- Joined

- Jul 25, 2008

- Messages

- 15,365

- Points

- 113

Human error over coding led to 6-hour disruption of DBS banking services in May: SM Tharman

Ili Nadhirah Mansor/TODAY

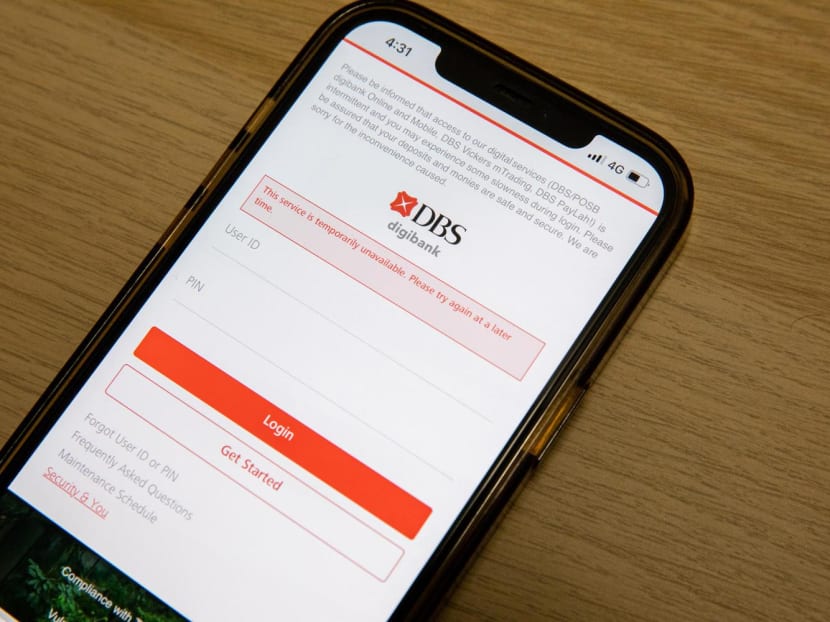

A screenshot of the DBS Internet banking login page showing an error message on March 29, 2023.

- A disruption to DBS Bank’s digital banking and ATM services on May 5, 2023 was caused by human error in coding the program used for system maintenance, Parliament has heard

- This led to a significant reduction in system capacity, which affected the system’s ability to process internet and mobile banking, electronic payments, and ATM transactions

- Senior Minister Tharman Shanmugaratnam gave the update in response to questions from Jurong GRC MP Tan Wu Meng on Wednesday (July 5)

- The over six-hour disruption was DBS' second in two months, prompting the Monetary Authority of Singapore to call it "unacceptable" and impose fresh capital requirements on DBS

SUFIYAN SAMSURI

Published July 5, 2023SINGAPORE — A disruption to DBS Bank’s digital banking and ATM services on May 5, 2023 was due to human error in coding the program used for system maintenance, Parliament was told on Wednesday (July 5).

Senior Minister Tharman Shanmugaratnam provided an update on the issue in response to questions filed by Member of Parliament (MP) for Jurong Group Representation Constituency (GRC) Tan Wu Meng.

Dr Tan asked about the cause of the May disruption, and what is being done to strengthen the reliability and resilience of retails banks with significant market share here, especially in relation to digital banking services.

In his response, Mr Tharman, speaking on behalf of Prime Minister Lee Hsien Loong, said that DBS' preliminary investigation showed that human error caused a significant reduction in system capacity.

This affected the system’s ability to process internet and mobile banking, electronic payment and ATM transactions, said Mr Tharman, who is also Coordinating Minister for Social Policies and Monetary of Authority Singapore (MAS) chairman.

In a statement at the time, DBS had blamed the over six-hour disruption, the second to hit the bank in two months, on "a systems issue". It did not mention human error at that time.

Mr Tharman added that according to DBS, the cause of the incident was unrelated to the earlier March 2023 disruption, which was caused by inherent software bugs.

He said that DBS convened a special board committee to oversee the root cause investigation and a comprehensive review of the bank’s IT resilience following the March 2023 incident.

Following the May incident, MAS then tasked the committee to extend its review to cover the latest incident and to use “qualified independent third parties” for the review.

“The MAS has stated publicly that it regards this second disruption within a period of two months as unacceptable, and that DBS had fallen short of MAS’ expectation for banks to deliver reliable services to their customers,” Mr Tharman said.

He added that MAS' move to impose additional capital requirements on DBS reflects the seriousness with which MAS views the recent disruptions and the impact that they have had on customers.

“MAS may vary the size of the additional capital requirement imposed on the bank and take other regulatory actions depending on the outcome of ongoing reviews," he said.

“MAS requires all retail banks in Singapore to ensure that their mission critical systems supporting digital banking are resilient. This includes having the ability to recover quickly from any system disruptions,” he said.

Mr Tharman said that banks are subject to regular inspections and off-site reviews by MAS to ensure their adherence to regulatory requirements and expectations.

More details on the disruptions will be provided by the bank publicly when the review is completed, he added.

TODAY has sought comment from DBS.