-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Serious Shitskin Sinkie family to be deported from Australia. Fuck off to India!

- Thread starter Cottonmouth

- Start date

- Joined

- Jun 14, 2010

- Messages

- 2,811

- Points

- 113

Wheres the expert Krafty? Would like to know his opinion

- Joined

- Jul 10, 2008

- Messages

- 66,328

- Points

- 113

This is a disgusting racist attack on an innocent family who already face setbacks in their lives. Threads like this one should not be allowed regardless of the circumstances.

However the question that has not been asked or answered is why they don't have PR or citizenship after 7 years in the country.

Had they actually emigrated to the country 7 years ago they would have done so on a immigrant visa which they could have then used to apply for citizenship a few years later.

However they arrived on a work visa which does not classify them as immigrants. They are foreign workers.

However the question that has not been asked or answered is why they don't have PR or citizenship after 7 years in the country.

Had they actually emigrated to the country 7 years ago they would have done so on a immigrant visa which they could have then used to apply for citizenship a few years later.

However they arrived on a work visa which does not classify them as immigrants. They are foreign workers.

- Joined

- Jul 22, 2013

- Messages

- 11,606

- Points

- 113

Can ask what indian magic they use? So he needs dialysis but he can survive 7 years without? The story is already fishy

- Joined

- Jun 14, 2010

- Messages

- 2,811

- Points

- 113

Possibility there were lies told during the health check

- Joined

- Apr 20, 2011

- Messages

- 6,595

- Points

- 113

why not legitimately convert citizenship? want to game CPF , gov bonus, SG property rental income, SG medical?

trust browm face at your own peril.

Thangaji preeti should take their plight online as they are same brown face.

trust browm face at your own peril.

Thangaji preeti should take their plight online as they are same brown face.

- Joined

- Apr 14, 2011

- Messages

- 20,089

- Points

- 113

The little snake played the racist card again by the false claim that each year only one or two Indians were admitted to local (Singapore) universities.

Indians the bestest in playing race cards.

- Joined

- Apr 20, 2011

- Messages

- 6,595

- Points

- 113

天下乌鸦一般黑

- Joined

- Jun 27, 2018

- Messages

- 31,512

- Points

- 113

It's an ah Neh story anyway....always gets tallerCan ask what indian magic they use? So he needs dialysis but he can survive 7 years without? The story is already fishy

- Joined

- Apr 7, 2018

- Messages

- 13,558

- Points

- 113

It's an ah Neh story anyway....always gets taller

Ah Neh fiction is always that they are race victims, discriminated against, prostitutes reject them, dog bark at them, automatic door won't open, people want to extort them.

- Joined

- Jun 11, 2017

- Messages

- 19,996

- Points

- 113

These Ah Nehs were PRs for 7 years....if they loved their host country and call it "home" then they should have become Australian citizens instead of just being a PR.

But no...they still want their HDB & CPF top ups from the SG gahmen and still enjoy the perks of PR status in Australia.

They deserve it.

But no...they still want their HDB & CPF top ups from the SG gahmen and still enjoy the perks of PR status in Australia.

They deserve it.

- Joined

- Jul 10, 2008

- Messages

- 66,328

- Points

- 113

These Ah Nehs were PRs for 7 years....if they loved their host country and call it "home" then they should have become Australian citizens instead of just being a PR.

But no...they still want their HDB & CPF top ups from the SG gahmen and still enjoy the perks of PR status in Australia.

They deserve it.

https://www.rayfordmigration.com/australia-news/top-10-benefits-of-having-an-australian-pr-visa/

PRs qualify for all health benefits so they cannot possibly be residents. They are probably on work visas.

With a high standard of living and balanced lifestyle backed by a strong economy and scenic landscaping, Australia is the choice of migration compared to other countries. People migrate to Australia to have a better life. Before doing that, you need to apply for the Permanent Residency (PR) visa in order to be granted a right to live, work and study without limitation in Australia. Having said that, let us evaluate the benefits of becoming a Permanent Resident in Australia.

1. As a permanent resident, you will be given a permanent visa. This entitles you to the right to live in Australia indefinitely. You can enjoy the facilities of unlimited travel to and from Australia once you become a permanent resident. However, initially the permanent visa is given for a period of five years and has to be applied again from either outside Australia or from within the country.

2. On procuring permanent residentship, you also enjoy unlimited freedom to pursue the course of study that you prefer. Permanent residents have various options to choose when it comes to University education. There are certain education loans that are available only to permanent residents. These loans are extremely helpful in managing your financial crisis that may arise due to the additional expenses associated with your study.

3. The next important aspect of permanent residence is regarding work permit. Working in Australia becomes easier with a Permanent Resident Visa. Permanent residents can work for any employer in any occupation. But, working in the Public Service or Armed forces is strictly restricted to the Australian Citizens. This, however, does not distinguish the industrial laws between the permanent residents and citizens. Permanent residents enjoy the same benefits under these laws as the citizens. They can become a part of trade unions and can claim worker’s compensation.

4. As regards to social security, the permanent residents must hold on for a period of two years before they are entitled to receive social security benefits like sickness, unemployment and student benefits that are offered by Australia’s Social Security Department.

5. An important benefit that the permanent residents will enjoy is the health care entitlement. As a permanent resident of Australia, you will enjoy the privilege of health insurance scheme run by the government called Medicare. Under Medicare, you could receive free treatment at a public hospital and subsidized medicine.

6. Permanent residents can also sponsor their relatives for acquisition of permanent residence. But this is possible only after the applicant meets certain residence and support assurance pre-requisites.

7. Children of permanent residents who are born in Australia are deemed Australian citizens by birth. This will be one great advantage because they will enjoy the maximum benefits in the field of education and health care.

8. Permanent residents have the right to take up some professions in Australia like that of a migration agent or any government position.

9. The permanent resident of Australia is also granted the right to travel to New Zealand and apply for a New Zealand Visa. This is a provision that has been granted by the government of New Zealand.

10. The permanent resident of Australia has the right to apply for Australian consular assistance overseas when things get a little rough abroad.

Of course there are a number of formalities and criteria to be fulfilled to be considered a Permanent Resident of Australia such as Visa Application, and so forth. The benefits above are the driving force why people are increasing considering Australia migration as their first choice. In a recent report by ‘The Advertiser’, a local Adelaide’s tabloid, it says that Australia is the ultimate destination for any immigrant looking to settle down as it provides everything one can ask for.

So, nurture your dream towards migration to Australia and make it a reality. Click Here for a Free Assessment today!

- Joined

- Jun 27, 2018

- Messages

- 31,512

- Points

- 113

Ozland tat good meh?https://www.rayfordmigration.com/australia-news/top-10-benefits-of-having-an-australian-pr-visa/

PRs qualify for all health benefits so they cannot possibly be residents. They are probably on work visas.

With a high standard of living and balanced lifestyle backed by a strong economy and scenic landscaping, Australia is the choice of migration compared to other countries. People migrate to Australia to have a better life. Before doing that, you need to apply for the Permanent Residency (PR) visa in order to be granted a right to live, work and study without limitation in Australia. Having said that, let us evaluate the benefits of becoming a Permanent Resident in Australia.

1. As a permanent resident, you will be given a permanent visa. This entitles you to the right to live in Australia indefinitely. You can enjoy the facilities of unlimited travel to and from Australia once you become a permanent resident. However, initially the permanent visa is given for a period of five years and has to be applied again from either outside Australia or from within the country.

2. On procuring permanent residentship, you also enjoy unlimited freedom to pursue the course of study that you prefer. Permanent residents have various options to choose when it comes to University education. There are certain education loans that are available only to permanent residents. These loans are extremely helpful in managing your financial crisis that may arise due to the additional expenses associated with your study.

3. The next important aspect of permanent residence is regarding work permit. Working in Australia becomes easier with a Permanent Resident Visa. Permanent residents can work for any employer in any occupation. But, working in the Public Service or Armed forces is strictly restricted to the Australian Citizens. This, however, does not distinguish the industrial laws between the permanent residents and citizens. Permanent residents enjoy the same benefits under these laws as the citizens. They can become a part of trade unions and can claim worker’s compensation.

4. As regards to social security, the permanent residents must hold on for a period of two years before they are entitled to receive social security benefits like sickness, unemployment and student benefits that are offered by Australia’s Social Security Department.

5. An important benefit that the permanent residents will enjoy is the health care entitlement. As a permanent resident of Australia, you will enjoy the privilege of health insurance scheme run by the government called Medicare. Under Medicare, you could receive free treatment at a public hospital and subsidized medicine.

6. Permanent residents can also sponsor their relatives for acquisition of permanent residence. But this is possible only after the applicant meets certain residence and support assurance pre-requisites.

7. Children of permanent residents who are born in Australia are deemed Australian citizens by birth. This will be one great advantage because they will enjoy the maximum benefits in the field of education and health care.

8. Permanent residents have the right to take up some professions in Australia like that of a migration agent or any government position.

9. The permanent resident of Australia is also granted the right to travel to New Zealand and apply for a New Zealand Visa. This is a provision that has been granted by the government of New Zealand.

10. The permanent resident of Australia has the right to apply for Australian consular assistance overseas when things get a little rough abroad.

Of course there are a number of formalities and criteria to be fulfilled to be considered a Permanent Resident of Australia such as Visa Application, and so forth. The benefits above are the driving force why people are increasing considering Australia migration as their first choice. In a recent report by ‘The Advertiser’, a local Adelaide’s tabloid, it says that Australia is the ultimate destination for any immigrant looking to settle down as it provides everything one can ask for.

So, nurture your dream towards migration to Australia and make it a reality. Click Here for a Free Assessment today!

Wage and unemployment numbers set to pressure RBA to cut interest rates again - Analysis & Opinion

about 8 hours ago

A collection of Australian $50 notes

PHOTO Another batch of weak wage and jobless numbers this week could force another rate cut. REUTERS: DANIEL MUNOZ

Reserve Bank governor Philip Lowe's thesis that the "economy may have reached a gentle turning point" looks like getting a brutal reality check.

Two of the RBA's greatest irritants — unemployment and wage growth — are updated this week; and if forecasts are correct, they are likely to exhibit a turn for the worse.

The consensus view of market economists is the unemployment rate will tick up again, this time to 5.3 per cent.

February's 4.9 per cent seems a long time ago.

The RBA's ideal of full employment at 4.5 per cent is not even on the radar — 5 per cent is as good as Dr Lowe's economic modellers can see, and that's still years away at the extremity of their forecast vision.

As for wages, the best anyone can come up with is that wage inflation over the first quarter, as measured by the Wage Price Index (WPI), won't be much worse than any of the previous quarters' very soft results.

The market has pencilled in another quarter 0.5 per cent wage growth; barely enough to hold the WPI at 2.3 per cent over the year.

Data collated by the Attorney-General's department points to completed enterprise bargaining agreements delivering even lower outcomes in the first quarter.

Given the standard EBA runs three years, and the trend of the past six months — particularly in the construction and public sectors — has been for a steep erosion in outcomes, weak wage growth looks locked in for some time.

RBA winds back forecasts

Westpac's Bill Evans says there is little to suggest there has been a meaningful acceleration in wages.

"Wage inflation has lifted off its record low of 1.9 per cent a year in June 2017, but running at 2.3 per cent in March 2019 it can hardly be described as a breakneck pace," Mr Evans said.

"We expect wage inflation to drift higher from here — our forecasts have it peaking around 2.75 per cent a year in late 2020 — but given how well contained wage inflation is across the nation, and between sectors, even this modest increase looks optimistic, with the risks meaningfully skewed to the downside."

WPI vs EBA

The low wage outcomes are a big factor in the RBA continually undershooting its inflation target. It also puts a brake on household consumption and ultimately the entire economy.

While the RBA's cuts to its GDP growth and unemployment forecasts last week gained most attention, household consumption growth was also pruned back from 2 per cent this year to just 1.5 per cent — not exactly great news for struggling retailers.

'Wait and see'

With everything being wound back, it was fairly obvious the RBA would also wave the white flag on a somewhat heroic punt on wages growth.

"The motivation behind this decision, which must be very disappointing for the RBA Governor given his strong focus on lifting wages growth, is firstly due to the RBA's own liaison program which shows that the majority of firms anticipate little change in wages growth over the next year," Mr Evans said.

Dr Lowe's basic proposition to the Parliament's economics committee on Friday was the economy would "strengthen gradually after a run of disappointing [GDP] numbers".

There appears to be little sense of urgency about the future of either the domestic or global economies, with the RBA happy to sit back and watch the magic of its June and July rate cuts work.

"It [the RBA board] judged that after having moved twice in quick succession it was appropriate to wait and assess developments both internationally and domestically," Dr Lowe told the MPs.

However, the RBA's downgraded internal forecasts paint a slightly different picture — slackness in the labour market, stagnant wages growth and chronically sub-target inflation.

Another disappointing batch of unemployment and wages data this week is likely to snap the RBA out of "wait and assess" mode and back to the old cutting board, sooner rather than later.

Market slide of trade jitters

Wall Street traders thought it would be wise to offload risk ahead of the weekend as another batch of trade-related comments from the White House left them somewhat confused and on edge.

Central to the new anxieties is the fate of the next round of US-China trade talks scheduled for next month.

"We're talking with China. We're not ready to make a deal — but we'll see what happens," US President Donald Trump told reporters on his way to a fundraiser.

"China wants to do something, but I'm not ready to do anything yet. Twenty-five years of abuse — I'm not ready so fast, so we'll see how that works out," Mr Trump said.

The key US indices recovered a bit after a sharp initial Friday sell-off. After a volatile week, they ended up roughly where they started.

The ASX had a much rougher time, down almost 3 per cent — its worst week since November last year. Futures trading point to a less than robust start on Monday.

Commodities hammered

The escalating US-China tensions' impact on equity markets has been modest compared to the pain being felt in trade-sensitive commodities.

Over the week, oil's global benchmark, Brent Crude, fell more than 5 per cent. It's down about 20 per cent from its April peak.

The slide may well become more pronounced as the International Energy Agency (IEA) again cuts its forecast for global oil demand.

"The prospects for a political agreement between China and the United States on trade have worsened. This could lead to reduced trade activity and less oil demand growth," the IEA said it monthly oil market report.

Iron ore fared worse, down almost 15 per cent for the week. Iron ore futures in the Dalian market have now fallen for seven consecutive days.

Then there's wool, another staple of Australia's export effort. It dropped more than 4 per cent last week to be down about 16 per cent from this time last year.

"Blood everywhere and none of it due to wool factors," was the blunt summary from industry veteran Peter Morgan.

Dr Morgan, who is the executive director of Australian Council of Wool Exporters and Processors, said global tensions were weighing heavily on the market.

"All that good work was overshadowed by the increasing global economic uncertainty associated with the trade disputes between the US and China, in particular the US and India, rising tension between with Iran, the downward pressures on interest rates and the unknowns arising from Brexit," Dr Morgan said.

"As always in such circumstances, commodity prices come under pressure, except for gold, which moves up."

The Eastern Market Indicator for wool prices

Profits a worry too

Interestingly, the big French investment bank Societe Generale (SG) says the US is staring down the barrel of a recession next year.

However, the trade war is more a catalyst in its analysis. The key factor is shrinking corporate margins and profits.

"If the US enters a recession in the next year, history is very likely to view it as a trade-war recession," SG's US economist Stephen Gallagher, said.

"Our analysis is that the weak profit structure in the US has made companies much more sensitive to any shock, higher costs and uncertainty.

"Trade tensions and tariffs are more damaging when margins are thin and companies are unable to absorb rising costs."

So will the Federal Reserve's easy monetary policy come to the rescue?

"Monetary policy has become more accommodative, and Fed officials are expected to cut rates further. Whether or not the policy response is sufficient to forestall a recession remains to be seen," Mr Gallagher said.

Australia

Date Event Comment

Monday

12/8/2019

Companies reporting Ansell, Aurizon, Bendigo & Adelaide Bank, GPT, JB Hi Fi

Tuesday

13/8/2019

Business survey Jul: Conditions picked up a bit but remain well below trend and confidence reversed an immediate post-election bounce

Companies reporting Challenger, Magellan

Wednesday

14/8/2019

Consumer confidence Aug: Confidence has fallen in the previous two readings, despite or perhaps because of, the RBA's cuts

Wage price index Q2: Still soft, forecast to grow 2.2pc YOY (down from 2.3pc) as stronger private sector outcomes are offset by slower growth in the public sector

RBA speech Deputy governor Guy Debelle speaks on "Risks to the Outlook"

Companies reporting Computershare, CSL, Dexus, H,T&E (formerly APN), Tabcorp, Vocus, NAB (Q3 update)

Thursday

15/8/2019

Employment/unemployment Jul: Market forecasts 20K new jobs & unemployment steady at 5.2pc

Average weekly earnings Biannual measure of wage growth, broader and more volatile than WPI, as measures structural changes in the jobs market and things like fringe benefits

Tourism data Jun: Arrivals are picking up

Companies reporting ASX, Blackmores, Evolution Mining, Invocare, QBE, Super Retail, Sydney Airport, Telstra, Treasury Wine Estates, Whitehaven, Woodside

Friday

16/8/2019

Companies reporting Cochlear, Domain, Newcrest, Star Entertainment

Overseas

Date Event Comment

Monday

12/8/2019

US: Budget statement Jul: Still running a big deficit around $US115b

Tuesday

13/8/2019

US: Inflation Jul: Still weak, but headline inflation boosted by fuel and core inflation by wages

US: Small business sentiment

Wednesday

14/8/2019

CH: Monthly economic data Jul: Mixed. Infrastructure investment may be boosted by property construction, industrial production and retail sales softer

EU: GDP

EU: Industrial production PMIs point to sharp contraction

Thursday

15/8/2019

US: Retail sales Jul: Modest rise forecast, largely due to higher fuel prices but also higher wages

US: Industrial production Jul: Manufacturing surveys point to softer production

US: Housing market survey Aug: May have picked up after recent softness in sentiment from home builders

CH: New home prices Jul: Up more than 10pc YOY

Friday

16/8/2019

US: New home starts Jul: Tipped to rebound

US: Consumer confidence Aug: US consumers are pretty optimistic at the moment

- Joined

- Oct 3, 2016

- Messages

- 35,356

- Points

- 113

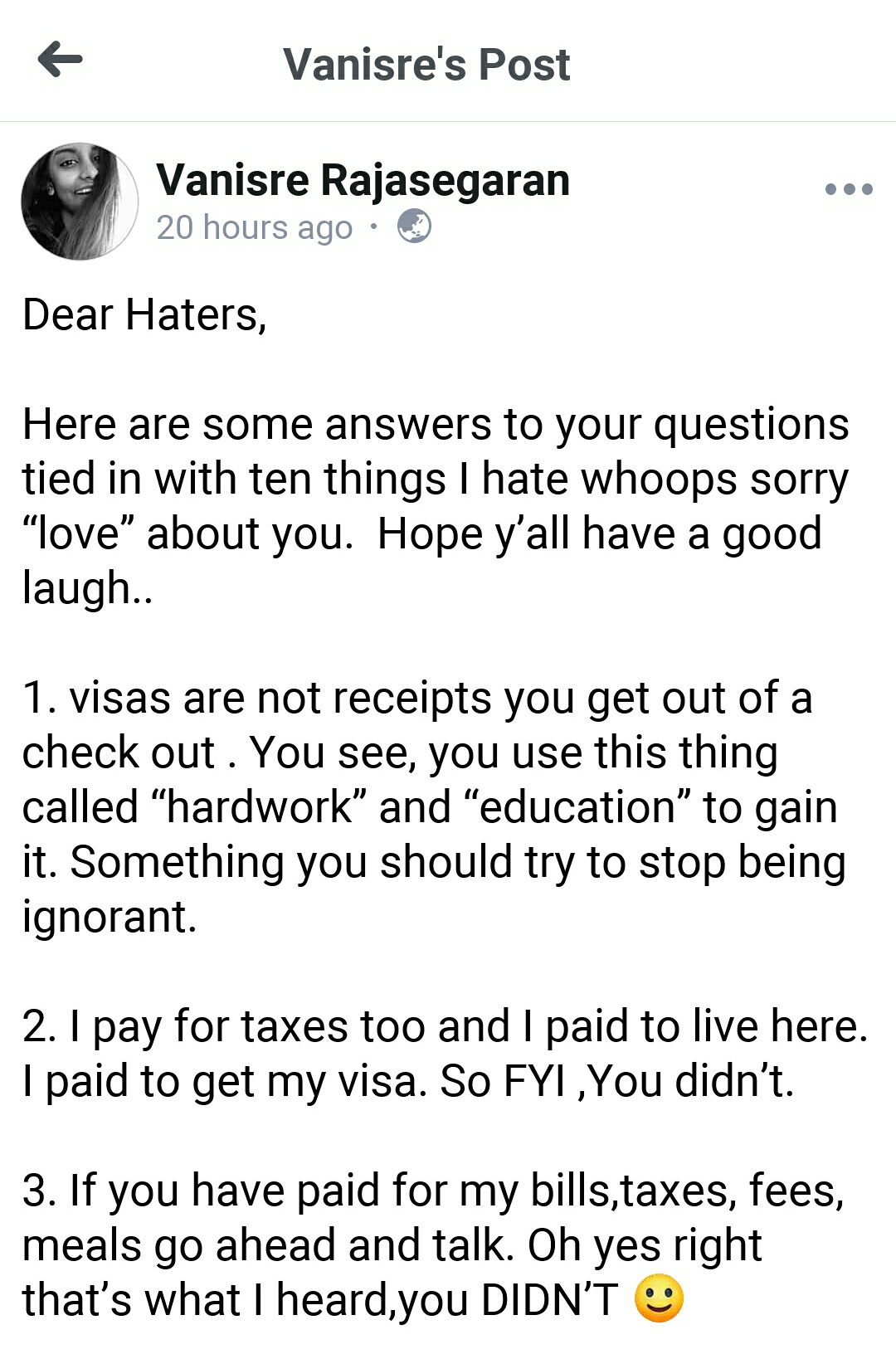

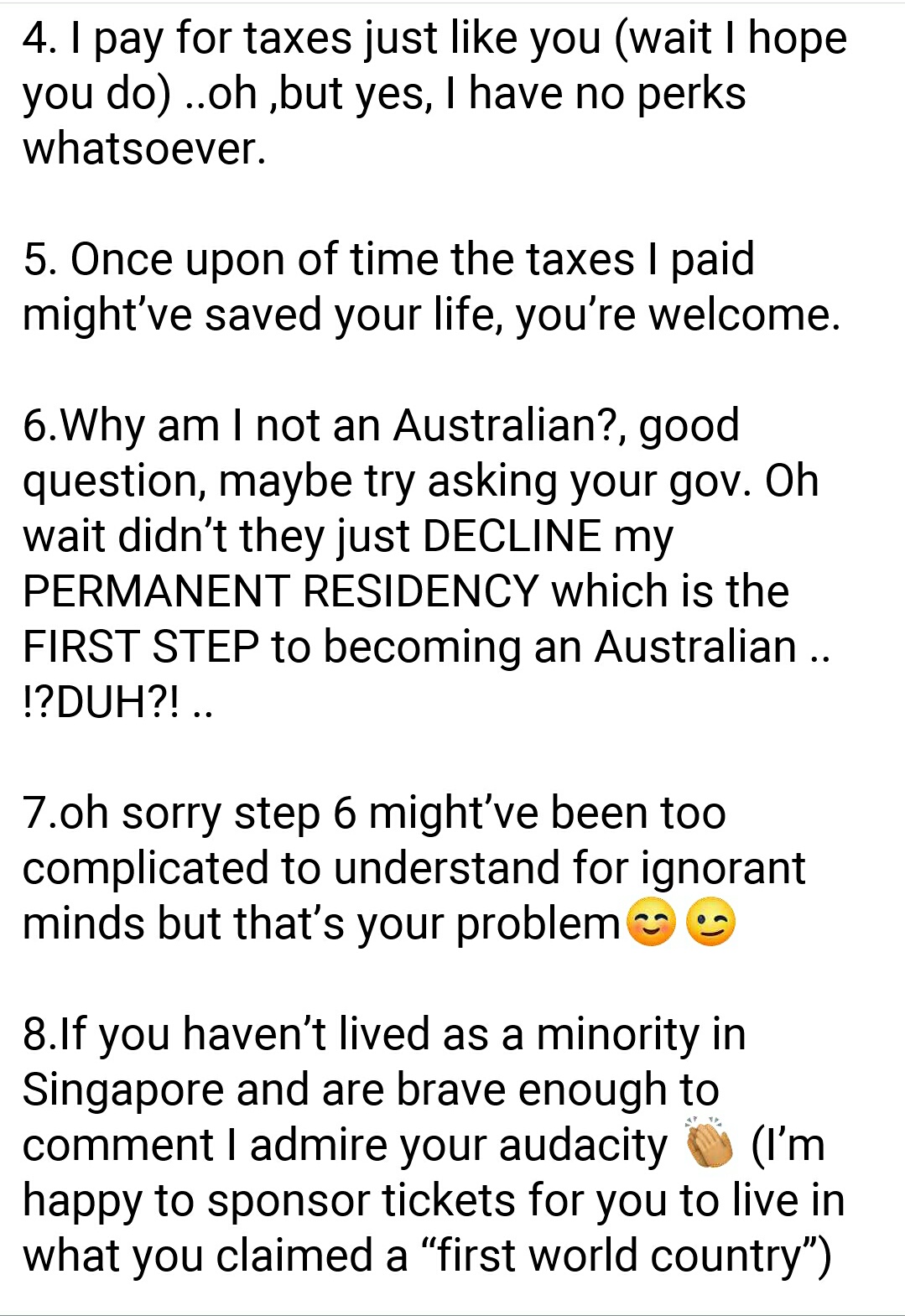

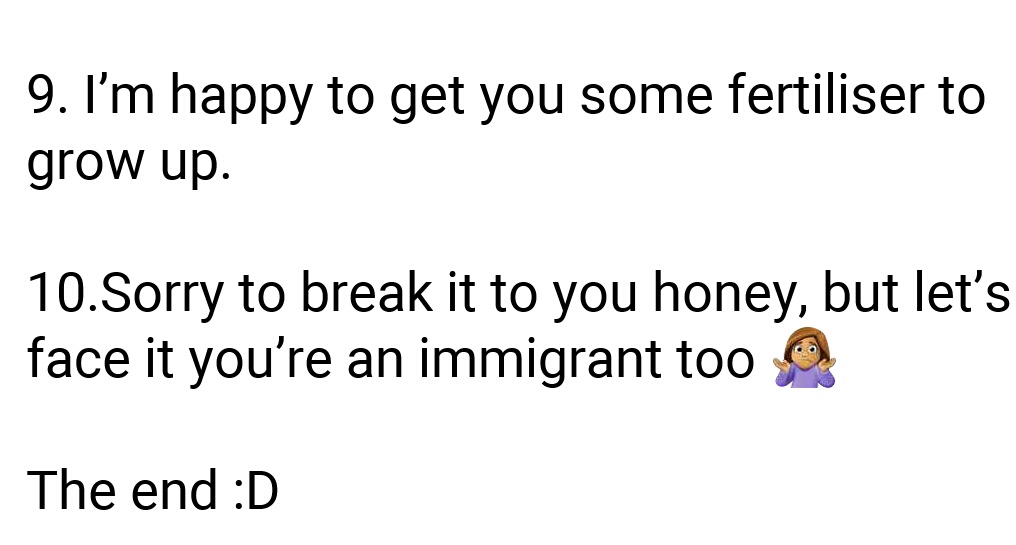

Look at this insolent entitled shitskin Indian fucking cunt. Deport her smelly black cunt to India!

- Joined

- Oct 3, 2016

- Messages

- 35,356

- Points

- 113

FUCK THIS SHITSKIN CUNT.

https://m.facebook.com/story.php?story_fbid=114676419878172&id=100040074442597

https://m.facebook.com/story.php?story_fbid=114676419878172&id=100040074442597

- Joined

- Jun 14, 2010

- Messages

- 2,811

- Points

- 113

More likely there are more conditions than just renal failure...cardiac issues and diabetes are usually part of the package

- Joined

- Jun 27, 2018

- Messages

- 31,512

- Points

- 113

uh what is this about?Look at this insolent entitled shitskin Indian fucking cunt. Deport her smelly black cunt to India!

View attachment 62899View attachment 62901View attachment 62902

- Joined

- Jun 27, 2018

- Messages

- 31,512

- Points

- 113

Ok to leave,,,Kangaroo Land is going to the dumps

Chilly economic winds are blowing – and budget fairytales are cold comfort

Greg Jericho

Even Peter Costello knew you don’t chase a surplus when the economy is slowing and revenue falling

Contact author

@GrogsGamut

Sun 11 Aug 2019 08.00 AEST Last modified on Sun 11 Aug 2019 18.34 AEST

Comments

1,231

‘We worry about [the deficit] mostly for reasons that are based on political folktale spin rather than economic rationale.’ Photograph: Lukas Coch/AAP

‘We worry about [the deficit] mostly for reasons that are based on political folktale spin rather than economic rationale.’ Photograph: Lukas Coch/AAP

Two fairytales about economic management continue to hold far too great a sway over our public debate and the government’s economic policy. The first is the myth of household budget comparison and the second is what I call the grasshopper fable of government budgets.

The belief that the government should run its budget like a household really needs to die a quick death. We hear it all the time – and it underlies the whole “surplus is better than deficit” line that is practically considered a statement of scientific fact by too many otherwise sensible people in politics and the media (and by extension the voting public).

Your household’s expenditure needs are nothing like a government’s and your budgetary limitation completely opposite.

RBA governor endorses lifting public sector wage caps to stimulate economy

RBA governor endorses lifting public sector wage caps to stimulate economy

Read more

Households don’t get the opportunity to print money should they be a bit short when it comes to pay the bills. They also don’t get to borrow money at interest rates lower than inflation.

This week the interest rate for Australian government 10-year bonds went below 1%.

Show me a household that can take out a 10-year loan at a 0.96% rate, despite the fact that their level of debt has risen over the past six years from $257bn to $549bn, and I’ll start listening to you saying the government needs to budget like a household.

The second budgetary fairytale is based on the grasshopper and ant fable – that the government needs to build up its budgetary surplus when times are good for when winter hits and we need to have savings to rely on.

Sign up to receive the top stories from Guardian Australia every morning

In essence this suggests that, should fiscal stimulus be needed, the economy reacts better to a government reducing a surplus than increasing a deficit.

But there is no evidence this is the case.

The economy responds to when – and how effectively – that stimulus is deployed. Spend government money on infrastructure that produces no economic benefit, then it doesn’t matter whether it reduces a surplus or increases a deficit, it is still wasted money.

Advertisement

This doesn’t mean you can always run ever-larger deficits and not have to worry, but it does mean we worry far too much about the size of our deficit and we worry about it mostly for reasons that are based on political folktale spin rather than any economic rationale.

Australian politics: subscribe by email

Read more

I note this because on Wednesday, the treasurer Josh Frydenberg responded to questions on ABC’s 7:30 about whether the government would “reset” policy should international trends require it, by stating that “we’re committed to a surplus”.

Earlier that day he told the ABC’s Peter Ryan when asked if the trade ructions between China and the US could “end up hurting your projections for a budget surplus” that “we will still deliver a surplus next year. Absolutely determined to do that”.

But why?

It is clear that delivering a budget surplus is all about government revenue and little else.

In the final six years of the Howard government, which saw budget surpluses, revenue was never lower than 25% of GDP. The first time since then that revenue has reached that level was 2018-19.

Had revenue stayed at that 25% of GDP level, given how much governments spent each year, we would have had a budget surplus in six of the past nine years.

For the current financial year the government predicts revenue of 25.2% of GDP and, lo and behold, it is also predicting a surplus.

But if revenue falls because company tax revenue is lower than expected because iron ore prices fall – as has happened since the China-US trade war has fired up, with prices falling from a five-year high of US$125.77 a tonne in July to now around US$96 a tonne. Then the chances of a budget surplus fall as well.

And it also comes at a time when the Reserve Bank continues to cry out for help stimulating the economy.

On Friday the governor of the RBA, Philip Lowe, told the House economics committee that “monetary policy is not the country’s only option. Monetary policy certainly can help, and it is helping, but there are certain downsides from relying too much on monetary policy”.

He noted that “one option is for fiscal support, including through spending on infrastructure” and that “there is no shortage of finance to do this, with interest rates the lowest they have ever been”.

Josh Frydenberg 'determined' to deliver surplus despite US-China trade tensions

Josh Frydenberg 'determined' to deliver surplus despite US-China trade tensions

Read more

The grasshopper fable of saving for the cold months might have some validity but not if the weather is already cold and yet you are telling everyone it is not time to consume your stores.

Advertisement

When the economy turns poor and revenue falls you don’t chase a surplus – even Peter Costello knew this. In 2000-01, the economy was hit by the Asian financial crisis and so the budget went from a surplus of $5.8bn to a deficit of $1bn because revenue fell from 26% of GDP to 24.9% while expenditure barely changed.

And right now the cold economic winds are blowing.

The US government this week is able to borrow money for 20 years at a lower rate than were it to borrow for a month. This is not normal. The last time that happened was in 2007 before the GFC hit. Here in Australia consumers are not spending and as a result the RBA has revised down its prediction for GDP growth for this year from 2.75% to 2.5%.

It is time to end the surplus mania, and for everyone to realise that there are many things more important for a government to be doing for our economy than telling fairy stories about the importance of a budget surplus.

• Greg Jericho writes on economics for Guardian Australia

Australia's media...

… has never been more concentrated, at a time when clear, factual reporting is so desperately needed. Guardian Australia will hold the new Coalition government to account and continue to report on the escalating climate emergency. We are editorially independent, free from commercial and political bias – this means we can promise to keep delivering quality journalism without favour or interference.

More people are reading and supporting our independent, investigative reporting than ever before. And unlike many news organisations, we have chosen an approach that allows us to keep our journalism accessible to all, regardless of where they live or what they can afford.

The Guardian is editorially independent, meaning we set our own agenda. Our journalism is free from commercial bias and not influenced by billionaire owners, politicians or shareholders. No one edits our editor. No one steers our opinion. This is important as it enables us to give a voice to those less heard, challenge the powerful and hold them to account. It’s what makes us different to so many others in the media, at a time when factual, honest reporting is critical.

Every contribution we receive from readers like you, big or small, goes directly into funding our journalism. This support enables us to keep working as we do – but we must maintain and build on it for every year to come. Support The Guardian from as little as $1 – and it only takes a minute. Thank you.

Chilly economic winds are blowing – and budget fairytales are cold comfort

Greg Jericho

Even Peter Costello knew you don’t chase a surplus when the economy is slowing and revenue falling

Contact author

@GrogsGamut

Sun 11 Aug 2019 08.00 AEST Last modified on Sun 11 Aug 2019 18.34 AEST

- Share on Facebook

- Share on Twitter

- Share via Email

Comments

1,231

‘We worry about [the deficit] mostly for reasons that are based on political folktale spin rather than economic rationale.’ Photograph: Lukas Coch/AAP

‘We worry about [the deficit] mostly for reasons that are based on political folktale spin rather than economic rationale.’ Photograph: Lukas Coch/AAP Two fairytales about economic management continue to hold far too great a sway over our public debate and the government’s economic policy. The first is the myth of household budget comparison and the second is what I call the grasshopper fable of government budgets.

The belief that the government should run its budget like a household really needs to die a quick death. We hear it all the time – and it underlies the whole “surplus is better than deficit” line that is practically considered a statement of scientific fact by too many otherwise sensible people in politics and the media (and by extension the voting public).

Your household’s expenditure needs are nothing like a government’s and your budgetary limitation completely opposite.

Read more

Households don’t get the opportunity to print money should they be a bit short when it comes to pay the bills. They also don’t get to borrow money at interest rates lower than inflation.

This week the interest rate for Australian government 10-year bonds went below 1%.

Show me a household that can take out a 10-year loan at a 0.96% rate, despite the fact that their level of debt has risen over the past six years from $257bn to $549bn, and I’ll start listening to you saying the government needs to budget like a household.

The second budgetary fairytale is based on the grasshopper and ant fable – that the government needs to build up its budgetary surplus when times are good for when winter hits and we need to have savings to rely on.

Sign up to receive the top stories from Guardian Australia every morning

In essence this suggests that, should fiscal stimulus be needed, the economy reacts better to a government reducing a surplus than increasing a deficit.

But there is no evidence this is the case.

The economy responds to when – and how effectively – that stimulus is deployed. Spend government money on infrastructure that produces no economic benefit, then it doesn’t matter whether it reduces a surplus or increases a deficit, it is still wasted money.

Advertisement

This doesn’t mean you can always run ever-larger deficits and not have to worry, but it does mean we worry far too much about the size of our deficit and we worry about it mostly for reasons that are based on political folktale spin rather than any economic rationale.

Australian politics: subscribe by email

Read more

I note this because on Wednesday, the treasurer Josh Frydenberg responded to questions on ABC’s 7:30 about whether the government would “reset” policy should international trends require it, by stating that “we’re committed to a surplus”.

Earlier that day he told the ABC’s Peter Ryan when asked if the trade ructions between China and the US could “end up hurting your projections for a budget surplus” that “we will still deliver a surplus next year. Absolutely determined to do that”.

But why?

It is clear that delivering a budget surplus is all about government revenue and little else.

In the final six years of the Howard government, which saw budget surpluses, revenue was never lower than 25% of GDP. The first time since then that revenue has reached that level was 2018-19.

Had revenue stayed at that 25% of GDP level, given how much governments spent each year, we would have had a budget surplus in six of the past nine years.

For the current financial year the government predicts revenue of 25.2% of GDP and, lo and behold, it is also predicting a surplus.

But if revenue falls because company tax revenue is lower than expected because iron ore prices fall – as has happened since the China-US trade war has fired up, with prices falling from a five-year high of US$125.77 a tonne in July to now around US$96 a tonne. Then the chances of a budget surplus fall as well.

And it also comes at a time when the Reserve Bank continues to cry out for help stimulating the economy.

On Friday the governor of the RBA, Philip Lowe, told the House economics committee that “monetary policy is not the country’s only option. Monetary policy certainly can help, and it is helping, but there are certain downsides from relying too much on monetary policy”.

He noted that “one option is for fiscal support, including through spending on infrastructure” and that “there is no shortage of finance to do this, with interest rates the lowest they have ever been”.

Read more

The grasshopper fable of saving for the cold months might have some validity but not if the weather is already cold and yet you are telling everyone it is not time to consume your stores.

Advertisement

When the economy turns poor and revenue falls you don’t chase a surplus – even Peter Costello knew this. In 2000-01, the economy was hit by the Asian financial crisis and so the budget went from a surplus of $5.8bn to a deficit of $1bn because revenue fell from 26% of GDP to 24.9% while expenditure barely changed.

And right now the cold economic winds are blowing.

The US government this week is able to borrow money for 20 years at a lower rate than were it to borrow for a month. This is not normal. The last time that happened was in 2007 before the GFC hit. Here in Australia consumers are not spending and as a result the RBA has revised down its prediction for GDP growth for this year from 2.75% to 2.5%.

It is time to end the surplus mania, and for everyone to realise that there are many things more important for a government to be doing for our economy than telling fairy stories about the importance of a budget surplus.

• Greg Jericho writes on economics for Guardian Australia

Australia's media...

… has never been more concentrated, at a time when clear, factual reporting is so desperately needed. Guardian Australia will hold the new Coalition government to account and continue to report on the escalating climate emergency. We are editorially independent, free from commercial and political bias – this means we can promise to keep delivering quality journalism without favour or interference.

More people are reading and supporting our independent, investigative reporting than ever before. And unlike many news organisations, we have chosen an approach that allows us to keep our journalism accessible to all, regardless of where they live or what they can afford.

The Guardian is editorially independent, meaning we set our own agenda. Our journalism is free from commercial bias and not influenced by billionaire owners, politicians or shareholders. No one edits our editor. No one steers our opinion. This is important as it enables us to give a voice to those less heard, challenge the powerful and hold them to account. It’s what makes us different to so many others in the media, at a time when factual, honest reporting is critical.

Every contribution we receive from readers like you, big or small, goes directly into funding our journalism. This support enables us to keep working as we do – but we must maintain and build on it for every year to come. Support The Guardian from as little as $1 – and it only takes a minute. Thank you.

- Joined

- Oct 3, 2016

- Messages

- 35,356

- Points

- 113

uh what is this about?

The Indian cunt who was about to be deported in 10 days staging her rights to stay put.

Similar threads

- Replies

- 8

- Views

- 946

- Replies

- 0

- Views

- 199

- Replies

- 6

- Views

- 469

- Replies

- 8

- Views

- 535