Hundreds of China's top graduates 'fired before hired' as trade war bites

University students preparing for the upcoming National Entrance Examination for Postgraduate (NEEP) at a library of Shenyang Agricultural University in Shenyang in China's northeastern Liaoning province.

PHOTO: AFP

HE HUIFANG

SOUTH CHINA MORNING POST

Jan 07, 2019

FacebookTwitterGoogle+Email

Tan Shiyang, a Beihang University biological science and medical engineering graduate student, should be one of the last people to have to worry about finding a decent job in China.

Biotech scientists with his skills are always in short supply and his Beijing-based school is regarded as one of the best, with a reputation as China's answer to the Massachusetts Institute of Technology.

And so, when Tan received multiple job offers soon after meeting representatives from various companies at an autumn on-campus recruitment fair at Beihang, things seemed to be working out as expected. He eventually decided to accept an offer of employment as a researcher with a hi-tech firm in Shenzhen, one of China's most vibrant cities.

ADVERTISING

Assured of a job after graduation, Tan settled back and focused on enjoying his final months as a student.

READ ALSO

China warns Spring Festival travellers to behave or be banned from rail and air travel

Hiring freezes and job cuts suggest a worse than expected employment outlook in China for the hi-tech and finance sectors. Photo: AFP

But in December, things took an unexpected turn. The company he had agreed to work for, Shenzhen Mindray Bio-Medical Electronics, told him that due to a change in the company's recruitment plans, the job offer was invalidated. Mindray, China's largest medical equipment maker, said it would give Tan 5,000 yuan (S$990.50), roughly a third of what would have been his salary for one month, as compensation.

The change has thrown Tan's life into chaos, coming as the "campus recruitment season" winds down and China's economic health continues its recent downward trend.

"I chose Mindray because I wanted to work as a researcher for an innovative firm, and that's why I turned down all other job offers," Tan said. "Now I have to start again … I had rarely thought about the economic downturn before, but now I guess I am one of its victims."

Tan is not the only graduate student caught off guard.

Eric Li had accepted a job offer from Mindray with a starting annual income of 200,000 yuan. When he too was told the offer had been withdrawn, he said his dreams were shattered.

"I had planned to make good use of the money to buy milk powder for my nephew every month," Li said. "I had planned to save 120,000 yuan a year to prepare for my marriage to my girlfriend.

"And I dreamed of the day when I could afford a down payment on a small flat in Shenzhen," he said. "That's now all vanished."

Li said Mindray had held a "welcoming party" for new hires on December 22 in Shenzhen, where company officials talked about the incoming employees' bright future. One week later, the students received a phone call from the company telling them their job offer had been terminated.

A number of students, who had similarly been hired by Mindray and then had their offers pulled, created a chat group to figure out their next steps. Li said the participants commonly felt it was their misfortune to have graduated in a year when China was under mounting economic pressure.

READ ALSO

Chinese university offers students academic credits for losing weight

In an email to the South China Morning Post, Mindray said it had signed tentative employment agreements with 485 new graduates from about 50 universities in China since September. But it decided to terminate 254 of those contracts at the end of December after "an internal review". The company had hired 430 new graduates a year ago.

Mindray, whose product lines include patient monitoring devices, said the demands of maintaining a sound operation in 2019 were "heavier than in than past years" and it had to scale back its student recruitment plans "for the sake of continuous and steady business development".

JUST HOW BADLY IS CHINA'S ECONOMY DOING?

Under Chinese regulations, agreements between students and potential employers are classified as contractual agreements, not official labour contracts, according to veteran human resources manager Elisa He. Thus, potential employers can legally terminate the contracts after the students agree to the terms.

It was rare, however, for an employer to terminate contracts with hundreds of students at once, He said.

Students shield themselves from the sun as they line up at a job fair at a university in Guangzhou, Guangdong province, China. Photo: Reuters

An official jobless claims report showed employment in China has been stable, despite the months-long US-China trade war and stock market volatility. Some 12.93 million jobs were created in the first 11 months of 2018, an increase of 130,000 over the same period last year. In November, China's surveyed jobless rate in urban areas fell to 4.8 per cent after rising to 4.9 per cent in October.

However, an increase in the number of companies announcing hiring freezes and job cuts suggests that in sectors such as hi-tech and finance, the employment picture actually could be much bleaker than official statistics suggest.

WILL A 'US$102 BILLION' MOVE TO AID CHINA'S SLOWING ECONOMY HELP?

Before the US and China announced a 90-day truce in their trade battle on December 1, then-new economic data had added weight to the argument that the slowdown in China's economy was worsening as the trade war with the US dampened consumer confidence and hurt sales of goods such as cars and electronics.

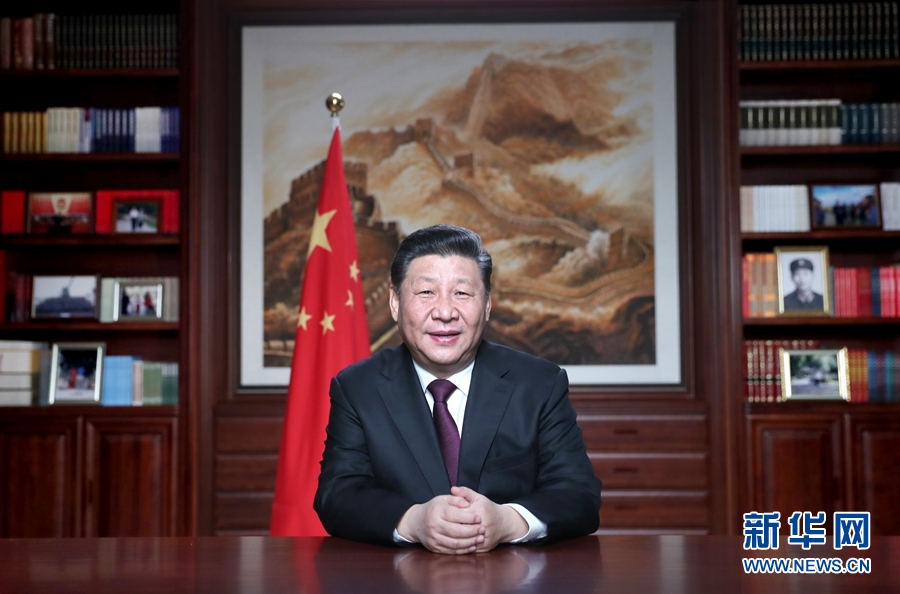

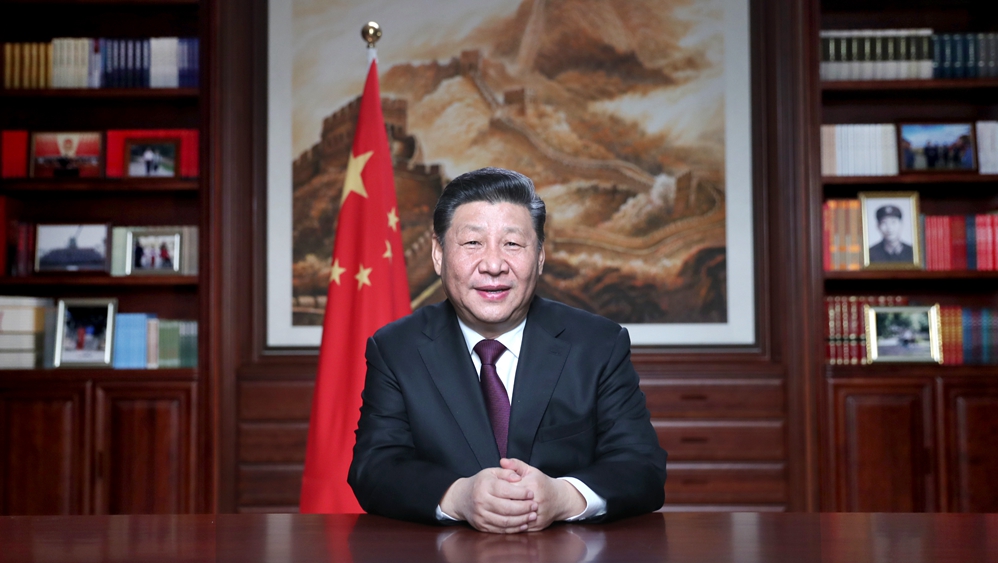

In light of these and other forecasts, China's leadership has made "stabilising" growth its top priority for 2019, since it regards job creation, especially for ambitious young graduates like Tan and Li, as necessary to ensure social stability.

Biotech scientists are usually in demand in China and are seen as likely to land jobs upon graduation from university. Photo: Alamy

This year, 8.34 million students will graduate from Chinese colleges and universities, an all-time high, according to the Ministry of Education. By contrast, a decade earlier in 2009, China had just 5.3 million new graduates. At the same time, China's economic growth has slowed to its lowest level in a decade and the worst is expected to come.

China's hi-tech firms and shadow banking institutions, which hired aggressively in past years, have either imposed hiring freezes or cut jobs.

Students draw sketches during a mock examination for art college entrance, at a sports stadium in Wuhan, Hubei province, China. Photo: Reuters

'WE ARE WASTING OUR RESOURCES TRAINING SO MANY UNIVERSITY STUDENTS'

Song Xuetao, an economist at Tianfeng Securities, wrote in a research note that about 2 million vacancies disappeared from 51job.com, a leading Chinese hiring website, from April to September. Song found that new job openings at private firms with 50 to 500 employees fell very sharply.

This decline has made young jobseekers insecure, pushing them to chase so-called stable positions at government agencies and state-owned enterprises as private firms like Mindray prove unreliable bets on a future.

Mindray, founded in 1991, went public on the New York Stock Exchange in 2006. But it decided to delist its shares from the New York market in 2016 and apply for a listing in China's A-share market. It finally launched an initial public offering on the Shenzhen Stock Exchange last October, raising about 6 billion yuan.

The company now has about 7,000 employees globally and posted a profit of 2.6 billion yuan in 2017 on sales of 11.2 billion yuan. Mindray received 13 per cent of its revenue from the North America market in 2017.

Joan Liu, another graduate student released from a work deal by Mindray, said the experience changed the way she looked at the job market.

"Mindray is a leading firm in the industry and its shares are publicly traded. However, it still has to terminate contracts with us … and you can imagine how other small firms are doing," she said.

"Now the first thing that comes to my mind [when considering an employment opportunity] is whether the job is safe, whether I would be laid off suddenly … I think only state-owned enterprises are trustworthy amid an economic downturn."

This article was first published in South China Morning Post.