newsweek.com

Economy will rebound in time for election after short, sharp recession, Newsweek poll says

Pronita Naidu

6-7 minutes

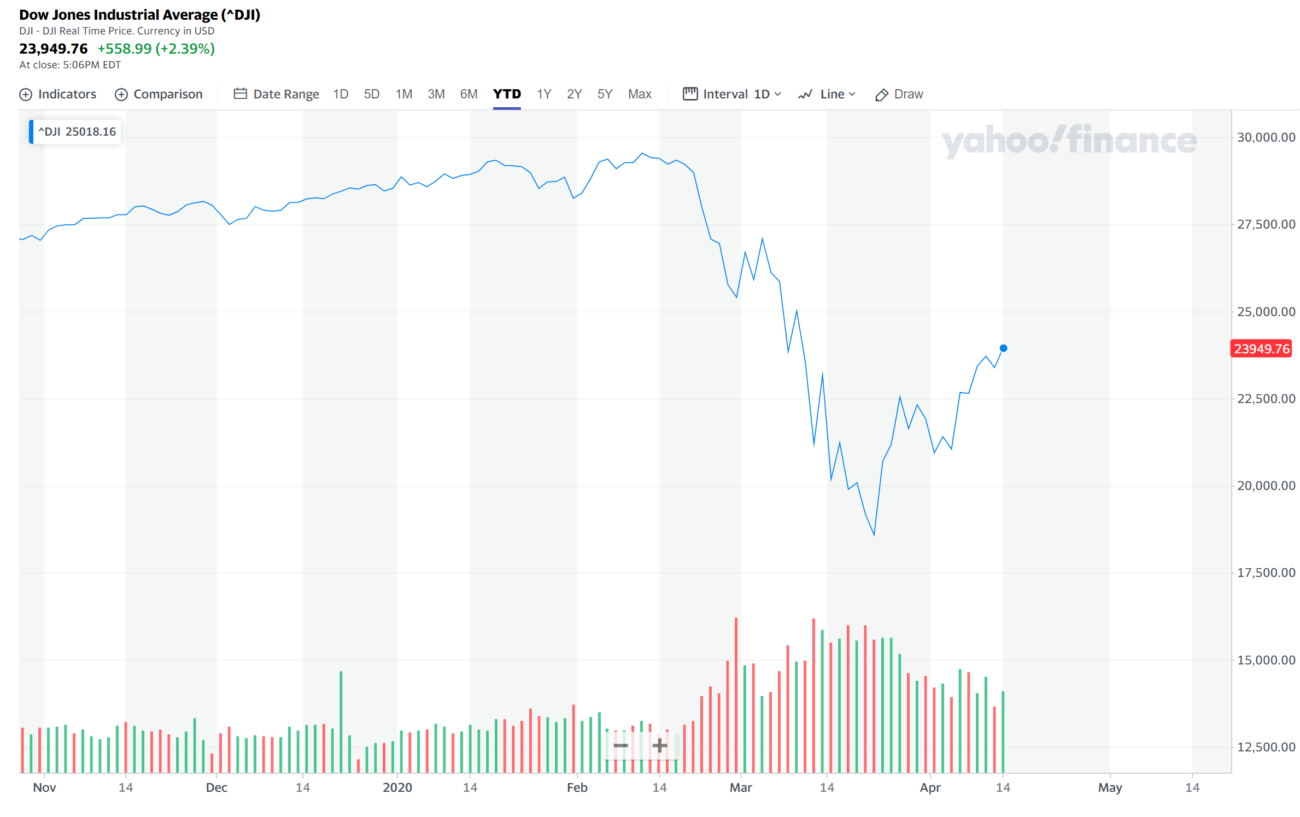

The coronavirus pandemic is plunging the United States into a recession that could be as sharp as the 2008 financial crash, although the economy will likely rebound before President Donald Trump faces re-election in November, according to economists polled by

Newsweek.

In a poll conducted on Monday, all 15 economists said they expected the economy to shrink sharply in the second quarter, ending the longest expansion in American history.

Five analysts forecast contraction in the first quarter as well, after the Trump administration and state and local governments imposed restrictions on travel and large gatherings, shutting down swaths of the economy to stop the spread of the deadly virus.

"The negative shock to the U.S. economy is severely affecting and interrupting the normal activities of all citizens and businesses," Berenberg said in its research note.

The German bank expects a sharp contraction of U.S. economic activity and gross domestic product through midyear. It forecast the first-quarter annualized growth rate to decline 4.5 percent from the previous quarter and the second quarter to dip 11.7 percent. Real GDP decreased at an annual rate of 5.5 percent in the first quarter of 2009 and dipped 0.7 percent in the second quarter of that year.

Nine of the 15 economists in the poll expect a recovery to begin in the third quarter. "This is based on an assumption that we start to see restrictions eased at some point in 3Q [third quarter], which is of course highly speculative," said James Knightley, ING's chief international economist.

"I would imagine President Trump would be very keen to see lives returning to normal by the time of the election," he added. Knightley expects an 8.6 percent annualized GDP decline in the second quarter, relative to the 4.4 percent decline experienced in Q1 2009 and an 8.4 percent drop in Q4 2008.

All the analysts forecast a rebound during the fourth quarter, well in time for the presidential election on November 3.

"The forecast assumes that we bottom out in April or May and gradually recover by the end of the year, but at a lower level than we started the year," said Scott Brown, chief economist at Raymond James. He expects real GDP to decline 12.5 percent in Q2 2020.

Trump has made the record-breaking economic expansion (which began under his predecessor, Barack Obama) and a 50-year low in unemployment a central part of his pitch to voters. The U.S. economy created 273,000 jobs in February, 100,000 more than expected, showing that employers were hiring at full steam before the pandemic restrictions kicked in.

While GDP is expected to recover quickly, the impact of the restrictions, which include bans on travel from Europe, closures of bars and restaurants, and cancellation of sporting and entertainment events, will ripple through the job market for longer.

"Given this drop in GDP, wages are expected to stagnate or decline," said Zachary Feinstein, an assistant professor at the Stevens Institute of Technology. He predicted higher levels of unemployment in some communities.

The shock of the recession, job losses and stagnant wages will affect the recovery well into the next president's term.

"The recession's malaise may linger, keeping households feeling subdued in regards to their own economic/financial prospects even though the recovery has already started," said Sam Bullard, a senior economist at Wells Fargo Securities.

Nearly two-thirds, or 65 percent, of registered voters of all political affiliations say President Donald Trump will "definitely" or "probably will" defeat whoever the Democratic challenger is against him in November, a CBS News/YouGov poll said. JOE RAEDLE / Staff/Getty images

These long-term effects will create a political problem for Trump. When voters go to the polls in November, much of the media coverage will still be focused on economic and job market data from the previous months. Because of the delays in gathering and reporting such data, the headlines will almost certainly be grim. In the meantime, leading indicators such as consumer confidence will still look bleak.

"By the November election, the worst may be behind us, but the recovery won't be materially showing in the lagging data," said Derek Holt, head of capital markets economics at ScotiaBank. He expects full-year GDP to decline for the first time since 2009.

The strength and the timing of the recovery will largely depend on the degree to which the government supports businesses and consumers affected by the recession.

"The weaker the support, the weaker the economy will be in October. The bill before Congress right now is inadequate. The support it provides for individuals is too short—it should be four months, not two weeks—and the support it provides businesses is inadequate," said Bert Brenner, director of asset allocation at People's United Advisors.

The House passed an economic relief bill on Saturday, funding paid sick and family leave, unemployment insurance and a free coronavirus test, along with other measures to help fight the crisis.

Republican senators are holding up the bill's approval, saying it would add to the burden on businesses.

In addition, the Federal Reserve slashed interest rates to 0-0.25 percent over the weekend—a level reached during the last financial crisis—and announced a $700 billion asset purchase program to support the economy.

The government's response will be almost as important a factor for voters as the state of the economy, said Michael Poutre, managing partner at Terraform Capital.

"It is a crapshoot to determine what the right moves are, but people will take that into account," Poutre said. "Historically, in times of crisis, people don't change, so Trump's chances, by default, look better for staying in office."