- Joined

- Jan 17, 2014

- Messages

- 1,620

- Points

- 48

Boss, where to find attractive term deposits, especially here in Singapore ?4. Term deposits.

Boss, where to find attractive term deposits, especially here in Singapore ?4. Term deposits.

It depends upon how much money you have. Someone mentioned in this forum that there are some banks paying up to 3% interest if you have a home loan and a credit card with that bank.The best thing to do is to call up a few banks and find out.Boss, where to find attractive term deposits, especially here in Singapore ?

My general impression of this CPF debate is not so much the lack of transparency on the part of the government but rather the lack of understanding of the financial world by Singaporeans in general.

Once they understand what is going on, they'll view the 2.5% return in a different light. Will this ever happen?... i doubt it simply because strident rhetoric requires far less effort than digesting the ins and outs of bonds, securities and T bills.

I'd be the first to admit that I am no expert myself. I just know the basics. That is why I have always restricted my investments to

1. Investing in Myself [nobody knows me better than me]

2. Property.

3. Companies that I have an in-depth knowledge of.

4. Term deposits.

different light means what?negative or positive?

"Not everyone realises that the minimum sum is not $155,000 but it's half of that if you use your housing pledge," he saiid.

Does the above statement means that one with more than $155k can also choose to pledge his property for half of 155k so that he can withdraw additional 77.5k? Is such an option available or cash must be used first and property can only be used when cash is not enough?

My understanding is that cash must be wiped up first then property can be considered.

I knew I'd be right because I have checked with them myself.

Could it be that the people commenting on CPF actually do not have much CPF at all????

This is human nature... to get sucked in by the rabble-rousers without having a clue about what is actually going on.

The muslims are famous for this sort of behavior. I remember when the looney towel heads were burning effigies of Salman Rushdie because of his book "Satanic Verses", one of the journalists asked a protester what exactly he was protesting about and whether he had read the book in the first place. The answer of course was "no". He had not read Satanic Verses and he didn't know why he was offended because he had never seen the content but since everyone else was rampaging in the streets it was his duty to join in.

It is this sort of mindless behavior that makes me ashamed to be part of the human race.

I honestly cannot see that there is anything more to add.

CPF is like a very flexible term deposit.

When a term deposit is placed with a bank, I could not care less what the bank does with the money as long as they pay me the interest accrued.

I have term deposits with Westpac which earned me 4.3% interest. Westpac made record profits last year but that does not mean that I have right to demand 6%. If I want to a share of Westpac's profits, I'll buy Westpac shares on the stockmarket. However, that also means I'm exposed to Westpac's losses should things turn pear shaped.

CPF is the same. It doesn't matter what Ho Jinx does, they still get guaranteed returns. If CPF members want better returns, there are a whole host of products they can invest in with their funds. The best bet is still property.

Many years ago, can pledge if you have more than $155K. Along the way, they changed the rule; cannot pledge if got more than $155K.

In thec last few years, they changed the rule again without publicising it. Now one can pledge even if more than $155K. There has been a lot of flip flops in the pledging policy . And all these manoeuvres can change without going to Parliament.

Once they understand what is going on, they'll view the 2.5% return in a different light. Will this ever happen?... i doubt it simply because strident rhetoric requires far less effort than digesting the ins and outs of bonds, securities and T bills.

.

Explain why EPF (Malaysia) can give average of 6% interest + no minimum sum bullshit.

"Significant amounts of money can in fact be taken out to be used, to be saved as you wish or to be used to meet immediate means."

Previously CPF allow you to pledge your HDB property for upto 50% of the Minimum Sum. For example if you have $130K in your combined OA and SA you set aside cash S77.5K and pledge property for $77.5K in order to meet the MS of $155K. You are happy because still able to withdraw $52.5K. Not anymore now as all cash portion will be considered first before property pledge. Using the same example above, you are unhappy for you are not allowed now to withdraw anything from CPF and the shortfall of $25K in the MS will have to be met by property pledge.

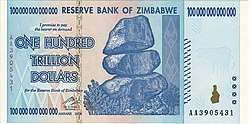

Malaysia currency inflation is shit...6% is not worth toilet paper

discussion is about cpf interest rate and so I am comparing it with our neighbour's. should not use inflation to muddy the facts.

CPF recognised as robust internationally: DPM Tharman

SINGAPORE - Deputy Prime Minister Tharman Shanmugaratnam defended the Central Provident Fund (CPF) yesterday, saying it is recognised internationally as a robust and sustainable system.

"We've provided a guarantee and a very fair rate of return that is not easy to beat in the market," said Mr Tharman, who is also Finance Minister. "The difference in our case is that we take risk away from the ordinary citizen.

"If you're wealthy, you're well-off and you know how to manage a large amount of finances, then that's a different matter.

"But experience has shown in the United States, Europe and United Kingdom that for most people, it's not wise to put too much investment risk on them."

Following recent calls for more transparency about the CPF system, he said that it currently provides "very significant flexibility".

Members can use funds to pay off housing loans, while in retirement it provides MediShield cover. "Not everyone realises that the minimum sum is not $155,000 but it's half of that if you use your housing pledge," he said.

"Significant amounts of money can in fact be taken out to be used, to be saved as you wish or to be used to meet immediate means."

He further explained that the CPF Board invests entirely in Singapore Government securities, of which the interest rate is known.

The Government then takes on the risk itself through investments, mainly in the Government of Singapore Investment Corporation (GIC), as well as in the Monetary Authority of Singapore.

Even with the GIC publishing its returns, Mr Tharman said: "It doesn't affect the CPF member because he or she is assured of a fair rate of return with no risk."

This, he said, is unique among social security systems around the world. He cited pensioners elsewhere who have had their retirement savings wiped out because of the global financial crisis.

Interest rates are linked to inflation rates...if ur currency inflation is high naturally interest rates have to be high to compensate

Explain why EPF (Malaysia) can give average of 6% interest + no minimum sum bullshit.