- Joined

- Oct 30, 2014

- Messages

- 36,768

- Points

- 113

Despite the dwindling leases, transactions for the 70-year leasehold landed properties in Jalan Chempaka Puteh, Jalan Chempaka Kuning and Bedok Road have been mostly profitable.

The leases for 144 terraced and semi-detached houses there are set to run out in 10 years – in August 2034.

Checks by The Straits Times found 110 transactions for such homes – with leases beginning in 1964 – between 1995 and 2023. The earliest recorded transaction on the Urban Redevelopment Authority (URA) Realis caveats database was in 1995.

Of the 38 homes that changed hands at least twice during this period, 27 transactions were profitable while 11 made a loss.

Property analysts said while the shrinking lease was notable, this was not unusual as overall prices of landed residential homes have risen.

Mr Nicholas Mak, chief research officer at property search portal Mogul.sg, said the profitable transactions could be because the homes were bought years ago when prices were lower.

For instance, the most profitable transaction was for a 4,300 sq ft semi-detached house in Bedok Road, which changed hands in April 2022 at $800,000. The seller, who bought the home at $342,000 in 2001, made a profit of $458,000.

On the other hand, the seller of a 4,100 sq ft terraced house in Jalan Chempaka Kuning recorded the biggest loss of $300,000 when it was sold for $450,000 in 2016. The Housing Board upgrader had bought the home at $750,000 in 2013.

Mr Mak noted that most of the home owners in the estate were not speculators as the median holding period – the amount of time a seller owns the home before selling it – was seven years, with the longest holding period at nearly 22 years.

A former resident who wanted to be known only as Mr Eddy, 66, who sold his semi-detached house in Bedok Road for $800,000 in 2023, said he did not expect to make a significant profit off the property. He bought the 4,100 sq ft home in 2002 at $410,000.

“It was on the market for eight months before I got the price I wanted,” said the regional sales director, adding that the buyers were a middle-aged couple who wanted to set up a home office.

While some residents have been hoping for more clarity on the fate of the land when the lease is up, others have been putting their homes up for sale on listing platform PropertyGuru. Checks from April 16 to May 24 showed that asking prices ranged from $550,000 to $790,000.

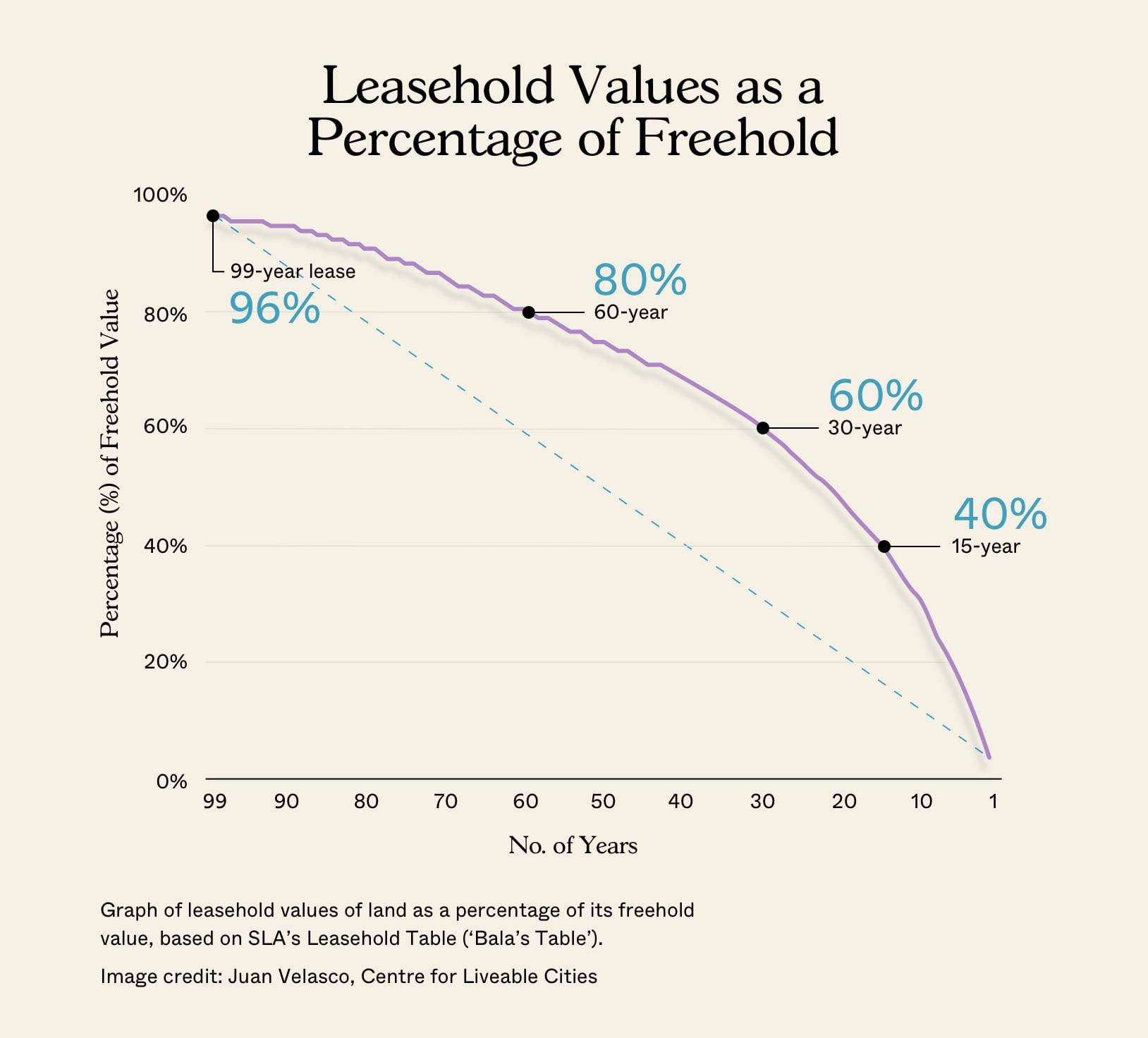

Although the transactions in the Chempaka estate were mostly profitable, Ms Christine Sun, chief researcher and strategist at property firm OrangeTee Group, said the overall values of properties that are 50 years and older have not increased “too significantly” over the past 10 years.

“This is because the cost of maintenance tends to be higher for such older properties. For those left with very few years, the depreciation may even be faster,” she said, noting that the affected homes are 60 years old.

Mr Mak added: “A rational buyer would not pay significantly more than 10 years’ worth of rental value for these houses, unless he has reasons to believe that the properties have some residual value at the end of the lease.”

Buyers would also have to pay for the home in cash, as they would not be able to get a bank loan due to the short remaining lease.

However, Ms Sun said buyers may still find the landed homes there to be affordable given the large land area.

In District 16, the Bedok and Upper East Coast area, leasehold landed homes were sold at a median of $2.75 million from January to May 2024, while freehold landed properties changed hands at a median of $4.68 million, she said.

A resident who wanted to be known only as Mr Koh bought a 3,300 sq ft semi-detached home in Jalan Chempaka Puteh with 13 years left on its lease in 2021 for about $750,000.

“I felt that the asking price was reasonable for the size – it was about $250 per sq ft, and renovated,” said the 51-year-old. “Simpang Bedok is also at our doorstep so there’s easy access to shops and food.”

He subsequently bought another property in the area for about $500,000, which he rents to a company at a “decent rental yield”.

Mr Mak said the 70-year leasehold homes, at less than $1 million each, were cheaper than some HDB flats.

“It’s very rare to be able to buy a landed house for that price. But the buyer must bear in mind that the days of owning that house are numbered,” he added.

https://www.straitstimes.com/singap...mpaka-landed-homes-despite-leases-running-out