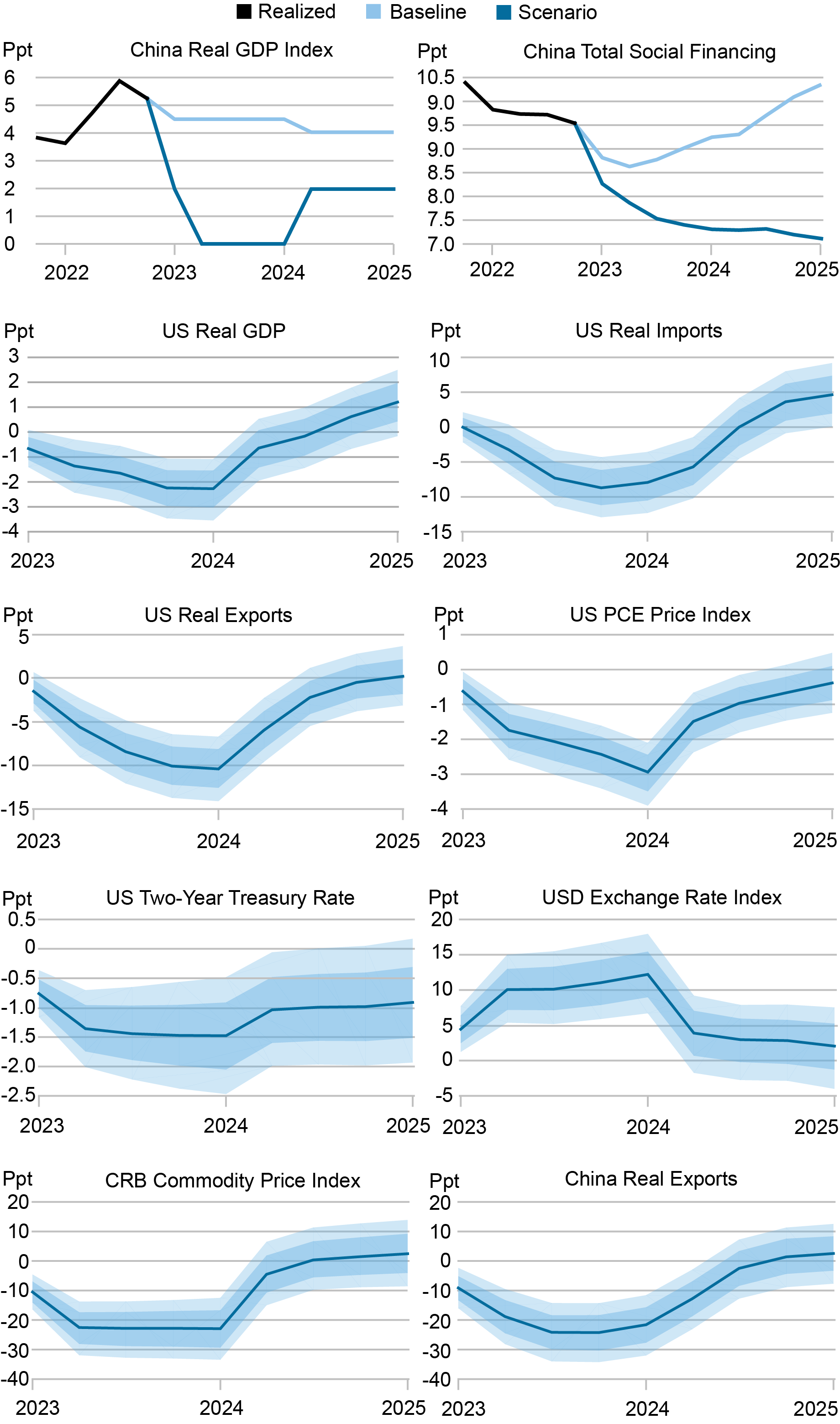

The magnitude of these impacts is larger than in our earlier post premised on a manufacturing-led boom in China, consistent with the larger deviation of GDP growth from baseline. The underlying mechanisms are however the same, albeit now working in the opposite direction.

The sudden plunge in Chinese domestic demand growth leads to sharp falls in global commodity prices and Chinese exports. These impacts reflect the key role China plays in global trade and production networks. Weaker Chinese demand translates into weaker demand for China’s worldwide value chain partners, with this impact amplified by the knock-on tightening of those firms’ financing constraints. The deterioration in global trade, of course, feeds into the similar deterioration in U.S. trade volumes.

The U.S. dollar, meanwhile, sees significant appreciation, in line with its longstanding

negative correlation with global commodity prices. In the context of our property crash scenario, this strength can be understood as reflecting risk-off behavior among global investors, who seek refuge in U.S. financial markets and U.S. dollar assets. The stronger dollar, in turn, contributes to a tightening in global financial conditions. In fact, the main impact of weaker Chinese demand on global financial conditions is via this indirect channel.

In short, the materialization the property crash scenario in China would tilt the balance of risks for U.S. growth and inflation to the downside. As we’ve discussed, however, the Chinese authorities appear to have adequate tools to contain new downward pressures on the country’s economy. At present, we regard the materialization of this scenario as less likely than the upside manufacturing boom scenario.

The two scenarios, of course, would carry different policy implications. A deep Chinese slowdown would contribute to lower U.S. and global inflation, likely bringing forward investor expectations for policy easing. In contrast, materially faster growth in China might add to the challenges of bringing inflation back to central bank targets, likely pushing out investor expectations for easing.