You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

China's Done With U.S. Semiconductors, Japan Stocks Collapse As “Asian NATO” PM Wins

- Thread starter LaoTze

- Start date

- Joined

- Dec 6, 2018

- Messages

- 17,397

- Points

- 113

Where are all the ACS ? Not condemning this fake news ? LOL

- Joined

- Jun 27, 2018

- Messages

- 30,783

- Points

- 113

So chicons lands has won the war? Yankeeland is fucked?

- Joined

- Aug 14, 2008

- Messages

- 10,395

- Points

- 113

Where are all the ACS ? Not condemning this fake news ? LOL

It has already been said many times about this bullshit news. Only retarded commiecunts still believe in this bullshit. Just like how flat earth believers believe in flat earth and how Islamist terrorists believe in pedophile Muhammad and man-made Allah.

Just look at how their CCP China-made C919 doing now.

- Joined

- Jun 27, 2018

- Messages

- 30,783

- Points

- 113

It has already been said many times about this bullshit news. Only retarded commiecunts still believe in this bullshit. Just like how flat earth believers believe in flat earth and how Islamist terrorists believe in pedophile Muhammad and man-made Allah.

Just look at how their CCP China-made C919 doing now.

dude...it's just teething problems...they will catch up with the ang mors...if they don't get their act together

- Joined

- Aug 14, 2008

- Messages

- 10,395

- Points

- 113

They can't. Making CPU/GPU chips is not like making chocolate chips. There are many specialised machines that only the west can provide and they are banned from selling to CCP and the likes. Even the current so called China-made chips which is old tech above 7 nano micron, still need those specialised machine from the west. China cannot make them and still need the west to provide maintenance and repair services. If those are also stop, then you can say bye bye to CCP China-made chips.dude...it's just teething problems...they will catch up with the ang mors...if they don't get their act together

Only commiecunt simpletons think CCP can one stop shop. Even their bullshit CCP China-made airplane C919 were just only the shell made by CCP China. Many of the critical internal parts of the plane were imported from the west and only the west can provide the qualified spare parts. Without the west, the airplane is a flying tomb.

Last edited:

- Joined

- Sep 22, 2008

- Messages

- 83,171

- Points

- 113

No point being nice to the US. They are ruthless. Look at the way they totally ignored the plight of other nations. Their interest, or rather the interest of the dark state comes first.So chicons lands has won the war? Yankeeland is fucked?

- Joined

- Jul 25, 2018

- Messages

- 4,593

- Points

- 113

No point being nice to the US. They are ruthless. Look at the way they totally ignored the plight of other nations. Their interest, or rather the interest of the dark state comes first.

- Joined

- May 16, 2023

- Messages

- 39,148

- Points

- 113

Global banks to use Swift for trialling live digital asset transactions from 2025

Technology and Innovation,3 October 2024 | 4 min read

- Banks across North America, Europe and Asia will use Swift connectivity to conduct live trials of digital asset and currency transactions as innovation accelerates from experimental phase to real-world application

- The trials follow groundbreaking collaborative work with dozens of financial institutions that have demonstrated Swift’s ability to connect multiple digital networks, technologies and asset classes

Swift has already successfully demonstrated that it can transfer tokenised value across public and private blockchains, interlink central bank digital currencies (CBDCs) globally, and integrate multiple digital asset and cash networks.

The new trials will explore how Swift can provide its community of financial institutions with a single window of access to multiple digital asset classes and currencies – paving the way for their seamless integration into the wider financial system. Initial use cases will focus on payments, FX, securities, and trade, to enable multi-ledger Delivery-versus-Payment (DvP) and Payment-versus-Payment (PvP) transactions.

Latest industry figures show that 134 countries are currently exploring CBDCs , and the tokenised asset market is projected to reach $16 trillion by 2030 . But the rapid growth of unconnected platforms and technologies has led to an increasingly fragmented landscape, creating a complex web of 'digital islands’ that presents a significant barrier to global adoption.

Swift’s trials will leverage its unique position at the heart of the financial system to interlink these disparate networks with each other as well as with existing fiat currencies, enabling its global community to seamlessly transact using digital assets and currencies alongside traditional forms of value, using their existing infrastructure.

- Joined

- May 16, 2023

- Messages

- 39,148

- Points

- 113

Earlier this month, Swift was named as a participant in Project Agorá, a Bank for International Settlements-led project exploring the integration of tokenised commercial bank deposits and tokenised wholesale CBDCs on a unified platform.

Tom Zschach, Chief Innovation Officer, Swift, said: "For digital assets and currencies to succeed on a global scale, it’s critical that they can seamlessly coexist with traditional forms of money. With Swift’s vast global reach we are uniquely positioned to bridge both emerging and established forms of value, and we’re now focused on demonstrating this in real-world, mainstream applications. As new forms of value emerge, our intention is to continue offering our community the ability to seamlessly make and track transactions of all kinds of assets - using the same secure and resilient infrastructure that is integral to their operations today."

Tom Zschach, Chief Innovation Officer, Swift, said: "For digital assets and currencies to succeed on a global scale, it’s critical that they can seamlessly coexist with traditional forms of money. With Swift’s vast global reach we are uniquely positioned to bridge both emerging and established forms of value, and we’re now focused on demonstrating this in real-world, mainstream applications. As new forms of value emerge, our intention is to continue offering our community the ability to seamlessly make and track transactions of all kinds of assets - using the same secure and resilient infrastructure that is integral to their operations today."

- Joined

- May 16, 2023

- Messages

- 39,148

- Points

- 113

TSMC Halts AI Chip Production for Chinese Firms Following U.S. Directive

- Editor Kim Eun-jin

- 2024.11.11 15:24

facebook(으)로 기사보내기 twitter(으)로 기사보내기 URL Copy(으)로 기사보내기 링크드인(으)로 기사보내기 Send to Email Share Scrap

U.S. Restricts Export of Advanced Semiconductors Below 7nm Citing National Security

On Nov. 9, Taiwan Semiconductor Manufacturing Company (TSMC) announced its decision to halt the production of artificial intelligence (AI) semiconductors for Chinese companies, following an order from the U.S. government. This move comes amid escalating tensions between the United States and China over technology and trade, marking a significant development in the ongoing rivalry between the two superpowers.

The U.S. Department of Commerce recently sent a document to TSMC outlining restrictions on the export of advanced semiconductors below 7 nanometers (nm), which are crucial for AI accelerators and graphics processing units (GPUs). Reuters reported that these restrictions are part of broader efforts to curb China's access to cutting-edge technology, citing national security concerns.

In response to the U.S. directive, TSMC has notified its Chinese customers that it will no longer accept orders for semiconductors below 7nm starting from Nov. 11. The Financial Times (FT) added that TSMC would require separate approval from the U.S. to supply these advanced semiconductors to Chinese companies in the future.

- Joined

- Sep 22, 2008

- Messages

- 83,171

- Points

- 113

US treats china like its a third rate small arab nation. Its market is as big as the US or the EU. Its a major consumer market as well as a producer. Cutting off china is like killing your own businesses. When china was thriving, so was the US and the EU. GM and VW sold more cars in china than the US.So chicons lands has won the war? Yankeeland is fucked?

Unfortunately, just like russia, the white people see china as a threat to their dominance. It must be curtailed and a new US submissive regime put in place. Just like in europe, japan and south korea.

Last edited:

- Joined

- May 16, 2023

- Messages

- 39,148

- Points

- 113

Exclusive: US ordered TSMC to halt shipments to China of chips used in AI applications

By Karen Freifeld and Fanny PotkinNovember 10, 20241:12 PM GMT+8Updated a day ago

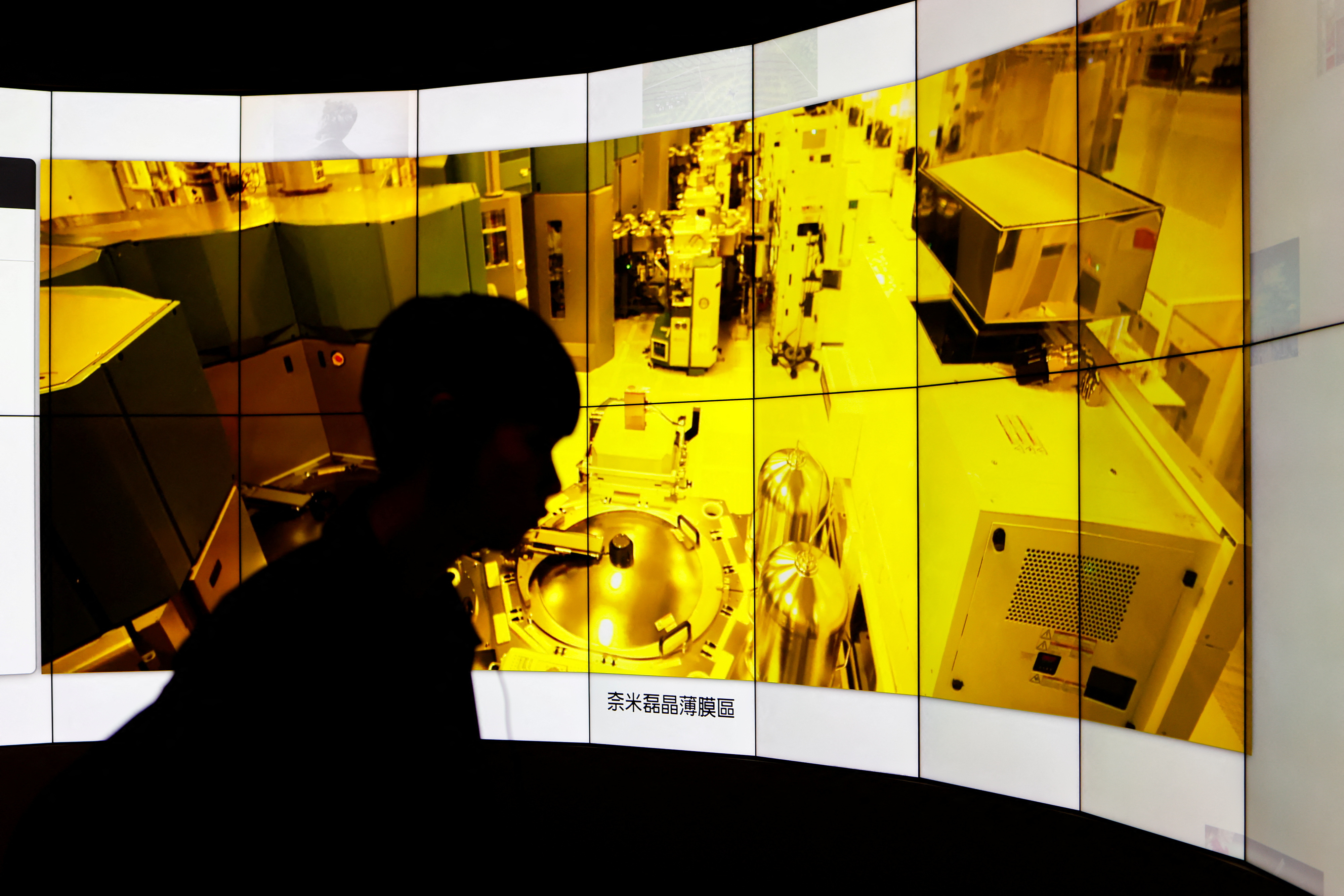

Item 1 of 2 A person visits TSMC Museum of Innovation in Hsinchu, Taiwan May 29, 2024. REUTERS/Ann Wang/File Photo

[1/2]A person visits TSMC Museum of Innovation in Hsinchu, Taiwan May 29, 2024. REUTERS/Ann Wang/File Photo Purchase Licensing Rights, opens new tab

NEW YORK/SINGAPORE, Nov 9 (Reuters) - The U.S. ordered Taiwan Semiconductor Manufacturing Co (2330.TW), opens new tab to halt shipments of advanced chips to Chinese customers that are often used in artificial intelligence applications starting Monday, according to a person familiar with the matter.

The Department of Commerce sent a letter to TSMC imposing export restrictions on certain sophisticated chips, of 7 nanometer or more advanced designs, destined for China that power AI accelerator and graphics processing units (GPU), the person said.

00:32How AI is helping decode the oinks and grunts of pigsSkip in 2s

The U.S. order, which is being reported for the first time, comes just weeks after TSMC notified the Commerce Department that one of its chips had been found in a Huawei AI processor, as Reuters reported last month. Tech research firm Tech Insights had taken apart the product, revealing the TSMC chip and apparent violation of export controls.

Huawei, at the center of the U.S. action, is on a restricted trade list, which requires suppliers to obtain licenses to ship any goods or technology to the company. Any license that could aid Huawei's AI efforts would likely be denied.

- Joined

- Jun 27, 2018

- Messages

- 30,783

- Points

- 113

Chicons land as a consumer market is way over rated. The vw tat U mentioned was because the chicons still learning from foreign companies via JVs. Now these companies can sell their own products...they are dumping foreign investors. Chicons have the worst economics mercantilism. So now foreign companies n gahmens fight back. The chicons reap wat they sowUS treats china like its a third rate small arab nation. Its market is as big as the US or the EU. Its a major consumer market as well as a producer. Cutting off china is like killing your own businesses. When china was thriving, so was the US and the EU. GM and VW sold more cars in china than the US.

Unfortunately, just like russia, the white people see china as a threat to their dominance. It must be curtailed and a new US submissive regime put in place. Just like in europe, japan and south korea.

what tiongkok is facing now with foreign investment, factory, financial institute, and etc thus causing its economy to fall are rippling through the US and EU economy to suffer as well with factory bankrupt, worker layoff, higher debt. They will next face the same fade as tiongkok

- Joined

- Jan 23, 2022

- Messages

- 2,092

- Points

- 83

1. Communist China had made many mistakes when it closed its economy thru the narrow mindedness of the devil Mao, in a World in positive changes & sadly left millions of its citizens starved & dead on foolish policies. When the revered & only TRUE leader of China -Deng Xiao Ping, was released from captivity upon death of Mao, he opened up China in 1979 & saw millions of Chinese citizen lives uplifted from abject poverty.

Sadly, it did not continue as there were forces in power within China. China is NOT easy to govern, with 1.4Billion Humans still stuck on the corrupted Maoist 'red book' beliefs, & thus the Rule of Might was sadly necessary & even comprehensible... but it had even extended to foreign investments, whom were only bullied, had their productivity, extensive life savings/funds & tech advances stolen outright, even though they were the ones whom had provided jobs, knowledge & much more to China citizens....

2. China is a MAJOR EXPORTING nation, even as it lacked much necessary mineral & societal resources. It claimed to be a factory of the World, but such were thru sweatshops & stolen tech. One day, it may be able to match the Free World on producing even critical microchips & production machines, but then...who in the Free World would be foolish enough to buy & trust its often dubious products that look good, luxurious, but will crumble within short time, as China is well known for decades for cutting corners to make a few bucks from the naive?

3. Much of the Free World is self sufficient as they have resources, labor, Rule of law, etc, such as USA, Australia, EU if they can stay united, lush fertile valleys of S.E Asia thru ASEAN, etc. that they would need any products made from the so called 'factory of the World' that is claimed by China & its paid or moronic lobbyists.

China, for sure is no consumerist society unlike the Free World nations. There is no middle class. Only the relatively few rich are consumers, like India's elites & the poor are kept poor & neglected....

Should protectionism thru trade tariffs come into place, to protect each individual nation's or grouping's economy, jobs & progress - guess which country will suffer the most?

Reformation of trade & political policies will be needed within China. The Chinese too are only our fellow Humans & no one would want to see any fellow Human starved....We Humankind may not be able to change the past, but the future for oneself, loved ones & society is yet unwritten, to progress & evolve...

Sadly, it did not continue as there were forces in power within China. China is NOT easy to govern, with 1.4Billion Humans still stuck on the corrupted Maoist 'red book' beliefs, & thus the Rule of Might was sadly necessary & even comprehensible... but it had even extended to foreign investments, whom were only bullied, had their productivity, extensive life savings/funds & tech advances stolen outright, even though they were the ones whom had provided jobs, knowledge & much more to China citizens....

2. China is a MAJOR EXPORTING nation, even as it lacked much necessary mineral & societal resources. It claimed to be a factory of the World, but such were thru sweatshops & stolen tech. One day, it may be able to match the Free World on producing even critical microchips & production machines, but then...who in the Free World would be foolish enough to buy & trust its often dubious products that look good, luxurious, but will crumble within short time, as China is well known for decades for cutting corners to make a few bucks from the naive?

3. Much of the Free World is self sufficient as they have resources, labor, Rule of law, etc, such as USA, Australia, EU if they can stay united, lush fertile valleys of S.E Asia thru ASEAN, etc. that they would need any products made from the so called 'factory of the World' that is claimed by China & its paid or moronic lobbyists.

China, for sure is no consumerist society unlike the Free World nations. There is no middle class. Only the relatively few rich are consumers, like India's elites & the poor are kept poor & neglected....

Should protectionism thru trade tariffs come into place, to protect each individual nation's or grouping's economy, jobs & progress - guess which country will suffer the most?

Reformation of trade & political policies will be needed within China. The Chinese too are only our fellow Humans & no one would want to see any fellow Human starved....We Humankind may not be able to change the past, but the future for oneself, loved ones & society is yet unwritten, to progress & evolve...

Last edited:

- Joined

- Sep 22, 2008

- Messages

- 83,171

- Points

- 113

The only " rule of law" US follow is "might is always right". China learned this the hard way during its crntury of humiliation. The arabs are learning about it currently. Mexico knew having free trade agreement with US counts for nothing. Same with russia wrt NATO expansion understanding if eastern germany is awarded bavk to Germany and US wuthdrawal from intermediate range nuclear missile agreement upon allowing ukraine to be admitted into NATO.3. Much of the Free World is self sufficient as they have resources, labor, Rule of law, etc, such as USA, Australia, EU if they can stay united, lush fertile valleys of S.E Asia thru ASEAN, etc. that they would need any products made from the so called 'factory of the World' that is claimed by China & its paid or moronic lobbyists.

- Joined

- Jul 25, 2018

- Messages

- 4,593

- Points

- 113

Similar threads

- Replies

- 0

- Views

- 248

- Replies

- 1

- Views

- 314

- Replies

- 2

- Views

- 437

- Replies

- 6

- Views

- 956