shanghai isn't only port in tiongkok

without exporting to yanks, where else can they export?

of coz, it's because tiongs recognize paper currency called US$

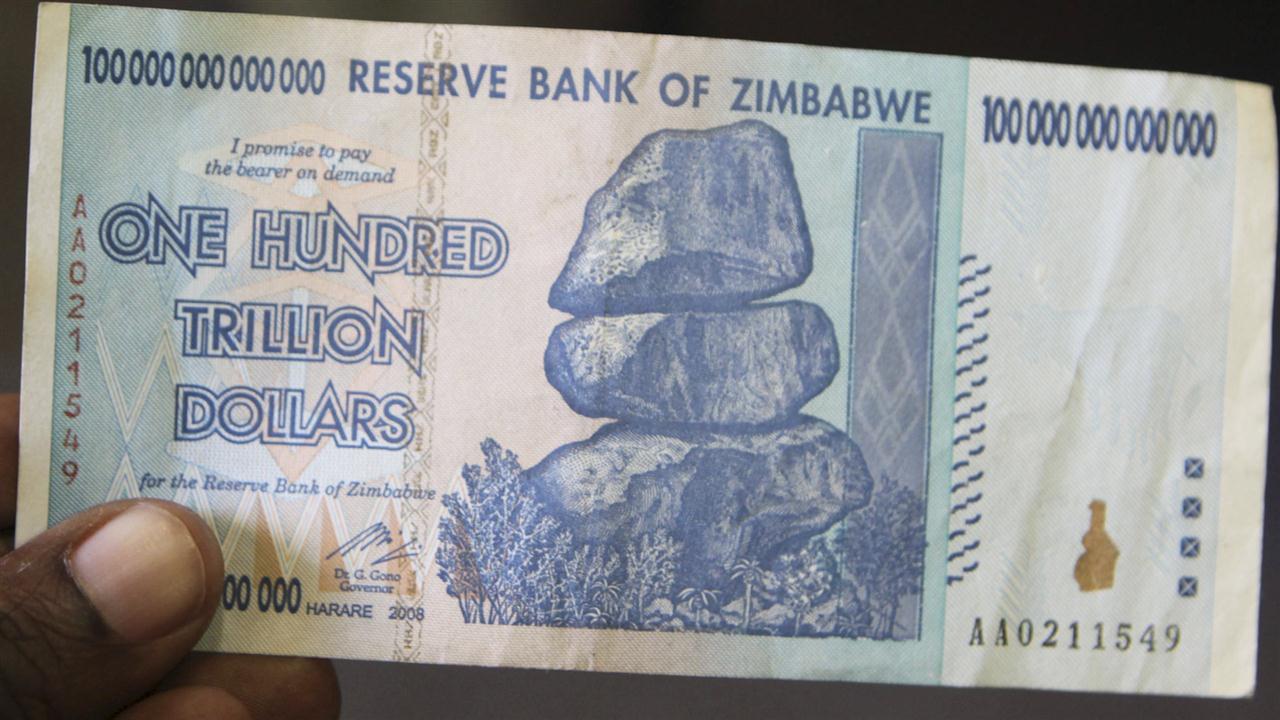

if tiongs recognized paper currency called zimbabwean dollars, individual zimbabweans could have paid tiongs trillions of zimbabwean dollars for tiongkok goods.

more apt comparison should be russkie rubes and iranian rials.

if russkies and iranians demand that their oil/gas/fertilizers/food can be purchased

only in local currency i.e. only in russkie rubles or eyeranian rials, a lot of problems they face would be solved.

no middlemen dollar, euro, pound, yen need to be used.

to buy russkie goods, first sell them something (whatever they want to buy) and earn russkie rubles, then use that russkie rubles to pay for russkie oil, gas, fertilizer, minerals, food.

ditto for eyeranians.

to buy eyeranian oil, gas, minerals, first sell them something (whatever they want to buy and earn eyeranian rials in exchange), and then use that eyeranian rial to pay for eyeranian oil, gas, minerals.

of coz eyeran is a much weaker, backward country, unable to be the best in the world in just about anything. that is true for other mediocre countries like turkey paki bangla indon niggeria kazakhstan egypt etc as well.

only explanation might be IQ and Race