- Joined

- Jan 19, 2009

- Messages

- 3,316

- Points

- 113

Just make sure you top up your special account to max FRS first to nullify the yearly increase. The 4% interest is more than adequate to cover the fuckup PAP's yearly increase.

Make sure housing loan is fully paid. If fully paid in CPF, you can now do periodic CPF housing refunds via the new CPF app. This allows you to earn interest at 2.5%, way better than any FDs. At 55, if you do not need the monies in Ordinary account, don't bother withdrawing. Leave inside. You can still take out any time after 55 should you need the money. It pays reasonably good interest.

Only when you have spare cash, then throw in FDs and other investment.

Bro Meng, I am still working now so still having employer contribution into SA and my MA is maxed liao

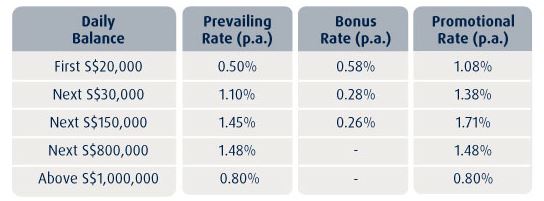

The long term FD that I placed with commercial banks now for my old aged living and my emergency fund is very liquid in the saving accounts

The long term FD that I placed with commercial banks now for my old aged living and my emergency fund is very liquid in the saving accounts

I hope all the sacrifices that I make in this decade is more than sufficient to show those malicious people (if they live long enough to see) that sinkie men can also retire comfortable