Why should we bear the burden of budget meals and app discounts, some hawkers ask

Hawkers at Bukit Canberra Hawker Centre are expected to offer app discounts and budget meals.

Aug 20, 2025

SINGAPORE – When Bukit Canberra Hawker Centre’s management announced it would scrap clauses requiring hawkers to provide free meals for the needy at their own cost, the update was met with relief by hawkers. But many question why they continue to be called upon to provide budget meals and discounts to diners who pay using operator apps.

The Pay-it-Forward initiative by Canopy Hawkers Group, which manages the Socially-conscious Enterprise Hawker Centre (SEHC), initially required stallholders to contribute 100 free meals over three years.

It was criticised by veteran food critic K.F. Seetoh in an Aug 8 Facebook post that described it as “forced charity”. Health Minister Ong Ye Kung – who oversees the ward where the hawker centre is located –

waded into the debate on Aug 11, writing on Facebook that hawkers did not face penalties if they did not provide the meals.

However, copies of the contract shown to the media, including The Straits Times, indicated that hawkers could chalk up demerit points for failing to provide the meals. The management team later said on Aug 15 that it would not enforce the obligation in the future.

“Some stalls are not doing well, so it’s better not to force them,” says John (not his real name), a hawker in his 50s, who runs one of the 44 stalls there. Like many of the tenants ST spoke to, he declined to reveal his name for fear of repercussions from his operator.

Another hawker, who is also in his 50s, adds: “Doing charity is voluntary, not by force.”

But many hawkers lament that they are still obliged to provide budget meals under $3.50 and pay for discounts given to diners using operator apps.

Absorbing discounts

A 2022 version of the contract seen by The Straits Times states that hawkers could face three demerit points and $30 in liquidated damages for “failure to use Bukit Canberra HC mobile apps for customers to place orders, make payment”.

Hawkers say the app was intended for the convenience of customers and should be a value-added service by the operator.

“Its cost should not be passed on to the tenants,” says John, who has to absorb the 10 per cent discount customers get from the Food Canopy app. “Hawker prices are controlled and many have thin margins due to rising costs. This just makes things harder.”

In response to ST’s queries, Canopy Hawkers Group says the loyalty programme, which provides a 10 per cent rebate for customers paying through its app, is meant to encourage repeat customers and support hawkers’ business.

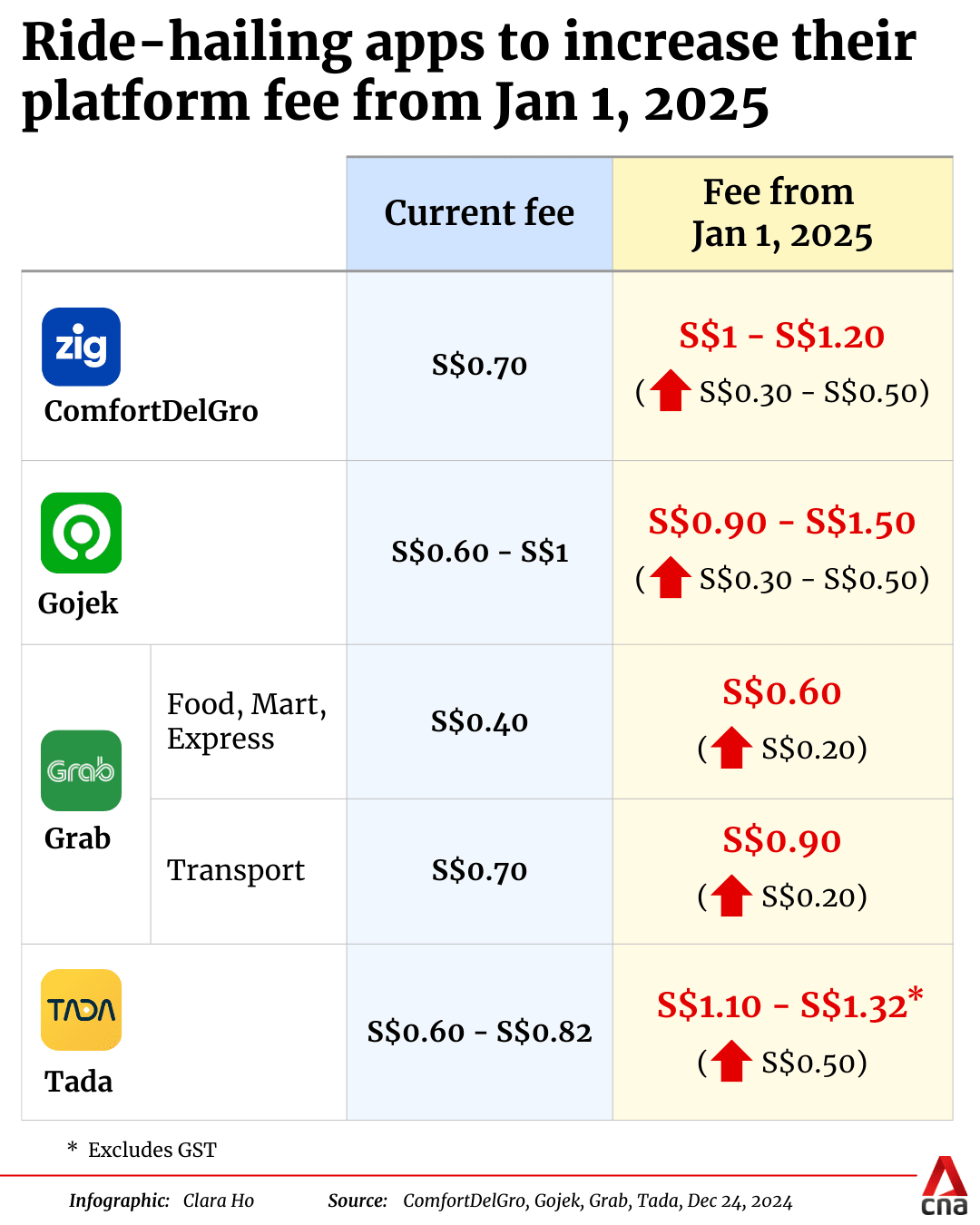

A similar arrangement has been rolled out at hawker centres run by FairPrice Group and Timbre Group.

Customers who pay using the app enjoy a 10 per cent discount on meals at One Punggol Hawker Centre and Yishun Park Hawker Centre, according to Timbre Group’s website.

“We lose a thousand dollars every month from the Timbre app,” says a 42-year-old who wanted to be known only as Rahman. He sells rojak and prata at One Punggol. However, he concedes that it was something he had agreed to when signing the contract.

Mr Yasser Farag, who runs Arabica Kebab stall in the same centre, was also prepared to offer concessions to customers, though the number of discounts caught him by surprise.

“I knew I had to keep prices low, but I didn’t expect so many people to have the app,” says the 58-year-old, who maintains that his experience at the hawker centre has otherwise been smooth.

Another hawker, who is in her late 50s, says prevalent usage of the app costs her around a thousand dollars each month. With the price of ingredients and utilities rising, her earnings have been shaved by a fifth. “I can’t afford to raise prices either, because I empathise with customers,” she adds.

Echoing the same sentiment is Ms Kumiko Tan, 44, owner of Hakka Leipopo, a chain with outlets in SEHCs, such as Anchorvale Village Hawker Centre and Punggol Coast Hawker Centre, both run by FairPrice Group.

“Times are hard for everyone. We won’t change the price of food to account for the discount,” she says. The cost of her dishes remains consistent across all outlets, even the one at the Tanjong Pagar Town Council-run Bukit Merah View Market & Hawker Centre.

Roughly 80 per cent of her customers at Anchorvale Village and Punggol Coast pay with the FairPrice Group app, which yields a 10 per cent discount. She adds: “I don’t think many of them know that the discount is paid for by the store owner. They think maybe it’s from the Government or the operator.”

Discounts offered through FairPrice Group app on display at Anchorvale Village Hawker Centre.

ST PHOTO: CHERIE LOK

But some hawkers, like a 38-year-old man operating a stall at Anchorvale Village Hawker Centre, feel the 10 per cent cut is fair, as the app helps boost business. “It’s a perk that, in a way, attracts customers,” he says.

How cheap is too cheap

The discount, however, cannot be applied to budget meals, which are low-cost dishes that tenants at SEHCs are obliged to offer – contractually, in the case of Bukit Canberra Hawker Centre’s tenants, at least.

At hawker centres operated by FairPrice Group, these affordable options are usually priced between $3 and $3.50, according to checks by ST.

Adam (not his real name), a hawker who runs a stall at Hawker Centre @ Our Tampines Hub, says that $3.50 is a manageable price point for budget meals. When

ST spoke to him in June 2024, his budget meals were fixed at $2.80.

Back then, a spokesperson for operator FairPrice Group confirmed budget meals at that particular hawker centre cost $2.80, but that the company was conducting a review.

Since the budget meal price has increased to $3.50, Adam says it is “much more reasonable”. “At least now, I can make around 20 to 30 cents in profit for each meal,” he adds. He previously told ST it was “impossible to make a profit” from $2.80 meals.

“I can’t make money off of it, but maybe only five to 10 people each month buy my budget meals, so still can tahan (endure in Malay),” adds a 45-year-old hawker, who wants to be known only as Hasan, at Buangkok Hawker Centre.

But Penang Alley’s $3.20 budget meals are snapped up by some 50 customers each month. Mrs Eileen Leong, the 57-year-old owner of the Buangkok Hawker Centre stall, says such meals, which consist of mainly eggs and kway teow, are “unsustainable”.

She tried asking her operator, Fei Siong Social Enterprise, to increase the budget meal price to $4 without success. With operation costs spiking 50 per cent and footfall down three-quarters by her estimates, she is seeking a reprieve.

In response to queries from ST, the National Environment Agency (NEA) reiterated what then-Senior Minister of State for Sustainability and the Environment Koh Poh Koon said in a November 2024 parliamentary address: Such value meals only account for 5 to 20 per cent of meals sold in SEHCs.

Portions, according to hawkers, tend to be smaller and often omit more expensive proteins such as meat.

“Hawkers are not expected to make a loss selling value meals as they would have taken into the consideration of its impact in their rentals when applying for the stalls. Moreover, SEHC operators can propose to revise the price of such value meals options, which NEA will review based on the market situation and stallholders’ ability to make a fair livelihood,” said NEA’s spokesperson, citing the case of Ci Yuan Hawker Centre in Hougang, where the price was reviewed and adjusted based on feedback from operators and hawkers.

Canopy Hawkers Group, likewise, adds that food prices are adjusted from time to time, in discussion with tenants.

According to NEA, in 2023, the median monthly stall rental at SEHCs and non-subsidised stalls at comparable NEA-managed hawker centres were $1,700 and $1,625 respectively. Ancillary costs at SEHCs, such as table-cleaning and centralised dishwashing fees, are comparable with similar NEA-managed hawker centres, it added.

The agency also assists hawkers financially through schemes such as the Hawkers’ Productivity Grant, which provides 80 per cent co-funding for hawkers to buy kitchen automation equipment and digital solutions such as queue management systems.

ST has contacted the relevant operators for more information. Timbre Group declined to comment, while FairPrice Group and Fei Siong Social Enterprise did not respond by press time.