- Joined

- Aug 20, 2022

- Messages

- 28,390

- Points

- 113

AIA denies S$100,000 payout to S'pore man with benign brain tumour, said condition 'not life-threatening' at time of surgery & not included in critical illness coverage

Critical illness.

Seri Mazliana

October 22, 2025, 05:53 PM

An AIA policyholder submitted a Straits Times forum letter calling for greater regulatory scrutiny of how insurance companies define “life-threatening” conditions.

This was after his claim for critical illness coverage, which he bought "several years ago", was rejected, despite undergoing surgery for a benign brain tumour.

Diagnosed with brain tumour, had surgery

Frankie Yee Kok Wah was diagnosed with the tumour in 2018, his Oct. 20 forum letter read.

As the tumour was initially small and asymptomatic, his doctor advised against surgery, opting instead for annual MRI surveillance to monitor changes in the tumour's size.

However, in November 2024, a scan revealed significant tumour growth.

Concerned that it could begin affecting his neurological functions and overall quality of life, his neurosurgeon strongly recommended surgical removal.

Yee proceeded with the operation.

Hospitalisation and critical illness claims rejected

When he submitted his hospitalisation and critical illness claims following the procedure, both were denied.

AIA’s stated reason for rejecting the S$100,000 critical illness claim was apparently that the tumour was "not life-threatening" at the time of surgery.

Yee said this interpretation was deeply problematic and asked if a policyholder must "wait until his condition becomes fatal" before a claim can be accepted:

“No responsible doctor would advise a patient to delay essential surgery until he is at death’s door just to meet an insurer’s definition of ‘life-threatening’.”

Yee urged the authorities to intervene and said insurance companies should be regulated by "medical reasonableness and the principles of fair dealing, not by rigid technicalities".

You can read the full forum letter here.

Definitions

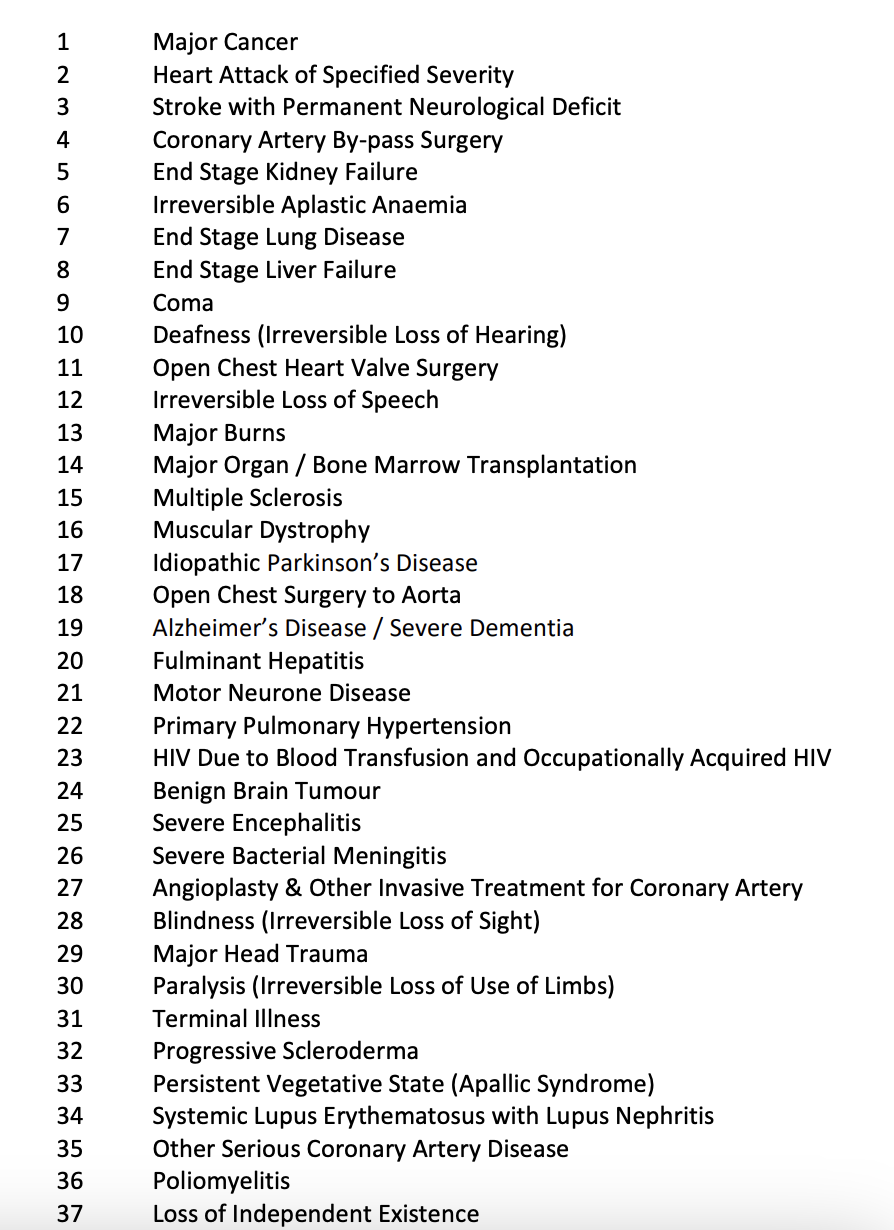

According to a Life Insurance Association (LIA) document linked in an AIA blogpost, there are 37 conditions considered critical illnesses.

Screenshot from LIA

Screenshot from LIAWhile a benign brain tumour is listed, there are caveats in both the blog post and the LIA document.

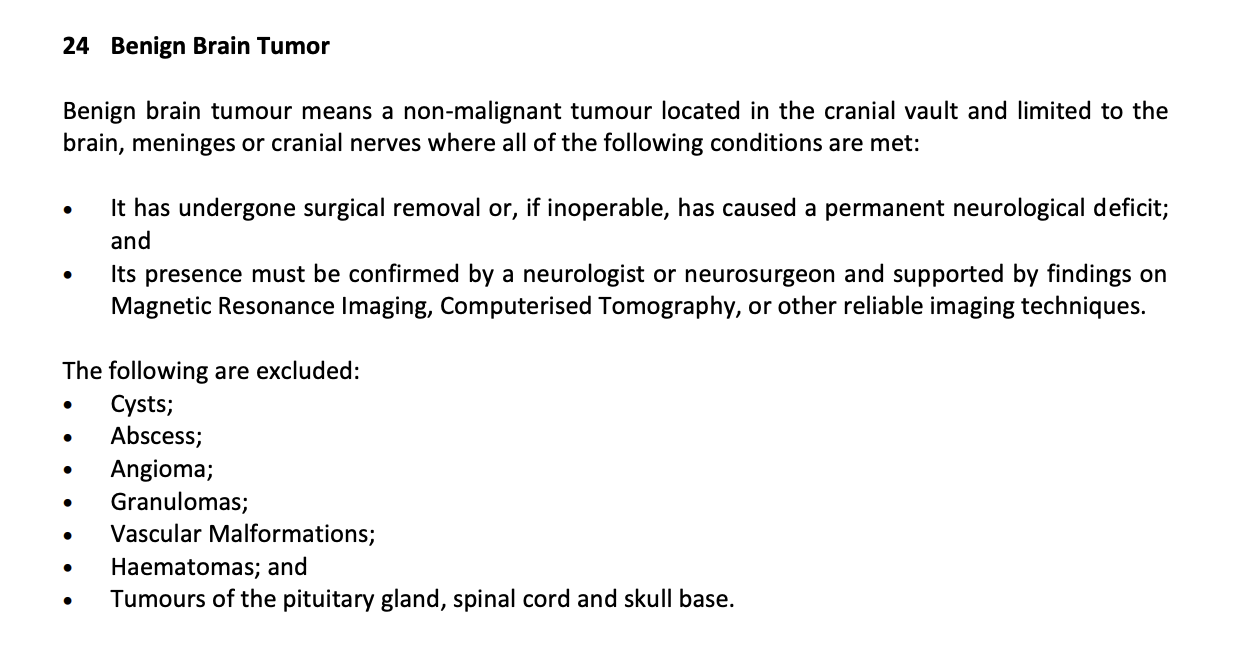

Screenshot from LIA

Screenshot from LIAThe blog post emphasised that these illnesses must reach a certain severity level to qualify:

"For example, a disease is not considered a "Major Cancer" until it is in its late stages, meaning a stage 1 breast cancer patient cannot make a claim."

In respect to Mothership's queries, AIA said they had reached out to Yee and clarified that his claim was carefully reviewed with "diagnostic tests and medical opinions considered, as well as a statement from his treating doctor".

They said his benign brain tumour did not meet the criteria outlined in his policy.

"We thank Mr Frankie Yee for sharing his feedback and bringing his concerns to our attention. We have reached out to Mr Yee to clarify that his claim was carefully reviewed, with diagnostic tests and medical opinions considered, as well as a statement from his treating doctor.

Unfortunately, his Benign Brain Tumour did not meet the criteria outlined in his Critical Illness policy.

We value the trust our customers place in us and are dedicated to ensuring that all claims are assessed with the utmost fairness to our customers."

Top photos via Canva