-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

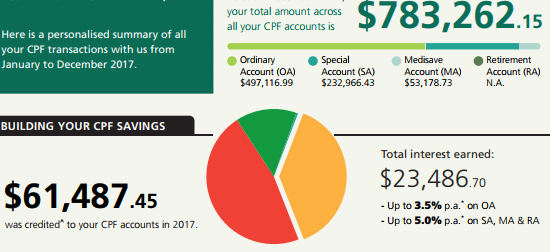

Chitchat Merry Christmas Samsters!! Looking Forward To Seeing Your CPF Interests For 2019? John Tan Feels Fucking Rich!!!

- Thread starter JohnTan

- Start date

- Joined

- Dec 6, 2012

- Messages

- 28,963

- Points

- 113

KNN my uncle don't have this amount in cpf but with his cash savings and cpf has more than johntan KNN

- Joined

- Jun 14, 2010

- Messages

- 2,805

- Points

- 113

Its 5% u turd if you are below 55Where else can you get 4% annual returns and your principal guaranteed?

- Joined

- Jul 12, 2011

- Messages

- 6,921

- Points

- 113

Which idiot would not like to have access to CPF funds and pay Sinkies 5% interest yearly?

- Joined

- May 6, 2012

- Messages

- 5,529

- Points

- 113

OL's bonds pay 6%...., so she's still the #1..Which idiot would not like to have access to CPF funds and pay Sinkies 5% interest yearly?

- Joined

- Jul 12, 2011

- Messages

- 6,921

- Points

- 113

Likely all will kick the bucket b4 they use up all their CPF, that's PAP's idea of holding back full payment. Already we see a trend of tos dying b4 hitting 80 yrs old.

- Joined

- Aug 19, 2008

- Messages

- 38,563

- Points

- 113

Fuck you and your baren daughter!

- Joined

- Jul 14, 2008

- Messages

- 91,258

- Points

- 113

It should be "barren" and not "baren".

Fuck you and your baren daughter!

- Joined

- Dec 6, 2012

- Messages

- 28,963

- Points

- 113

KNN the bear learn rook rike my uncle cpf type KNN about 100k in oa 200k in sa and 57k in ma KNN is it johntan one KNN

Do you feel rich after checking your CPF interest paid to you for 2019? Majulah PAP!

- Joined

- Jul 20, 2009

- Messages

- 6,189

- Points

- 113

Obviously, you don't know where to shop!Where else can you get 4% annual returns and your principal guaranteed?

- Joined

- Oct 30, 2014

- Messages

- 36,768

- Points

- 113

Obviously, you don't know where to shop!

CPF is safe and very reliable. Far too many sinkies lost their savings in dubious investments.

- Joined

- Mar 5, 2019

- Messages

- 11,137

- Points

- 113

Congratulations John! You are a prime example of the Majulah in Singapura!Do oppies have as much as John in his CPF account? I can't wait to see how much interest PAP will pay me end of this year!!

- Joined

- Jul 19, 2011

- Messages

- 28,256

- Points

- 113

John, you gave us lots of returns as a result.

The historical average yearly return of the S&P 500 is 11.888% over the last 10 years, as of end of November 2022. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average return (including dividends) is 9.181%

The historical average yearly return of the S&P 500 is 11.888% over the last 10 years, as of end of November 2022. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average return (including dividends) is 9.181%

Similar threads

- Replies

- 6

- Views

- 563

- Replies

- 3

- Views

- 1K

- Replies

- 35

- Views

- 2K

- Replies

- 1

- Views

- 460