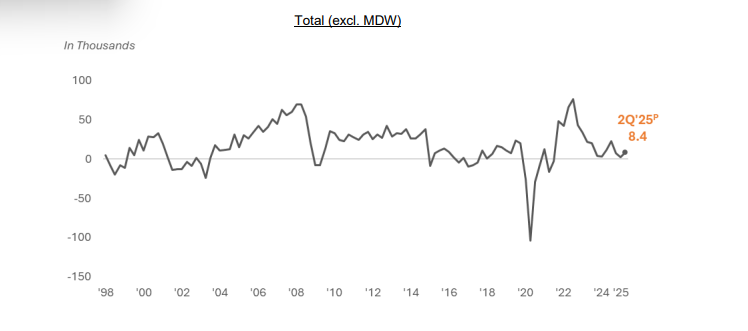

Total employment in Singapore increased to 8,400 in Q2 2025

Share On

Although lower than the preceding year, the rate of total employment growth reflects larger gains in both resident and non-resident employment compared to the previous quarter.

The Ministry of Manpower's just-released

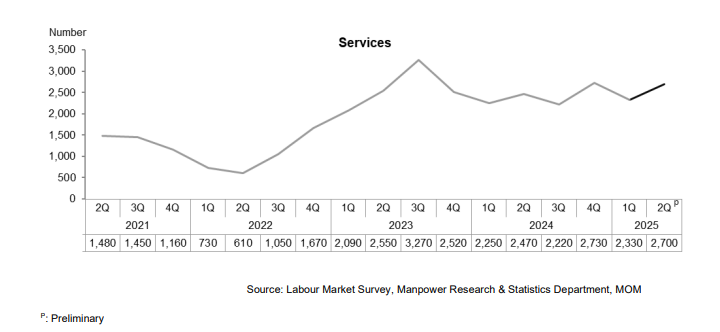

Labour Market Advance Release for Q2 2025 has revealed a positive pick-up in Singapore's employment growth momentum, with numbers rising from 2,300 in Q1 2025 to 8,400 in Q2 2025.

Although lower than in Q2 2024 (11,300), the data for this quarter, published on Wednesday (30 July 2025), reflects larger gains in both resident and non-resident employment compared to the previous quarter.

Resident employment

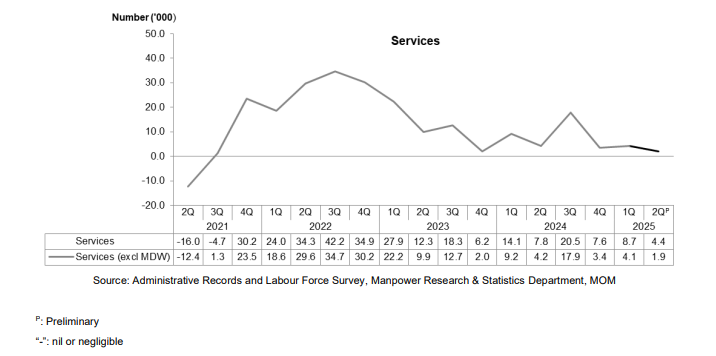

Resident employment continued to expand in sectors such as

financial services and

health & social services, while some sectors like

professional services and

information & communications registered continued declines.

Resident employment also declined in

retail trade, as employers continued to release workers after the seasonal hiring in Q4 2024 for year-end festivities.

Non-resident employment

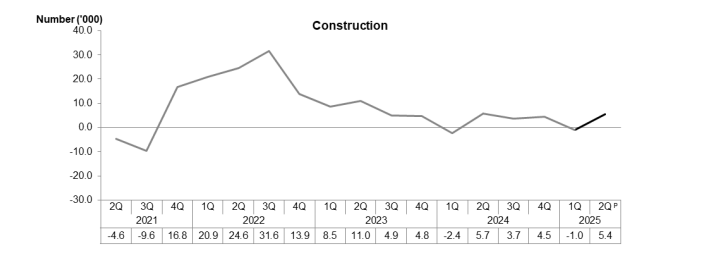

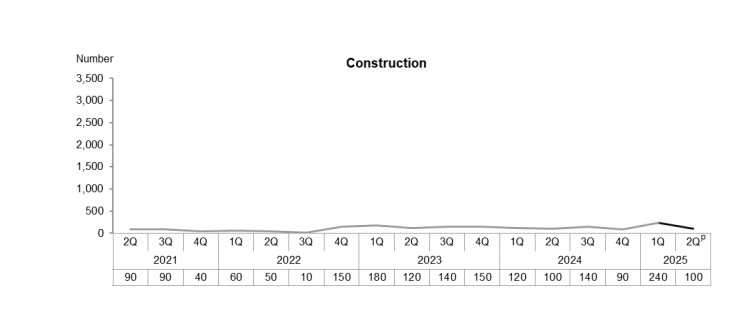

Growth in non-resident employment was driven entirely by work permit holders, particularly in the

construction sector. Increases in non-resident employment were also seen in

administrative & support services and

health & social services.

Other findings from the report are as follows:

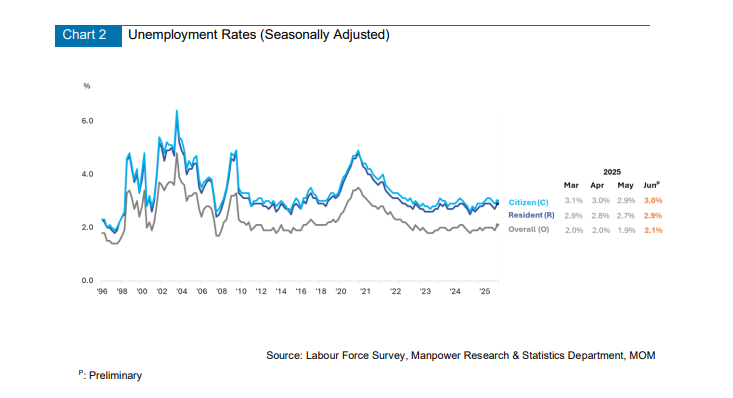

Unemployment rates remained broadly stable

After dipping slightly in April and May, both resident and citizen unemployment rates rose slightly in June 2025 (resident: 2.9%,

citizen: 3.0%), returning to levels seen in March 2025.

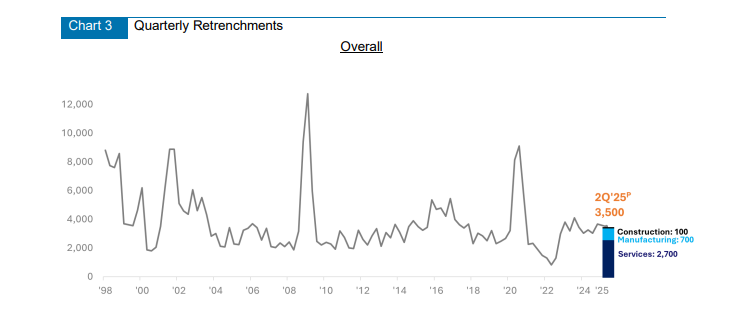

The number and incidence of retrenchments remained steady and low

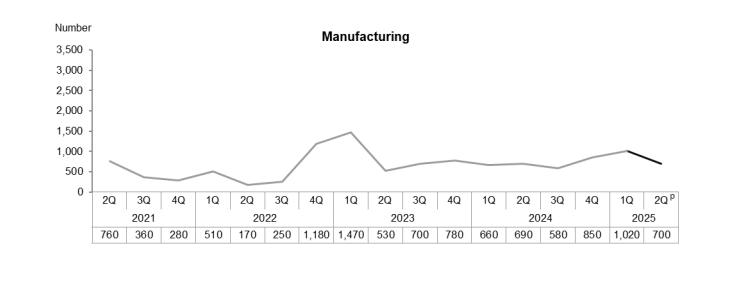

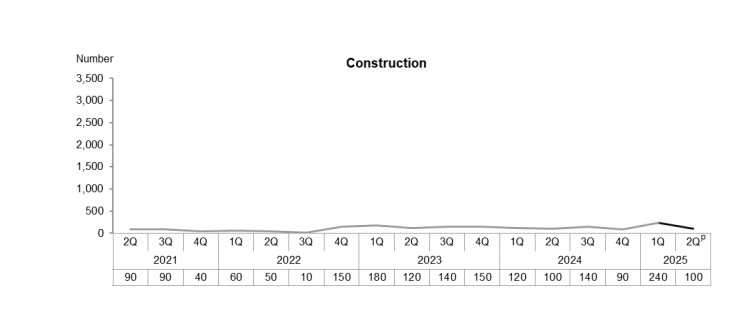

Retrenchments remained stable at 3,500 in Q2 2025 (Q1 2025: 3,590), with similar or lower levels across most sectors. The incidence of retrenchment also remained low at 1.4 retrenched per 1,000 employees. Business reorganisation or restructuring continued to be the top reason cited for retrenchments.

Looking ahead

Looking ahead

Global economic uncertainty is likely to persist in the coming months and may weigh on hiring and wage growth, particularly in outward-oriented sectors. Business sentiment remains steady yet cautious, with expectations for hiring and wage increases in Q3 2025 dipping slightly compared to the previous quarter.

According to MOM’s business expectations poll conducted between April and June 2025, the proportion of firms planning to hire edged down from 44.0% in Q2 to 43.7% in Q3. Similarly, the share of firms anticipating wage increases declined from 24.4% to 22.4%.

These dips were most notable in sectors exposed to global demand fluctuations, such as financial & insurance services, professional services, and transportation & storage.

Singapore Salary Budgets 2026: Singapore's Salary Budgets Remain Steady at 4% Amid Economic Uncertainties, ETHRWorldSEAhrsea.economictimes.indiatimes.com

Singapore Salary Budgets 2026: Singapore's Salary Budgets Remain Steady at 4% Amid Economic Uncertainties, ETHRWorldSEAhrsea.economictimes.indiatimes.com