- Joined

- Jan 18, 2010

- Messages

- 7,177

- Points

- 48

This sinkie uncle steady, fight all the way for what he deserve...

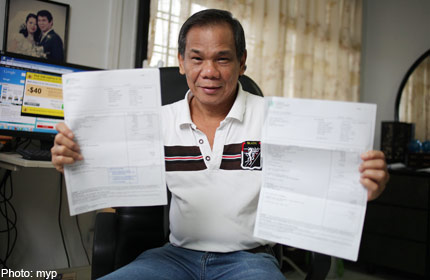

Retired businessman Steven Choo, 60, underwent angioplasty at the Singapore General Hospital (SGH) to unclog blood vessels in his legs last November.

Mr Choo, who is diabetic, underwent the procedure - with "balloons" and stents used to unblock the arteries - which prevented gangrene from spreading from his toes.

But the successful operation marked the start of another round of problems for him. On the day he was discharged from hospital, he received a shock: His medical bill came up to $14,501, but Medisave and MediShield would cover only $900 and $810, respectively, or $1,710 combined.

SGH also told him he would not get his $6,620 deposit back, and that he still owed it $5,381, Mr Choo told my paper in an interview. The remaining $790 was covered by a government grant.

The Central Provident Fund (CPF) Board told him that the Medisave claim submitted by the hospital did not indicate a surgical procedure. This meant he could not claim the full amount he should have been entitled to: $3,050.

Insurance company AIA, which handles his MediShield account, told him likewise.

Mr Choo then hand-delivered a four-page report from his doctor to the CPF Board, explaining that angioplasty is a surgical procedure. But then he got another shock.

He said: "CPF Board wrote to tell me that they're not paying because (the angioplasty) was not done in a 'proper' place."

The CPF Board's letter, dated Feb 8, read: "Only surgical procedures performed in a properly equipped operating theatre... are Medisave claimable."

The head of SGH's diagnostic radiology department, Associate Professor Tay Kiang Hiong, told my paper that Mr Choo's angioplasty had been planned to take place in an operating theatre. But his operation was moved to an angiography suite - where angioplasty is also typically conducted.

This was because "there were urgent and complicated cases that needed to be performed in the operating theatre", said Prof Tay.

Mr Choo then sent an e-mail message to the CPF Board arguing that he had been penalised because of where his operation was conducted.

The case remained in limbo for three months, said Mr Choo, who wrote to the CPF Board repeatedly, only to receive the same reply each time that his appeal was under review.

In May, the Ministry of Health (MOH) sent him an e-mail message informing him that his appeal had been successful.

Not long after, Mr Choo's MediShield claim was also approved.

AIA told my paper that the claim was reviewed twice because there were inaccuracies in the initial claim.

Late last month, SGH called Mr Choo to tell him that both Medisave and MediShield amounts due to him had been paid out fully.

He was also entitled to a $638 refund from his deposit.

Six months later, the problem has been resolved but it has left Mr Choo irate. He said: "If I did not fight for it, where would I get the money from?"

Mr Choo added that he hopes that others would not have to be put through the same ordeal.

An MOH spokesman told my paper that angioplasty typically takes place in operating theatres.

As Mr Choo's angioplasty took place in an angiography suite, it "was not deemed a surgical procedure".

This is why SGH did not submit a Medisave claim for the procedure, said the spokesman.

The spokesman added: "We have since clarified with SGH that an angioplasty procedure... can be submitted for Medisave claims, even if it took place in the angiography suite."

[email protected]