SINGAPORE: Temasek Holdings on Tuesday (Jul 13) reported a record net portfolio value for the last financial year, while signalling cautious optimism in the global economy for the short to medium term.

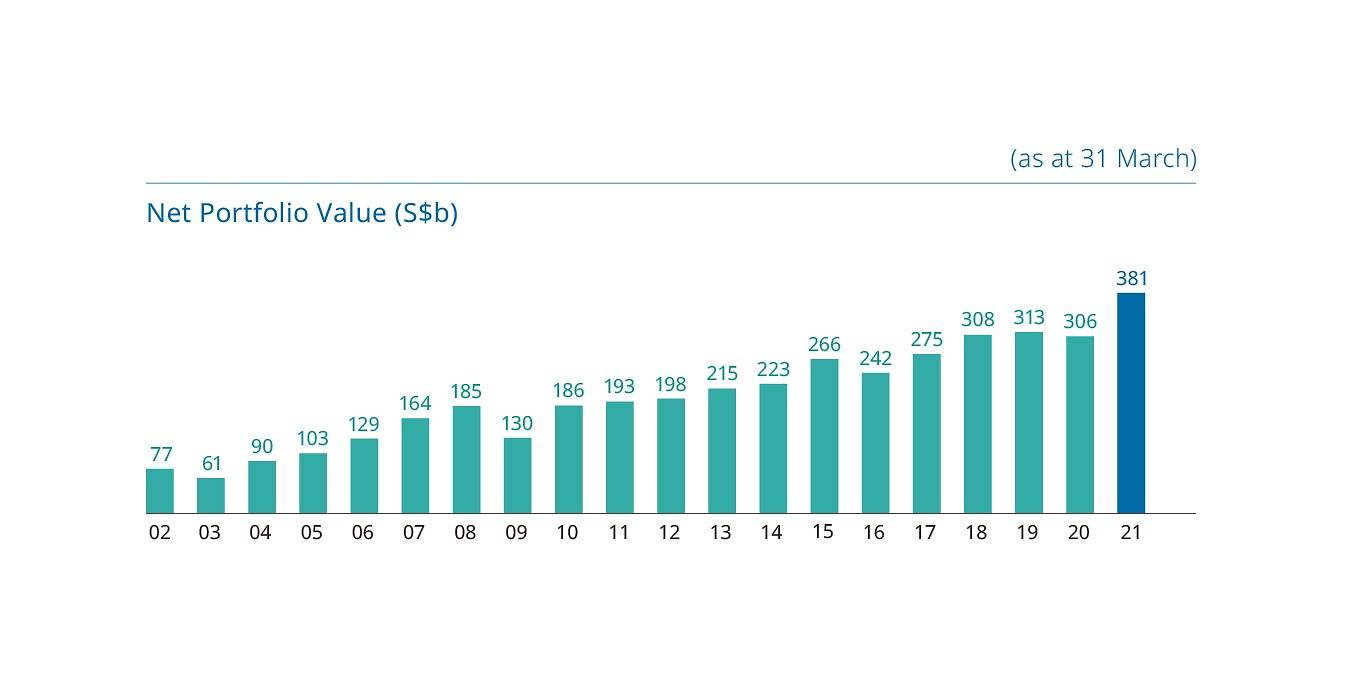

For the year ended Mar 31, its net portfolio was valued at S$381 billion, an increase of S$75 billion - or nearly 25 per cent - from the S$306 billion it achieved a year ago, according to its latest annual review.

This marks a turnaround from the previous financial year of 2019/2020, which saw a 2.2 per cent drop in the net portfolio value due to the COVID-19 pandemic.

Temasek's portfolio value was given a boost by the recovery in the global equity markets and the public listing of some of the companies in its portfolio, said its representatives at a press conference.

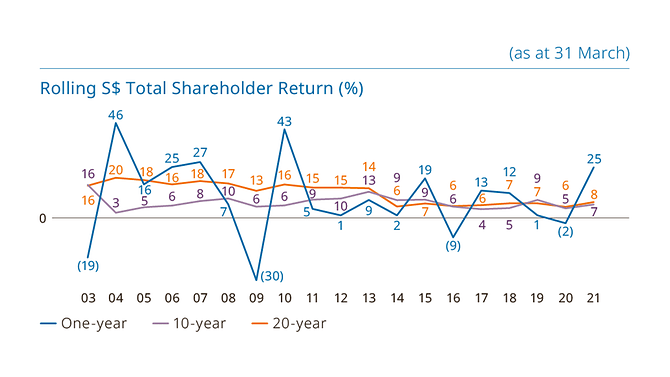

Its one-year total shareholder return, which takes into account all dividends distributed to the shareholder minus any capital injections, turned positive at 24.53 per cent, compared with the -2.28 per cent a year ago.

Over a longer term, its 10-year and 20-year total shareholder returns came in at 7 per cent and 8 per cent respectively, a slight increase from the 5 per cent and 6 per cent respectively in the previous year.

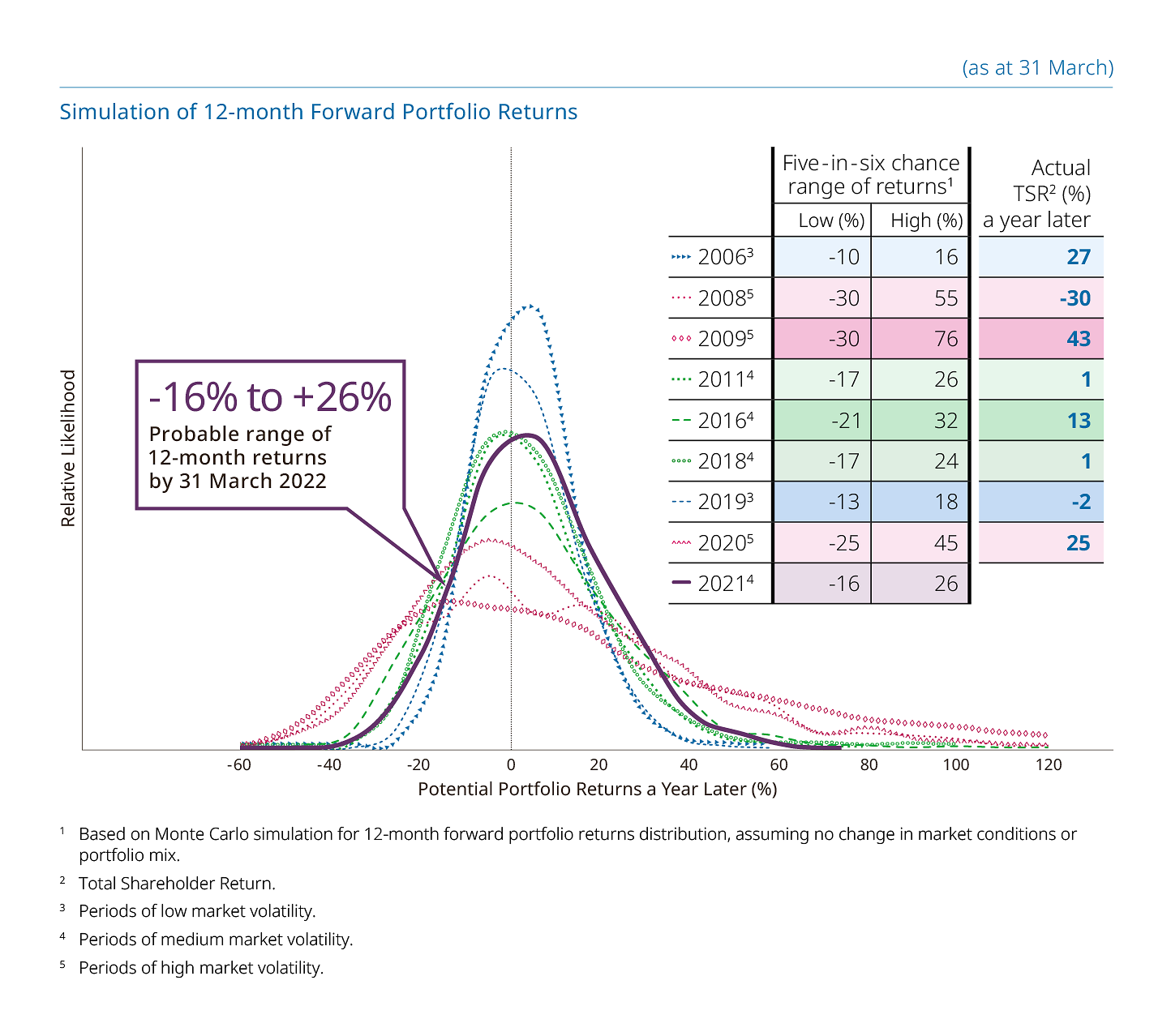

Asked if the record net portfolio value and jump in one-year shareholder return will be sustainable, Temasek International’s joint head of North America Mukul Chawla said the firm’s simulations show a wide range of outcomes “from plus 26 per cent to minus 16 per cent” over the next 12 months.

But he stressed that Temasek holds a long-term view to managing its portfolio and returns.

“We don't manage from one year to the next. As we said, we position the portfolio for the long term and then the returns are an outcome of that,” added Mr Chawla, who is also the joint head of telecommunications, media and technology at Temasek International.

“So it's sort of hard to compare one year with others. I point you to look at our long-term returns and what those have trended to as the real marker of our performance.”

RECORD INVESTMENTS, DIVESTMENTS

Temasek said it invested S$49 billion and divested S$39 billion in the last financial year – both record numbers and significant increases from the previous year when it invested S$32 billion and divested S$26 billion.

The Americas accounted for the largest share of new investments, followed by Singapore and China. Overall, Asia remained the anchor of Temasek’s portfolio at 64 per cent, with China (27 per cent) and Singapore (24 per cent) remaining the top two markets.

“It was an active year, despite pandemic lockdowns and travel restrictions. We invested to stimulate innovation and growth as we repositioned our portfolio for a changing world,” the Singapore state investment firm said in its press release.

“We invested during market dislocations based on our value tests. We invested similarly into our portfolio companies and maintained our disciplined sale of investments. Over the year as markets rebounded, several of our unlisted investments went public to gird themselves for their next phase of development.”

Temasek also said it has sharpened its focus on new opportunities that are aligned with four structural trends, namely digitisation, sustainable living, future of consumption and longer lifespans.

Overall, financial services (24 per cent), as well as telecommunications, media and technology (21 per cent) remained the two biggest sectors in its portfolio. But it noted that the compositions of these two sectors have changed “significantly” over the last decade, partly driven by digitisation.

For instance, it is interested in payments and financial technology businesses that “stand to benefit from the acceleration of digitisation”. Over the past year, it invested in UK-based wealth management services platform FNZ and local start-up Nium that facilitates global digital payments and card issuance.

It also has a strong focus on the technology space as digitisation has “become a mainstream enabler”. This includes software, Internet, e-commerce, the sharing economy, cloud computing and digital content.

Its investments in technology include US-based online entertainment platform Roblox, as well as software developer of cybersecurity tools Snyk and virtual live events management platform Hopin, from the UK.

On divestments, Mr Chawla said all decisions are subject to the firm’s intrinsic value tests although opportunities for some of its portfolio companies to tap into the public markets allowed it to rebalance its portfolio as well.

“I'll give you a real example - a company called BluJay Solutions where we are selling out of a small amount but not all of it,” he told reporters. “And it's natural that we continue to rebalance our portfolio in line with our stated trends and themes.”

OUTLOOK AHEAD

Moving forward, Temasek said it expects the global economy to “recover steadily” on the back of accommodative fiscal and monetary policy, but cautioned of an uneven recovery across countries as some struggle with new peaks of COVID-19 infections and slow vaccination rates.

It also noted “potential geopolitical reverberations” as tensions mount between China and the US.

“Overall, we are cautiously optimistic on the global economic recovery in the short to medium term. We continue to shape our portfolio for resilience in anticipation of future threats and opportunities,” Temasek said in a press release.

“The goal is to sustain our performance, generate risk-adjusted returns over the long term, and mitigate climate risks.”

SUSTAINABILITY GOALS

Temasek also said that sustainability remains at its core.

It remains committed to halve the net carbon emissions attributable to its portfolio by 2030 and its longer-term goal for net zero carbon emissions by 2050.

The investment firm has also set an initial internal carbon price of US$42 per tonne of carbon dioxide equivalent, as part of internalising the economic and future social costs of carbon emissions in its investment decisions.

A portion of its long-term incentives will be aligned with its annual carbon reduction targets through the next 10 years, it added in its press release.

“We will refine our carbon pricing strategies during this coming decade, likely with increasing internal carbon pricing, as we get further clarity on the economic and policy levers of change.”

Meanwhile, it has sought climate-aligned investment opportunities over the past year such as the joint venture with DBS, Standard Chartered and the Singapore Exchange to form global carbon exchange and marketplace Climate Impact X.

It is also looking to enable “carbon negative solutions” such as carbon capture, utilisation and storage, and it has taken the first step by investing in Canada-based company Svante that specialises in low-cost carbon capture technology.

Asked if it sets carbon reduction targets for its portfolio companies, managing director of climate change strategy Neo Gim Huay said while Temasek has been engaging portfolio companies on climate and sustainability issues, specific plans remain decided by the companies’ management and board.

“Having said that, one of the things that we've also done is to provide a platform for regular exchange of ideas and experience,” she said.

“Some of our companies are ahead of others, in terms of thinking about climate risks, carbon footprinting, disclosures-related issues, and we've created a sustainability council which comprises the CEOs of our portfolio companies where they come together to exchange ideas and knowledge.”

The panel was also asked about the upcoming leadership change and how will Temasek be moving forward with its investment strategy.

It was announced in February that Ho Ching will retire as the chief executive officer of Temasek Holdings on Oct 1 after 17 years at the helm.

Mr Dilhan Pillay will succeed her as chief executive and executive director on the same day, while holding on to his current position as the chief executive of Temasek International, the commercial arm of Temasek driving its investments.

Mr Fock Wai Hoong, managing director of investments with a focus on the telecommunications, media and technology sectors and Southeast Asia, described Temasek as “an evolutionary organisation, not a revolutionary organization”.

“So I think changes that we make are progressive and I think, once again, well positioned for the future," he said.

Chiming in, Temasek International's investment group joint head and head of portfolio development Nagi Hamiyeh said the state investment firm has over the years worked on building “a strong bench of senior management”.

“So there is no one person that makes any one decision. We all work collectively together through committees, through participation and we're all part and parcel of this journey going forward. So I don't believe there will be much change.”

He also stressed that succession planning is something that Temasak takes “very seriously” and is an ongoing process.

“Even though Dilhan is taking over on Oct 1… we are already planning for the next generation," said Mr Hamiyeh.

https://www.channelnewsasia.com/new...cord-net-portfolio-value-381-billion-15211044

For the year ended Mar 31, its net portfolio was valued at S$381 billion, an increase of S$75 billion - or nearly 25 per cent - from the S$306 billion it achieved a year ago, according to its latest annual review.

This marks a turnaround from the previous financial year of 2019/2020, which saw a 2.2 per cent drop in the net portfolio value due to the COVID-19 pandemic.

Temasek's portfolio value was given a boost by the recovery in the global equity markets and the public listing of some of the companies in its portfolio, said its representatives at a press conference.

Its one-year total shareholder return, which takes into account all dividends distributed to the shareholder minus any capital injections, turned positive at 24.53 per cent, compared with the -2.28 per cent a year ago.

Over a longer term, its 10-year and 20-year total shareholder returns came in at 7 per cent and 8 per cent respectively, a slight increase from the 5 per cent and 6 per cent respectively in the previous year.

Asked if the record net portfolio value and jump in one-year shareholder return will be sustainable, Temasek International’s joint head of North America Mukul Chawla said the firm’s simulations show a wide range of outcomes “from plus 26 per cent to minus 16 per cent” over the next 12 months.

But he stressed that Temasek holds a long-term view to managing its portfolio and returns.

“We don't manage from one year to the next. As we said, we position the portfolio for the long term and then the returns are an outcome of that,” added Mr Chawla, who is also the joint head of telecommunications, media and technology at Temasek International.

“So it's sort of hard to compare one year with others. I point you to look at our long-term returns and what those have trended to as the real marker of our performance.”

RECORD INVESTMENTS, DIVESTMENTS

Temasek said it invested S$49 billion and divested S$39 billion in the last financial year – both record numbers and significant increases from the previous year when it invested S$32 billion and divested S$26 billion.

The Americas accounted for the largest share of new investments, followed by Singapore and China. Overall, Asia remained the anchor of Temasek’s portfolio at 64 per cent, with China (27 per cent) and Singapore (24 per cent) remaining the top two markets.

“It was an active year, despite pandemic lockdowns and travel restrictions. We invested to stimulate innovation and growth as we repositioned our portfolio for a changing world,” the Singapore state investment firm said in its press release.

“We invested during market dislocations based on our value tests. We invested similarly into our portfolio companies and maintained our disciplined sale of investments. Over the year as markets rebounded, several of our unlisted investments went public to gird themselves for their next phase of development.”

Temasek also said it has sharpened its focus on new opportunities that are aligned with four structural trends, namely digitisation, sustainable living, future of consumption and longer lifespans.

Overall, financial services (24 per cent), as well as telecommunications, media and technology (21 per cent) remained the two biggest sectors in its portfolio. But it noted that the compositions of these two sectors have changed “significantly” over the last decade, partly driven by digitisation.

For instance, it is interested in payments and financial technology businesses that “stand to benefit from the acceleration of digitisation”. Over the past year, it invested in UK-based wealth management services platform FNZ and local start-up Nium that facilitates global digital payments and card issuance.

It also has a strong focus on the technology space as digitisation has “become a mainstream enabler”. This includes software, Internet, e-commerce, the sharing economy, cloud computing and digital content.

Its investments in technology include US-based online entertainment platform Roblox, as well as software developer of cybersecurity tools Snyk and virtual live events management platform Hopin, from the UK.

On divestments, Mr Chawla said all decisions are subject to the firm’s intrinsic value tests although opportunities for some of its portfolio companies to tap into the public markets allowed it to rebalance its portfolio as well.

“I'll give you a real example - a company called BluJay Solutions where we are selling out of a small amount but not all of it,” he told reporters. “And it's natural that we continue to rebalance our portfolio in line with our stated trends and themes.”

OUTLOOK AHEAD

Moving forward, Temasek said it expects the global economy to “recover steadily” on the back of accommodative fiscal and monetary policy, but cautioned of an uneven recovery across countries as some struggle with new peaks of COVID-19 infections and slow vaccination rates.

It also noted “potential geopolitical reverberations” as tensions mount between China and the US.

“Overall, we are cautiously optimistic on the global economic recovery in the short to medium term. We continue to shape our portfolio for resilience in anticipation of future threats and opportunities,” Temasek said in a press release.

“The goal is to sustain our performance, generate risk-adjusted returns over the long term, and mitigate climate risks.”

SUSTAINABILITY GOALS

Temasek also said that sustainability remains at its core.

It remains committed to halve the net carbon emissions attributable to its portfolio by 2030 and its longer-term goal for net zero carbon emissions by 2050.

The investment firm has also set an initial internal carbon price of US$42 per tonne of carbon dioxide equivalent, as part of internalising the economic and future social costs of carbon emissions in its investment decisions.

A portion of its long-term incentives will be aligned with its annual carbon reduction targets through the next 10 years, it added in its press release.

“We will refine our carbon pricing strategies during this coming decade, likely with increasing internal carbon pricing, as we get further clarity on the economic and policy levers of change.”

Meanwhile, it has sought climate-aligned investment opportunities over the past year such as the joint venture with DBS, Standard Chartered and the Singapore Exchange to form global carbon exchange and marketplace Climate Impact X.

It is also looking to enable “carbon negative solutions” such as carbon capture, utilisation and storage, and it has taken the first step by investing in Canada-based company Svante that specialises in low-cost carbon capture technology.

Asked if it sets carbon reduction targets for its portfolio companies, managing director of climate change strategy Neo Gim Huay said while Temasek has been engaging portfolio companies on climate and sustainability issues, specific plans remain decided by the companies’ management and board.

“Having said that, one of the things that we've also done is to provide a platform for regular exchange of ideas and experience,” she said.

“Some of our companies are ahead of others, in terms of thinking about climate risks, carbon footprinting, disclosures-related issues, and we've created a sustainability council which comprises the CEOs of our portfolio companies where they come together to exchange ideas and knowledge.”

The panel was also asked about the upcoming leadership change and how will Temasek be moving forward with its investment strategy.

It was announced in February that Ho Ching will retire as the chief executive officer of Temasek Holdings on Oct 1 after 17 years at the helm.

Mr Dilhan Pillay will succeed her as chief executive and executive director on the same day, while holding on to his current position as the chief executive of Temasek International, the commercial arm of Temasek driving its investments.

Mr Fock Wai Hoong, managing director of investments with a focus on the telecommunications, media and technology sectors and Southeast Asia, described Temasek as “an evolutionary organisation, not a revolutionary organization”.

“So I think changes that we make are progressive and I think, once again, well positioned for the future," he said.

Chiming in, Temasek International's investment group joint head and head of portfolio development Nagi Hamiyeh said the state investment firm has over the years worked on building “a strong bench of senior management”.

“So there is no one person that makes any one decision. We all work collectively together through committees, through participation and we're all part and parcel of this journey going forward. So I don't believe there will be much change.”

He also stressed that succession planning is something that Temasak takes “very seriously” and is an ongoing process.

“Even though Dilhan is taking over on Oct 1… we are already planning for the next generation," said Mr Hamiyeh.

https://www.channelnewsasia.com/new...cord-net-portfolio-value-381-billion-15211044