- Joined

- Nov 24, 2008

- Messages

- 24,671

- Points

- 113

Photographer: Nicky Loh/Bloomberg

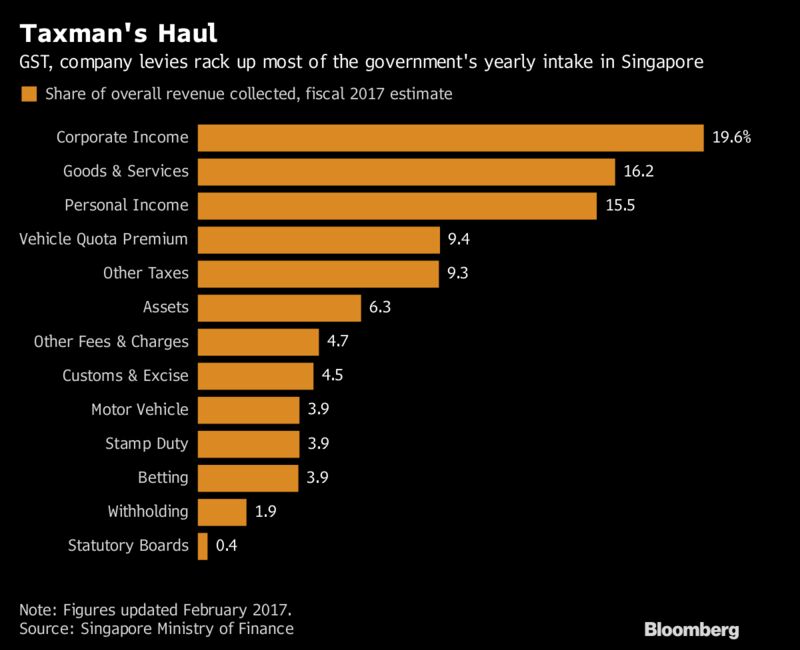

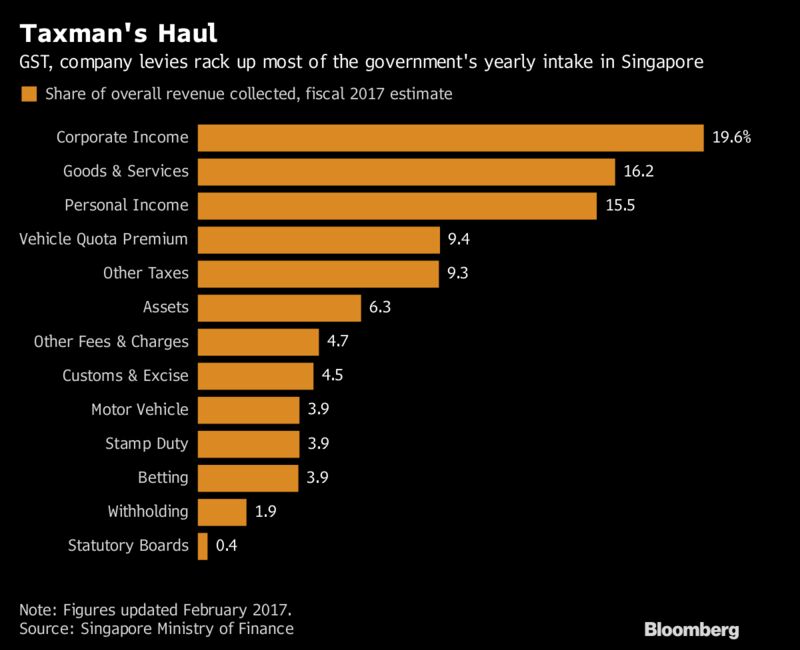

These Are the Taxes Singapore Could Hike in Next Month's Budget

By

Michelle Jamrisko

January 11, 2018, 1:00 PM PST

Authorities have several other options to increase taxes, or at least signal that they’re needed in the coming years, as the city state grapples with rising health and retirement costs as the population ages rapidly.

Here are a few other measures to watch as the budget is announced:

1. E-commerce

Economies in the region are just starting to tackle the sticky issue of how to help level the playing field between brick-and-mortar retail and online vendors through a tax on the latter.

While Malaysia, Thailand and Indonesia all have been brainstorming this kind of levy, Singapore may have to move faster, said Chua Hak Bin, a senior economist at Maybank Kim Eng Research in Singapore. That’s because any increase in the GST would give online retailers an even bigger unfair advantage, he said.

Francis Tan, an economist at United Overseas Bank Ltd. in Singapore, sees the same urgency for an e-commerce levy.

“It’s pretty important right now, especially when there’s a growing share -- rising at a double-digit pace every year -- of Singaporeans shopping online,” he said. “They just have to plug this gap” between taxing online and conventional stores, he said.

Online shoppers in Singapore generally aren’t taxed for their purchases if they don’t exceed S$400 ($300), Indranee Rajah, senior minister of state for law and finance, said in a November interview. Given how quickly online vendors are changing the way people shop, such a tax change should have been achieved “probably yesterday,” she said.

2. Estate tax

Singapore removed the tax on assets for people who died after Feb. 15, 2008, and it’s possible the government may seek to reinstate the estate duty at some point, said Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd. in Singapore. The levy fits the government’s goal of broadening the tax base and ensuring that the fees are equitable.

“It does send across a very important message about equitibility -- to make sure that when there’s inter-generational transfer of wealth, some of this is to be redistributed” by taxing part of it, he said.

3. Personal income, corporate taxes

Income tax rates in Singapore are among the lowest in the world, and there may be room to adjust those without threatening the city state’s competitiveness.

The tax rate for top earners, at 22 percent, compares favorably to a 30 percent average across Asia and 34, 35 and 36 percent in Latin America, Europe and North America, according to data compiled by tax and financial advisory firm KPMG LLP.

Call of Duties

Even after U.S. slashes rates, Singapore's taxes are among most attractive globally

Source: KPMG LLP

Notes: Averages provided for Asia, Europe, Latin America. Data reflects U.S. tax changes enacted December 2017.

On the corporate side, Singapore ranks No. 2 in the world in the World Bank’s ease-of-doing business index, including a No. 7 ranking in the “paying taxes” sub-category. The overall ranking is three spots higher than rival Hong Kong.

But with tax competition heating up across the world as the U.S. lowers rates, it’s unlikely Singapore will move in the opposite direction.

Finance Minister Heng Swee Keat, in response to a question on the U.S. tax cuts this week, gave no hints of possible adjustments.

“There is increasing competition in the global arena,” said Heng. “We must continue to develop and strengthen our competitive advantages, by maintaining our pro-business environment and building on our connectivity to the global markets and our strong links” to Southeast Asia and Asian economies, he said.

4. Virtual currencies

Officials like Ravi Menon, managing director of the Monetary Authority of Singapore, have been careful not to cast a judging eye on the hype around cryptocurrencies such as bitcoin, instead clarifying that while there may be investment risk, the authorities won’t regulate them beyond signs of illicit financing.

But Ernst & Young LLP is looking for more clarity on how to treat virtual currencies in tax terms. The Inland Revenue Authority of Singapore needs to address whether the currencies be treated as a commodity for tax purposes, or as a commodity derivative, “given the proposed statutory definition that it is a digital representation of value where the underlying asset is a virtual commodity,” said Amy Ang, a partner and financial services tax leader at Ernst & Young Solutions.

These Are the Taxes Singapore Could Hike in Next Month's Budget

By

Michelle Jamrisko

January 11, 2018, 1:00 PM PST

- Economists say watch for news on e-commerce, estate duties

- Income taxes are less likely to be raised after U.S. cuts

Authorities have several other options to increase taxes, or at least signal that they’re needed in the coming years, as the city state grapples with rising health and retirement costs as the population ages rapidly.

Here are a few other measures to watch as the budget is announced:

1. E-commerce

Economies in the region are just starting to tackle the sticky issue of how to help level the playing field between brick-and-mortar retail and online vendors through a tax on the latter.

While Malaysia, Thailand and Indonesia all have been brainstorming this kind of levy, Singapore may have to move faster, said Chua Hak Bin, a senior economist at Maybank Kim Eng Research in Singapore. That’s because any increase in the GST would give online retailers an even bigger unfair advantage, he said.

Francis Tan, an economist at United Overseas Bank Ltd. in Singapore, sees the same urgency for an e-commerce levy.

“It’s pretty important right now, especially when there’s a growing share -- rising at a double-digit pace every year -- of Singaporeans shopping online,” he said. “They just have to plug this gap” between taxing online and conventional stores, he said.

Online shoppers in Singapore generally aren’t taxed for their purchases if they don’t exceed S$400 ($300), Indranee Rajah, senior minister of state for law and finance, said in a November interview. Given how quickly online vendors are changing the way people shop, such a tax change should have been achieved “probably yesterday,” she said.

2. Estate tax

Singapore removed the tax on assets for people who died after Feb. 15, 2008, and it’s possible the government may seek to reinstate the estate duty at some point, said Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd. in Singapore. The levy fits the government’s goal of broadening the tax base and ensuring that the fees are equitable.

“It does send across a very important message about equitibility -- to make sure that when there’s inter-generational transfer of wealth, some of this is to be redistributed” by taxing part of it, he said.

3. Personal income, corporate taxes

Income tax rates in Singapore are among the lowest in the world, and there may be room to adjust those without threatening the city state’s competitiveness.

The tax rate for top earners, at 22 percent, compares favorably to a 30 percent average across Asia and 34, 35 and 36 percent in Latin America, Europe and North America, according to data compiled by tax and financial advisory firm KPMG LLP.

Call of Duties

Even after U.S. slashes rates, Singapore's taxes are among most attractive globally

Source: KPMG LLP

Notes: Averages provided for Asia, Europe, Latin America. Data reflects U.S. tax changes enacted December 2017.

On the corporate side, Singapore ranks No. 2 in the world in the World Bank’s ease-of-doing business index, including a No. 7 ranking in the “paying taxes” sub-category. The overall ranking is three spots higher than rival Hong Kong.

But with tax competition heating up across the world as the U.S. lowers rates, it’s unlikely Singapore will move in the opposite direction.

Finance Minister Heng Swee Keat, in response to a question on the U.S. tax cuts this week, gave no hints of possible adjustments.

“There is increasing competition in the global arena,” said Heng. “We must continue to develop and strengthen our competitive advantages, by maintaining our pro-business environment and building on our connectivity to the global markets and our strong links” to Southeast Asia and Asian economies, he said.

4. Virtual currencies

Officials like Ravi Menon, managing director of the Monetary Authority of Singapore, have been careful not to cast a judging eye on the hype around cryptocurrencies such as bitcoin, instead clarifying that while there may be investment risk, the authorities won’t regulate them beyond signs of illicit financing.

But Ernst & Young LLP is looking for more clarity on how to treat virtual currencies in tax terms. The Inland Revenue Authority of Singapore needs to address whether the currencies be treated as a commodity for tax purposes, or as a commodity derivative, “given the proposed statutory definition that it is a digital representation of value where the underlying asset is a virtual commodity,” said Amy Ang, a partner and financial services tax leader at Ernst & Young Solutions.