-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

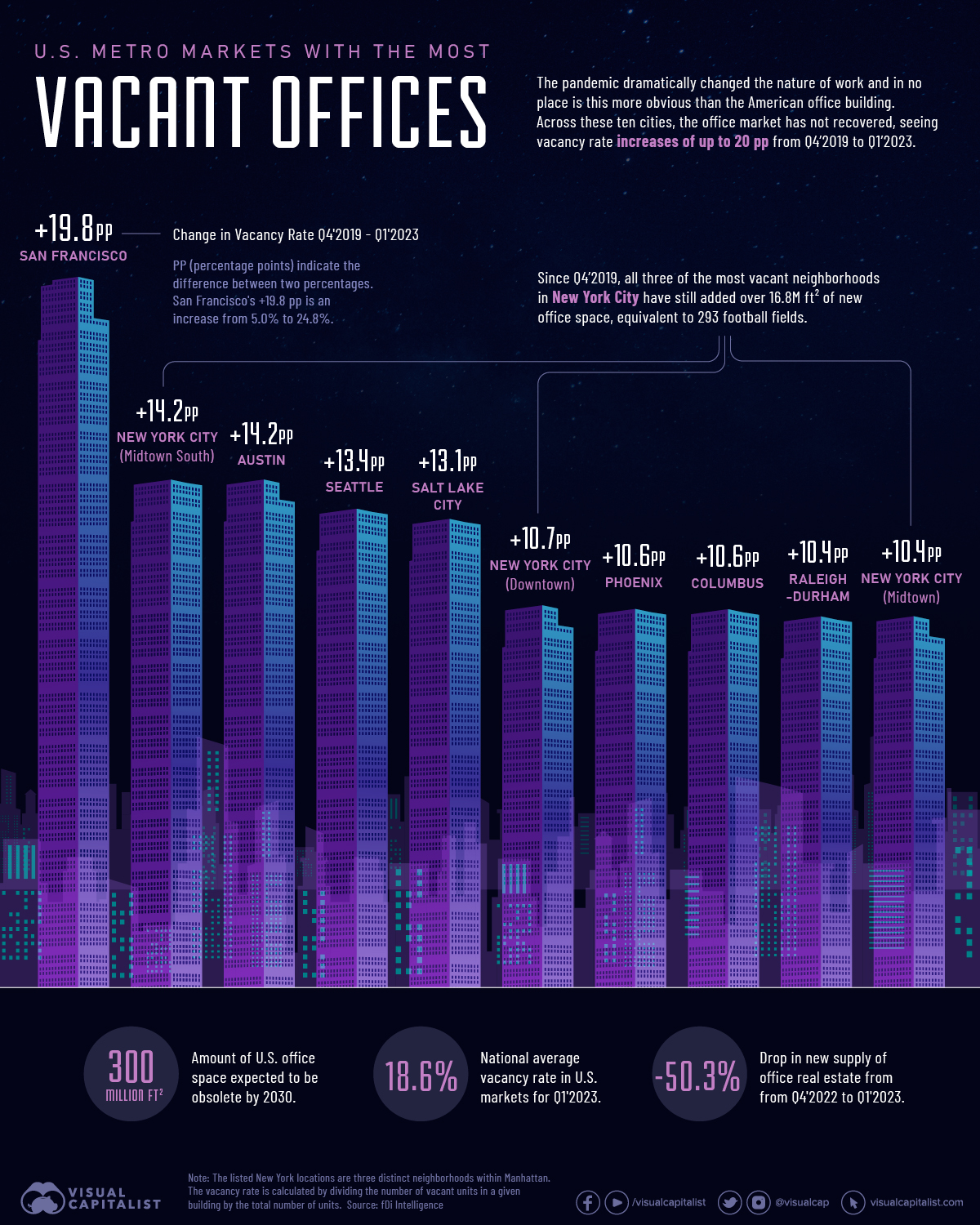

Murika tio dua kee liao... Many cities have empty office buildings

- Thread starter k1976

- Start date

NEW YORK – In New York and London, owners of gleaming office towers are walking away from their debt rather than pouring good money after bad. The landlords of downtown San Francisco’s largest mall have abandoned it. A new Hong Kong skyscraper is only a quarter leased.

The creeping rot inside commercial real estate is like a dark seam running through the global economy. Even as stock markets rally and investors are hopeful that the fastest interest-rate increases in a generation will ebb, the trouble in property is set to play out for years.

After a long buying binge fueled by cheap debt, owners and lenders are grappling with changes in how and where people work, shop and live in the wake of the pandemic. At the same time, higher interest rates are making it more expensive to buy or refinance buildings.

The creeping rot inside commercial real estate is like a dark seam running through the global economy. Even as stock markets rally and investors are hopeful that the fastest interest-rate increases in a generation will ebb, the trouble in property is set to play out for years.

After a long buying binge fueled by cheap debt, owners and lenders are grappling with changes in how and where people work, shop and live in the wake of the pandemic. At the same time, higher interest rates are making it more expensive to buy or refinance buildings.

A tipping point is coming: In the US alone, about US$1.4 trillion (S$1.9 trillion) of commercial real estate loans are due this year and next, according to the Mortgage Bankers Association. When the deadline arrives, owners facing large principal payments may prefer to default instead of borrowing again to pay the bill.

Major institutional owners including Blackstone, Brookfield and Pimco have already chosen to stop payments on some buildings because they have better uses for their cash and resources.

“There’s significant stress,” said Mr Harold Bordwin, a principal in New York at Keen-Summit Capital Partners LLC, which specializes in renegotiating distressed real estate.

Major institutional owners including Blackstone, Brookfield and Pimco have already chosen to stop payments on some buildings because they have better uses for their cash and resources.

“There’s significant stress,” said Mr Harold Bordwin, a principal in New York at Keen-Summit Capital Partners LLC, which specializes in renegotiating distressed real estate.

The number of transactions is plunging–and when deals do happen, the price declines are stark.

In the US, where return-to-office rates have been lower than in Asia and Europe, values for institutional-quality offices are down 27 per cent since March 2022, when interest rates started going up, according to data analytics company Green Street.

Apartment building prices have declined 21 per cent, and malls are off 18 per cent. Office prices are expected to fall more than 25 per cent in Europe and almost 13 per cent in the Asia-Pacific region before hitting a trough according to PGIM Real Estate, a unit of Prudential Financial Inc.

In the US, where return-to-office rates have been lower than in Asia and Europe, values for institutional-quality offices are down 27 per cent since March 2022, when interest rates started going up, according to data analytics company Green Street.

Apartment building prices have declined 21 per cent, and malls are off 18 per cent. Office prices are expected to fall more than 25 per cent in Europe and almost 13 per cent in the Asia-Pacific region before hitting a trough according to PGIM Real Estate, a unit of Prudential Financial Inc.

What PGIM analysts have called “the great reset” of values is likely to be agonizingly slow. It took six years for US office prices to recover after the 2008 financial crisis, even though that episode was centered on residential real estate.

“This time we think it’ll take 10 years,” said Mr Richard Barkham, global chief economist for CBRE Group.

Commercial real estate’s woes will add to the stress on a financial system that’s already reeling from this year’s crisis in regional banks. And as the downturn deepens, it stands to have a transformational impact on some cities as they contend with empty buildings and lower property tax revenue.

The question is whether the commercial property correction will be big enough to destabilize the wider economy. As broad as the forces arrayed against the real estate sector may be, it’s also very local business, encompassing not only urban skyscrapers but small-town shopping centers, suburban apartment buildings and sprawling warehouse parks.

“This time we think it’ll take 10 years,” said Mr Richard Barkham, global chief economist for CBRE Group.

Commercial real estate’s woes will add to the stress on a financial system that’s already reeling from this year’s crisis in regional banks. And as the downturn deepens, it stands to have a transformational impact on some cities as they contend with empty buildings and lower property tax revenue.

The question is whether the commercial property correction will be big enough to destabilize the wider economy. As broad as the forces arrayed against the real estate sector may be, it’s also very local business, encompassing not only urban skyscrapers but small-town shopping centers, suburban apartment buildings and sprawling warehouse parks.

Singapore defies global slowdown in commercial real estate while Hong Kong, New York struggle to fill vacant skyscrapers

- Overall occupancy levels in Singapore’s central business district are nearing 95 per cent with rents up 2.5 per cent, according to a property agency

- In Hong Kong, meanwhile, some 13 million sq ft of office space sat empty in April, with 15 per cent of the most valuable space still vacant

Singapore’s gleaming office towers are defying a global slowdown in commercial real estate, in a sign of the Asian hub’s continuing appeal.

Prime office rents in the city state increased 2.5 per cent in the first half of 2023. The overall occupancy level in the central business district in the second quarter reached 94.4 per cent, edging up from the previous quarter, according to a report from Knight Frank Singapore.

As vacant skyscrapers in metropolises from New York to Hong Kong struggle to lure new tenants, Singapore stands out. Despite rising rents and a fragile global economic outlook, demand for office space in the city state is growing as multinational companies continue to relocate functions and set up headquarters there.

Prime office rents in the city state increased 2.5 per cent in the first half of 2023. The overall occupancy level in the central business district in the second quarter reached 94.4 per cent, edging up from the previous quarter, according to a report from Knight Frank Singapore.

As vacant skyscrapers in metropolises from New York to Hong Kong struggle to lure new tenants, Singapore stands out. Despite rising rents and a fragile global economic outlook, demand for office space in the city state is growing as multinational companies continue to relocate functions and set up headquarters there.

The city state saw more than 8,000 newly registered entities in the first five months, according to Knight Frank, citing data from the Accounting and Corporate Regulatory Authority. A total of 203 foreign firms have registered in the city since 2021, according to the Straits Times.

Meanwhile, distress is spreading in the United States’ commercial real-estate industry. The amount of troubled assets climbed to nearly US$64 billion in the first quarter of this year.

Meanwhile, distress is spreading in the United States’ commercial real-estate industry. The amount of troubled assets climbed to nearly US$64 billion in the first quarter of this year.

New York office vacancies are expected to reach a record 22.7 per cent this year, while 13 million square feet of Hong Kong office space sat empty in April, with 15 per cent of the most valuable space still vacant.

Major institutional owners including Brookfield Corp. have chosen to stop payments on some buildings. A cocktail of challenges – from higher interest rates to the enduring nature of remote work – may lead to a bigger shakeout that jolts the industry and leaves city centres pockmarked with empty buildings.

Major institutional owners including Brookfield Corp. have chosen to stop payments on some buildings. A cocktail of challenges – from higher interest rates to the enduring nature of remote work – may lead to a bigger shakeout that jolts the industry and leaves city centres pockmarked with empty buildings.

https://www.google.com.sg/amp/s/amp...-climbing-office-rents-occupancy-rates?espv=1

Our in-house Property Big Bosses must be huat big big deal woh

Our in-house Property Big Bosses must be huat big big deal woh

Hong Kong’s Office Towers Have Never Been So Empty

Gift this article

The Henderson commercial building under construction in March.Photographer: Paul Yeung/Bloomberg

By Shawna Kwan

June 5, 2023 at 8:30 AM GMT+8

Updated on

June 5, 2023 at 12:14 PM GMT+8

Hong Kong’s office towers, among the most expensive commercial real estate in the world, have never been this empty.

Billionaire Li Ka-shing’s trophy asset at Cheung Kong Center is about 25% vacant, while his latest project underway across the street with sweeping views of Victoria Harbour has signed up one tenant.

Fellow tycoon Lee Shau Kee’s curved glass The Henderson building under construction nearby is just 30% leased. Rents and sale prices are cratering.

https://www.google.com.sg/amp/s/amp...race-sell-property-values-fall-further?espv=1

Business

Business

Hong Kong homeowners slash prices as they race to sell before property values fall further

- Owners are only managing to attract buyers when they cut prices by at least 10 per cent from what they were two months ago, says analyst

- Analysts warned a further fall in pre-owned home prices could fire up the number of negative equity cases in the coming months

Homeowners in Hong Kong are offering steep discounts as they race to offload their properties quickly before the market falls further.

In a recent case that underscores the trend, a seller in Tai Po was forced to take a 28 per cent loss when he offloaded his property for HK$4.3 million (US$550,000) less than he had paid for it in 2019.

Owners are only managing to attract buyers when they cut prices by at least 10 per cent from what they were two months ago, said Louis Chan Wing-kit, CEO of the residential division at Centaline Property Agency.

“If [owners] want to offload their properties now, they have to cut asking prices substantially as home prices are likely to fall further in the coming quarters,” he said.

In a recent case that underscores the trend, a seller in Tai Po was forced to take a 28 per cent loss when he offloaded his property for HK$4.3 million (US$550,000) less than he had paid for it in 2019.

Owners are only managing to attract buyers when they cut prices by at least 10 per cent from what they were two months ago, said Louis Chan Wing-kit, CEO of the residential division at Centaline Property Agency.

“If [owners] want to offload their properties now, they have to cut asking prices substantially as home prices are likely to fall further in the coming quarters,” he said.

There were 3,341 cases of negative equity – where the value of a home falls below that of the mortgage on it – at the end of June, the results of a quarterly survey by the HKMA showed. This was a 47.6 drop from 6,379 instances in the previous quarter.

But analysts said a further fall in pre-owned home prices could fire up the number of negative equity cases in the coming months as owners rushed to cash out before the market slumps too far.

But analysts said a further fall in pre-owned home prices could fire up the number of negative equity cases in the coming months as owners rushed to cash out before the market slumps too far.

Hong Kong’s house prices have come under pressure from rising interest rates that make mortgages more unaffordable.

The HKMA last week raised the city’s base rate for the 11th time in 17 months in lockstep with the Federal Reserve, as the US central bank resumed its fight against inflation after a breather six weeks ago. Hong Kong’s monetary policy follows the United States as the city’s currency is pegged to the US dollar.

Hong Kong’s commercial banks including Bank of China (Hong Kong), HSBC and Hang Seng Bank raised the lending rate for their best customers by 12.5 basis points to 5.875 per cent starting Friday after the 25 basis points increase in the base rate to 5.75 per cent.

The HKMA last week raised the city’s base rate for the 11th time in 17 months in lockstep with the Federal Reserve, as the US central bank resumed its fight against inflation after a breather six weeks ago. Hong Kong’s monetary policy follows the United States as the city’s currency is pegged to the US dollar.

Hong Kong’s commercial banks including Bank of China (Hong Kong), HSBC and Hang Seng Bank raised the lending rate for their best customers by 12.5 basis points to 5.875 per cent starting Friday after the 25 basis points increase in the base rate to 5.75 per cent.

https://www.businesstimes.com.sg/pr...dly-selling-five-hong-kong-houses-16-discount

Among them, the house on 50 Chung Hom Kok Road is the biggest at 6,364 square feet, according to the sales brochure.

PHOTO: GOOGLE

CIFI Holdings Group’s chairman Lin Zhong and other executives are trying to sell five houses in Hong Kong for about 16 per cent below cost at US$253 million, Hong Kong Economic Times reported, citing unidentified people.

The homes are on 44 to 50 Chung Hom Kok Road and 1 Horizon Drive. Among them, the house on 50 Chung Hom Kok Road is the biggest at 6,364 square feet, according to the sales brochure. It’s asking for HK$442 million (S$76 million), down from initial HK$520 million.

The house on 48 Chung Hom Kok Road has the steepest discount, with the asking price cut to about HK$402 million from HK$495 million.

Chinese tycoon’s firm is reportedly selling five Hong Kong houses at 16% discount

Published Thu, Aug 03, 2023 · 11:51 am

Among them, the house on 50 Chung Hom Kok Road is the biggest at 6,364 square feet, according to the sales brochure.

PHOTO: GOOGLE

Hong Kong

CIFI Holdings Group’s chairman Lin Zhong and other executives are trying to sell five houses in Hong Kong for about 16 per cent below cost at US$253 million, Hong Kong Economic Times reported, citing unidentified people.

The homes are on 44 to 50 Chung Hom Kok Road and 1 Horizon Drive. Among them, the house on 50 Chung Hom Kok Road is the biggest at 6,364 square feet, according to the sales brochure. It’s asking for HK$442 million (S$76 million), down from initial HK$520 million.

The house on 48 Chung Hom Kok Road has the steepest discount, with the asking price cut to about HK$402 million from HK$495 million.

https://www.google.com.sg/amp/s/sto...-at-age-33-reveals-previous-salary?amp?espv=1

Act Cheerie, China savvy investors are no match for Balai MOE scholar who huat big big in SG property De woh.... Any miss the boat bro?

https://www.edgeprop.sg/property-news/millennial-placemakers-reshaping-geylang

Gheyland huat huat property for u, boss?

Gheyland huat huat property for u, boss?

Similar threads

- Replies

- 2

- Views

- 499

- Replies

- 18

- Views

- 1K

- Replies

- 30

- Views

- 1K

- Replies

- 6

- Views

- 569