-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

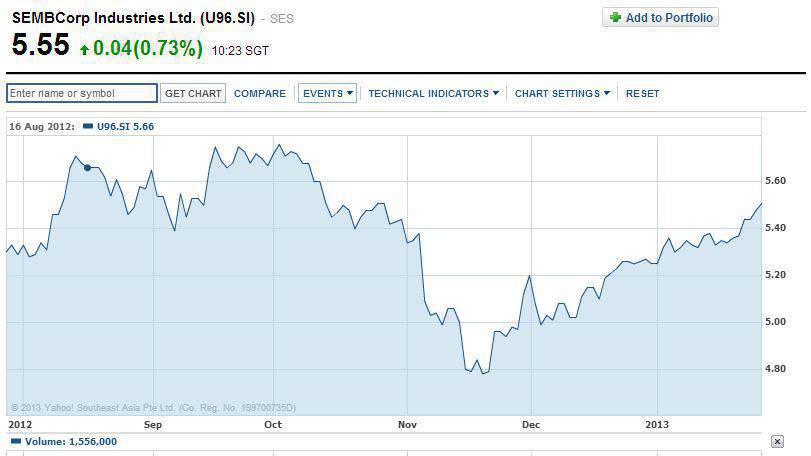

SEMBCorp Industries Ltd. (U96.SI)

- Thread starter MBSSLUTS

- Start date

STOCKS NEWS SINGAPORE-Index edges down; Sembcorp Industries outperforms

Reuters – Mon, Nov 12, 2012 1:29 PM SGT

SEMBCorp Industries Ltd.

Singapore shares were slightly lower, but Sembcorp Industries outperformed the market after several brokers highlighted the strong growth momentum and attractive valuation of the conglomerate's utilities business.

The Straits Times Index was down 0.1 percent at 3,006.22 points, while MSCI's broadest index of Asia-Pacific shares outside Japan was 0.2 percent higher.

Shares of Sembcorp Industries rose as much as 2.4 percent on a volume of 3.3 million shares, 1.2 times the average full-day volume over the past 30 days.

Sembcorp reported a 18.5 percent fall in third-quarter net profit to S$181.2 million ($148 million) from a year earlier, dragged by lower revenue recognition for its rig building projects.

However, net profit for its utilities unit jumped 27 percent to S$99.8 million. Utilities contribute about 55 percent of the group's net profit, while marine constitutes nearly 39 percent. The rest came from urban development and other businesses.

UOB Kay Hian said Sembcorp's utilities earnings growth in 2012-2015 fiscal years will be driven by three additional power plant capacities in Oman, Singapore and India.

Maybank Kim Eng said after stripping out Sembcorp's other business segments, utilities valuations still look "extremely attractive", trading at an implied price-earnings ratio of about 6.3 times for fiscal year 2013.

Shares of Harry's Holdings Ltd jumped as much as 53 percent to S$0.23, matching the price offered by F&B Asia Ventures Ltd, a unit of Everstone Capital Partners II LLC, to privatise the Singapore bar chain operator.

More than 1.5 million shares changed hands, 10 times the average full-day volume over the past 30 days.

1323 (0523 GMT)

(Reporting by Eveline Danubrata in Singapore; Editing by Sunil Nair; [email protected])

STOCKS NEWS SINGAPORE-OCBC ups CityDev target price

Reuters – 1 hour 54 minutes ago

OCBC Investment Research raised its target price for property developer City Developments Ltd to S$13.96 from S$13.18, and kept its 'buy' rating on the stock, citing healthy demand for some major residential project launches in the next year.

CityDev shares were up 0.2 percent at S$12.50 by 0215 GMT. They have gained 40.4 percent since the start of the year, compared with the Straits Times Index's 19 percent rise.

CityDev is expected to launch the Echelon, a 508-unit condominium near a centrally located train station in Singapore, which OCBC anticipates will sell well due to its good location. CityDev could also launch a 912-unit development in the east of the island.

OCBC also noted CityDev management's expectations that mass market residential projects will continue selling well due to abundant liquidity in the market, with prices expected to show moderate increases.

CityDev is likely to be active in government land sales tenders in future, especially for mass markets sites located near train stations, it said.

1016 (0216 GMT)

When these analysists make these kind of statement, they are looking at a very "turkey" and Dom P. for Christmas, "YOU"...you buy, they sell at married deals prices...don't become a "TURKEY" for Christmas or the next " Futt tiu cheong dish or $8,888" for Lunar New Year!!:p

Last edited:

When these analysists make these kind of statement, they are looking at a very "turkey" and Dom P. for Christmas, "YOU"...you buy, they sell at married deals prices...don't become a "TURKEY" for Christmas or the next " Futt tiu cheong dish or $8,888" for Lunar New Year!!:p

I got this stock tip before 12.12.2012

:oIo:

:oIo:

When these analysists make these kind of statement, they are looking at a very "turkey" and Dom P. for Christmas, "YOU"...you buy, they sell at married deals prices...don't become a "TURKEY" for Christmas or the next " Futt tiu cheong dish or $8,888" for Lunar New Year!!:p

There are two. Both are good so don't watch the wrong channel.

http://sg.finance.yahoo.com/echarts...n;ohlcvalues=0;logscale=off;source=undefined;

http://sg.finance.yahoo.com/echarts...n;ohlcvalues=0;logscale=off;source=undefined;

Sembcorp is approaching strong resistance at 5.23 where it is a confluence of resistances - 100D MA, horizontal resistance and Gap.

PLUS spinning top at this very moment (4.03pm)

PLUS spinning top at this very moment (4.03pm)

Last edited:

I think at this point keppel corp or sembmarine could be better choices

I think at this point keppel corp or sembmarine could be better choices

Keppel sees acquisition opportunities as rig prices slump

Keppel Corp., the world’s largest oil-rig maker, said there are opportunities to buy companies even as the entry of Chinese shipyards creates a price war in the market for offshore exploration.

“2013 is expected to be an extension of previous years, laden with uncertainties and potential risks,” Chief Executive Officer Choo Chiau Beng said yesterday in Singapore, where the company is based. “However, in navigating such an environment, there will also be opportunities ripe for acquisitions,” Choo said without elaborating.

Keppel may consider buying a yard in China as the world’s second-largest economy boosts offshore drilling to meet its energy demand, Choo said last month. Competition with Chinese and South Korean shipyards has suppressed margins, he said yesterday as Keppel reported a 22% drop in fourth-quarter net income.

With orders for new ships plunging to an eight-year low in 2012, China Rongsheng Heavy Industries Group Holdings and its local rivals are foraying into the offshore business, lured by a market that will reach about $400 billion in 2017. The new entrants are lowering prices to grab contracts, hurting margins at Keppel Corp. and Sembcorp Marine, the world’s two- biggest rig makers.

Shares rise

Keppel shares rose 1% to close at $11.45 in Singapore, the highest since Oct 8. The stock has advanced 4.1% this year, compared with the 3.2% gain in the benchmark Straits Times Index.

“The China risk is becoming increasingly recognised,” analyst Vincent Fernando at Religare Capital Markets in Singapore said in a note today. This highlights “the risks” for Singapore yards, he said.

The company, which already has one yard in China making parts for oil rigs, will seek out acquisitions if the government opens offshore projects by state-owned enterprises to foreign companies, Choo had said.

Keppel’s latest acquisition was a 20% stake for US$115 million ($142 million) in KrisEnergy Holdings, which is exploring and developing fields in Southeast Asia.

“We only look at attractive acquisitions,” Choo said. The company yesterday reported fourth-quarter profit totalled $305 million in the three months ended Dec. 31, compared with $389 million a year earlier. Sales climbed 7.1% to $3 billion.

Margin narrows

Profit at the offshore and marine unit dropped 15% from a year earlier to $212 million in the fourth quarter, the company said. Operating profit margin narrowed to 13% in three month period, compared with 21% a year ago.

Keppel reiterated yesterday that it expects an operating margin of between 10% to 12% for the offshore unit.

The global onshore and offshore plant construction market is expected to rise to $1.6 trillion in 2017 from $1.2 billion in 2012, according to South Korea’s Ministry of Knowledge. The offshore oil and gas market may account for 26% of that, the ministry said in a Jan 7 statement.

While demand for rigs has been booming, ship orders have plummeted because of excess fleet capacity and global economic uncertainties. Vessel prices have fallen as much as 27% in the past two years, according to Clarkson Plc, the world’s biggest shipbroker.

Keppel won $10 billion of contracts last year and the company has a net order book of $12.8 billion with deliveries stretching out to 2019, Choo said.

Full-year profit totalled $1.49 billion on revenue of $3 billion, the company said in a statement. Keppel plans to pay a dividend of 27 cents a share and a dividend in specie of Keppel REIT units equivalent to 27.4 cents, according to the statement.

Full-year profit totalled $1.49 billion on revenue of $3 billion, the company said in a statement. Keppel plans to pay a dividend of 27 cents a share and a dividend in specie of Keppel REIT units equivalent to 27.4 cents, according to the statement.

The cash dividends and the dividends in specie make it very worthwhile . Keppel's propects remain bright.

Can I buy Temasek instead?

Can I buy Temasek instead?

That would be akin to comitting financial suicide.

Can I buy Temasek instead?

No Temasek, GIC also boleh.

STOCKS NEWS SINGAPORE-OCBC ups CityDev target price

Reuters – 1 hour 54 minutes ago

OCBC Investment Research raised its target price for property developer City Developments Ltd to S$13.96 from S$13.18, and kept its 'buy' rating on the stock, citing healthy demand for some major residential project launches in the next year.

CityDev shares were up 0.2 percent at S$12.50 by 0215 GMT. They have gained 40.4 percent since the start of the year, compared with the Straits Times Index's 19 percent rise.

CityDev is expected to launch the Echelon, a 508-unit condominium near a centrally located train station in Singapore, which OCBC anticipates will sell well due to its good location. CityDev could also launch a 912-unit development in the east of the island.

OCBC also noted CityDev management's expectations that mass market residential projects will continue selling well due to abundant liquidity in the market, with prices expected to show moderate increases.

CityDev is likely to be active in government land sales tenders in future, especially for mass markets sites located near train stations, it said.

1016 (0216 GMT)

I'll be very careful about these recommendation. If it is really that good, the banks and investment house will already bought in at much lower price. Guess who will they sell to? People like you buying on their recommendation. Price will go up, but it will drop even faster.

Last edited:

I'll be very careful about these recommendation. If it is really that good, the banks and investment house will already bought in at much lower price. Guess who will they sell to? People like you buying on their recommendation. Price will go up, but it will drop even faster.

Ha ha ha i only recommended U96 and that was more than a month ago. The rest are news! Now i am just waiting to off load this stock.

:oIo:

:oIo:S51 and BN4 are good buys if u have the dough. :oIo:

Ha ha ha i only recommended U96 and that was more than a month ago. The rest are news! Now i am just waiting to off load this stock.:oIo:

S51 and BN4 are good buys if u have the dough. :oIo:

Stocks are too slow and wild for me. I trade forex and options only. :oIo:

Stocks are too slow and wild for me. I trade forex and options only. :oIo:

Ha ha ha good luck then.

:oIo:

:oIo:Similar threads

- Replies

- 17

- Views

- 918

- Replies

- 19

- Views

- 2K

- Replies

- 41

- Views

- 3K

- Replies

- 0

- Views

- 521