-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Untenable situation for the stock market

- Thread starter Worm

- Start date

- Joined

- Oct 5, 2018

- Messages

- 19,928

- Points

- 113

Country Garden's troubles reflect the collapse of China's property market. There's reason to believe China's real estate crisis is far from over, as noted by Country Garden Chief Financial Officer Wu Bijun:

"The home market hasn't entirely bottomed out, and the sector's consolidation isn't over. Property sales nationwide still haven't stabilized."

https://www.wsj.com/articles/chinas...depression-real-estate-giant-says-11661863259

- Joined

- Oct 5, 2018

- Messages

- 19,928

- Points

- 113

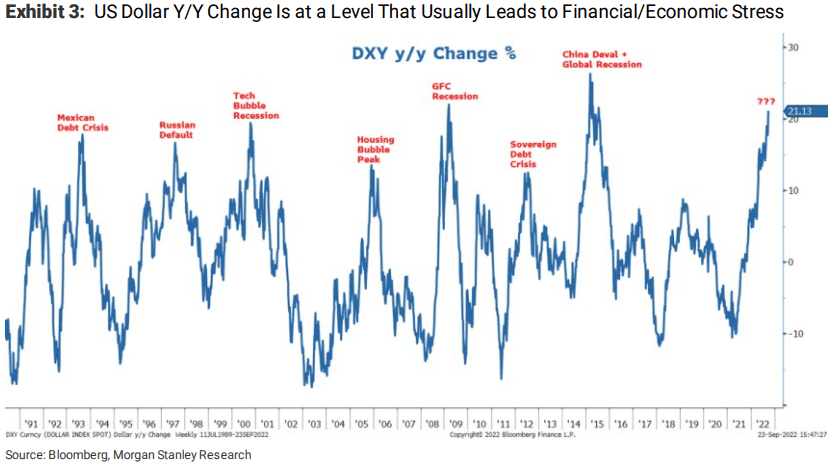

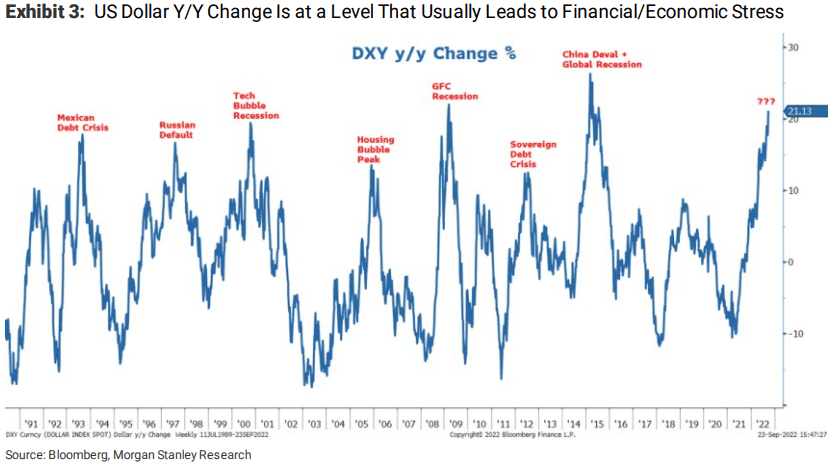

A surging U.S. dollar is creating an ‘untenable situation’ for the stock market, warns Morgan Stanley

https://www.marketwatch.com/story/a...rket-warns-morgan-stanleys-wilson-11664220122Morgan Stanley chief equity strategist Michael Wilson, one of the Wall Street’s most vocal bears who correctly predicted this year’s stock market selloff, calculated, in a Monday note, that every 1% rise in the ICE U.S. Dollar Index has a negative 0.5% impact on S&P 500 earnings. He also saw an approximate 10% headwind for earnings growth in the fourth quarter.

“The recent move in the U.S. dollar creates an untenable situation for risk assets that historically has ended in a financial or economic crisis, or both,” wrote strategists led by Wilson. “While hard to predict such events, the conditions are in place for one, which would help accelerate the end to this bear market.” (See chart below)

- Joined

- Feb 26, 2019

- Messages

- 12,449

- Points

- 113

My favourite USA blackberries now cost almost 8 bucks for a small punnet.A surging U.S. dollar is creating an ‘untenable situation’ for the stock market, warns Morgan Stanley

https://www.marketwatch.com/story/a...rket-warns-morgan-stanleys-wilson-11664220122

Morgan Stanley chief equity strategist Michael Wilson, one of the Wall Street’s most vocal bears who correctly predicted this year’s stock market selloff, calculated, in a Monday note, that every 1% rise in the ICE U.S. Dollar Index has a negative 0.5% impact on S&P 500 earnings. He also saw an approximate 10% headwind for earnings growth in the fourth quarter.

“The recent move in the U.S. dollar creates an untenable situation for risk assets that historically has ended in a financial or economic crisis, or both,” wrote strategists led by Wilson. “While hard to predict such events, the conditions are in place for one, which would help accelerate the end to this bear market.” (See chart below)

- Joined

- Oct 5, 2018

- Messages

- 19,928

- Points

- 113

they lose their textures and turns soft quickly, you have to quickly consume them after buying.My favourite USA blackberries now cost almost 8 bucks for a small punnet.

- Joined

- Feb 26, 2019

- Messages

- 12,449

- Points

- 113

I have resorted to buying frozen ones from korea. Blend with yogurt and slurp down. Much cheaper.they lose their textures and turns soft quickly, you have to quickly consume them after buying.

- Joined

- Oct 5, 2018

- Messages

- 19,928

- Points

- 113

Civil service is paying well, and HDB loan is 2.6%pa.WTFF

No worries.

Sgp are buying pigeon holes at $1M+.

All these GCBs will be visiting Bedok Reservoir soon.

It is more worrying for those in private sector and takes bank loan. Even rentals are increasing for all sectors.

- Joined

- Oct 5, 2018

- Messages

- 19,928

- Points

- 113

I have been buying very good and cheap cheese from Redman. 40-50% cheaper than NTUC.I have resorted to buying frozen ones from korea. Blend with yogurt and slurp down. Much cheaper.

Redman's yogurts and frozen berries are very cheap too.

- Joined

- Aug 10, 2008

- Messages

- 112,401

- Points

- 113

WTFF

No worries.

Sgp are buying pigeon holes at $1M+.

All these GCBs will be visiting Bedok Reservoir soon.

Give some business to Pandan Reservoir.

- Joined

- Jun 28, 2017

- Messages

- 602

- Points

- 43

Scary times we live in. Local banks r strong. Big discounts coming up.

Let’s discuss if there are any good Singapore stocks ? UOB ?

- Joined

- Mar 11, 2015

- Messages

- 2,824

- Points

- 113

i m watching next Thursday’s CPI print like a hawk

- Joined

- Jan 28, 2022

- Messages

- 245

- Points

- 28

Liquidity may dry up suddenly like a person who had seizure after the jab. Yeah, of course when investors flee big discounts would show up.Scary times we live in. Local banks r strong. Big discounts coming up.

Similar threads

- Replies

- 8

- Views

- 946

- Replies

- 4

- Views

- 513

- Replies

- 1

- Views

- 288

- Replies

- 1

- Views

- 506