Temasek restructuring, setting up three bodies to manage portfolio segments

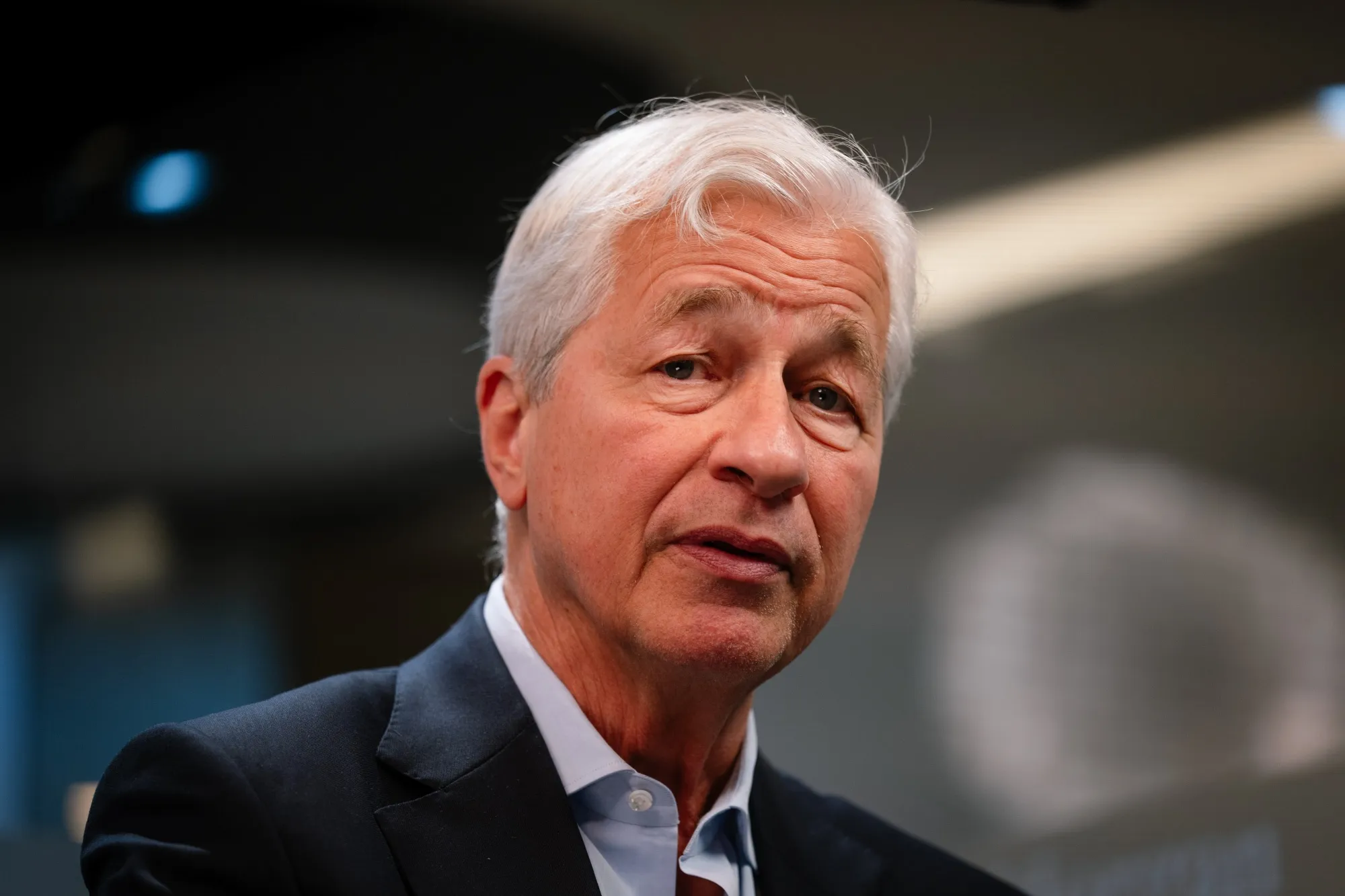

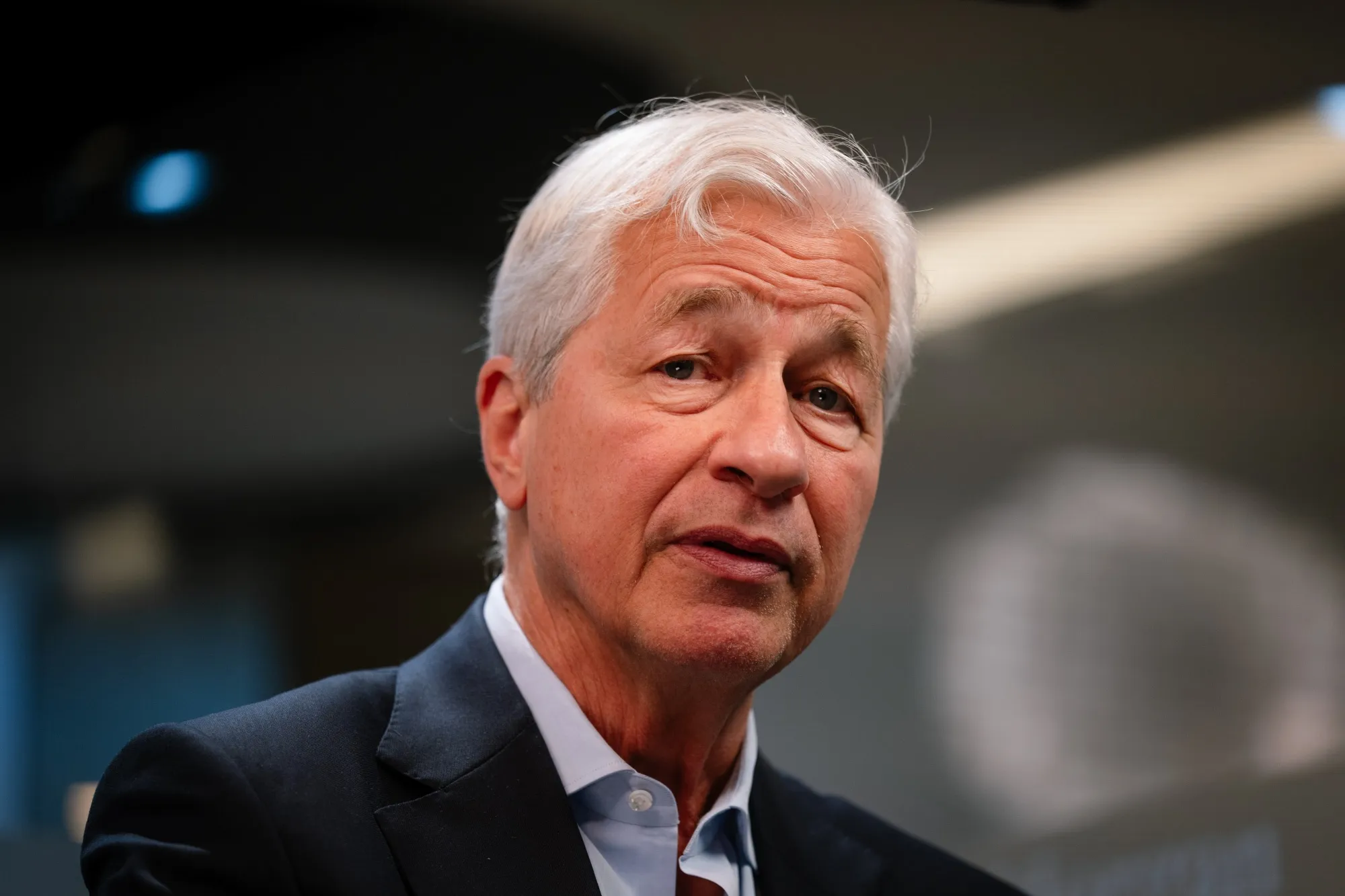

Temasek chief executive and executive director Dilhan Pillay speaking at a media briefing on Aug 28.

Aug 28, 2025

SINGAPORE - Temasek will be restructuring and setting up three entities to manage three distinct portfolio segments amid heightened global uncertainty and economic change in the macro landscape, the Singapore investment company announced on Aug 28.

The three portfolio segments will be: global direct investments; Singapore-based Temasek portfolio companies (TPCs); and partnerships, funds and asset management companies (PFAs).

To manage these three segments, Temasek will set up three wholly owned entities called Temasek Global Investments, Temasek Singapore for TPCs and Temasek Partnership Solutions for PFAs, with effect from April 1, 2026.

These will drive Temasek’s growth as the firm continues to build a resilient and forward-looking portfolio, it said.

Temasek chief executive and executive director Dilhan Pillay said at a media briefing: “The world does change from time to time, but we have had a relative time of stability over the last 30 years, especially since the World Trade Organisation came about… and so our organisation structure has been fairly stable over the last 20 years.”

But things have changed for many, whether they are governments, multinational corporations, domestic companies, and even individuals and societies, he added.

“And so we definitely need to realign our organisational structure, for this new environment that we are in and around the three portfolio entities that we have,” said Mr Pillay.

He added that the most important thing is to adapt the organisation to cater to changes that are likely to be ahead, and be more agile and nimble.

Temasek has also constantly evolved over the last 50 years, and typically when there are crises, Mr Pillay added.

“As the old adage says, never waste a crisis. We are ensuring that we are not wasting what’s happening today in the global environment,” he said.

In 2002, nearly all of Temasek’s portfolio – at 94 per cent – was in its Singapore-based TPCs, with only 4 per cent in global direct investments and 2 per cent in PFAs.

Over the decades, the portfolio allocation to global direct investments and PFAs grew. As at March 2025, Singapore-based TPCs make up 41 per cent of Temasek’s portfolio, while global direct investments make up 36 per cent and PFAs 23 per cent.

This was because Temasek wanted to become a truly global investor, Mr Pillay said, which meant not just investing in Asia and emerging markets, but also stepping up investments in America and Europe.

Mirroring Temasek’s growth in its global investments, the group now has 13 offices worldwide and 959 employees.

Mr Pillay said the target now is to keep the global direct investments and TPCs to around 40 per cent each, and 20 per cent to PFAs. But depending on the volatility of the market, Temasek can rebalance slightly among these three engines according to the opportunities it sees.

He added that when it comes to resilience and volatility, the resilient component of the portfolio – which consists of core portfolio companies, some companies globally and private credit – should be around 60 per cent. This component should deliver stable returns over time, with a narrower range of outcomes, he said.

Mr Dilhan Pillay added that the most important thing is to adapt Temasek to cater to changes that are likely to be ahead, and be more agile and nimble.

ST PHOTO: KUA CHEE SIONG

The remaining 40 per cent can be in a dynamic component, which includes innovation and emerging technologies, with strong growth prospects and long-term compounding potential.

In response to media questions on why Temasek decided to reorganise now, Mr Pillay said that the world today is different even from when Temasek

celebrated its 50th anniversary in September 2024.

“The rules-based order that we’ve been used to, that we’ve been able to rely upon as an investment firm… is changing. The United States has got a very clear objective of ‘America first’, and other countries are now trying to figure out how to operate within that framework that they have,” he said.

“It’s never a good time to do anything. It’s just the right time. The world is changing. If we just sit back and be the way we are, it might not be the right thing.”

Ultimately, the three new segments will allow Temasek to anchor its strategy for 2030 and beyond, especially since the portfolio segments have distinct attributes, he said.

This is because global direct investments, TPCs and PFAs require different strategies and capabilities, he added.

Temasek Global Investments: To focus on world market leaders

As at March 31, $155 billion of Temasek’s overall portfolio is in global direct investments. The value of its global direct investments has also grown more than 20 times from 2004 to 2025.

Temasek is generally a minority investor in these global investments, said Mr Pillay.

“In order to take a control position, you have to be prepared to own ‘the morning after’ of the whole company, not just the investment. That means you have to have a multitude of skill sets to be able to do it,” he said.

This differs from Temasek’s TPCs, where Temasek contributes to the firms’ business development, business model evolution and transformation. In some cases, it also has a member on the company’s board.

When it comes to global investments, growth equity is Temasek’s main focus, Mr Pillay said. It also has co-investments, sector or market funds, and public market investments.

It also still invests in early-stage investments because it believes in innovation as a driver of future growth, but Temasek is very selective in such investments in the current global environment, he added.

About a third of Temasek’s global direct investments are headquartered in the Americas. By sector, the top industry these investments are from is financial services, followed by telecommunications, media and technology.

Success drivers for global direct investments include sourcing good deals, having deep market or sectoral expertise, active portfolio management and being able to influence the outcomes.

Temasek Singapore: To enhance the value of home-grown companies

Temasek Singapore will focus on active portfolio management to enhance the value of its Singapore-based TPCs, enabling them to be globally competitive while staying rooted in Singapore.

These companies have an aggregate revenue of about $200 billion and employ over 160,000 people in Singapore. They include firms like DBS Bank, CapitaLand, Keppel, PSA, Sembcorp, Seatrium and Singtel.

As at March 31, $180 billion of Temasek’s overall portfolio is in its TPCs.

The challenge for these companies is to be resilient and adapt to a changing world, with issues such as the disruption to business models and operations from artificial intelligence, Mr Pillay said.

“With the portfolio companies, it is not just the financial metrics. Operating metrics are critical – the way the company is building itself up… even talent becomes an issue for us to consider. We have to make sure that there are good labour relations, because everybody should prosper when the company prospers,” he said.

The underlying country exposure of the portfolio companies is still concentrated in Singapore, with 54 per cent here, 14 per cent in China, 4 per cent in India, and 15 per cent in the rest of the Asia-Pacific.

Mr Pillay added that companies can also think about whether they can have more exposure beyond Asia, to Europe, the Middle East and America.

Drivers for success for these companies also include continuous transformation, orienting their strategies, having a sustainability framework and communicating well with their investors.

Temasek Partnership Solutions: To scale capital, tap opportunities

This segment will focus on managing the allocation of capital to invest in funds and build strategic relationships with these funds and other investors, Temasek said.

This will also involve working with Seviora Holdings, Temasek’s main asset management platform, to deepen relationships with partners. Seviora’s board will also be reconstituted, with Mr Pillay taking the role of chairman from Sept 1.

Temasek’s asset management companies have over $90 billion of assets under management as at March 31.

This entity will then help Temasek to scale its capital and tap a broad range of opportunities that include offering capital solutions such as private equity, private credit, public market investments, and tailored financing options.

At the end of the day, these strategies will help Temasek navigate changes in the world so it can fulfil its responsibility to the community and Singapore.

Mr Pillay noted that Temasek is very aware of its responsibility entrusted to it by the Government, alongside bodies like GIC and the Monetary Authority of Singapore.

When asked whether the reorganisation would help Temasek in its goal of maximising returns from Singapore’s reserves, Mr Pillay said it is about a long-term returns trajectory based on where Temasek invests and the outlook for equities, and how the portfolio is structured.

“And I think when you are in an environment which is changing, and if you’ve been given that responsibility to get returns over that changing environment, the ability to anticipate when you have to put more risk on and take risk off is not easy. It’s not straightforward,” he said.

Temasek added: “In a rapidly changing world, with rising geopolitical tensions and changes to the rules-based order, Temasek has to sense the changes in our operating landscape, adapt our organisational structure to support portfolio strategies for growth and returns, and perform with greater accountability and alignment.”