- Joined

- Oct 5, 2018

- Messages

- 19,774

- Points

- 113

Tiagong, sgd is world 11st most powerful currency de wohThe Singapore dollar’s two-year streak as the top-performing Asian currency is seen ending this year as the nation’s central bank may start loosening its policy as soon as April.

https://www.bnnbloomberg.ca/singapore-dollar-s-stellar-run-seen-ending-on-monetary-easing-1.2051067

Analysts project 0.75% (2-3 cuts) for 2024 but inflation is getting higher - oil and industrial metal prices strengthening. Russia's military factories are also more productive now with ample processed steel supply from China lately. I fear that all these hints that Russia will invade Moldova, Poland and Baltic states soon.I think China's economy, non property sector esp, will rebound soon. With high ir in US, consumers and manufacturers will definitely be seeking lower cost goods to purchase, and with only 2 rises worth 50 basis points left for the FED, matter of time they will cut IR...simplistic thinking

Unless u believe in the Illuminati and New World Order, I don't think so, unless Russia wants to rain on the POTUS electionAnalysts project 0.75% (2-3 cuts) for 2024 but inflation is getting higher - oil and industrial metal prices strengthening. Russia's military factories are also more productive now with ample processed steel supply from China lately. I fear that all these hints that Russia will invade Moldova, Poland and Baltic states soon.

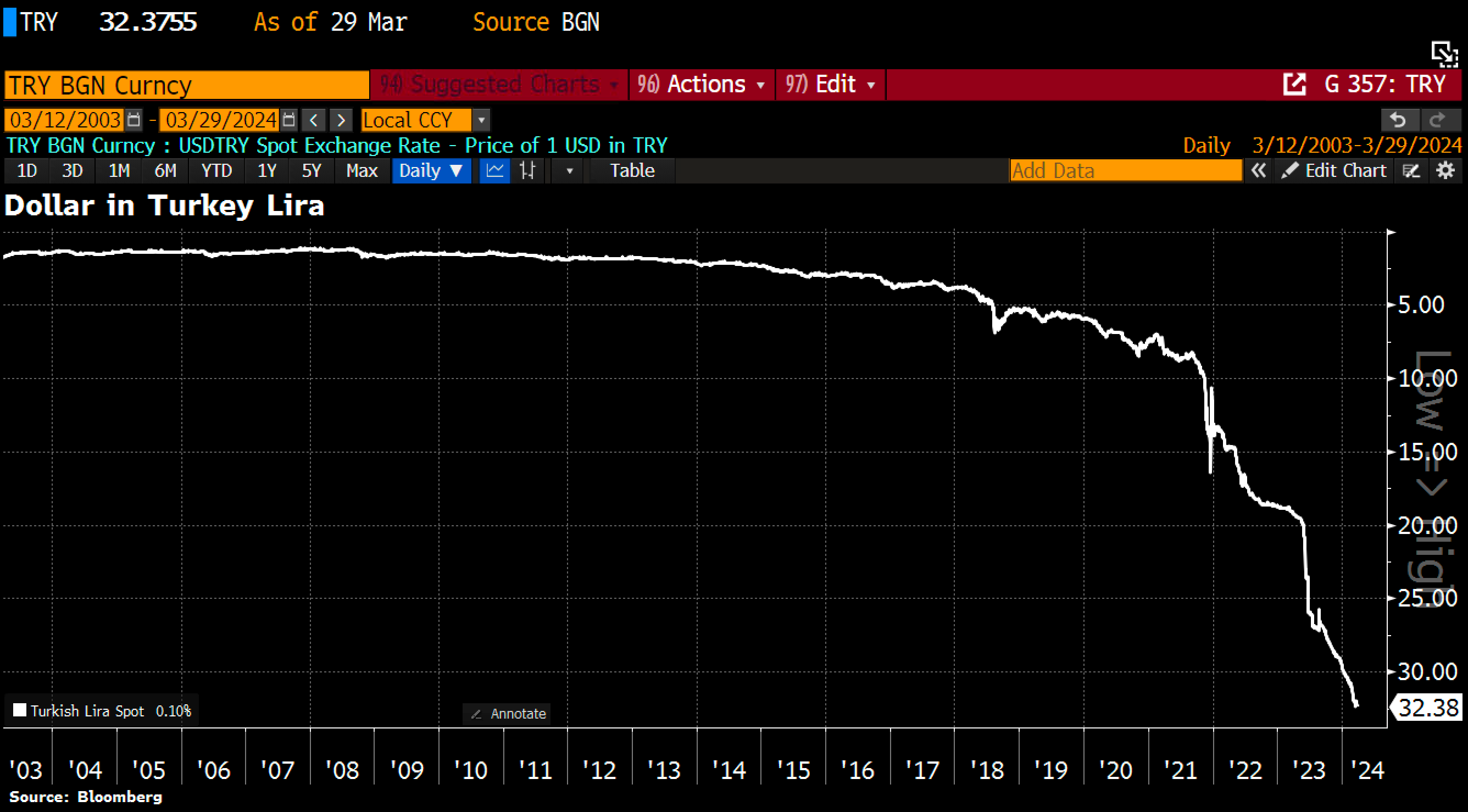

They are hoarding Gold at God SpeedTurkey inflation at 67% and Turkey Lira near All-Time low

The maps says a lot about Russia.Unless u believe in the Illuminati and New World Order, I don't think so, unless Russia wants to rain on the POTUS election

cryptos also saved a lot of people.They are hoarding Gold at God Speed

https://www.google.com/amp/s/amp.cnn.com/cnn/2024/03/20/business/turkey-inflation-gold-dollar-stocks

Istanbul/LondonCNN —

Down a dimly lit alleyway tucked just inside Istanbul’s Grand Bazaar, a few dozen men are packed together, shouting, waving, and frantically speaking on their phones, others nervously pacing.

This “standing market” — a low-rent version of a chaotic stock exchange floor — is where Istanbul’s traders come to deal in precious metals and currencies. These days it’s dollars and gold they’re after. Turkish lira, not so much.

“Right now our money is almost worthless. Since people haven’t seen inflation fall, they don’t trust the Turkish lira anymore,” explained Adnan Kapukaya, a trader and market expert.