The Straits Times; Published on Mar 8, 2012

Protect CPF savings from inflation

TO ENSURE the adequacy of retirement funds, Central Provident Fund (CPF) members should consider their 'real' returns on CPF savings, after subtracting inflation, which reduces future purchasing power ('CPF Life: Wouldn't the monthly payout be eroded by inflation?' by Mr Christopher Teng; yesterday)[alt link].

The Minimum Sum is adjusted for inflation, yet the Ordinary Account (OA) and Special Account (SA) 'nominal' interest rates are not; and neither, it seems, are the CPF Life payouts, which thus create significant exposure to inflation.

For example, if the SA nominal rate is 4 per cent, and inflation is 6 per cent, one loses 2 percentage point purchasing power.

From 1995 to 2006, this was not so important because inflation was low, between a negative 0.4 per cent and 2 per cent, averaging 0.87 per cent annually.

But from 2007 to last year, inflation rose dramatically - as high as 6.6 per cent (2008) and 5.2 per cent (last year), averaging 3.5 per cent over this five-year period, which is four times higher than that for the 1995-2006 period.

So, at a 4 per cent SA rate, the real return from 1995 to 2006 would have averaged 3.13 per cent (4 per cent minus 0.87 per cent), and from 2007 to last year, a low 0.5 per cent (4 per cent minus 3.5 per cent).

To demonstrate the magnitude of these real return differences over a career, compound $10,000 annually over a 30-year period.

Using a 3.13 per cent real return yields $25,200 after 30 years, while 0.5 per cent correspondingly yields only $11,600. Thus, today's real yields will leave retirees with only half the real purchasing power of the earlier period, and their CPF Life payouts are also exposed to inflation.

While future inflation and OA/SA rates are unknown risks, it is clear that inflation can affect retirement purchasing power dramatically.

Without inflation indexing, CPF members seem to have no means to maintain purchasing power over the long haul should inflation continue or escalate rapidly.

Perhaps returns in CPF retirement accounts should be set at a minimum real yield to factor in inflation.

Many countries offer inflation-protected notes and bonds, so this is a mainstream practice.

The Government of Singapore Investment Corporation, which invests the CPF capital, has a target long-term real return that takes inflation into account.

Factoring inflation protection into the SA rate assures CPF members, who will rely on their retirement savings, that these are protected from the unpredictable ravages of inflation.

Michael Dee

Copyright © 2011 Singapore Press Holdings. All rights reserved.

http://www.straitstimes.com/STForum/Story/STIStory_775061.html

=========

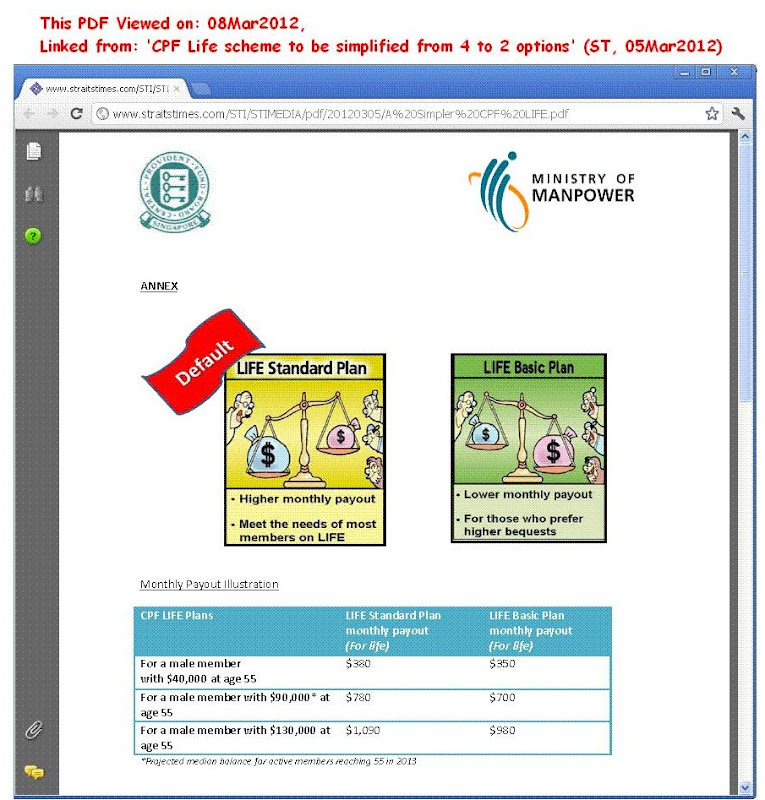

[full size]

[full size]

=========

My idea is perhaps that in the interim, the govt can give a bonus interest over and above the ordinary CPF interest rate which is tagged to the annual rate of inflation: e.g. if inflation that year is 6% and ordinary rate is 2.5%, then bonus interest of 3.5% is payable on the original principal sum, so that total interest will always at least negate the problem of inflation resulting in no erosion in the principal value of CPF savings. CPF life should also be made equally transparent: each year should end with a bonus payout based upon that year's inflation rate with the baseline payout rate being raised. Should deflation occur, then the bonus would automatically be reduced or cut, ditto the base rate for the next year although an early warning would allow pensioners and annuity holders to adjust their respective expenditures accordingly.

PS: Actually, the BEST idea is to pay interest based upon annual inflation rate: e.g. inflation rate plus say 0.1%: so if there is inflation of 10% that year, interest payable by govt is 10.1%, if there is deflation, then only 0.1% interest is payable: this is a much more stable system since it is the real value of their savings that people are concerned about: no point earning 4% interest when the rate of inflation is 10% becos one would have then lost approx 6% in value of one's savings as everything in the marketplace now costs an average of 10% more now anyhow.

PS: In a state of HYPERINFLATION:where by one definition it is- inflation exceeding 50% each month [Wiki: Hyperinflation], the 2.5% that the CPF OA pays, or even the 5% that the SA might pay is peanuts, peanuts really...

Caption: YOUNG KID .....ALREADY BILLIONAIRE

Caption: YOUNG KID .....ALREADY BILLIONAIRE

[Pict source: 'HYPERINFLATION IN ZIMBABWE..' (Sept2008/ [link])]

Protect CPF savings from inflation

TO ENSURE the adequacy of retirement funds, Central Provident Fund (CPF) members should consider their 'real' returns on CPF savings, after subtracting inflation, which reduces future purchasing power ('CPF Life: Wouldn't the monthly payout be eroded by inflation?' by Mr Christopher Teng; yesterday)[alt link].

The Minimum Sum is adjusted for inflation, yet the Ordinary Account (OA) and Special Account (SA) 'nominal' interest rates are not; and neither, it seems, are the CPF Life payouts, which thus create significant exposure to inflation.

For example, if the SA nominal rate is 4 per cent, and inflation is 6 per cent, one loses 2 percentage point purchasing power.

From 1995 to 2006, this was not so important because inflation was low, between a negative 0.4 per cent and 2 per cent, averaging 0.87 per cent annually.

But from 2007 to last year, inflation rose dramatically - as high as 6.6 per cent (2008) and 5.2 per cent (last year), averaging 3.5 per cent over this five-year period, which is four times higher than that for the 1995-2006 period.

So, at a 4 per cent SA rate, the real return from 1995 to 2006 would have averaged 3.13 per cent (4 per cent minus 0.87 per cent), and from 2007 to last year, a low 0.5 per cent (4 per cent minus 3.5 per cent).

To demonstrate the magnitude of these real return differences over a career, compound $10,000 annually over a 30-year period.

Using a 3.13 per cent real return yields $25,200 after 30 years, while 0.5 per cent correspondingly yields only $11,600. Thus, today's real yields will leave retirees with only half the real purchasing power of the earlier period, and their CPF Life payouts are also exposed to inflation.

While future inflation and OA/SA rates are unknown risks, it is clear that inflation can affect retirement purchasing power dramatically.

Without inflation indexing, CPF members seem to have no means to maintain purchasing power over the long haul should inflation continue or escalate rapidly.

Perhaps returns in CPF retirement accounts should be set at a minimum real yield to factor in inflation.

Many countries offer inflation-protected notes and bonds, so this is a mainstream practice.

The Government of Singapore Investment Corporation, which invests the CPF capital, has a target long-term real return that takes inflation into account.

Factoring inflation protection into the SA rate assures CPF members, who will rely on their retirement savings, that these are protected from the unpredictable ravages of inflation.

Michael Dee

Copyright © 2011 Singapore Press Holdings. All rights reserved.

http://www.straitstimes.com/STForum/Story/STIStory_775061.html

=========

=========

My idea is perhaps that in the interim, the govt can give a bonus interest over and above the ordinary CPF interest rate which is tagged to the annual rate of inflation: e.g. if inflation that year is 6% and ordinary rate is 2.5%, then bonus interest of 3.5% is payable on the original principal sum, so that total interest will always at least negate the problem of inflation resulting in no erosion in the principal value of CPF savings. CPF life should also be made equally transparent: each year should end with a bonus payout based upon that year's inflation rate with the baseline payout rate being raised. Should deflation occur, then the bonus would automatically be reduced or cut, ditto the base rate for the next year although an early warning would allow pensioners and annuity holders to adjust their respective expenditures accordingly.

PS: Actually, the BEST idea is to pay interest based upon annual inflation rate: e.g. inflation rate plus say 0.1%: so if there is inflation of 10% that year, interest payable by govt is 10.1%, if there is deflation, then only 0.1% interest is payable: this is a much more stable system since it is the real value of their savings that people are concerned about: no point earning 4% interest when the rate of inflation is 10% becos one would have then lost approx 6% in value of one's savings as everything in the marketplace now costs an average of 10% more now anyhow.

PS: In a state of HYPERINFLATION:where by one definition it is- inflation exceeding 50% each month [Wiki: Hyperinflation], the 2.5% that the CPF OA pays, or even the 5% that the SA might pay is peanuts, peanuts really...

[Pict source: 'HYPERINFLATION IN ZIMBABWE..' (Sept2008/ [link])]

Last edited: