- Joined

- Jul 25, 2008

- Messages

- 15,380

- Points

- 113

Andrew Willans

Andrew WillansAndrew Willans• 3rd+• 3rd+Private Real EstatePrivate Real Estate

2h • Edited • 2h • Edited •

Follow

VC due diligence - how it started & how its going …

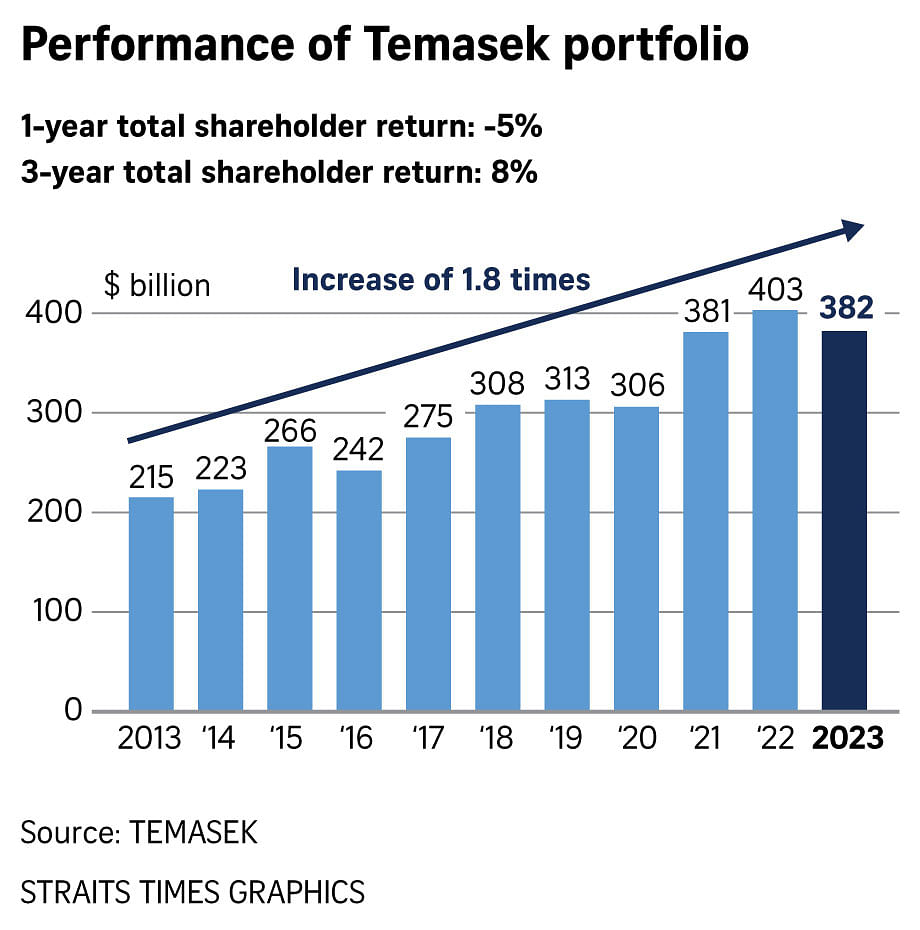

Temasek did 8 months of due diligence on its investment in FTX. Temasak said:

“Similar to all investments, we conducted an extensive due diligence process on FTX, which took approximately 8 months from February to October 2021. During this time, we reviewed FTX’s audited financial statement, which showed it to be profitable…In addition, our due diligence efforts focused on the associated regulatory risk with crypto financial market service providers, particularly licensing and regulatory compliance”

Temasek - Singapore

"Alameda is un-auditable... we are only able to ballpark what its balances are, let alone something like a comprehensive transaction history. We sometimes find $50m of assets lying around that we lost track of; such is life" according to Sam Bankman-Fried

The following are excerpts from the First Interim Report of John J. Ray III to the Independent Directors on Control Failures at the FTX Exchanges) filed on April 9, 2023:

"Thousands of deposit checks were collected from the FTX Group’s offices, some stale-dated for months, due to the failure of personnel to deposit checks in the ordinary course; instead, deposit checks collected like junk mail."

“Accounts were opened using names and email addresses that were not obviously linked to FTX, using pseudonymous email addresses, in the names of shell companies created for these purposes, or in the names of individuals (including individuals with no direct connection FTX)”

"The FTX group had no cybersecurity staff whatsoever."

"FTX stored private keys to its crypto wallets in AWS."

"Fifty-six entities within the FTX Group did not produce financial statements of any kind."

"Approximately 80,000 transactions were simply left as unprocessed accounting entries in catch-all QuickBooks accounts titled 'Ask My Accountant.'"

"Transfers in the tens of millions of dollars were approved via Slack emoji, or discussed in disappearing Signal or Telegram chats."

“FTX had "an environment in which a handful of employees had, among them, virtually limitless power to direct transfers of fiat currency and crypto assets and to hire and fire employees, with no effective oversight or controls to act as checks on how they exercised those powers."

Eight months of due diligence is a lot.

Above info courtesy of Molly White's Twitter Feed.

Andrew WillansAndrew Willans• 3rd+• 3rd+Private Real EstatePrivate Real Estate

2h • Edited • 2h • Edited •

Follow

VC due diligence - how it started & how its going …

Temasek did 8 months of due diligence on its investment in FTX. Temasak said:

“Similar to all investments, we conducted an extensive due diligence process on FTX, which took approximately 8 months from February to October 2021. During this time, we reviewed FTX’s audited financial statement, which showed it to be profitable…In addition, our due diligence efforts focused on the associated regulatory risk with crypto financial market service providers, particularly licensing and regulatory compliance”

Temasek - Singapore

"Alameda is un-auditable... we are only able to ballpark what its balances are, let alone something like a comprehensive transaction history. We sometimes find $50m of assets lying around that we lost track of; such is life" according to Sam Bankman-Fried

The following are excerpts from the First Interim Report of John J. Ray III to the Independent Directors on Control Failures at the FTX Exchanges) filed on April 9, 2023:

"Thousands of deposit checks were collected from the FTX Group’s offices, some stale-dated for months, due to the failure of personnel to deposit checks in the ordinary course; instead, deposit checks collected like junk mail."

“Accounts were opened using names and email addresses that were not obviously linked to FTX, using pseudonymous email addresses, in the names of shell companies created for these purposes, or in the names of individuals (including individuals with no direct connection FTX)”

"The FTX group had no cybersecurity staff whatsoever."

"FTX stored private keys to its crypto wallets in AWS."

"Fifty-six entities within the FTX Group did not produce financial statements of any kind."

"Approximately 80,000 transactions were simply left as unprocessed accounting entries in catch-all QuickBooks accounts titled 'Ask My Accountant.'"

"Transfers in the tens of millions of dollars were approved via Slack emoji, or discussed in disappearing Signal or Telegram chats."

“FTX had "an environment in which a handful of employees had, among them, virtually limitless power to direct transfers of fiat currency and crypto assets and to hire and fire employees, with no effective oversight or controls to act as checks on how they exercised those powers."

Eight months of due diligence is a lot.

Above info courtesy of Molly White's Twitter Feed.