https://www.rt.com/op-ed/434245-china-africa-trade-war/

China sees Trump’s trade war as an opportunity to boost ties with Africa

Darius Shahtahmasebi is a New Zealand-based attorney and political analyst.

Published time: 25 Jul, 2018 16:05

Get short URL

Xi Jinping and Cyril Ramaphosa at The Council for Scientific and Industrial Reasearch (CSIR) in Pretoria on July 24, 2018 © Phill Magakoe / AFP

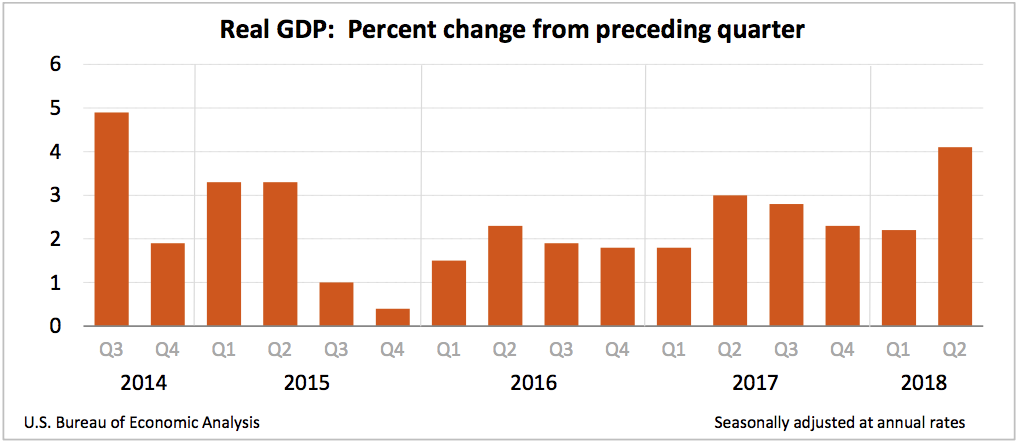

“The United States has initiated trade actions affecting a broad group of countries and faces retaliation or retaliatory threats from China, the European Union, its NAFTA partners and Japan, among others. Our modelling suggests that if current trade policy threats are realised and business confidence falls as a result, global output could be about 0.5 percent below current projections by 2020,” the International Monetary Fund’s Maury Obstfeld said earlier this month.

China, not the US, is Africa’s largest trading partner. Trade between Africa and China has grown from $765 million in 1978 to over $170 billion in 2017, and is soon expected to reach $400 billion. According to the United National Conference on Trade and Development (UNCTAD) World Investment Report 2018, China was the fourth largest foreign investor in Africa in 2016, spending about $40 billion. China was not too far behind the US, the UK, and France, and its rate of investment continues to grow a lot faster than the US can afford to keep up with.

In fact, if I remember correctly, it wasn’t all too long ago that President Trump was openly calling African nations “shithole countries” – a remark that left a chilling void quickly filled by China. From January 12 to 16 of this year alone, right as the US commander-in-chief was insulting the entire continent, Chinese Foreign Minister Wang Yi visited four African countries: Rwanda, Angola, Gabon, and São Tomé and Príncipe.

Read more

Trump asks why so many immigrants come to US from ‘s***hole countries’ – reports

Trump asks why so many immigrants come to US from ‘s***hole countries’ – reports

China’s Africa Strategy

The aim of these visits was of course to encourage these nations to join China’s Belt and Road Initiative. Even as we speak, Chinese President Xi Jinping is in Africa recruiting as many allies as possible to take on the US in its ill-conceived trade war with some of the world’s major players. His visit included stops in Senegal, Rwanda, South Africa, and the Indian Ocean island of Mauritius. While on this latest tour, Xi has signed dozens of trade and investment deals, including a $126 million loan agreement for two road projects in Rwanda. Rwandan media has praised the relationship, with one commentator referring to these kinds of investment as the “cornerstone for Africa’s development.”

Most importantly, however, Johannesburg will host Xi’s much anticipated reunion with Brazil, Russia, and India at the five-nation BRICS summit. This is the first BRICS summit since Trump’s delusional threats of a trade war became a political reality, and even includes Turkish President Recep Tayyip Erdogan, as well as some African leaders, such as Angola’s Joao Lourenco and Zambia’s Edgar Lungu.

Just this Tuesday, China pledged to invest $14.7 billion in South Africa and grant loans to its state power utility and logistics company, instantly helping the South African rand to make some early gains. China is already South Africa’s biggest trading partner, and this does not seem set to change any time soon.

South Africa is not the continent’s only nation looking to capitalise on the economic opportunities offered by China. Countries in West Africa, including Nigeria, Mauritania, and Ivory Coast (Cote d’Ivoire) have all expressed interest in joining China’s Belt and Road Initiative. Zimbabwe’s president, Emmerson Mnangagwap said earlier this year that the “Belt and Road Initiative is indeed a vision for the future.” Tanzania’s minister of foreign affairs, Augustine Mahiga, further described the Belt and Road Initiative as a “user-friendly globalization of the economy.”

Not all countries appear to be offering a user-friendly system of governance; quite the opposite (there is one in particular that comes to mind). African leaders will also meet this September in Beijing for the Forum on China-Africa Cooperation (FOCAC) summit – it should not be a mystery at all as to what the major topics of discussion will be.

Read more

China to invest $15 billion in South African economy

China to invest $15 billion in South African economy

The Major Point of Difference with the US

The major point of difference between China and the US is that while Donald Trump openly insults the entire continent, China has made a point of including anyone and almost everyone in its plans to develop Africa. Rwanda, Senegal, and Mauritius are all considered resource-poor, yet this has not stopped the Chinese president from visiting these three nations recently in an attempt to portray China as a partner for Africa’s industrialization. Whereas the US makes a point of targeting and showing interest in countries only when they have resources that can be extracted to benefit a select few, China may in fact be demonstrating it can listen closely to Africa’s aspirations instead.

This is not some pro-Beijing propaganda secretly paid for by the Chinese media. In fact, this latter point was taken directly from the Washington Post.

Take Rwanda, for example. The US already enacted sanctions on Rwanda’s US exports earlier this year, when Rwanda imposed tariffs on used clothing and shoes from America in order to try and boost its own local manufacturing. The amount of money the US invests in Africa appears to be waning, even under the Obama administration, who committed $3.1 billion in a three-year period to an initiative to address African power shortages. In all honesty, Obama spent more money drone-bombing the continent than the US has ever spent on actually developing it.

The Risk

It is no secret that investing in Africa comes with its fair share of risks. Security risks are the most commonly cited, though risks can also exist in other forms, such as inability to pay back loans to which China has made an abundance of. However, consider this statement by Kansai University Professor Michiko Kitaba in the Diplomat which reads:

Read more

Trump slams currency manipulation by Brussels & Beijing

Trump slams currency manipulation by Brussels & Beijing

“From the Chinese perspective, the African continent is the last stop for the One Belt, One Road concept. Since the economic reforms in 1979 and the emergence of the concept of the “socialist market economy” in the 1990s, the market (read: demand) has become the essential growth factor for the economy in China. The One Belt, One Road is a structure that will generate new demand to counter the excess supply capacity of the Chinese economy. Even if the loans become uncollectable, China does not need to recoup its capital outlays at this stage. Mining rights for natural resources, harbor leases, and other settlements in kind are far more useful to the future of the Chinese economy. Even if such “goodies” are abandoned, China can score a significant win in the long term if it can form a renminbi economic zone and provide the groundwork for building a world where international trade does not rely on the U.S. dollar.”

You won’t see this point highlighted much in mainstream media circles but this, my friends, is where the true value in Beijing’s investments in Africa lies. Just over a week ago, reports emerged that China National Offshore Oil Corp (CNOOC) is willing to invest $3 billion in its existing oil and gas operation in Nigeria, Africa’s most populous nation. At the time, CNOOC Chief Executive Yuan Guangyu announced that his company had invested more than $14 billion in its Nigerian operations and expressed readiness to invest more. This announcement followed a more devastating development in May this year relating to a deal which sees Nigeria and China agreeing on a currency-swap worth $2.4 billion to boost commercial ties and reduce the need to use the US dollar in bilateral trade. China is Nigeria’s second largest trading partner after the US.

READ MORE: Trade war bailout: Trump promises $12bn in emergency aid to US farmers

To China, the risk is worth it. While technically known for decades, it is America’s best kept secret that the empire’s entire existence is predicated on the status of the US dollar on the global financial markets. As far back as 1989, writing in his book The Roaring ‘80s, former Rhodes Scholar, Emmy Award-winning TV host, and Wall Street insider Adam Smith explained this dynamic brilliantly:

“First, we have a large reservoir of moral credit from our position as a world military leader and from our past as an investor and lender. Second, the dollar is the key currency. Dollars are what the world banks in, insures in, denominates. Before the dollar, it was the pound sterling, and the British got an extension on the tenure of their empire because the world hadn’t found another currency in which to denominate. If you operate in the key currency, it takes longer for the whistle to blow.”

Unfortunately for the United States war machine, that whistle may slowly but surely on its way to being blown, as China purposely chips away at the status of the US dollar piece by piece. Forget whatever you think you know about Trump’s animosity with China or any of its allies, including North Korea and Iran; because this is the real dilemma the United States is facing in its mounting confrontation with China: a very possible economic collapse as countries move away from the dollar and replace it with the yuan instead.

And the United States only has itself to blame.

China sees Trump’s trade war as an opportunity to boost ties with Africa

Darius Shahtahmasebi is a New Zealand-based attorney and political analyst.

Published time: 25 Jul, 2018 16:05

Get short URL

Xi Jinping and Cyril Ramaphosa at The Council for Scientific and Industrial Reasearch (CSIR) in Pretoria on July 24, 2018 © Phill Magakoe / AFP

- 1035

- 1

“The United States has initiated trade actions affecting a broad group of countries and faces retaliation or retaliatory threats from China, the European Union, its NAFTA partners and Japan, among others. Our modelling suggests that if current trade policy threats are realised and business confidence falls as a result, global output could be about 0.5 percent below current projections by 2020,” the International Monetary Fund’s Maury Obstfeld said earlier this month.

China, not the US, is Africa’s largest trading partner. Trade between Africa and China has grown from $765 million in 1978 to over $170 billion in 2017, and is soon expected to reach $400 billion. According to the United National Conference on Trade and Development (UNCTAD) World Investment Report 2018, China was the fourth largest foreign investor in Africa in 2016, spending about $40 billion. China was not too far behind the US, the UK, and France, and its rate of investment continues to grow a lot faster than the US can afford to keep up with.

In fact, if I remember correctly, it wasn’t all too long ago that President Trump was openly calling African nations “shithole countries” – a remark that left a chilling void quickly filled by China. From January 12 to 16 of this year alone, right as the US commander-in-chief was insulting the entire continent, Chinese Foreign Minister Wang Yi visited four African countries: Rwanda, Angola, Gabon, and São Tomé and Príncipe.

Read more

Trump asks why so many immigrants come to US from ‘s***hole countries’ – reports

Trump asks why so many immigrants come to US from ‘s***hole countries’ – reports China’s Africa Strategy

The aim of these visits was of course to encourage these nations to join China’s Belt and Road Initiative. Even as we speak, Chinese President Xi Jinping is in Africa recruiting as many allies as possible to take on the US in its ill-conceived trade war with some of the world’s major players. His visit included stops in Senegal, Rwanda, South Africa, and the Indian Ocean island of Mauritius. While on this latest tour, Xi has signed dozens of trade and investment deals, including a $126 million loan agreement for two road projects in Rwanda. Rwandan media has praised the relationship, with one commentator referring to these kinds of investment as the “cornerstone for Africa’s development.”

Most importantly, however, Johannesburg will host Xi’s much anticipated reunion with Brazil, Russia, and India at the five-nation BRICS summit. This is the first BRICS summit since Trump’s delusional threats of a trade war became a political reality, and even includes Turkish President Recep Tayyip Erdogan, as well as some African leaders, such as Angola’s Joao Lourenco and Zambia’s Edgar Lungu.

Just this Tuesday, China pledged to invest $14.7 billion in South Africa and grant loans to its state power utility and logistics company, instantly helping the South African rand to make some early gains. China is already South Africa’s biggest trading partner, and this does not seem set to change any time soon.

South Africa is not the continent’s only nation looking to capitalise on the economic opportunities offered by China. Countries in West Africa, including Nigeria, Mauritania, and Ivory Coast (Cote d’Ivoire) have all expressed interest in joining China’s Belt and Road Initiative. Zimbabwe’s president, Emmerson Mnangagwap said earlier this year that the “Belt and Road Initiative is indeed a vision for the future.” Tanzania’s minister of foreign affairs, Augustine Mahiga, further described the Belt and Road Initiative as a “user-friendly globalization of the economy.”

Not all countries appear to be offering a user-friendly system of governance; quite the opposite (there is one in particular that comes to mind). African leaders will also meet this September in Beijing for the Forum on China-Africa Cooperation (FOCAC) summit – it should not be a mystery at all as to what the major topics of discussion will be.

Read more

China to invest $15 billion in South African economy

China to invest $15 billion in South African economy The Major Point of Difference with the US

The major point of difference between China and the US is that while Donald Trump openly insults the entire continent, China has made a point of including anyone and almost everyone in its plans to develop Africa. Rwanda, Senegal, and Mauritius are all considered resource-poor, yet this has not stopped the Chinese president from visiting these three nations recently in an attempt to portray China as a partner for Africa’s industrialization. Whereas the US makes a point of targeting and showing interest in countries only when they have resources that can be extracted to benefit a select few, China may in fact be demonstrating it can listen closely to Africa’s aspirations instead.

This is not some pro-Beijing propaganda secretly paid for by the Chinese media. In fact, this latter point was taken directly from the Washington Post.

Take Rwanda, for example. The US already enacted sanctions on Rwanda’s US exports earlier this year, when Rwanda imposed tariffs on used clothing and shoes from America in order to try and boost its own local manufacturing. The amount of money the US invests in Africa appears to be waning, even under the Obama administration, who committed $3.1 billion in a three-year period to an initiative to address African power shortages. In all honesty, Obama spent more money drone-bombing the continent than the US has ever spent on actually developing it.

The Risk

It is no secret that investing in Africa comes with its fair share of risks. Security risks are the most commonly cited, though risks can also exist in other forms, such as inability to pay back loans to which China has made an abundance of. However, consider this statement by Kansai University Professor Michiko Kitaba in the Diplomat which reads:

Read more

Trump slams currency manipulation by Brussels & Beijing

Trump slams currency manipulation by Brussels & Beijing “From the Chinese perspective, the African continent is the last stop for the One Belt, One Road concept. Since the economic reforms in 1979 and the emergence of the concept of the “socialist market economy” in the 1990s, the market (read: demand) has become the essential growth factor for the economy in China. The One Belt, One Road is a structure that will generate new demand to counter the excess supply capacity of the Chinese economy. Even if the loans become uncollectable, China does not need to recoup its capital outlays at this stage. Mining rights for natural resources, harbor leases, and other settlements in kind are far more useful to the future of the Chinese economy. Even if such “goodies” are abandoned, China can score a significant win in the long term if it can form a renminbi economic zone and provide the groundwork for building a world where international trade does not rely on the U.S. dollar.”

You won’t see this point highlighted much in mainstream media circles but this, my friends, is where the true value in Beijing’s investments in Africa lies. Just over a week ago, reports emerged that China National Offshore Oil Corp (CNOOC) is willing to invest $3 billion in its existing oil and gas operation in Nigeria, Africa’s most populous nation. At the time, CNOOC Chief Executive Yuan Guangyu announced that his company had invested more than $14 billion in its Nigerian operations and expressed readiness to invest more. This announcement followed a more devastating development in May this year relating to a deal which sees Nigeria and China agreeing on a currency-swap worth $2.4 billion to boost commercial ties and reduce the need to use the US dollar in bilateral trade. China is Nigeria’s second largest trading partner after the US.

READ MORE: Trade war bailout: Trump promises $12bn in emergency aid to US farmers

To China, the risk is worth it. While technically known for decades, it is America’s best kept secret that the empire’s entire existence is predicated on the status of the US dollar on the global financial markets. As far back as 1989, writing in his book The Roaring ‘80s, former Rhodes Scholar, Emmy Award-winning TV host, and Wall Street insider Adam Smith explained this dynamic brilliantly:

“First, we have a large reservoir of moral credit from our position as a world military leader and from our past as an investor and lender. Second, the dollar is the key currency. Dollars are what the world banks in, insures in, denominates. Before the dollar, it was the pound sterling, and the British got an extension on the tenure of their empire because the world hadn’t found another currency in which to denominate. If you operate in the key currency, it takes longer for the whistle to blow.”

Unfortunately for the United States war machine, that whistle may slowly but surely on its way to being blown, as China purposely chips away at the status of the US dollar piece by piece. Forget whatever you think you know about Trump’s animosity with China or any of its allies, including North Korea and Iran; because this is the real dilemma the United States is facing in its mounting confrontation with China: a very possible economic collapse as countries move away from the dollar and replace it with the yuan instead.

And the United States only has itself to blame.

Trade war chickens home to roost: Billions of pounds of meat fill US warehouses with nowhere to go

Trade war chickens home to roost: Billions of pounds of meat fill US warehouses with nowhere to go