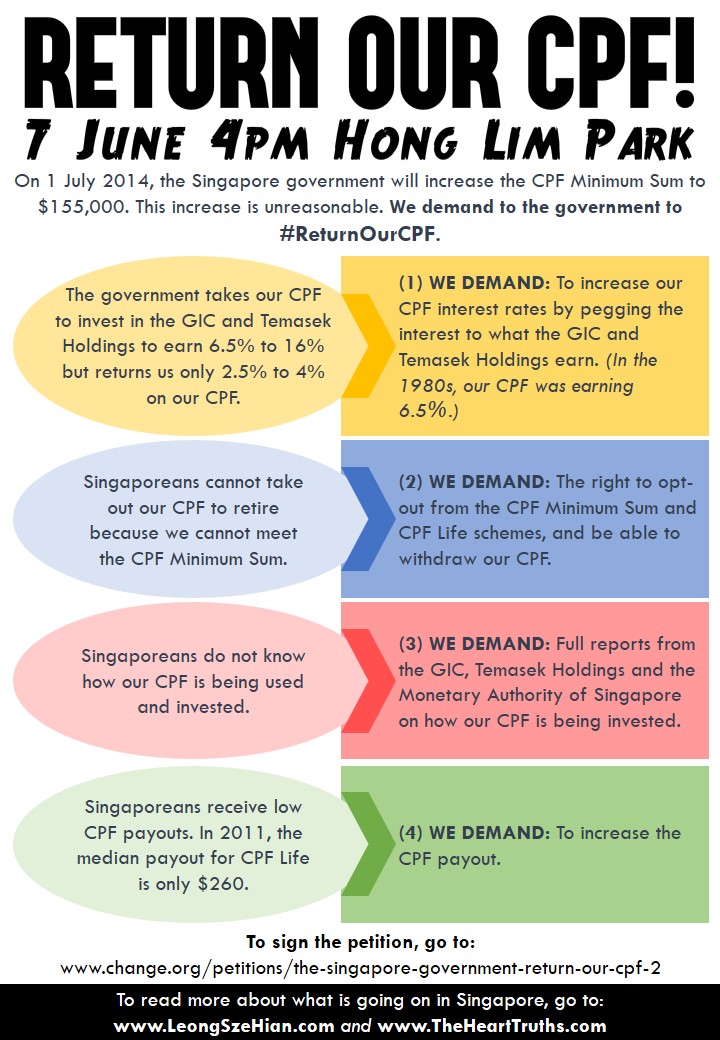

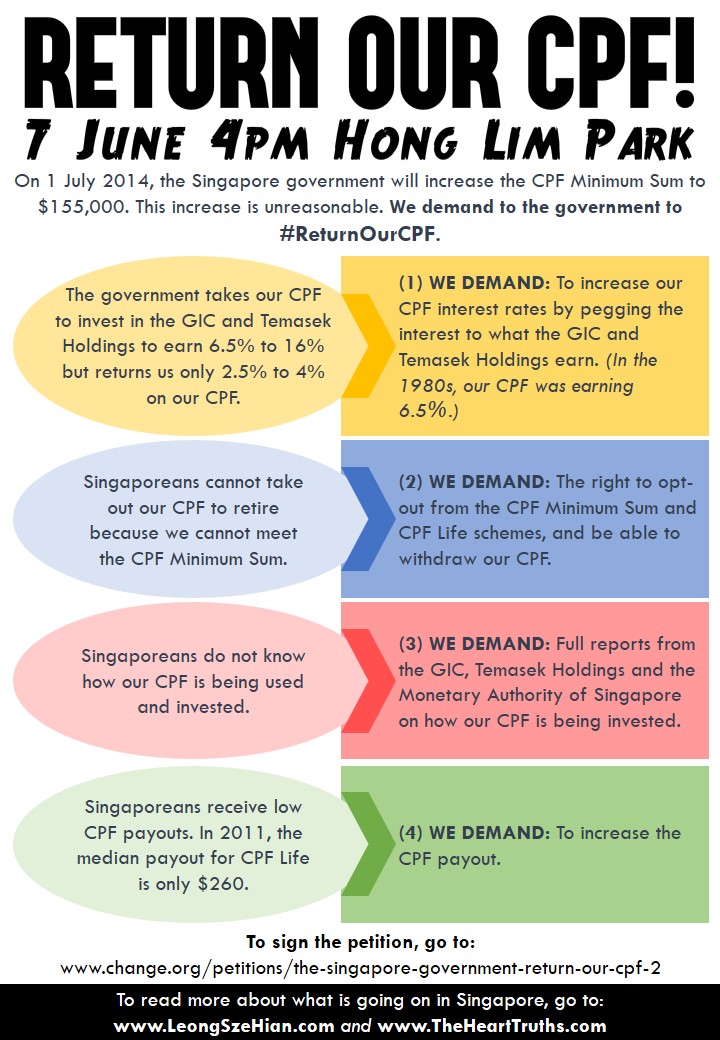

More than $90,000 and and still counting. Today there will be thunderous support at Hong Lim Park.

<header style="margin: 0px 0px 10px; padding: 0px; border: 0px; outline: 0px; font-size: 15px; vertical-align: baseline; color: rgb(136, 136, 136); background: transparent;">Update EIGHT 06062014] Fund Raising For Roy Ngerng’s Court Case Against Lee Hsien Loong

</header>This is the 8th update for the fund raising for the court case. We have reached the target of $70,000 four days ago for the legal fees. There are still some funds coming in. If the funds slow down in the next few days, I will move towards doing a weekly update instead. You can read more about what the court case is about and the fund raising appeal here.

We are now awaiting the pre-trial on 4 July 2014. The court case will be decided at a later date.

Tomorrow is the #ReturnOurCPF event. I will be speaking at the event. Leong Sze Hian Kenneth Jeyaretnam, Mr Tan Kin Lian and Vincent Wijeysingha, among others, will also be speaking. Please do come and attend the event, so that together, we can send out a strong message that Singaporeans are concerned about the CPF and we want the government to take our concerns seriously.

We are $21,284.20 in excess at this point. The funds will be set aside for any legal costs orders (if) made against me during the court proceedings by the court for me to pay the opposing sides legal cost if I lose any (interlocutory) applications in court. We have currently stopped putting out an active appeal for funds but if the funds continue coming in, I will be open and transparent with them and publish them, so as to be accountable.

Please see below for further information on the funds coming in so far, as of 5.00pm today.

Funds Raised So Far

We have raised $91,284.20 so far.

<header style="margin: 0px 0px 10px; padding: 0px; border: 0px; outline: 0px; font-size: 15px; vertical-align: baseline; color: rgb(136, 136, 136); background: transparent;">Update EIGHT 06062014] Fund Raising For Roy Ngerng’s Court Case Against Lee Hsien Loong

</header>This is the 8th update for the fund raising for the court case. We have reached the target of $70,000 four days ago for the legal fees. There are still some funds coming in. If the funds slow down in the next few days, I will move towards doing a weekly update instead. You can read more about what the court case is about and the fund raising appeal here.

We are now awaiting the pre-trial on 4 July 2014. The court case will be decided at a later date.

Tomorrow is the #ReturnOurCPF event. I will be speaking at the event. Leong Sze Hian Kenneth Jeyaretnam, Mr Tan Kin Lian and Vincent Wijeysingha, among others, will also be speaking. Please do come and attend the event, so that together, we can send out a strong message that Singaporeans are concerned about the CPF and we want the government to take our concerns seriously.

We are $21,284.20 in excess at this point. The funds will be set aside for any legal costs orders (if) made against me during the court proceedings by the court for me to pay the opposing sides legal cost if I lose any (interlocutory) applications in court. We have currently stopped putting out an active appeal for funds but if the funds continue coming in, I will be open and transparent with them and publish them, so as to be accountable.

Please see below for further information on the funds coming in so far, as of 5.00pm today.

Funds Raised So Far

We have raised $91,284.20 so far.

- Joined

- Jul 10, 2008

- Messages

- 66,954

- Points

- 113

Leaving for honglimpark now.

See you there.

Cheers.

You're wasting your time.

- Joined

- Jul 25, 2013

- Messages

- 17,813

- Points

- 113

Yes NZ is transitioning from universal superannuation to Kiwisaver which is similar to CPF.

https://www.kiwisaver.govt.nz/

The advantage of Kiwisaver is that you can choose your risk portfolio. Here are the returns thus far :

[TABLE="width: 1"]

<caption style="color: rgb(255, 255, 255); font-size: 12px; font-weight: bold; padding: 7px 10px; text-align: left; text-shadow: rgba(15, 25, 61, 0.74902) 1px 1px 1px; background: url(https://www.bnz.co.nz/static/www/images/0912-template-sprite-dark-blue.png?090414103814760=cb) 0px -340px no-repeat rgb(28, 61, 132);">BNZ KiwiSaver Scheme fund performance to 30 April 2014</caption><tbody>[TR="class: first-child"]

[TH] [/TH]

[TH]1 Month[/TH]

[TH]3 Months[/TH]

[TH]1 Year[/TH]

[TH="class: last-child"]Since inception1[/TH]

[/TR]

[TR]

[TD="class: first-child"]Cash Fund[/TD]

[TD]0.24%[/TD]

[TD]0.74%[/TD]

[TD]3.29%[/TD]

[TD="class: last-child"]3.02% p.a.[/TD]

[/TR]

[TR]

[TD="class: first-child"]Conservative Fund[/TD]

[TD]0.77%[/TD]

[TD]2.23%[/TD]

[TD]4.05%[/TD]

[TD="class: last-child"]3.66% p.a.[/TD]

[/TR]

[TR]

[TD="class: first-child"]Moderate Fund[/TD]

[TD]0.75%[/TD]

[TD]2.71%[/TD]

[TD]5.67%[/TD]

[TD="class: last-child"]4.99% p.a.[/TD]

[/TR]

[TR]

[TD="class: first-child"]Balanced Fund[/TD]

[TD]0.76%[/TD]

[TD]3.26%[/TD]

[TD]7.90%[/TD]

[TD="class: last-child"]6.91% p.a.[/TD]

[/TR]

[TR="class: last-child"]

[TD="class: first-child"]Growth Fund[/TD]

[TD]0.65%[/TD]

[TD]3.74%[/TD]

[TD]10.47%[/TD]

[TD]9.17% p.a.[/TD]

[/TR]

</tbody>[/TABLE]

Considering the fact that the NZD has averaged a risk free 5% return over the last few years, it shows how difficult it is to achieve anything more than a 2 to 3% above the cash rate over the long term while guaranteeing returns at the same time.

what are the composition of the funds?how come they have transparency and show the returns of the funds?how come they can give up to 10% returns?do they have a ho jinx managing the funds and throwing hundreds of millions here and there into emerging markets like machiam mahjong tiles?how many years since inception?

- Joined

- Jul 25, 2013

- Messages

- 17,813

- Points

- 113

Leaving for honglimpark now.

See you there.

Cheers.

what time is honglimpark?

- Joined

- Jul 10, 2008

- Messages

- 66,954

- Points

- 113

what time is honglimpark?

You must be freakin' blind.

This poster has appeared in just about every thread here over the last whole week.

- Joined

- Jul 10, 2008

- Messages

- 66,954

- Points

- 113

what are the composition of the funds?how come they have transparency and show the returns of the funds?how come they can give up to 10% returns?do they have a ho jinx managing the funds and throwing hundreds of millions here and there into emerging markets like machiam mahjong tiles?how many years since inception?

The cash fund is a guaranteed return.

The rest of the funds carry greater risk and can give negative returns over certain periods.

I don't know the exact composition of each fund but like any fund, they are tailored to suit the risk profile of the investor. A Younger couple would opt for the growth fund but have to accept the fact that they might go into negative territory along the way.

Those approaching retirement age would opt for the cash fund with a guaranteed return.

- Joined

- Jul 25, 2013

- Messages

- 17,813

- Points

- 113

yeah yeah theres so many of these stupid things i dont even know which to follow anymore.and some are pretty dumb,they need to focus on the foreigner and immigrant issue.

You must be freakin' blind.

This poster has appeared in just about every thread here over the last whole week.

Similar threads

- Replies

- 4

- Views

- 613

- Replies

- 34

- Views

- 1K

- Replies

- 7

- Views

- 517

- Replies

- 46

- Views

- 2K

- Replies

- 7

- Views

- 1K