- Joined

- Jan 5, 2010

- Messages

- 2,107

- Points

- 83

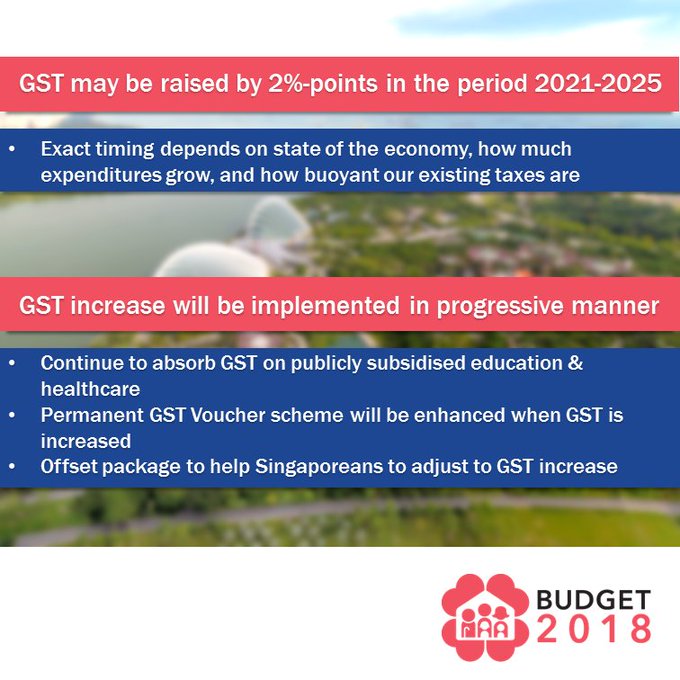

Poor people GST burden is probably already 12% now in Singapore.

This is because almost ALL the services consumed by the poor involve low wage foreign workers whose employers have to pay a worker's levy: e.g. NTUC/7-11 cashier, bus driver, cleaners, HDB MRT infrastructure construction worker, nurses, security guard, cheap hairdresser, public pool life guard, F&B for fast food, postal service postman etc.

By one account, the Singapore government sucks S$3 billion from employers annually https://www.theonlinecitizen.com/20...evies-have-been-used-to-help-foreign-workers/ .

In 2016/7 at 7% GST tax rate, IRAS collected $11.1 billion in GST taxes https://www.businesstimes.com.sg/go...revenue-in-fy2017-up-nearly-5-from-a-year-ago . On a per % GST basis, each percent of GST accounted for $1.5857 billion collected.

$3 billion is approximately equal to a 1.89% GST increase, or for convenience ~2%.

However, both GST and foreign worker levy are both REGRESSIVE taxes because a greater proportion of wealth is spent by poor on these taxes as compared to the rich.

Activities that rich people have perchant for are often from employment pass holders who pay zero levy to work in Singapore. Such occupations include: cosmetic surgeon, personal maid, banker/ remisers, personal coach/shrink, professional hair dresser, pilot/air stewardesses on international travel flight, Michelin star chef, SSO musicians, private tuitors/ education center, private sports coaches, lawyers, domestic helpers etc.

As described, the majority of employees in the establishment that rich people visit pay little or nothing in terms of foreign worker levies and as a % of company turnover, the foreign workers levy for their industries is also very low (e.g. law firm).

Rich people also enjoy duty free shopping during their frequent holidays and need not declare their purchases at customs so long as they falsely declare that the luxuary items were brought out of Singapore to begin with. Singapore customs will not be able to dispute this false declaration because no inventory was recorded during the travellers exit to begin with (suffice to say the wealthy traveller should be wise not to return with duplicates of the same item to avoid importation accusations). It is also unheard of for Singapore customs to tax the importation of art master pieces or exotic animals, some of which are worth hundreds of millions of dollars and the wealthy can enjoy gazing at such masterpieces and exotic animals in the luxuary of their homes without paying and GST whilst the poor have to pay GST for admission tickets to museum art galleries or even the Singapore zoo.

Rich people are also able to access foreign based interlectual services which poor people with obsolete digital technology are unable to. Richer people are able to do more foreign online delivery purchases which are largely GST free whilst poorer people cannot do the same for basic food necessities which are perishable and need to be purchased from supermarket locally.

In conclusion, rich people can quite easily evade GST for luxuaries but the poor cannot and in aggravation, suffer the DOUBLE JEOPARDY of implicit GST in the form of increased basic necessities cost inflation as a consequence of increased SME business costs attributable to high foreign worker levies.

This is because almost ALL the services consumed by the poor involve low wage foreign workers whose employers have to pay a worker's levy: e.g. NTUC/7-11 cashier, bus driver, cleaners, HDB MRT infrastructure construction worker, nurses, security guard, cheap hairdresser, public pool life guard, F&B for fast food, postal service postman etc.

By one account, the Singapore government sucks S$3 billion from employers annually https://www.theonlinecitizen.com/20...evies-have-been-used-to-help-foreign-workers/ .

In 2016/7 at 7% GST tax rate, IRAS collected $11.1 billion in GST taxes https://www.businesstimes.com.sg/go...revenue-in-fy2017-up-nearly-5-from-a-year-ago . On a per % GST basis, each percent of GST accounted for $1.5857 billion collected.

$3 billion is approximately equal to a 1.89% GST increase, or for convenience ~2%.

However, both GST and foreign worker levy are both REGRESSIVE taxes because a greater proportion of wealth is spent by poor on these taxes as compared to the rich.

Activities that rich people have perchant for are often from employment pass holders who pay zero levy to work in Singapore. Such occupations include: cosmetic surgeon, personal maid, banker/ remisers, personal coach/shrink, professional hair dresser, pilot/air stewardesses on international travel flight, Michelin star chef, SSO musicians, private tuitors/ education center, private sports coaches, lawyers, domestic helpers etc.

As described, the majority of employees in the establishment that rich people visit pay little or nothing in terms of foreign worker levies and as a % of company turnover, the foreign workers levy for their industries is also very low (e.g. law firm).

Rich people also enjoy duty free shopping during their frequent holidays and need not declare their purchases at customs so long as they falsely declare that the luxuary items were brought out of Singapore to begin with. Singapore customs will not be able to dispute this false declaration because no inventory was recorded during the travellers exit to begin with (suffice to say the wealthy traveller should be wise not to return with duplicates of the same item to avoid importation accusations). It is also unheard of for Singapore customs to tax the importation of art master pieces or exotic animals, some of which are worth hundreds of millions of dollars and the wealthy can enjoy gazing at such masterpieces and exotic animals in the luxuary of their homes without paying and GST whilst the poor have to pay GST for admission tickets to museum art galleries or even the Singapore zoo.

Rich people are also able to access foreign based interlectual services which poor people with obsolete digital technology are unable to. Richer people are able to do more foreign online delivery purchases which are largely GST free whilst poorer people cannot do the same for basic food necessities which are perishable and need to be purchased from supermarket locally.

In conclusion, rich people can quite easily evade GST for luxuaries but the poor cannot and in aggravation, suffer the DOUBLE JEOPARDY of implicit GST in the form of increased basic necessities cost inflation as a consequence of increased SME business costs attributable to high foreign worker levies.