-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tan Min-Liang's company, Razer has been crashing since listed

- Thread starter Hangover

- Start date

Razer Phone is yet another great phone doomed by its poor camera

https://mashable.com/2018/04/19/razer-phone-review

casing ilooks so........orrbit

https://mashable.com/2018/04/19/razer-phone-review

casing ilooks so........orrbit

Did Ho Jinx touch him or the firm?

Looks like this Neyla Zannia did a good job explaining why u shouldn't buy the stock.

3 things you have to know about razer before buying its stock

Published on 2017-11-24 by Neyla Zannia

by Value Penguin

Razer, a leading gaming brand, had an immensely successful IPO earlier this month, garnering a lot of investor interest. Admittedly, Razer has been building a pretty loyal fan base among hardcore gamers who fancy the brand's cool keyboards, mice, headphones and other gaming peripherals. After soaring 40% after its debut on the HK Exchange, however, its stock has continued a 15% decline for the past week. Given these circumstances, we wanted to examine if investors should take a serious interest in trading this stock. Here are top three factors investors should weigh before jumping in the water.

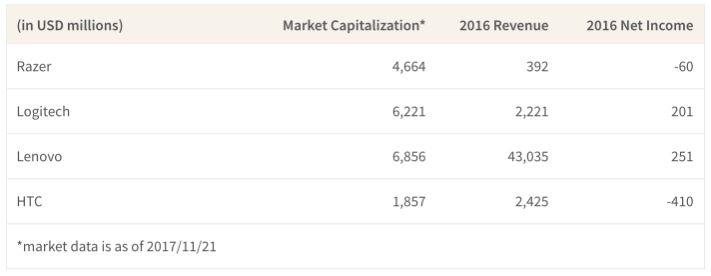

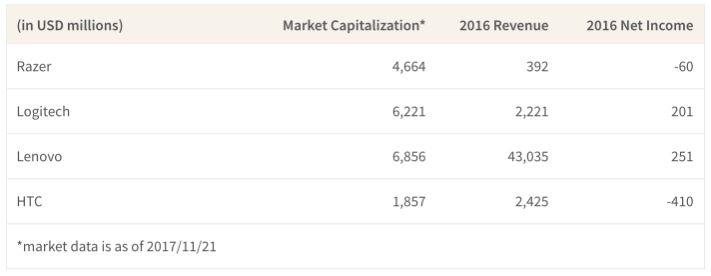

Razer is extremely expensive compared to similar companies

Compared to its well-known competitors in the market, Razer's stock is extremely expensive. Although it makes no profit on a revenue of $500mn, Razer currently holds a market valuation of roughly $4.7bn. In comparison, Logitech, the leader in electronics peripherals that makes $2.5bn in annual revenue and $250mn in annual profit, is currently worth about $6 billion. Juxtaposing these two leaders in gaming peripherals market make it quite obvious just how expensive Razer's stock is. Their relative valuations would imply that investors firmly believe Razer will be able to match Logitech in both its revenue and profit at some point in the near future. To put it another way, even if Razer were to increase the size of its business by 4x, investors would be breaking even.

Many of Razer's growth initiatives are unlikely to be profitable

Razer has been focusing on two new growth initiatives: smartphones and gaming computers. For example, Razer's peripherals sales actually has been growing at a rather meek pace, while its systems revenue (laptops) and other revenue (smartphone) have been driving 80% of the company's growth.

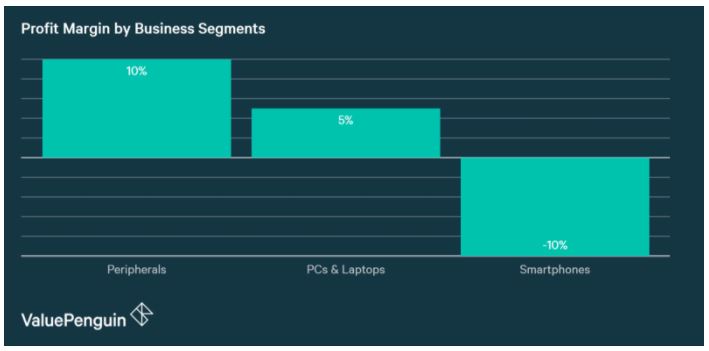

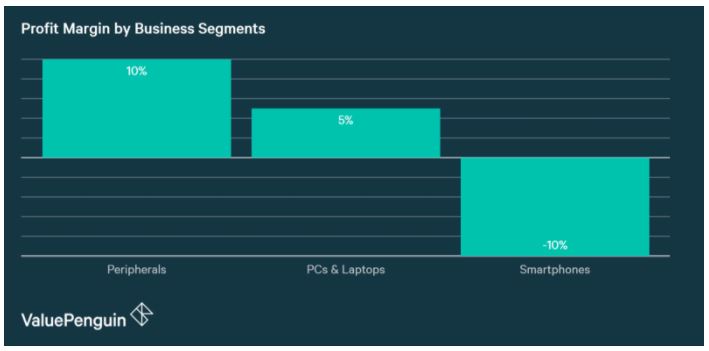

The problem, however, is that both smartphones and computers are very unprofitable products sold in an ultra competitive market. For instance, even Lenovo, a world leader in PCs and laptops with $45bn in annual revenue, earns only a 5% pre-tax profit margin on its PC & Smart Device division. This is about half of Logitech's and also Razer's profit margins in peripheral products like mice and keyboards. Smartphones are even worse: both Lenovo and HTC's smartphone businesses are losing money despite having collective sale of more than $10bn on an annual basis. This is why both Lenovo and HTC are valued at only around $7bn and $2bn, respectively. In other words, even if Razer's systems and other revenues were to grow by 20-30x, they would still be less than 10% of Lenovo in size, unprofitable and therefore worthless to investors.

Razer's main source of strength is its brand, which is fading

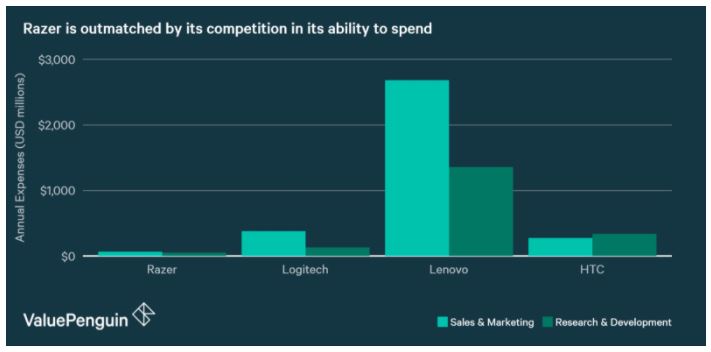

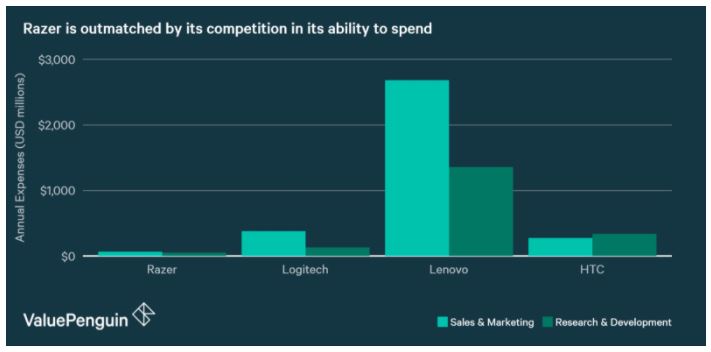

On a high level, Razer is an electronics design company with a pretty strong brand among gamers, which represents a rapidly growing consumer segment. In fact, it doesn't even manufacture its own devices, with 100% of its products are "manufactured to [their] specifications by independent contract manufacturers," according to their IPO filing. Given this, it's worth exploring just how much resource Razer invests into developing its products and marketing its brand. In this case, numbers shed even more negative light on Razer the company: both its sales & marketing cost and research & development cost are far lower than any of those of its competitors.

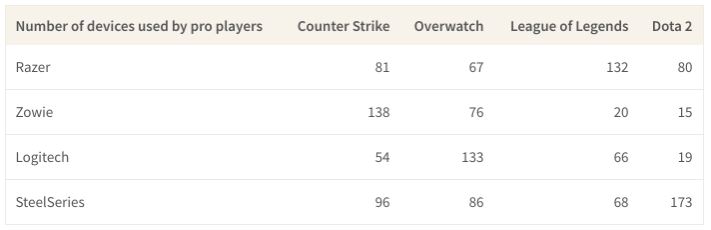

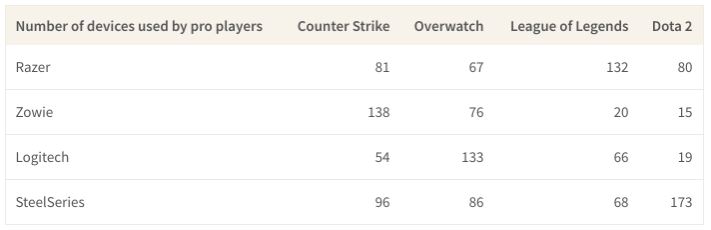

This is a very big concern for Razer's growth prospects going forward. Companies like Razer promote their brands by sponsoring famous pro e-sports players, much the same way that Nike has done successfully over the last few decades. According to the data we collected from on-winning.com below, there doesn't yet seem to be a clear winner in terms of adoption by pro-players. Most likely, companies with bigger pockets eventually will spend more to equip all the popular players with their own products, and take more market share over time. This is especially so given that most of the brands like Razer, Logitech and SteelSeries are all ranked as the top gaming devices by a countless number of blogs and reviewers, meaning their products are all quite good. From this perspective, the fact that Razer is so outmatched by its rivals in terms of their budgets is not an encouraging sign.

Razer's stock seems overvalued

In summary, Razer's stock seems overvalued compared to the business realities it is facing. Despite the fact that its valuation is quite close to its competitors, both the size of its business and its war chest are significantly smaller than its competitors. Given its strong brand, Razer will likely continue to grow its business. However, it will have a very difficult time growing into the sky-high expectations that investors have set for the company.

3 things you have to know about razer before buying its stock

Published on 2017-11-24 by Neyla Zannia

by Value Penguin

Razer, a leading gaming brand, had an immensely successful IPO earlier this month, garnering a lot of investor interest. Admittedly, Razer has been building a pretty loyal fan base among hardcore gamers who fancy the brand's cool keyboards, mice, headphones and other gaming peripherals. After soaring 40% after its debut on the HK Exchange, however, its stock has continued a 15% decline for the past week. Given these circumstances, we wanted to examine if investors should take a serious interest in trading this stock. Here are top three factors investors should weigh before jumping in the water.

Razer is extremely expensive compared to similar companies

Compared to its well-known competitors in the market, Razer's stock is extremely expensive. Although it makes no profit on a revenue of $500mn, Razer currently holds a market valuation of roughly $4.7bn. In comparison, Logitech, the leader in electronics peripherals that makes $2.5bn in annual revenue and $250mn in annual profit, is currently worth about $6 billion. Juxtaposing these two leaders in gaming peripherals market make it quite obvious just how expensive Razer's stock is. Their relative valuations would imply that investors firmly believe Razer will be able to match Logitech in both its revenue and profit at some point in the near future. To put it another way, even if Razer were to increase the size of its business by 4x, investors would be breaking even.

Many of Razer's growth initiatives are unlikely to be profitable

Razer has been focusing on two new growth initiatives: smartphones and gaming computers. For example, Razer's peripherals sales actually has been growing at a rather meek pace, while its systems revenue (laptops) and other revenue (smartphone) have been driving 80% of the company's growth.

The problem, however, is that both smartphones and computers are very unprofitable products sold in an ultra competitive market. For instance, even Lenovo, a world leader in PCs and laptops with $45bn in annual revenue, earns only a 5% pre-tax profit margin on its PC & Smart Device division. This is about half of Logitech's and also Razer's profit margins in peripheral products like mice and keyboards. Smartphones are even worse: both Lenovo and HTC's smartphone businesses are losing money despite having collective sale of more than $10bn on an annual basis. This is why both Lenovo and HTC are valued at only around $7bn and $2bn, respectively. In other words, even if Razer's systems and other revenues were to grow by 20-30x, they would still be less than 10% of Lenovo in size, unprofitable and therefore worthless to investors.

Razer's main source of strength is its brand, which is fading

On a high level, Razer is an electronics design company with a pretty strong brand among gamers, which represents a rapidly growing consumer segment. In fact, it doesn't even manufacture its own devices, with 100% of its products are "manufactured to [their] specifications by independent contract manufacturers," according to their IPO filing. Given this, it's worth exploring just how much resource Razer invests into developing its products and marketing its brand. In this case, numbers shed even more negative light on Razer the company: both its sales & marketing cost and research & development cost are far lower than any of those of its competitors.

This is a very big concern for Razer's growth prospects going forward. Companies like Razer promote their brands by sponsoring famous pro e-sports players, much the same way that Nike has done successfully over the last few decades. According to the data we collected from on-winning.com below, there doesn't yet seem to be a clear winner in terms of adoption by pro-players. Most likely, companies with bigger pockets eventually will spend more to equip all the popular players with their own products, and take more market share over time. This is especially so given that most of the brands like Razer, Logitech and SteelSeries are all ranked as the top gaming devices by a countless number of blogs and reviewers, meaning their products are all quite good. From this perspective, the fact that Razer is so outmatched by its rivals in terms of their budgets is not an encouraging sign.

Razer's stock seems overvalued

In summary, Razer's stock seems overvalued compared to the business realities it is facing. Despite the fact that its valuation is quite close to its competitors, both the size of its business and its war chest are significantly smaller than its competitors. Given its strong brand, Razer will likely continue to grow its business. However, it will have a very difficult time growing into the sky-high expectations that investors have set for the company.

I hope he succeeds unlike sim Wong hoo.....he needs to focus on what works and stop innovating and get his balance sheet back into shape.stop trying to be the next apple and stick to what makes money even if it's crappy keyboards and mouse.

I hope he succeeds unlike sim Wong hoo.....he needs to focus on what works and stop innovating and get his balance sheet back into shape.stop trying to be the next apple and stick to what makes money even if it's crappy keyboards and mouse.

He depended on temasek and lured many investors during the share placement.

Sim Wong Hoo didn't depend on temasek to succeed

He depended on temasek and lured many investors during the share placement.

Sim Wong Hoo didn't depend on temasek to succeed

I believed sim Wong hoo did two ipos one in sg and one in US (which got delisted) back in 2000 which made him a billionaire(now he's worth less than a tenth of that).....tan Ming Liang only went ipo one or two years ago which meant he built a company of 250 mil sales all by himself selling mouse and keyboards over the last ten years.

Sim Wong hoo was just a lucky bastard who stumbled upon a billion dollar invention and blew it all.

Ok lab.. It's an accounting game played by companies to get qualified for listing.

Once they make it and get the capital raised, they can still grow as long as the company is sound

Consumer electronics is a high risk high return industry. If this sinkie guy plays his cards right he'll do fine

Once they make it and get the capital raised, they can still grow as long as the company is sound

Consumer electronics is a high risk high return industry. If this sinkie guy plays his cards right he'll do fine

To really succeed in Singkieland have to depend on pap....SWH actually rebuff pap that why he has been down hill eversince. He should have concentrated on USA market and of course come up with better products...so no need put up with pap..He depended on temasek and lured many investors during the share placement.

Sim Wong Hoo didn't depend on temasek to succeed

This is the next Sim Wong Hoo

Who is this botak?

This is the next Sim Wong Hoo

Are u a fucking retard? Why make such a useless posting with no head no tail? U should be bitch slapped!

Should watch Dr Tan Min Han's company https://lucencedx.com still private for now.

He is the older brother of Tan Min Liang.

He is the older brother of Tan Min Liang.

This is the next Sim Wong Hoo

I know him. I've talked to him a couple of times at gatherings for towkays. He would make a fine addition to the party and the grassroots.

i knew it was a disaster when i heard about the IPO...............

I know him. I've talked to him a couple of times at gatherings for towkays. He would make a fine addition to the party and the grassroots.

you got share your doggy treats with him ?

i knew it was a disaster when i heard about the IPO...............

It is one of the biggest tech IPO flops in recent years.

Good thing that he choose to list in HK and avoided ripping sg investors off.

I know him. I've talked to him a couple of times at gatherings for towkays. He would make a fine addition to the party and the grassroots.

I just smoke with him. He is not a show-off like tan min liang and very passionate about his work. If he joins PAP, I will vote for PAP.

His inventions will make conscription redundant in Singapore.

Who is this botak?

hope technik co-founder peter ho.

https://vulcanpost.com/615216/hope-technik-multimillion-dollar-group/

Similar threads

- Replies

- 6

- Views

- 355

- Replies

- 23

- Views

- 852

- Replies

- 19

- Views

- 2K

- Replies

- 41

- Views

- 5K