-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Serious Time for pap to re-inflate the credit bubble.

- Thread starter hbk75

- Start date

After reporting that inflation is down. And economy in slow down. First is on car loans.

PAP needs more money. PAP wants to give easy credit to marginal drivers so that they can drive up price of COEs. COE at $48k is not enough to maintain PAP's gambling losses and spending.

Singaporeans are so pitiful to have to work so hard to maintain an addicted pap govt

PAP needs more money. PAP wants to give easy credit to marginal drivers so that they can drive up price of COEs. COE at $48k is not enough to maintain PAP's gambling losses and spending.

Singaporeans are so pitiful to have to work so hard to maintain an addicted pap govt

there are 70% fools that will always be willing to be stuck in pap's ponzi.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Our economy is in an deflationary spiral, we should support our government to increase the cost of living:

- Increase the costs of consumables to support CPI, eg. higher GST, higher petrol tax

- Import more foreigners and give free residency to those who commit to buy own a house and car for ten years.

- Allow maximum loan for car and houses for locals, to drive up the cost of living and inflation.

- Build another Casino - we saw the boost to our economy for MBS and RWS

- Increase the costs of consumables to support CPI, eg. higher GST, higher petrol tax

- Import more foreigners and give free residency to those who commit to buy own a house and car for ten years.

- Allow maximum loan for car and houses for locals, to drive up the cost of living and inflation.

- Build another Casino - we saw the boost to our economy for MBS and RWS

- Joined

- Aug 10, 2008

- Messages

- 13,374

- Points

- 113

PAP needs more money. PAP wants to give easy credit to marginal drivers so that they can drive up price of COEs. COE at $48k is not enough to maintain PAP's gambling losses and spending.

Singaporeans are so pitiful to have to work so hard to maintain an addicted pap govt

Absolutely. If you want to count on Singapore strength. I show you now.

Big ticket item like cars is being charge 100K in Singapore. That is equal to around 3 cars for a ordinary folks in Australia.

Talk about housing. We are building on cheap land. But government charges high land prices. Effectively, it is moving the money from your CPF to the state through Stat boards. It a transfer of wealth from people to the state. look at our housing price, one HDB can easily buy 2 houses in other country like in Australia.

Now, everything is down. Starting from our Minister of Fiance (HSK). Our export down, our wholesale price down, our retail in bad shape with rolls and rolls of empty shop unit and our finance HUB is lao SAI ing all over.

So to kick start consumer spending again, we have to relax car loan. If this can't work, i think we have to collect less car duties or encourage car user to scrap their car even earlier by giving them much higher rebate. That would encourage people to buy car again, take up new loan etc etc ...

If all else can't work , we got to scrap TDSR ... stamp duties ......

Tell you guys the hard truth, we has been keeping this highly paid government alive with so much money paid to them.

Anyway, govermnent should ask Ho ching to step into our Ministry of finance to run the show. She has the capability and resources.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

there are 70% fools that will always be willing to be stuck in pap's ponzi.

We definitely must hire more foreigners in civil service to improve efficiency and prevent 'inbreeding'

Our economy is in an deflationary spiral, we should support our government to increase the cost of living:

- Increase the costs of consumables to support CPI, eg. higher GST, higher petrol tax

- Import more foreigners and give free residency to those who commit to buy own a house and car for ten years.

- Allow maximum loan for car and houses for locals, to drive up the cost of living and inflation.

- Build another Casino - we saw the boost to our economy for MBS and RWS

this is a good time for PAP to increase GST.

this is because

1. inflation is low

2. PAP had strong mandate from Singaporeans

3. Singaporeans trust their government to help them.

4. Lee hsien loong will set up economic steering committee and he will be the chair person.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

this is a good time for PAP to increase GST.

this is because

1. inflation is low

2. PAP had strong mandate from Singaporeans

3. Singaporeans trust their government to help them.

4. Lee hsien loong will set up economic steering committee and he will be the chair person.

Good. You see my point.

We just need to encourage everyone here to vote for the incumbent in the next election

and we will see Daylight thereafter

- Joined

- Oct 1, 2008

- Messages

- 2,470

- Points

- 63

Our economy is in an deflationary spiral, we should support our government to increase the cost of living:

- Increase the costs of consumables to support CPI, eg. higher GST, higher petrol tax Land of the rising Sun

- Import more foreigners and give free residency to those who commit to buy own a house and car for ten years.Household debt

- Allow maximum loan for car and houses for locals, to drive up the cost of living and inflation. More debt

- Build another Casino - we saw the boost to our economy for MBS and RWS Korea

It's a recipe for disaster. I've read that they're exploring new markets and products which is the way to go.Duh, it's falling demand globally. Even if you move 2 million people from India or China to Singapore, it won't move the needle. It's like taking someone's problem and putting it in Singapore and make the existing infrastructure crumble faster than b4.

Absolutely. If you want to count on Singapore strength. I show you now.

Big ticket item like cars is being charge 100K in Singapore. That is equal to around 3 cars for a ordinary folks in Australia.

Talk about housing. We are building on cheap land. But government charges high land prices. Effectively, it is moving the money from your CPF to the state through Stat boards. It a transfer of wealth from people to the state. look at our housing price, one HDB can easily buy 2 houses in other country like in Australia.

Now, everything is down. Starting from our Minister of Fiance (HSK). Our export down, our wholesale price down, our retail in bad shape with rolls and rolls of empty shop unit and our finance HUB is lao SAI ing all over.

So to kick start consumer spending again, we have to relax car loan. If this can't work, i think we have to collect less car duties or encourage car user to scrap their car even earlier by giving them much higher rebate. That would encourage people to buy car again, take up new loan etc etc ...

If all else can't work , we got to scrap TDSR ... stamp duties ......

Tell you guys the hard truth, we has been keeping this highly paid government alive with so much money paid to them.

Anyway, govermnent should ask Ho ching to step into our Ministry of finance to run the show. She has the capability and resources.

so when people borrowed too much and default. who to save the banks?

We definitely must hire more foreigners in civil service to improve efficiency and prevent 'inbreeding'

our civil service especially finance are run by a gang of idiots. first inflate debts then try to help reduced and now blowing up again. interest low is ok. dun kenna like 1998 8% all up lorry.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

so when people borrowed too much and default. who to save the banks?

In long term, it is good for our financial sector. We had been hoping to merge our banks into one of those TBTF (Too Big Too Fail).

It was during the Asian Financial Crisis that we saw POSB, Keppel Tatlee and OUB being swallowed up.

A few months ago, Indonesia's BCA Bank became the largest bank in ASEAN by market cap

http://www.straitstimes.com/business/banking/dbs-toppled-as-southeast-asias-largest-bank

Imagine, SCB (Singapore being its largest shareholder), DBS, UOB and OCBC merged into 2, they are only on par with second-tier China Minsheng Bank or China Merchant Bank. Yes, our banks are so small.

Even Australia's Wespac OR Commonwealth bank is larger than our OCBC, DBS and UOB combined.

So a crisis is an opportunity to merge them.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Cash is king! Altogether now! HUAT AH!

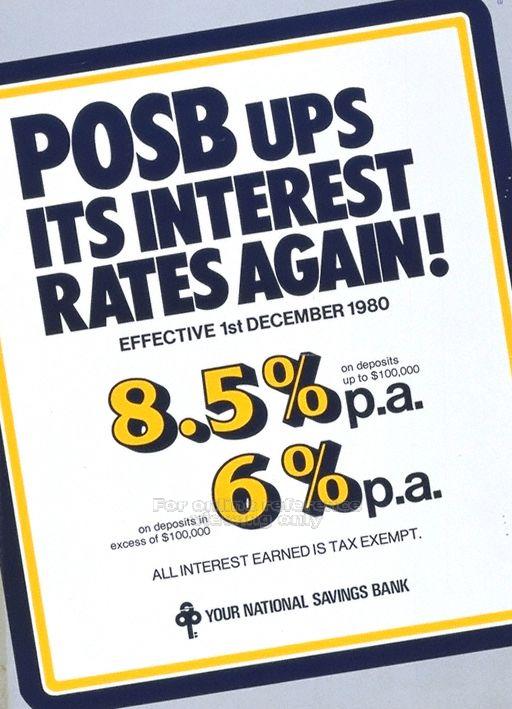

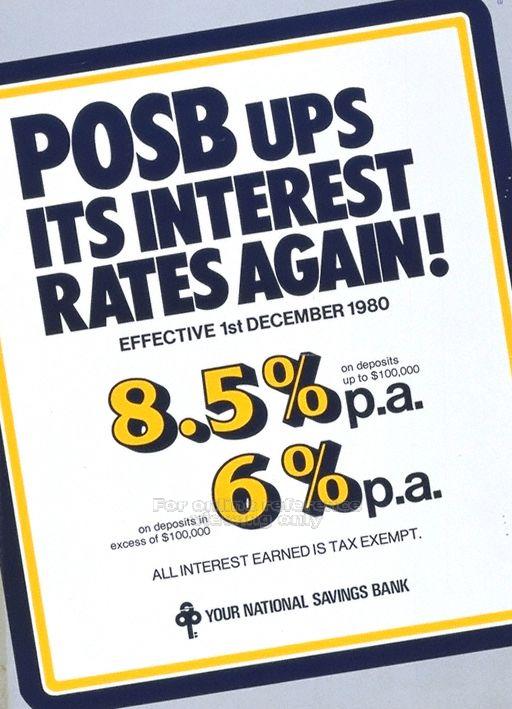

Cash is King perhaps in times like this. Who still remember this ad?

Cash is King perhaps in times like this. Who still remember this ad?

the days of money as a store of value are gone. Global negative real interest rates are here to stay for a long long time.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Singdollar weakness likely to continue for months ahead

http://www.straitstimes.com/business/economy/singdollar-weakness-likely-to-continue-for-months-ahead

http://www.straitstimes.com/business/economy/singdollar-weakness-likely-to-continue-for-months-ahead

Chart of the Day: Singaporean bankers are struggling to sell loans as client demand wanes

Demand for both business and consumer loans is weak.

It’s getting tougher and tougher for bankers in Singapore to make clients sign up for loans, as companies look to pare down their debt and consumers tighten the purse strings in anticipation of weaker economic growth.

This chart from Natixis shows the unabated decline in both consumer and business loan growth, a leading indicator of economic activity.

“With foreign buyers missing and Singaporean consumers conservative, demand for loans slowed. And demand for credit is decelerating across the economy, ranging from consumer to general commerce,” said Natixis.

According to S&P, loan growth is expected to hover at 3%-5% for Singapore banks in 2016, following the modest 3.7% growth in 2015.

“Macro prudential measures to cool the domestic property market have also proven effective, with a corresponding decline in mortgage volumes. This has important revenue implications since interest income from loans accounts for some 60% of revenue in the banking system,” S&P said.

“Furthermore, if loan growth slows down, non-interest income from loan-related services would also weaken. Muted loan growth could result in pedestrian earnings growth, partially offset by expansion of net interest margins,” S&P added.

Real reason PAPpies relax car loan rules..

Demand for both business and consumer loans is weak.

It’s getting tougher and tougher for bankers in Singapore to make clients sign up for loans, as companies look to pare down their debt and consumers tighten the purse strings in anticipation of weaker economic growth.

This chart from Natixis shows the unabated decline in both consumer and business loan growth, a leading indicator of economic activity.

“With foreign buyers missing and Singaporean consumers conservative, demand for loans slowed. And demand for credit is decelerating across the economy, ranging from consumer to general commerce,” said Natixis.

According to S&P, loan growth is expected to hover at 3%-5% for Singapore banks in 2016, following the modest 3.7% growth in 2015.

“Macro prudential measures to cool the domestic property market have also proven effective, with a corresponding decline in mortgage volumes. This has important revenue implications since interest income from loans accounts for some 60% of revenue in the banking system,” S&P said.

“Furthermore, if loan growth slows down, non-interest income from loan-related services would also weaken. Muted loan growth could result in pedestrian earnings growth, partially offset by expansion of net interest margins,” S&P added.

Real reason PAPpies relax car loan rules..

- Joined

- Jul 25, 2013

- Messages

- 17,813

- Points

- 113

In long term, it is good for our financial sector. We had been hoping to merge our banks into one of those TBTF (Too Big Too Fail).

It was during the Asian Financial Crisis that we saw POSB, Keppel Tatlee and OUB being swallowed up.

A few months ago, Indonesia's BCA Bank became the largest bank in ASEAN by market cap

http://www.straitstimes.com/business/banking/dbs-toppled-as-southeast-asias-largest-bank

Imagine, SCB (Singapore being its largest shareholder), DBS, UOB and OCBC merged into 2, they are only on par with second-tier China Minsheng Bank or China Merchant Bank. Yes, our banks are so small.

Even Australia's Wespac OR Commonwealth bank is larger than our OCBC, DBS and UOB combined.

So a crisis is an opportunity to merge them.

i thought too big to fail doesnt really mean its too big to fail.....it can and will still fail,it just mean whether theres a bigger idiot able to bail it out.

if our local banks fail,i dunno if our sg government is strong enough to bail them out.our three banks total combined assets is 1 trillion,just 10 percent loss will be disastrous.

i thought too big to fail doesnt really mean its too big to fail.....it can and will still fail,it just mean whether theres a bigger idiot able to bail it out.

if our local banks fail,i dunno if our sg government is strong enough to bail them out.our three banks total combined assets is 1 trillion,just 10 percent loss will be disastrous.

If u see sinkapore official reserves has not even change much over the last 15 years. Under gct also 300 billion sgd. After fed printed so much still same amount.

Similar threads

- Replies

- 3

- Views

- 282

- Replies

- 3

- Views

- 375

- Replies

- 15

- Views

- 591

- Replies

- 3

- Views

- 532