-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Lawrence Wong can prevent the housing crash?

- Thread starter hbk75

- Start date

why must prevent? let it crash lah!

wait so long still haven't crash one??

where got crash?

if people want to lao sai you dun let them.

what will happen? people lao sai everywhere!!

low interest rates are preventing the lau sai from happening.

- Joined

- Jul 17, 2008

- Messages

- 13,369

- Points

- 83

low interest rates are preventing the lau sai from happening.

The time that it will crash will be when recession hit and everyone starts losing their jobs.

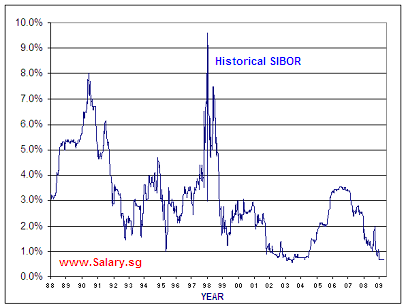

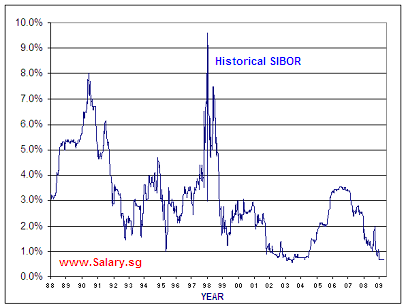

SIBOR is going up, but is still relatively low.

The time that it will crash will be when recession hit and everyone starts losing their jobs.

SIBOR is going up, but is still relatively low.

wondering which idiot in mas go allow mortgage rates to go at 1% for an extended period of time. usa using low rates before they are suffering a deflation and using low rates to generate recovery. singapore was a fast economy so having extremely low rates is a recipe for disaster. now they have a big bubble that no ministars will dare to pop it.

- Joined

- Jul 17, 2008

- Messages

- 13,369

- Points

- 83

wondering which idiot in mas go allow mortgage rates to go at 1% for an extended period of time. usa using low rates before they are suffering a deflation and using low rates to generate recovery. singapore was a fast economy so having extremely low rates is a recipe for disaster. now they have a big bubble that no ministars will dare to pop it.

Nobody. MAS does not cotrol interest rate for the monetary policy. They manage FX.

- Joined

- Jul 17, 2008

- Messages

- 13,369

- Points

- 83

Why still haven't crash?

I am still waiting for it!

Too soon. Wait till people start losing their jobs and interest rate 4 to 5%.

- Joined

- Jul 25, 2013

- Messages

- 17,813

- Points

- 113

looks like in 97',the sibor made many sinkies jump down and commit suicide.

can u imagine what would happen when sinkies owe 200k to 400k mortgage loan or 800k condo mortgage loan and the sibor rate goes up to 9 percent?lots of daft and stupid sinkies are going to be lieing at the bottom of the hdb voiddeck while their children wail over their parents dead bodies.and im going to be there licking up their delicious tears of sadness.oh your delicious indelectable tears oh so yummy!!!!your tears sustain me!!!

can u imagine what would happen when sinkies owe 200k to 400k mortgage loan or 800k condo mortgage loan and the sibor rate goes up to 9 percent?lots of daft and stupid sinkies are going to be lieing at the bottom of the hdb voiddeck while their children wail over their parents dead bodies.and im going to be there licking up their delicious tears of sadness.oh your delicious indelectable tears oh so yummy!!!!your tears sustain me!!!

- Joined

- Feb 21, 2012

- Messages

- 1,142

- Points

- 0

PAP wants property price to "drop significantly", Tharman had said this several times and Khaw calls the property market a bubble fuelled by low interest rates that will collapse in a matter of time. This is not a secret by PAP, the 70% have voted for this so they deserve a property crash.

Lawrence Wong is a junior and has very little power on this, the cooling measures is decided by Tharman, and supply was decided by Khaw.

The evil greedy super rich developers had strong holding power and had foolishly refused to cut prices to sell off much of their inventory last year and early this year, thinking they can outlast the cooling measures. Now the developers are stuck with huge unsold inventory, a large oversupply and crashing demand, escalating vacancy rates and falling rents, rising interest rates and falling prices, and the economy is heading for a recession.

Now the developers have to slash prices much more to offload units than if they had did it last year and early this year. Hope the evil greedy developers die pain pain.

Lawrence Wong is a junior and has very little power on this, the cooling measures is decided by Tharman, and supply was decided by Khaw.

The evil greedy super rich developers had strong holding power and had foolishly refused to cut prices to sell off much of their inventory last year and early this year, thinking they can outlast the cooling measures. Now the developers are stuck with huge unsold inventory, a large oversupply and crashing demand, escalating vacancy rates and falling rents, rising interest rates and falling prices, and the economy is heading for a recession.

Now the developers have to slash prices much more to offload units than if they had did it last year and early this year. Hope the evil greedy developers die pain pain.

PAP wants property price to "drop significantly", Tharman had said this several times and Khaw calls the property market a bubble fuelled by low interest rates that will collapse in a matter of time. This is not a secret by PAP, the 70% have voted for this so they deserve a property crash.

Lawrence Wong is a junior and has very little power on this, the cooling measures is decided by Tharman, and supply was decided by Khaw.

The evil greedy super rich developers had strong holding power and had foolishly refused to cut prices to sell off much of their inventory last year and early this year, thinking they can outlast the cooling measures. Now the developers are stuck with huge unsold inventory, a large oversupply and crashing demand, escalating vacancy rates and falling rents, rising interest rates and falling prices, and the economy is heading for a recession.

Now the developers have to slash prices much more to offload units than if they had did it last year and early this year. Hope the evil greedy developers die pain pain.

Ms Yellen just prolonging the agony by putting interest rate on hold...

She is looking at China for signals before acting... But this game of wait and see just put the world in a limbo..

( meantime, some weak property holders will throw in the towel and there will be bargains now and then))

She should just bite the bullet and not let the future generation bear the pain.

Nobody. MAS does not cotrol interest rate for the monetary policy. They manage FX.

Using FX to control inflation seems not too effective these days when central banks all over the world can do massive printing whenever they feel like it. Is used to be quite ok during GKS era when money cannot printed anyhow. Just see how mas loses billions trying to control the FX rates.

looks like in 97',the sibor made many sinkies jump down and commit suicide.

can u imagine what would happen when sinkies owe 200k to 400k mortgage loan or 800k condo mortgage loan and the sibor rate goes up to 9 percent?lots of daft and stupid sinkies are going to be lieing at the bottom of the hdb voiddeck while their children wail over their parents dead bodies.and im going to be there licking up their delicious tears of sadness.oh your delicious indelectable tears oh so yummy!!!!your tears sustain me!!!

sibor increase is not that scary if you can afford to pay. the scary part like in 1997 is banks asking for margin calls. i wonder how many sinkies have 300k of hard cash to standby for such events when banks asked for top ups?

PAP wants property price to "drop significantly", Tharman had said this several times and Khaw calls the property market a bubble fuelled by low interest rates that will collapse in a matter of time. This is not a secret by PAP, the 70% have voted for this so they deserve a property crash.

Lawrence Wong is a junior and has very little power on this, the cooling measures is decided by Tharman, and supply was decided by Khaw.

The evil greedy super rich developers had strong holding power and had foolishly refused to cut prices to sell off much of their inventory last year and early this year, thinking they can outlast the cooling measures. Now the developers are stuck with huge unsold inventory, a large oversupply and crashing demand, escalating vacancy rates and falling rents, rising interest rates and falling prices, and the economy is heading for a recession.

Now the developers have to slash prices much more to offload units than if they had did it last year and early this year. Hope the evil greedy developers die pain pain.

i dun think pap wants to crash the property market. but sometime such things are inevitable. pap even how power is only isolated into this 640 sq km plot of land. they have little influence on how fed reserve are going to hike their rates.

- Joined

- Jul 25, 2013

- Messages

- 17,813

- Points

- 113

is khaw trying to incite fear in the market and saying prices will come down eventually?what about those sinkies who have paid sky high prices for their pigeon holes?will their cpf money be flushed down the drain?

and very nice of PAP to use this secondary school meeting as a propaganda session.

and very nice of PAP to use this secondary school meeting as a propaganda session.

Last edited:

is khaw trying to incite fear in the market and saying prices will come down eventually?what about those sinkies who have paid sky high prices for their pigeon holes?will their cpf money be flushed down the drain?

and very nice of PAP to use this secondary school meeting as a propaganda session.

Alot of sinkies are paying exceeded 1k psf for some ulu location condos. these people will have a wake up call soon.

- Joined

- Jul 17, 2008

- Messages

- 13,369

- Points

- 83

Using FX to control inflation seems not too effective these days when central banks all over the world can do massive printing whenever they feel like it. Is used to be quite ok during GKS era when money cannot printed anyhow. Just see how mas loses billions trying to control the FX rates.

True but it only applies to the Greenback.

To some extend, other than Uncle Sam, any country that print $ indiscriminately will be faced with inflation and devaluation of its currency.

Similar threads

- Replies

- 34

- Views

- 2K

- Replies

- 1

- Views

- 273

- Replies

- 6

- Views

- 520