- Joined

- Feb 26, 2019

- Messages

- 12,449

- Points

- 113

Printing RM1.9 Trillion – Why Ringgit Could Breach 4.50 And Plunge Into A Free Fall As Investors Continue To Lose Confidence

July 13th, 2022 by financetwitterhttp://www.financetwitter.com/2022/07/prin...confidence.html

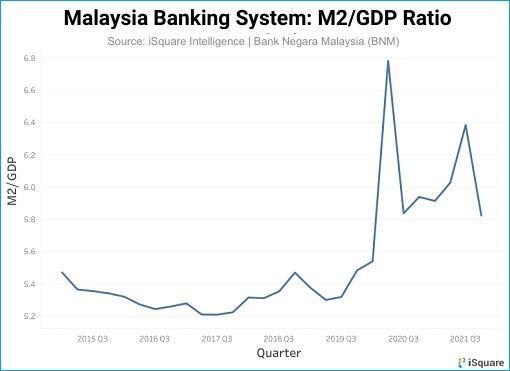

Foreign investors have every reason to doubt the illegitimate governments of both Muhyiddin and Ismail. According to M2/GDP ratio from Bank Negara Malaysia, there was a huge spike of money supply (M2 is a measure of the money supply that includes cash, checking deposits, and easily-convertible near money) against the country’s GDP (gross domestic product).

When the M2/GDP ratio skyrocketed to 6.8 from 5.6 around second and third quarter 2020, it means the country has 6.8 times amount of money compared to GDP growth. This could only mean one thing – Malaysia was suddenly flushed with cash because backdoor PM Muhyiddin was printing money. Exactly how much money? The additional 1.2 jumps in ratio means 1.2 multiples of GDP.

Based on 2019’s GDP of US$364.7 billion, it means the backdoor government had printed at least US$437 billion or RM1,900 billion – that’s RM1.9 trillion. The M2/GDP ratio is also a measurement of how much money is needed to create a single dollar of GDP. Crucially, M2 is a critical factor in the forecasting of economic issues like inflation. Printing money increases money supply, which in turn causes inflation.