https://oilprice.com/Energy/Crude-Oil/Canadian-Oil-Crisis-Continues-As-Prices-Plunge.html

Canadian Oil Crisis Continues As Prices Plunge

By Nick Cunningham - Aug 09, 2018, 6:00 PM CDT

Canadian oil producers are once again suffering from a steep discount for their oil, causing the largest spread between Canadian oil and WTI in years.

Western Canada Select (WCS) recently fell below $40 per barrel, dropping to as low as $38 per barrel on Tuesday. That put it roughly $31 per barrel below WTI, the largest discount since 2013.

The sharp decline in WCS prices is a reflection of a shortage of pipeline capacity. Much of the talk about pipeline bottlenecks these days focuses on the Permian basin, and the unfolding slowdown in shale drilling, which could curtail U.S. oil production growth. But Canada’s oil industry was contending with an inability to build new pipeline infrastructure long before Texas shale drillers.

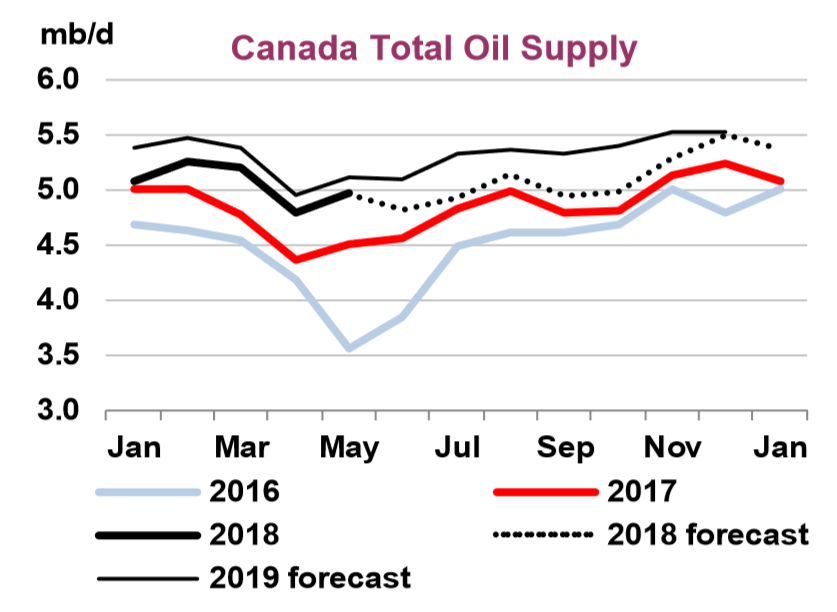

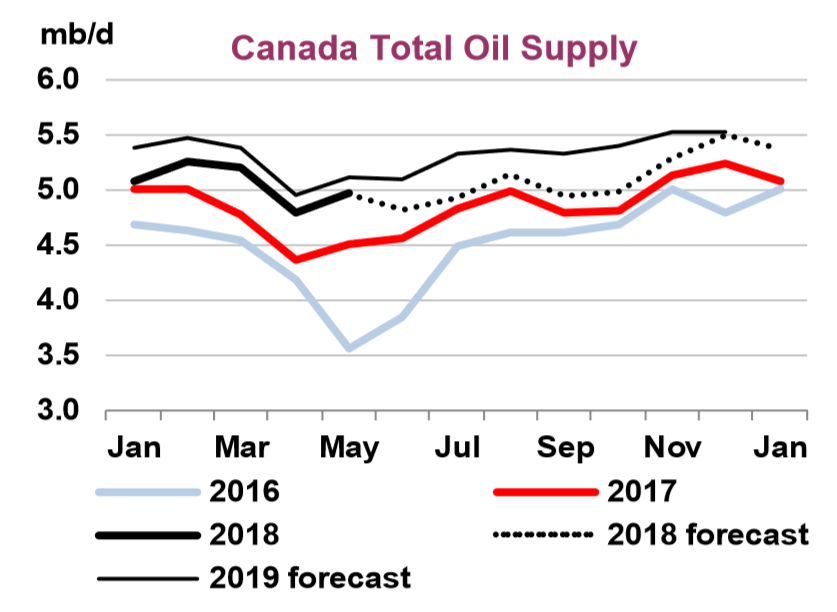

However, the problem has grown more acute over the last 12 months. Even as pipeline takeaway capacity hasn’t budged, Canadian oil production continues to rise. Output could jump by around 230,000 barrels per day (bpd) in 2018, followed by another 265,000-bpd increase in 2019, according to the International Energy Agency.

(Click to enlarge)

As more supply comes online, the pipelines are filling up, and there is little relief in sight. Until Enbridge’s Line 3 replacement is completed – targeted for late 2019 – midstream capacity won’t expand. Enbridge recently received a crucial permit from the state of Minnesota, through which the pipeline will traverse, even though state regulators questioned the need for the pipeline. Environmental groups and Native American tribes affected by the pipeline have vowed to mount a resistance to the replacement and construction of the Line 3, echoing the protests of the Dakota Access Pipeline from two years ago. Related: Shockwave In Shipping Could Send Brent Soaring

“They're bringing highly toxic, highly poisonous tar sands oil directly through major watersheds and the last standing reserve of wild rice that the Ojibwe have to harvest,” Bill Paulson, a member of the Ojibwe tribe, told CNN last month. “Our culture is the wild rice and gathering and being out in the woods. If there's a threat to that, then there's a direct threat to the people.”

Join the world's largest energy community

with over 10,000+ members

Learn, Share, and Discuss on the OilPrice Community

It is unclear how this will play out, but the opposition could delay the project beyond the expected start date. That means that the discount for WCS will stick around.

And because there is little, if any, empty space on Alberta’s pipelines, not only will the WCS discount linger, but the benchmark could suffer from higher volatility. “The Western Canadian oil patch is operating on the edge of available takeaway capacity, which makes discounts especially sensitive to shifts in supply (e.g. Syncrude ramping up from its outage), demand (e.g. higher-than-anticipated Midwest refinery maintenance) or marginal transport capacity (e.g. rail capacity spread too thin),” Rory Johnston, a commodity economist at Scotiabank, told Oilprice.com.

In theory, Alberta could build more refining capacity to process Canadian oil rather than scrambling to find pipeline space or selling at a steep discount, but refineries are expensive, and they would not resolve the problem of takeaway capacity. “The majority of hydrocarbons produced in Western Canada need to be exported--building additional refineries domestically to get around crude oil pipeline bottlenecks would simply shift it to a product pipeline capacity challenge,” Johnston said. “One way or another, those barrels still need to get to end consumers--either by pipeline, rail, barge, or truck.” Related: Oil Prices Hit 7-Week Low As Trade War Heats Up

Shipping oil by rail to the U.S. Gulf Coast can cost as much as $20 per barrel or more, according to Scotiabank, double the rate for shipping by pipeline. But with the WCS discount as large as it is, the economics could still work out. However, rail companies have been hesitant to invest in new rail capacity for shipping oil, especially if the business opportunity of doing so only lasts for another two or three years. Still, crude-by-rail shipments have climbed significantly this year, hitting a record high 198,788 barrels per day in May, the latest month for which data is available. However, even if rail economics look attractive, the lack of sufficient capacity means that rail won’t be able to entirely bridge the gap.

With midstream capacity stubbornly stuck without a near-term solution, the Canadian government has moved to essentially nationalize the Trans Mountain Expansion project, buying it from Kinder Morgan after the U.S.-based company moved to scrap the expansion plans.

But on that front as well, Ottawa continues to receive bad news, following its desperate bid to take over the project. The Canadian Press reported on August 7 that expanding the project will cost $1.9 billion more than previously thought, and will take a year longer than expected, putting the start date off until late 2021.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

https://www.cbc.ca/news/business/canada-oil-price-1.4776207

Canada's oil price discount rises to widest gap since 2013

Pete Evans · CBC News · Posted: Aug 07, 2018 11:57 AM ET | Last Updated: August 8

The thick sludgy oil shown here, known as Western Canada Select, is more expensive to process and transport than other forms of oil, which is why it always trades at a discount. (Reuters)

The price gap between the Canadian oilsands benchmark and the more widely used American one has risen to its widest level in more than five years.

The price of the heavy type of oil that comes out of Alberta's oilsands — known as Western Canada Select — is now trading below $40 US a barrel, and was changing hands at $38.29 a barrel on Tuesday. West Texas Intermediate, which is a type of oil that's much easier to refine and as such is the much more commonly used oil price benchmark, was trading at just under $70.

That puts the gap between the two oil prices at $31.25, the widest gulf since 2013. And it means Canadian producers are getting far less for their oil than others do.

And experts are blaming the usual suspects for it: pipelines.

"Continued growth in Western Canadian oilsands production is running up against insufficient pipeline capacity," Scotiabank's commodity economist Rory Johnston said.

Despite being a major oil producer, Canada actually refines little crude oil, which means most of what the country produces has to get shipped to refineries on the U.S. Gulf Coast. And while many have been proposed, very few pipelines have actually been built, meaning that those that do exist are at full capacity.

That means Canadian oil producers have to sell their product to refineries at a discount, to offset the difficulty and cost of getting it there. Major oilsands producer Canadian Natural Resources said last week that it plans to shift its focus to invest in lighter fuel blends, to take advantage of the price mismatch. "To maximize value, we are shifting capital from primary heavy crude oil to light crude oil," CNR said in releasing its quarterly earnings.

Rail is another way for Canadian oil companies to get their oil to market, and there too, the system can't process any more oil. Canadian oil shipments by rail rose to a record 198,788 barrels of oil per day in May, the latest month for which there is available data.

That's an all-time high, but capacity is not rising fast enough to offset tight pipeline space.

Judith Dwarkin, chief economist at RS Energy Group says the uptick in crude by rail is a function of the widening price gap.

"It only takes one barrel not able to get into the pipeline for the spread to widen," she said. "Really it's egress by pipeline that needs to be addressed."

Analyst Tom Kloza of the Oil Price Information Service says lack of pipelines are to blame.

"You don't have a pipeline to move it to the Pacific Ocean where you would be golden, so you are seeing these weak numbers," Kloza said.

Another factor is shutdowns of various oil processing facilities on both sides of the border. In June, a power outage at Syncrude helped the price gap to narrow to as little as $16 a barrel, as reduced output from a major oilsands producer made it easier for other producers to get their product to market.

But that outage is over now, and Syncrude is ramping back up to full production, which has caused the comparative oversupply of WCS.

Making things worse, refineries in the U.S. have less appetite for Canadian crude. A refinery in Whiting, Ind., owned by British multinational firm BP is scheduled to go offline for maintenance later this year. The 414,000 barrels-per-day refinery "is probably the biggest customer for Canadian heavy oil," Kloza said, so it being offline will reduce demand for Western Canada Select.

"We expect that the discount is going to remain especially volatile over the next year or so as we teeter on the edge of sufficient takeaway capacity out of Western Canada," Johnston said.

Dwarkin agrees that the volatility will last for as long as pipelines continue to be an issue.

"It's a triple whammy depressing prices at our end of the pipeline system. And the impact of that is not rocket science."

https://www.rt.com/business/435712-canadian-oil-crisis-continues/

Canadian oil crisis continues as prices plunge

Published time: 11 Aug, 2018 09:18

Get short URL

© Larry Macdougal / Global Look Press

Western Canada Select (WCS) recently fell below $40 per barrel, dropping to as low as $38 per barrel on Tuesday. That put it roughly $31 per barrel below WTI, the largest discount since 2013.

The sharp decline in WCS prices is a reflection of a shortage of pipeline capacity. Much of the talk about pipeline bottlenecks these days focuses on the Permian basin, and the unfolding slowdown in shale drilling, which could curtail U.S. oil production growth. But Canada’s oil industry was contending with an inability to build new pipeline infrastructure long before Texas shale drillers.

Read more

The oil giant that outsmarted Trudeau

The oil giant that outsmarted Trudeau

However, the problem has grown more acute over the last 12 months. Even as pipeline takeaway capacity hasn’t budged, Canadian oil production continues to rise. Output could jump by around 230,000 barrels per day (bpd) in 2018, followed by another 265,000-bpd increase in 2019, according to the International Energy Agency.

As more supply comes online, the pipelines are filling up, and there is little relief in sight. Until Enbridge’s Line 3 replacement is completed – targeted for late 2019 – midstream capacity won’t expand. Enbridge recently received a crucial permit from the state of Minnesota, through which the pipeline will traverse, even though state regulators questioned the need for the pipeline. Environmental groups and Native American tribes affected by the pipeline have vowed to mount a resistance to the replacement and construction of the Line 3, echoing the protests of the Dakota Access Pipeline from two years ago.

“They're bringing highly toxic, highly poisonous tar sands oil directly through major watersheds and the last standing reserve of wild rice that the Ojibwe have to harvest,” Bill Paulson, a member of the Ojibwe tribe, told CNN last month. “Our culture is the wild rice and gathering and being out in the woods. If there's a threat to that, then there's a direct threat to the people.”

It is unclear how this will play out, but the opposition could delay the project beyond the expected start date. That means that the discount for WCS will stick around.

And because there is little, if any, empty space on Alberta’s pipelines, not only will the WCS discount linger, but the benchmark could suffer from higher volatility. “The Western Canadian oil patch is operating on the edge of available takeaway capacity, which makes discounts especially sensitive to shifts in supply (e.g. Syncrude ramping up from its outage), demand (e.g. higher-than-anticipated Midwest refinery maintenance) or marginal transport capacity (e.g. rail capacity spread too thin),” Rory Johnston, a commodity economist at Scotiabank, told Oilprice.com.

Read more

44 things you didn’t know about oil

44 things you didn’t know about oil

In theory, Alberta could build more refining capacity to process Canadian oil rather than scrambling to find pipeline space or selling at a steep discount, but refineries are expensive, and they would not resolve the problem of takeaway capacity. “The majority of hydrocarbons produced in Western Canada need to be exported--building additional refineries domestically to get around crude oil pipeline bottlenecks would simply shift it to a product pipeline capacity challenge,” Johnston said. “One way or another, those barrels still need to get to end consumers--either by pipeline, rail, barge, or truck.”

Shipping oil by rail to the US Gulf Coast can cost as much as $20 per barrel or more, according to Scotiabank, double the rate for shipping by pipeline. But with the WCS discount as large as it is, the economics could still work out. However, rail companies have been hesitant to invest in new rail capacity for shipping oil, especially if the business opportunity of doing so only lasts for another two or three years. Still, crude-by-rail shipments have climbed significantly this year, hitting a record high 198,788 barrels per day in May, the latest month for which data is available. However, even if rail economics look attractive, the lack of sufficient capacity means that rail won’t be able to entirely bridge the gap.

With midstream capacity stubbornly stuck without a near-term solution, the Canadian government has moved to essentially nationalize the Trans Mountain Expansion project, buying it from Kinder Morgan after the US-based company moved to scrap the expansion plans.

But on that front as well, Ottawa continues to receive bad news, following its desperate bid to take over the project. The Canadian Press reported on August 7 that expanding the project will cost $1.9 billion more than previously thought, and will take a year longer than expected, putting the start date off until late 2021.

Canadian Oil Crisis Continues As Prices Plunge

By Nick Cunningham - Aug 09, 2018, 6:00 PM CDT

Canadian oil producers are once again suffering from a steep discount for their oil, causing the largest spread between Canadian oil and WTI in years.

Western Canada Select (WCS) recently fell below $40 per barrel, dropping to as low as $38 per barrel on Tuesday. That put it roughly $31 per barrel below WTI, the largest discount since 2013.

The sharp decline in WCS prices is a reflection of a shortage of pipeline capacity. Much of the talk about pipeline bottlenecks these days focuses on the Permian basin, and the unfolding slowdown in shale drilling, which could curtail U.S. oil production growth. But Canada’s oil industry was contending with an inability to build new pipeline infrastructure long before Texas shale drillers.

However, the problem has grown more acute over the last 12 months. Even as pipeline takeaway capacity hasn’t budged, Canadian oil production continues to rise. Output could jump by around 230,000 barrels per day (bpd) in 2018, followed by another 265,000-bpd increase in 2019, according to the International Energy Agency.

(Click to enlarge)

As more supply comes online, the pipelines are filling up, and there is little relief in sight. Until Enbridge’s Line 3 replacement is completed – targeted for late 2019 – midstream capacity won’t expand. Enbridge recently received a crucial permit from the state of Minnesota, through which the pipeline will traverse, even though state regulators questioned the need for the pipeline. Environmental groups and Native American tribes affected by the pipeline have vowed to mount a resistance to the replacement and construction of the Line 3, echoing the protests of the Dakota Access Pipeline from two years ago. Related: Shockwave In Shipping Could Send Brent Soaring

“They're bringing highly toxic, highly poisonous tar sands oil directly through major watersheds and the last standing reserve of wild rice that the Ojibwe have to harvest,” Bill Paulson, a member of the Ojibwe tribe, told CNN last month. “Our culture is the wild rice and gathering and being out in the woods. If there's a threat to that, then there's a direct threat to the people.”

Join the world's largest energy community

with over 10,000+ members

Learn, Share, and Discuss on the OilPrice Community

It is unclear how this will play out, but the opposition could delay the project beyond the expected start date. That means that the discount for WCS will stick around.

And because there is little, if any, empty space on Alberta’s pipelines, not only will the WCS discount linger, but the benchmark could suffer from higher volatility. “The Western Canadian oil patch is operating on the edge of available takeaway capacity, which makes discounts especially sensitive to shifts in supply (e.g. Syncrude ramping up from its outage), demand (e.g. higher-than-anticipated Midwest refinery maintenance) or marginal transport capacity (e.g. rail capacity spread too thin),” Rory Johnston, a commodity economist at Scotiabank, told Oilprice.com.

In theory, Alberta could build more refining capacity to process Canadian oil rather than scrambling to find pipeline space or selling at a steep discount, but refineries are expensive, and they would not resolve the problem of takeaway capacity. “The majority of hydrocarbons produced in Western Canada need to be exported--building additional refineries domestically to get around crude oil pipeline bottlenecks would simply shift it to a product pipeline capacity challenge,” Johnston said. “One way or another, those barrels still need to get to end consumers--either by pipeline, rail, barge, or truck.” Related: Oil Prices Hit 7-Week Low As Trade War Heats Up

Shipping oil by rail to the U.S. Gulf Coast can cost as much as $20 per barrel or more, according to Scotiabank, double the rate for shipping by pipeline. But with the WCS discount as large as it is, the economics could still work out. However, rail companies have been hesitant to invest in new rail capacity for shipping oil, especially if the business opportunity of doing so only lasts for another two or three years. Still, crude-by-rail shipments have climbed significantly this year, hitting a record high 198,788 barrels per day in May, the latest month for which data is available. However, even if rail economics look attractive, the lack of sufficient capacity means that rail won’t be able to entirely bridge the gap.

With midstream capacity stubbornly stuck without a near-term solution, the Canadian government has moved to essentially nationalize the Trans Mountain Expansion project, buying it from Kinder Morgan after the U.S.-based company moved to scrap the expansion plans.

But on that front as well, Ottawa continues to receive bad news, following its desperate bid to take over the project. The Canadian Press reported on August 7 that expanding the project will cost $1.9 billion more than previously thought, and will take a year longer than expected, putting the start date off until late 2021.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- The Unforeseen Consequences Of China's Insatiable Oil Demand

- Why The U.S. Won’t Sanction Venezuela’s Oil

- Canada Frees Itself From Saudi Oil Imports

https://www.cbc.ca/news/business/canada-oil-price-1.4776207

Canada's oil price discount rises to widest gap since 2013

- Facebook

- LinkedIn

- Email

- Reddit

Pete Evans · CBC News · Posted: Aug 07, 2018 11:57 AM ET | Last Updated: August 8

The thick sludgy oil shown here, known as Western Canada Select, is more expensive to process and transport than other forms of oil, which is why it always trades at a discount. (Reuters)

The price gap between the Canadian oilsands benchmark and the more widely used American one has risen to its widest level in more than five years.

The price of the heavy type of oil that comes out of Alberta's oilsands — known as Western Canada Select — is now trading below $40 US a barrel, and was changing hands at $38.29 a barrel on Tuesday. West Texas Intermediate, which is a type of oil that's much easier to refine and as such is the much more commonly used oil price benchmark, was trading at just under $70.

That puts the gap between the two oil prices at $31.25, the widest gulf since 2013. And it means Canadian producers are getting far less for their oil than others do.

And experts are blaming the usual suspects for it: pipelines.

"Continued growth in Western Canadian oilsands production is running up against insufficient pipeline capacity," Scotiabank's commodity economist Rory Johnston said.

Despite being a major oil producer, Canada actually refines little crude oil, which means most of what the country produces has to get shipped to refineries on the U.S. Gulf Coast. And while many have been proposed, very few pipelines have actually been built, meaning that those that do exist are at full capacity.

That means Canadian oil producers have to sell their product to refineries at a discount, to offset the difficulty and cost of getting it there. Major oilsands producer Canadian Natural Resources said last week that it plans to shift its focus to invest in lighter fuel blends, to take advantage of the price mismatch. "To maximize value, we are shifting capital from primary heavy crude oil to light crude oil," CNR said in releasing its quarterly earnings.

Rail is another way for Canadian oil companies to get their oil to market, and there too, the system can't process any more oil. Canadian oil shipments by rail rose to a record 198,788 barrels of oil per day in May, the latest month for which there is available data.

That's an all-time high, but capacity is not rising fast enough to offset tight pipeline space.

Judith Dwarkin, chief economist at RS Energy Group says the uptick in crude by rail is a function of the widening price gap.

"It only takes one barrel not able to get into the pipeline for the spread to widen," she said. "Really it's egress by pipeline that needs to be addressed."

Analyst Tom Kloza of the Oil Price Information Service says lack of pipelines are to blame.

"You don't have a pipeline to move it to the Pacific Ocean where you would be golden, so you are seeing these weak numbers," Kloza said.

Another factor is shutdowns of various oil processing facilities on both sides of the border. In June, a power outage at Syncrude helped the price gap to narrow to as little as $16 a barrel, as reduced output from a major oilsands producer made it easier for other producers to get their product to market.

But that outage is over now, and Syncrude is ramping back up to full production, which has caused the comparative oversupply of WCS.

Making things worse, refineries in the U.S. have less appetite for Canadian crude. A refinery in Whiting, Ind., owned by British multinational firm BP is scheduled to go offline for maintenance later this year. The 414,000 barrels-per-day refinery "is probably the biggest customer for Canadian heavy oil," Kloza said, so it being offline will reduce demand for Western Canada Select.

"We expect that the discount is going to remain especially volatile over the next year or so as we teeter on the edge of sufficient takeaway capacity out of Western Canada," Johnston said.

Dwarkin agrees that the volatility will last for as long as pipelines continue to be an issue.

"It's a triple whammy depressing prices at our end of the pipeline system. And the impact of that is not rocket science."

https://www.rt.com/business/435712-canadian-oil-crisis-continues/

Canadian oil crisis continues as prices plunge

Published time: 11 Aug, 2018 09:18

Get short URL

© Larry Macdougal / Global Look Press

- 82

- 1

Western Canada Select (WCS) recently fell below $40 per barrel, dropping to as low as $38 per barrel on Tuesday. That put it roughly $31 per barrel below WTI, the largest discount since 2013.

The sharp decline in WCS prices is a reflection of a shortage of pipeline capacity. Much of the talk about pipeline bottlenecks these days focuses on the Permian basin, and the unfolding slowdown in shale drilling, which could curtail U.S. oil production growth. But Canada’s oil industry was contending with an inability to build new pipeline infrastructure long before Texas shale drillers.

Read more

The oil giant that outsmarted Trudeau

The oil giant that outsmarted Trudeau However, the problem has grown more acute over the last 12 months. Even as pipeline takeaway capacity hasn’t budged, Canadian oil production continues to rise. Output could jump by around 230,000 barrels per day (bpd) in 2018, followed by another 265,000-bpd increase in 2019, according to the International Energy Agency.

As more supply comes online, the pipelines are filling up, and there is little relief in sight. Until Enbridge’s Line 3 replacement is completed – targeted for late 2019 – midstream capacity won’t expand. Enbridge recently received a crucial permit from the state of Minnesota, through which the pipeline will traverse, even though state regulators questioned the need for the pipeline. Environmental groups and Native American tribes affected by the pipeline have vowed to mount a resistance to the replacement and construction of the Line 3, echoing the protests of the Dakota Access Pipeline from two years ago.

“They're bringing highly toxic, highly poisonous tar sands oil directly through major watersheds and the last standing reserve of wild rice that the Ojibwe have to harvest,” Bill Paulson, a member of the Ojibwe tribe, told CNN last month. “Our culture is the wild rice and gathering and being out in the woods. If there's a threat to that, then there's a direct threat to the people.”

It is unclear how this will play out, but the opposition could delay the project beyond the expected start date. That means that the discount for WCS will stick around.

And because there is little, if any, empty space on Alberta’s pipelines, not only will the WCS discount linger, but the benchmark could suffer from higher volatility. “The Western Canadian oil patch is operating on the edge of available takeaway capacity, which makes discounts especially sensitive to shifts in supply (e.g. Syncrude ramping up from its outage), demand (e.g. higher-than-anticipated Midwest refinery maintenance) or marginal transport capacity (e.g. rail capacity spread too thin),” Rory Johnston, a commodity economist at Scotiabank, told Oilprice.com.

Read more

44 things you didn’t know about oil

44 things you didn’t know about oil In theory, Alberta could build more refining capacity to process Canadian oil rather than scrambling to find pipeline space or selling at a steep discount, but refineries are expensive, and they would not resolve the problem of takeaway capacity. “The majority of hydrocarbons produced in Western Canada need to be exported--building additional refineries domestically to get around crude oil pipeline bottlenecks would simply shift it to a product pipeline capacity challenge,” Johnston said. “One way or another, those barrels still need to get to end consumers--either by pipeline, rail, barge, or truck.”

Shipping oil by rail to the US Gulf Coast can cost as much as $20 per barrel or more, according to Scotiabank, double the rate for shipping by pipeline. But with the WCS discount as large as it is, the economics could still work out. However, rail companies have been hesitant to invest in new rail capacity for shipping oil, especially if the business opportunity of doing so only lasts for another two or three years. Still, crude-by-rail shipments have climbed significantly this year, hitting a record high 198,788 barrels per day in May, the latest month for which data is available. However, even if rail economics look attractive, the lack of sufficient capacity means that rail won’t be able to entirely bridge the gap.

With midstream capacity stubbornly stuck without a near-term solution, the Canadian government has moved to essentially nationalize the Trans Mountain Expansion project, buying it from Kinder Morgan after the US-based company moved to scrap the expansion plans.

But on that front as well, Ottawa continues to receive bad news, following its desperate bid to take over the project. The Canadian Press reported on August 7 that expanding the project will cost $1.9 billion more than previously thought, and will take a year longer than expected, putting the start date off until late 2021.