Over the past year, "bitcoin whales" have dumped over 500,000 BTC, institutionalised take backs and stabilised the market

By: Russell Thompson | yesterday, 21:44

{"uid":0.7073136099825994,"hostPeerName":"

https://gagadget.com","initialGeometry":"{\"windowCoords_t\":0,\"windowCoords_r\":430,\"windowCoords_b\":745,\"windowCoords_l\":0,\"frameCoords_t\":600,\"frameCoords_r\":365,\"frameCoords_b\":850,\"frameCoords_l\":65,\"posCoords_t\":600,\"posCoords_b\":850,\"posCoords_r\":365,\"posCoords_l\":65,\"styleZIndex\":\"\",\"allowedExpansion_r\":130,\"allowedExpansion_b\":495,\"allowedExpansion_t\":0,\"allowedExpansion_l\":0,\"yInView\":0.58,\"xInView\":1}","permissions":"{\"expandByOverlay\":true,\"expandByPush\":true,\"readCookie\":false,\"writeCookie\":false}","metadata":"{\"shared\":{\"sf_ver\":\"1-0-45\",\"ck_on\":1,\"flash_ver\":\"26.0.0\",\"canonical_url\":\"

https://gagadget.com/en/658066-over...alised-take-backs-and-stabilised-the-market/\",\"amp\":{\"canonical_url\":\"

https://gagadget.com/en/658066-over...alised-take-backs-and-stabilised-the-market/\"}}}","reportCreativeGeometry":false,"isDifferentSourceWindow":false,"sentinel":"0-760485169587352717","width":300,"height":250,"_context":{"ampcontextVersion":"2505300108000","ampcontextFilepath":"

https://3p.ampproject.net/2505300108000/ampcontext-v0.js","sourceUrl":"

https://gagadget.com/en/658066-over...sed-take-backs-and-stabilised-the-market-amp/","referrer":"

https://www.google.com/","canonicalUrl":"

https://gagadget.com/en/658066-over...nalised-take-backs-and-stabilised-the-market/","pageViewId":"7978","location":{"href":"

https://gagadget.com/en/658066-over...sed-take-backs-and-stabilised-the-market-amp/"},"startTime":1751702623227,"tagName":"AMP-AD","mode":{"localDev":false,"development":false,"esm":false,"test":false,"rtvVersion":"012505300108000"},"canary":false,"hidden":false,"initialLayoutRect":{"left":65,"top":600,"width":300,"height":250},"domFingerprint":"1118288916","experimentToggles":{"canary":false,"a4aProfilingRate":false,"doubleclickSraExp":false,"doubleclickSraReportExcludedBlock":true,"flexAdSlots":false,"flexible-bitrate":false,"ios-fixed-no-transfer":false,"story-ad-placements":false,"story-disable-animations-first-page":true,"story-load-inactive-outside-viewport":true,"amp-sticky-ad-to-amp-ad-v4":false,"story-video-cache-apply-audio":false,"amp-story-subscriptions":true,"interaction-to-next-paint":true,"amp-story-first-page-max-bitrate":false,"story-load-first-page-only":true,"story-ad-page-outlink":false,"amp-geo-ssr":true,"story-remote-localization":true,"attribution-reporting":false,"amp-next-page":true},"sentinel":"0-760485169587352717"},"initialIntersection":{"time":2052,"rootBounds":{"left":0,"top":0,"width":430,"height":745,"bottom":745,"right":430,"x":0,"y":0},"boundingClientRect":{"left":65,"top":600,"width":300,"height":250,"bottom":850,"right":365,"x":65,"y":600},"intersectionRect":{"left":65,"top":600,"width":300,"height":145,"bottom":745,"right":365,"x":65,"y":600},"intersectionRatio":0.58}}" height="250" width="300" title="3rd party ad content" role="region" aria-label="Advertisement" tabindex="0" data-amp-3p-sentinel="0-760485169587352717" allow="sync-xhr 'none';" frameborder="0" allowfullscreen="" allowtransparency="" scrolling="no" marginwidth="0" marginheight="0" sandbox="allow-top-navigation-by-user-activation allow-popups-to-escape-sandbox allow-forms allow-modals allow-pointer-lock allow-popups allow-same-origin allow-scripts" class="i-amphtml-fill-content" id="google_ads_iframe_2" style="position: absolute; margin: auto; display: block; height: 250px; max-height: 100%; max-width: 100%; min-height: 0px; min-width: 0px; width: 300px; inset: 0px; border: 0px !important; padding: 0px !important;">

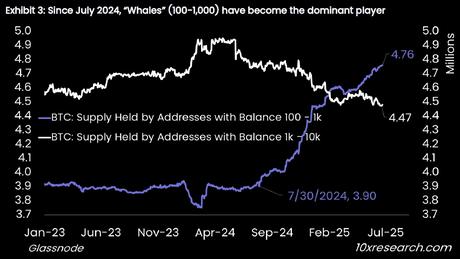

Over the past 12 months, the crypto market has undergone a quiet but powerful shift: large private holders of bitcoin - the so-called "whales" - have sold off more than 500,000 BTC (at current exchange rates ≈ $50 billion). But these coins did not go nowhere: they were happily bought by institutional investors, cumulatively building up their positions to almost 900,000 BTC. As a result, the market is becoming less chaotic and more "mature" - with less volatility and new rules of the game.

Why are "whales" selling out?

We are talking about early investors, crypto miners, offshore wallets and unidentified "old-timers" of the network, who bought BTC back at prices of $100-$1,000 and for years held significant volumes - from 1,000 to 10,000 BTC. Analysts assume that some of them started to "cash out", fixing multiple profits. Some simply as part of portfolio rebalancing, others because of worsening regulation or approaching retirement age (literally).

Particular activity was noted in the first quarter of 2025 as bitcoin climbed above the $90,000 mark - whales started to exit and funds started to actively enter.

Who is replacing them?

According to Bloomberg and 10x Research, the main buyers have been large funds and institutional players: these include ETFs (e.g., BlackRock, Fidelity, Ark Invest) as well as corporate traders like MicroStrategy. Pension funds, asset managers and private banks are also among the buyers.

According to reports, institutional investors now own about 25% of all BTC issuance - that's more than 4.8 million coins - making them the largest ownership class. By comparison, whales (addresses with 1,000-10,000 BTC) saw their share drop by nearly 10% over the year.

Institutional investors own about 4.8 million coins out of the roughly 20 million bitcoins in circulation. Illustration: 10x Research

What's making a difference.

- Declining volatility.

According to Deribit, BTC's 30-day realised volatility has hit a two-year low. This is due to institutionalists tending to hold positions longer and not reacting to harsh news or Ilon Musk's tweets.

- Changing growth model.

With the arrival of institutionalisation, the BTC market is becoming more "gold-like" - not a hype drive, but long-term capital protection. This means less speculative spikes, but also more stable capitalisation.

- Fund effect.

ETFs are becoming the new gateway to the market for retail - more people are buying bitcoin through regulated instruments rather than directly into wallets.

But there are risks

Analysts warn: if capital flows into ETFs slow down and the former "whales" continue to sell, it could lead to short-term drawdowns. In addition, institutional concentration carries systemic risks: if one of the major players falls under sanctions or goes bankrupt, it could hit the market hard.