Subscribe

Markets

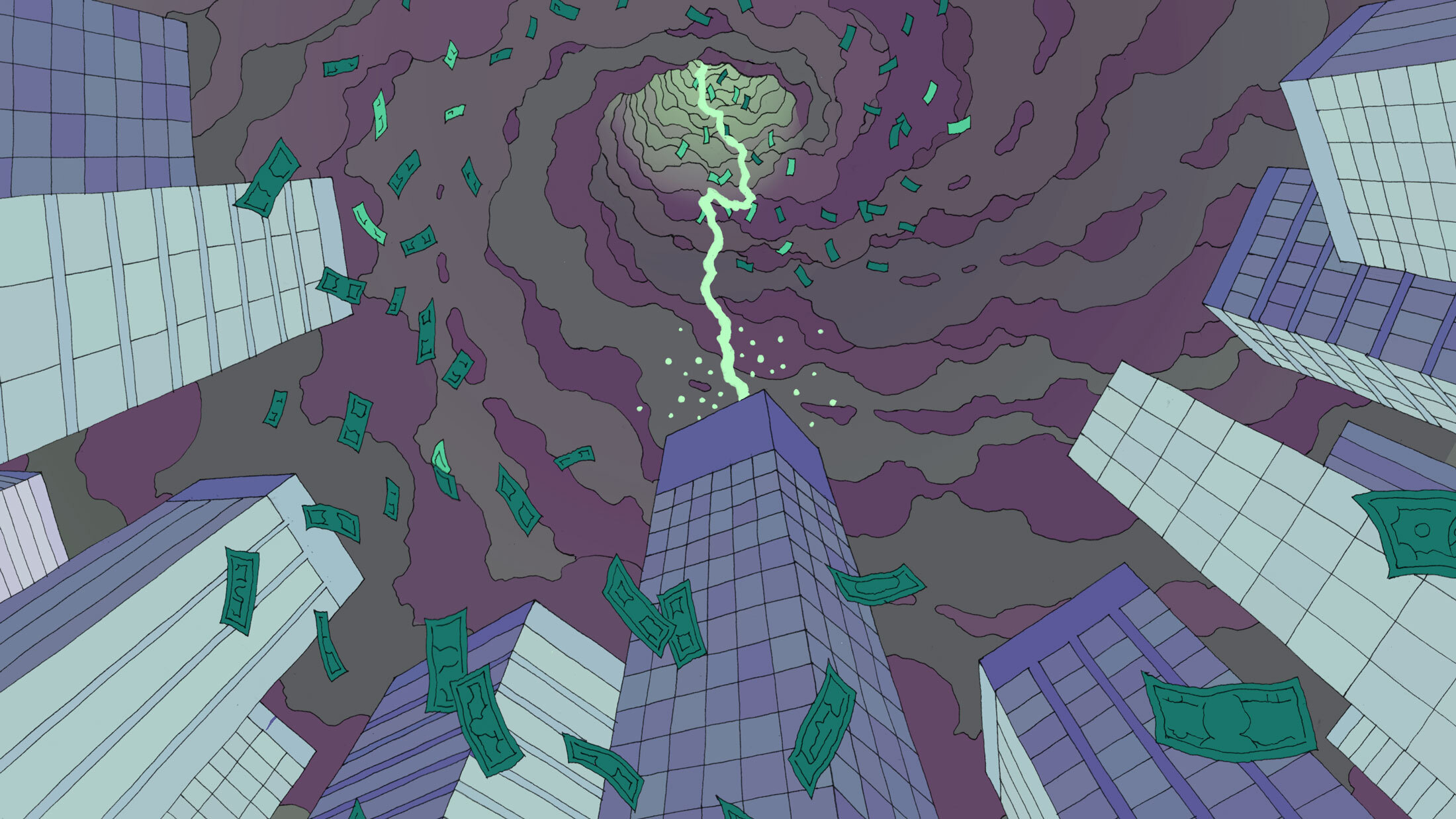

GIC Posts Worst Five-Year Return Since 2016 as Global Economy Slows

- CEO Lim Chow Kiat warns markets “not out of the woods yet”

- Sovereign wealth fund is among world’s biggest investors

Gift this article

0:25

Singapore Sovereign Wealth Fund GIC Posts Worst 5-Year Return Since 2016

Unmute

WATCH: Singapore’s GIC Pte reported its worst five-year returns since 2016. David Ramli reports.Source: Bloomberg

By David Ramli and Low De Wei

July 25, 2023 at 5:00 PM EDT

Singapore sovereign wealth fund GIC Pte reported its worst five-year returns since 2016, citing the slowing global economy as it warned the consequences of rising interest rates are yet to fully play out.

The firm, which the Sovereign Wealth Fund Institute has estimated runs $690 billion, posted annualized nominal returns of 3.7% for the five years ending March 31, the lowest in seven years. Its 20-year real return hit an eight-year high of 4.6% after moving past 2003, a fiscal year when markets slumped. The fund doesn’t publish one-year results or its assets under management.

Have a confidential tip for our reporters? Get in Touch

Before it’s here, it’s on the Bloomberg Terminal

More From Bloomberg

Temasek to Pour $10 Billion Over Three Years in India

Singapore Transport Minister to Remain in Country During Graft Probe, CNA Reports

Singapore Says Premier Did Not Hide Information on Minister’s Arrest

Singapore Opposition Lawmaker Quits as Political Scandals Mount

Top Reads

Crowded Singapore Makes Room for Microgyms

by Isabel Kua

How to Invest $10,000 Right Now

by Suzanne Woolley

A $500 Billion Corporate-Debt Storm Builds Over Global Economy

by Jeremy Hill and Lucca De Paoli

Extreme Heat Threatens Europe's $2 Trillion Travel Industry

by Jack Wittels

Terms of Service Manage Cookies Trademarks Privacy Policy ©2023 Bloomberg L.P. All Rights Reserved

Careers Made in NYC Advertise Ad Choices Help

Create your account to continue reading.

Continue reading with one of the options below

FREE ACCOUNT

- Read this article

- Free newsletters

SUBSCRIPTION

- Unlimited access to Bloomberg.com

- Unlimited access to the Bloomberg app

- Subscriber-only newsletters

Continue