Modi vows to make India world's No. 3 economy by 2030

Ruling party promises $1.4tn infrastructure push in election manifesto

YUJI KURONUMA, Nikkei staff writer April 08, 2019 18:00 JST

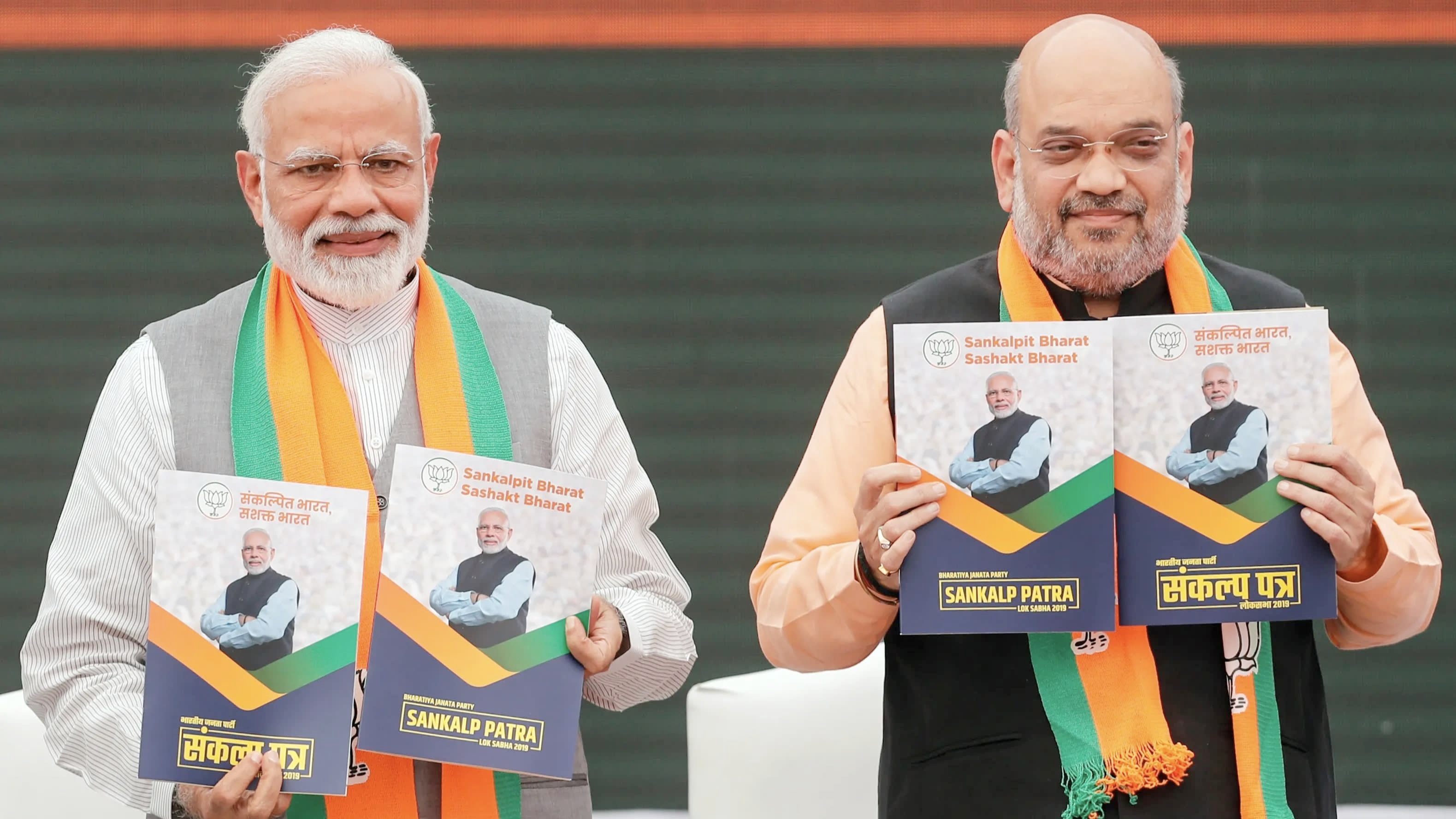

Indian Prime Minister Narendra Modi and chief of India's ruling Bharatiya Janata Party (BJP) Amit Shah, display copies of their party's election manifesto for the April/May general election in New Delhi. ©Reuters

NEW DELHI -- The party of Indian Prime Minister Narendra Modi on Monday pledged to pour 100 trillion rupees ($1.44 trillion) into infrastructure by 2024 and to turn the country into the world's third-largest economy by 2030 ahead of the country's upcoming general election.

But it is unclear how the ruling Bharatiya Janata Party intends to fund the ambitious plan, given that the Indian government only takes in about 27 trillion rupees a year. The party offered no breakdown of the investments, though they will likely include new roads, railways and power plants.

The BJP pledged to grow gross domestic product to $5 trillion by 2025 and to $10 trillion by 2032. It aims to make India's economy the third largest in the world by 2030, up from sixth now.

The manifesto includes targets already set by the Modi administration, such as doubling the country's 101 airports within five years and increasing nationwide renewable energy capacity to 175 gigawatts.

Other items are aimed squarely at the crucial rural vote. The BJP promised to double farmers' incomes -- a goal it set previously but remains far from achieving -- and provide interest-free agricultural loans.

Voters will go to the polls on one of seven designated dates between April 11 and May 19, depending on their district. Votes will be counted May 23.

Ruling party promises $1.4tn infrastructure push in election manifesto

YUJI KURONUMA, Nikkei staff writer April 08, 2019 18:00 JST

Indian Prime Minister Narendra Modi and chief of India's ruling Bharatiya Janata Party (BJP) Amit Shah, display copies of their party's election manifesto for the April/May general election in New Delhi. ©Reuters

NEW DELHI -- The party of Indian Prime Minister Narendra Modi on Monday pledged to pour 100 trillion rupees ($1.44 trillion) into infrastructure by 2024 and to turn the country into the world's third-largest economy by 2030 ahead of the country's upcoming general election.

But it is unclear how the ruling Bharatiya Janata Party intends to fund the ambitious plan, given that the Indian government only takes in about 27 trillion rupees a year. The party offered no breakdown of the investments, though they will likely include new roads, railways and power plants.

The BJP pledged to grow gross domestic product to $5 trillion by 2025 and to $10 trillion by 2032. It aims to make India's economy the third largest in the world by 2030, up from sixth now.

The manifesto includes targets already set by the Modi administration, such as doubling the country's 101 airports within five years and increasing nationwide renewable energy capacity to 175 gigawatts.

Other items are aimed squarely at the crucial rural vote. The BJP promised to double farmers' incomes -- a goal it set previously but remains far from achieving -- and provide interest-free agricultural loans.

Voters will go to the polls on one of seven designated dates between April 11 and May 19, depending on their district. Votes will be counted May 23.