- Joined

- May 16, 2023

- Messages

- 45,086

- Points

- 113

CapitaLand Investment to build $260 million Singapore automated logistics hub

Get ST's newsletters delivered to your inbox

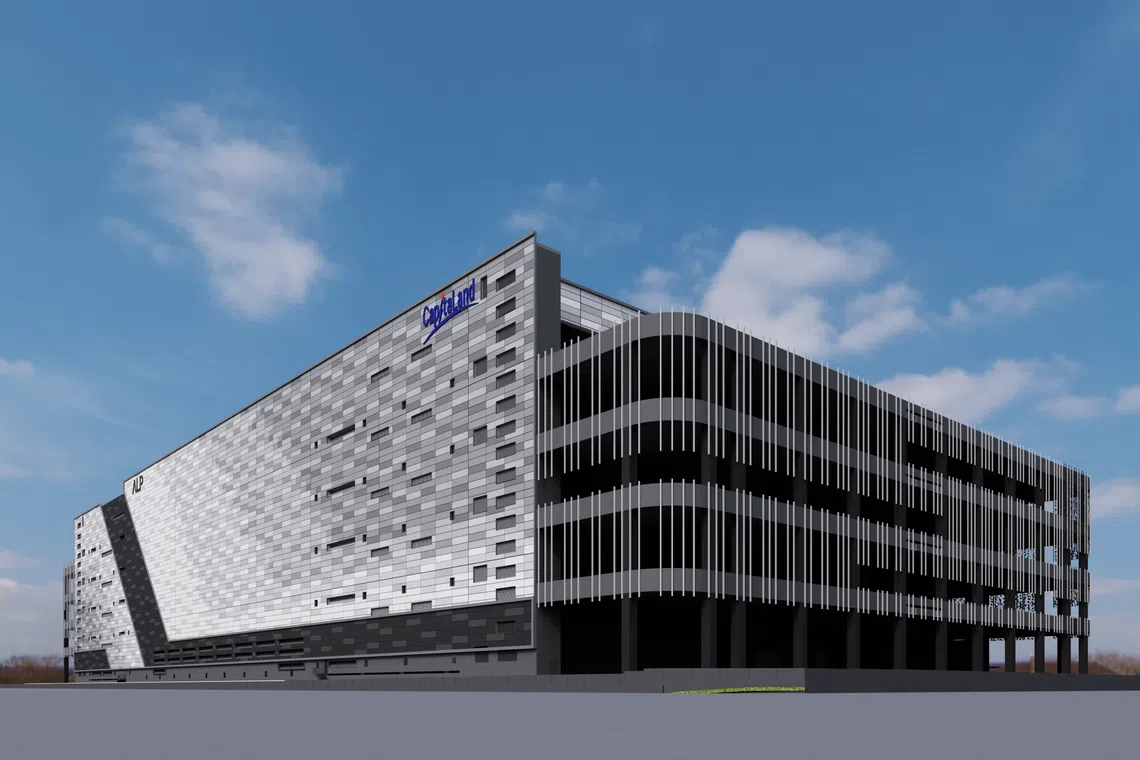

An artists' impression of the Omega 1 Singapore facility at 19 Gul Lane in Jurong.

PHOTO: CAPITALAND INVESTMENT

Follow topic:

CapitaLandPublished Jan 08, 2026, 09:20 AM

Updated Jan 08, 2026, 09:57 AM

SINGAPORE - CapitaLand Investment Limited (CLI) on Jan 8 announced plans for its regional fund to develop a $260 million automated facility in Singapore.

It also announced a minority investment in smart logistics infrastructure company, Ally Logistic Property (ALP), which will lease the facility.

CLI’s CapitaLand South-east Asia Logistics Fund (CSLF) has acquired a 5.1-hectare (ha) site at 19 Gul Lane in the Jurong Industrial Estate to develop the project – Omega 1 Singapore.

The five-storey facility is set to be completed in 2028 and will have a gross floor area of 71,000 square metres. It will also be equipped with robotics, as well as an automated storage and retrieval system capable of handling about 60,000 pallet positions.

Patricia Goh, CLI’s chief executive officer of South-east Asia and global head of logistics and self-storage, private funds, said that the move is a strategic response to demand for “modern, automated logistics solutions across the region”. This demand, she said, has been driven by growth in digitally enabled consumption, an ageing population, rising labour costs and supply chain rationalisation.

Concurrent with the development, CLI has acquired a minority stake in ALP, a smart logistics infrastructure firm based in Asia.