-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CPF Life drawdown age raised from 62 to 65

- Thread starter theDoors

- Start date

- Joined

- Sep 9, 2011

- Messages

- 7,813

- Points

- 0

cathylmg said:For your info, nowadays all on 30 years liao. Don't belief go and check it out yourself...

30 years is probably enough time to get re-born.

- Joined

- Mar 20, 2011

- Messages

- 4,440

- Points

- 0

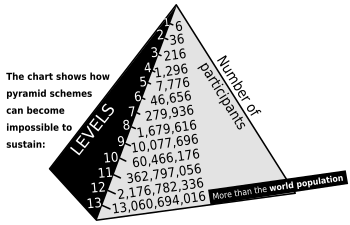

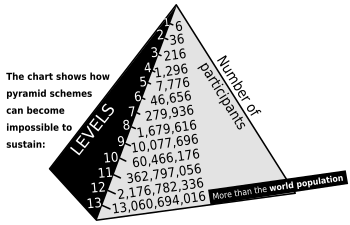

Pyramid Scam

I call it "the last man dies scheme". Those who are in the front will get the monies pooled in by those younger folks. Even if the pool shrinks to a low level (not sustainable), this can be funded by other means (legally or illegally) until someone blows the whistle. This is also the time that all CEOs will flee and the companies owing monies to punters (CPF account holders too) will collapse.

The best way out is to migrate, disown Singapore as 'citizens' and draw out the monies quickly before any bad news is being announced. Just don't be the last suckers because there's no prize or medal to become suckers.

I call it "the last man dies scheme". Those who are in the front will get the monies pooled in by those younger folks. Even if the pool shrinks to a low level (not sustainable), this can be funded by other means (legally or illegally) until someone blows the whistle. This is also the time that all CEOs will flee and the companies owing monies to punters (CPF account holders too) will collapse.

The best way out is to migrate, disown Singapore as 'citizens' and draw out the monies quickly before any bad news is being announced. Just don't be the last suckers because there's no prize or medal to become suckers.

- Joined

- Sep 4, 2008

- Messages

- 4,315

- Points

- 0

I think the govt should come out with a third option, called the CPF After Life option.

knn!!! hahahaha!!!

- Joined

- Jul 10, 2008

- Messages

- 36,081

- Points

- 113

Since the 1980s, the PAP has been devising schemes after schemes on how not to release the CPF monies that are due to us. At first they try persuasion and encouragement to get S'poreans to delay withdrawing their CPF balances but when that failed, they blatantly passed laws in broad daylight to force us to leave our CPF monies with them longer.

that's what happens when they have over two thirds majority in Parliament, any policy good or bad can get bulldozed thru' with little effort.

screw this CPF Life, PTUI! never had me supported this compulsory annuity shit since this idea was conceived back in 07, and as long as they don't have an option for me to opt out of it, me will continue to vote against PAP in the GE.

PTUI! right now even intending to cut down to two options only and opting out isn't an option! PTUI!

- Joined

- Apr 6, 2009

- Messages

- 4,963

- Points

- 63

What if a CPF member dies before drawdown age 65 ?What if a CPF member is sick or poor or jobless and need money for daily survival between 55 to 65 ?

PAP's Moto:- As long as we hold the money, you die your business.

Wow...die die cannot retire or die in SG...must run road!

You die in Singapore before as certain age they will take your kidney first if you did not opt out.

that's what happens when they have over two thirds majority in Parliament, any policy good or bad can get bulldozed thru' with little effort.

screw this CPF Life, PTUI! never had me supported this compulsory annuity shit since this idea was conceived back in 07, and as long as they don't have an option for me to opt out of it, me will continue to vote against PAP in the GE.

PTUI! right now even intending to cut down to two options only and opting out isn't an option! PTUI!

That's right, do not get fooled by the PAP, especially when it comes to your CPF. Always remember, it is not you that the PAP is concerned with. Whatever CPF schemes they conceived of is to fit into their purposes, mainly to retain the CPF monies as long as they can such that GIC and Temasek continues to enjoy the cheapest source of funds for them to punt in the investment (casino) world. In other words, all the losses they have racked up are our CPF monies!!!

- Joined

- Oct 17, 2008

- Messages

- 867

- Points

- 0

CPF Life scheme can do better ...

04:46 AM Mar 08, 2012

Letter from Tan Say Yin

THERE are two negatives in the Central Provident Fund Life scheme: Low payouts and, especially, the uncertainty of the monthly quantum, which could fluctuate yearly depending on interest rates.

And if the payout is at the lower end of the range, it could be further eroded by inflation in the future.

Private companies can structure their annuities with a locked-in monthly payout, with some even providing participating annuities whereby bonuses could be declared, which then raise the monthly payout.

The CPF Life scheme surely could do better, since it has a larger pool of members, as it is mandatory from next year for the majority of Singaporeans who turn 55.

I am in my late 50s and am looking at various options for my retirement. Using the CPF online calculator, I did some comparisons.

Assuming I have S$117,000 in my Retirement Account, the Minimum Sum monthly payout would be S$1,040 from the age of 65. The current CPF Life Balanced Plan, however, would provide a lower monthly payout ranging from S$768 to S$844.

I am aware that the monthly payouts last for as long as a member lives, But the Minimum Sum example I quoted could last for a good 20 years, likely to be sufficient for most Singaporeans.

Even if the difference in payouts between the two schemes was, say, only S$136, I would get S$32,640 more under the Minimum Sum scheme.

I could set aside this amount to possibly give me another three years of allowance, taking me to a ripe old age of 88 years. I am therefore not sold on CPF Life.

URL http://www.todayonline.com/Voices/EDC120308-0000059/CPF-Life-scheme-can-do-better-,,,

Copyright 2012 MediaCorp Pte Ltd | All Rights Reserved

04:46 AM Mar 08, 2012

Letter from Tan Say Yin

THERE are two negatives in the Central Provident Fund Life scheme: Low payouts and, especially, the uncertainty of the monthly quantum, which could fluctuate yearly depending on interest rates.

And if the payout is at the lower end of the range, it could be further eroded by inflation in the future.

Private companies can structure their annuities with a locked-in monthly payout, with some even providing participating annuities whereby bonuses could be declared, which then raise the monthly payout.

The CPF Life scheme surely could do better, since it has a larger pool of members, as it is mandatory from next year for the majority of Singaporeans who turn 55.

I am in my late 50s and am looking at various options for my retirement. Using the CPF online calculator, I did some comparisons.

Assuming I have S$117,000 in my Retirement Account, the Minimum Sum monthly payout would be S$1,040 from the age of 65. The current CPF Life Balanced Plan, however, would provide a lower monthly payout ranging from S$768 to S$844.

I am aware that the monthly payouts last for as long as a member lives, But the Minimum Sum example I quoted could last for a good 20 years, likely to be sufficient for most Singaporeans.

Even if the difference in payouts between the two schemes was, say, only S$136, I would get S$32,640 more under the Minimum Sum scheme.

I could set aside this amount to possibly give me another three years of allowance, taking me to a ripe old age of 88 years. I am therefore not sold on CPF Life.

URL http://www.todayonline.com/Voices/EDC120308-0000059/CPF-Life-scheme-can-do-better-,,,

Copyright 2012 MediaCorp Pte Ltd | All Rights Reserved

- Joined

- Oct 17, 2008

- Messages

- 867

- Points

- 0

http://www.asiaone.com/Business/My+...And+Savings/Story/A1Story20090914-167794.html

With rising life expectancy, it is prudent to ensure that your retirement savings will last for all your days.

The opt-in system began on Sept 5 and is open to older CPF members who wish to join the annuity scheme ahead of 2013, when it will be implemented for those turning 55 then. For older CPF members, the monthly payouts will start as early as next January.

While many are still undecided, some, like Madam Wong Kwai Sim, 55, have taken the plunge. She has opted for the CPF Life Balanced Plan, which will give her an estimated monthly payout of $856 to $948 when she hits 65.

Madam Wong, who works part-time as a clerk, currently has $117,000 in her Retirement Account, which is also the prevailing MS.

Last edited:

- Joined

- Oct 17, 2008

- Messages

- 867

- Points

- 0

CPF Life payouts are for life

Annuity premiums and payouts at Govt's discretion and will vary, says minister. -myp

Tue, Jul 21, 2009

my paper

http://www.asiaone.com/print/Business/News/My+Money/Story/A1Story20090721-156078.html

Not even 5 years into the scheme, the payout has already been reduced.

Annuity premiums and payouts at Govt's discretion and will vary, says minister. -myp

Tue, Jul 21, 2009

my paper

http://www.asiaone.com/print/Business/News/My+Money/Story/A1Story20090721-156078.html

In response, Mr Gan said that a guaranteed monthly amount is not feasible and that it would be adjusted regularly to ensure the fund's solvency.

Not even 5 years into the scheme, the payout has already been reduced.

that's what happens when they have over two thirds majority in Parliament, any policy good or bad can get bulldozed thru' with little effort.

They knew the importance of this and that's why they have been going great lengths to make sure they have this advantage every election. I believe being opposition party member in parliament is not easy and with limited access to information, they have to try their means to gun down issues they think is not right very carefully. Else they may appear to be making a fool of themselves by the ruling party and most readily amplified by the media to run them down. Due to their scarcity and at disadvantaged position, it would be unfair to expect them to deliver knockout blows every punch. We need them stay long enough in parliament to watch our backs for us until a stage where they have gown in strength and numbers to a more level playing field, then a more critical and demanding expectation will be more appropriate.

Last edited:

- Joined

- Jul 10, 2008

- Messages

- 36,081

- Points

- 113

We need them stay long enough in parliament to watch our backs for us until a stage where they have gown in strength and numbers to a more level playing field, then a more critical and demanding expectation will be more appropriate.

bro erection2011 taught me an important lesson earlier. true winners need not win all the time

True.

The pap still controls all the information.

They decide what to release and what to keep secret.

So those things they don't want let us know we will never know.

Including the oppositions.

How to do a good fight when the opp don't even have the information availiable?

The pap still controls all the information.

They decide what to release and what to keep secret.

So those things they don't want let us know we will never know.

Including the oppositions.

How to do a good fight when the opp don't even have the information availiable?

- Joined

- Sep 9, 2011

- Messages

- 7,813

- Points

- 0

freedalas said:That's right, do not get fooled by the PAP, especially when it comes to your CPF. Always remember, it is not you that the PAP is concerned with. Whatever CPF schemes they conceived of is to fit into their purposes, mainly to retain the CPF monies as long as they can such that GIC and Temasek continues to enjoy the cheapest source of funds for them to punt in the investment (casino) world. In other words, all the losses they have racked up are our CPF monies!!!

Imagine drawdown age one day increases to 85.

Similar threads

- Replies

- 3

- Views

- 1K

- Replies

- 3

- Views

- 367

- Replies

- 0

- Views

- 245

- Replies

- 11

- Views

- 1K

- Replies

- 10

- Views

- 1K