https://www.law360.com/articles/1041157/nine-west-creditors-warn-of-fight-over-50m-dip-term-loan

Nine West Creditors Warn Of Fight Over $50M DIP Term Loan

By Alex Wolf

Law360 (May 7, 2018, 7:56 PM EDT) -- The unsecured creditors of Nine West Holdings Inc. could make it more difficult for the bankrupt women’s shoe and apparel company to gain access to a proposed $50 million debtor-in-possession term loan, as an attorney for the creditors complained Monday that it seemed “exorbitantly expensive” and restrictive.

The comments made by Akin Gump Strauss Hauer & Feld LLP partner Daniel Golden came during an otherwise objection-less “second day” hearing in Nine West’s New York bankruptcy case, where the wholesale and retail fashion company received final authorization...

https://www.usatoday.com/story/money/2018/05/14/rockport-shoes-bankruptcy/608071002/

Rockport shoe company files for Chapter 11 bankruptcy protection, may close stores

Nathan Bomey, USA TODAY Published 1:40 p.m. ET May 14, 2018 | Updated 5:44 p.m. ET May 14, 2018

A multitude of retailers have filed for bankruptcy this year as the industry continues to struggle. Here are some of the big names. Time

TWEETLINKEDIN 2 COMMENTEMAILMORE

Rockport Group became the latest shoe company to trip on retail's rocky terrain Monday as it filed for Chapter 11 bankruptcy protection.

The company, whose shoe brands include Rockport, Aravon and Dunham, follows Payless ShoeSource and Nine West into bankruptcy court as shoe sellers grapple with declining traffic to physical stores.

Rockport is aiming to keep its shoemaking business alive in a sale to a private equity firm. But the company warned that it may be forced to close all of its standalone retail stores, including 27 in the U.S.

Rockport partially blamed a turbulent separation from its previous owner, Adidas unit Reebok, which sold Rockport in 2015 to an entity created by shoe company New Balance and Berkshire Partners.

More Money: What does Sears have left? Amazon's in; Whirlpool, Craftsman are out; and Kenmore may go

More Money: CBS, seeking to block Viacom merger, sues Shari Redstone, family and National Amusements

More Money: With gas prices going up, what's it cost to fill up your car?

Separating from Adidas turned out to be "more complex," "meaningfully longer" and "significantly more expensive than planned," interim Chief Financial Officer Paul Kosturos said in a court filing.

The New Balance-Berkshire entity offloaded its stake in the business to Rockport creditors in late 2017, at which point the company began considering a sale of its assets, according to the court filing.

More Money: Payless emerges from bankruptcy court protection after closing more than 673 stores

More Money: Nine West files for Chapter 11 bankruptcy protection

More Money: Gibson guitar maker files for Chapter 11 bankruptcy protection

Rockport also said it faced disruptions in its global supply chain, contract disputes, underwhelming sales and intense competition, including online threats.

Founded in 1971, West Newton, Mass.-based Rockport is hoping to stay in business with a deal to sell its assets to private equity firm Charlesbank.

Rockport gets about 57% of its sales from its wholesale business, which distributes products to department stores, specialty retailers, independent stores and online sellers, according to court records.

The company also has 33 stores in Canada, sells products online and maintains relationships with 22 global distributors that sell its products in 35 countries.

Follow USA TODAY reporter Nathan Bomey on Twitter @NathanBomey.

https://footwearnews.com/2018/business/retail/rockport-bankrupt-adidas-chapter-11-1202562908/

How Bankrupt Rockport Says Adidas Separation Hurt Its Business

By Sheena Butler-Young

Sheena Butler-Young

More Stories By Sheena

Adidas Speedfactory Pop-Up Lab in NYC

CREDIT: Adidas

In a bankruptcy declaration with the court, The Rockport Co. LLC interim CFO Paul Kosturos said a “costly and time-consuming separation” from Adidas was among the key factors contributing to the shoemaker’s need to seek Chapter 11 protection this week.

Previously family-owned, Rockport — founded in 1971 in West Newton, Mass. — came under Reebok’s ownership in 1986. Reebok and its subsidiaries were snapped by Adidas in 2005. In early 2015, New Balance Holding, the company’s investment arm, and Boston-based Berkshire Partners LLC bought Rockport from Adidas Group for an estimated $280 million.

But according to Kosturos, the latter split proved more complicated and costly than the firm had anticipated.

“Separation of the [Rockport Group’s] operations from the Adidas Networks was not completed until November 2017 and proved to be more complex, took meaningfully longer and was significantly more expensive than planned,” Kosturos told the court in the May 14 declaration. “In addition, [Rockport] encountered operational challenges during the initial development of [its] own logistics network that negatively impacted revenue.”

Related News

The Number of Amazon Sellers Making $1 Million a Year Hits a New High

ICSC to Invigorate Brick-and-Mortar Retail with Board Additions

The company — which joins an ever-growing list of footwear (and retail, in general) players such as Aerosoles, Nine West Holdings, Payless ShoeSource and Walking Co. that have recently filed bankruptcy — also cited heavy competition, underperforming stores and supply chain interruption as factors sending it to bankruptcy court.

“Over the last three years, [Rockport has] faced economic headwinds and operational challenges that significantly and adversely impacted the operating performance of [its] footwear business,” Kosturos said.

Home to the Aravon, Dunham, Rockport and Cobb Hill collections, the company — and its Canadian subsidiaries — filed Chapter 11 on Monday with a plan to turn ownership over to private equity firm Charlesbank.

The agreement with Charlesbank — which entered a stalking-horse bid as part of a court-supervised sale process — includes Rockport’s global wholesale assets, e-commerce platform and retail operations in Asia and Europe.

Rockport’s potential new owner plans to evaluate Rockport’s North American retail operations and determine whether it will attempt to acquire certain locations. Rockport is seeking court authorization to close the North American retail stores not acquired by Charlesbank or another party.

Throughout the process, customers can continue to shop the brand at department and specialty stores globally, as well as through its e-commerce platform and select retail locations. To do so, Rockport has obtained $20 million in new-money debtor-in-possession financing from noteholders in addition to its existing $60 million credit facility. It has also filed a series of first-day motions seeking authorization to pay employee wages and benefits, honor customer commitments and manage day-to-day operations through the sale process.

The company expects to pay for all goods and services delivered on or after May 14. Payments for good and services prior to the filing will be addressed through Chapter 11. Charlesbank will assume responsibility for payment of certain pre-petition obligations to product suppliers of the acquired assets.

https://www.bloomberg.com/news/arti...-to-plan-a-bankruptcy-filing-with-asset-sales

business

Nine West Plans a Bankruptcy Filing With Asset Sales

By

Emma Orr

and

Lauren Coleman-Lochner

January 24, 2018, 10:28 PM GMT+8 Corrected January 25, 2018, 12:08 AM GMT+8

The plan hinges on asset sales to pay off creditors, according to the people, who asked not to be identified because the negotiations are private. Nine West would seek Chapter 11 court protection with a restructuring plan agreed upon in advance by its creditors, said the people. The goal is to file before a March 15 interest payment, they said.

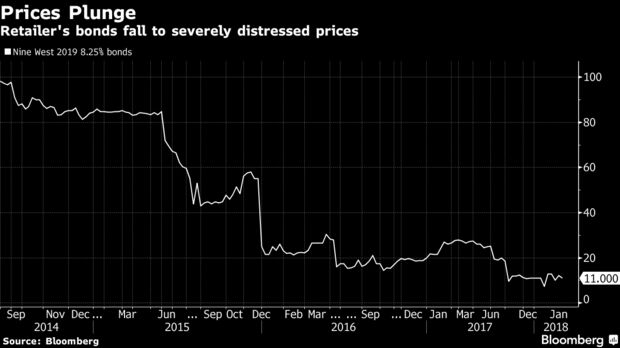

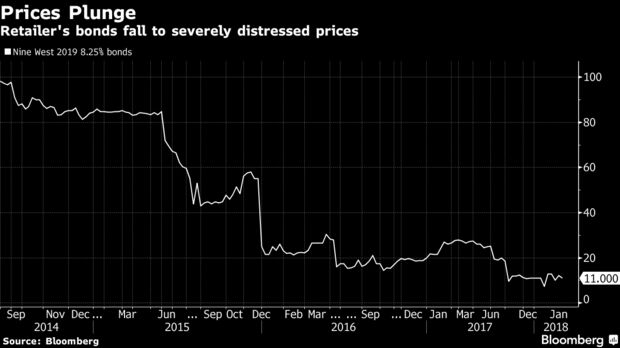

First-lien lenders would likely be repaid in full, with unsecured term-loan lenders getting the majority of the equity in the reorganized company, according to one of the people. A small portion of the equity would go to holders of the retailer’s bonds, the person said. Nine West’s 8.25 percent notes due 2019 traded Monday at 11 cents on the dollar, according to Trace bond-price reporting data.

A representative for Nine West and its private equity owner Sycamore Partners LLC declined to comment. Chapter 11 bankruptcy allows a company to stay in business while it works out a plan to repay its creditors.

Nine West, led by interim Chief Executive Officer Ralph Schipani, doesn’t have any debt maturing until 2019, but then it would have to refinance around $1 billion, including a term loan, an asset-based revolver and unsecured bonds. The retailer has one of the highest leverage ratios in the industry, with debt exceeding 19 times adjusted earnings, according to Moody’s Investors Service. Nine West has been negotiating with its creditors at least since last year, when lenders and bondholders organized with advisers.

Creditor Negotiations

Three groups of creditors hired their own advisers for negotiations, Bloomberg previously reported. One set of secured lenders is led by KKR & Co. and Farmstead Capital Management; a separate group of holders with both secured and unsecured term loans includes Carlson Capital and CVC Credit Partners. Brigade Capital Management, also a creditor, hired its own advisers.

The 40-year-old brand, named for its original Manhattan street address, aimed to meld comfort and fashion. The vagaries of the latter led to setbacks that eventually resulted in its purchase by Sycamore, known for turning around deeply distressed retail brands. Sycamore bought Nine West as part of its $2.2 billion acquisition of Jones Group Inc. in 2014.

Since its founding in 2011, the New York-based private equity firm has snapped up, financed or invested in struggling retailers such as Staples, the Belk department-store chain and Talbots. Some of those didn’t end well: Coldwater Creek liquidated after filing for bankruptcy in 2014, and in 2016 Aeropostale sued the firm, accusing lender Sycamore of pushing it into bankruptcy.

Nine West would be only the latest in a string of retail bankruptcies. Last year’s filings included specialty clothing chain Gymboree Corp. and toyseller Toys ‘R’ Us. Department-store chain Bon-Ton Stores is also preparing to file for bankruptcy early this year, Bloomberg reported this month.

(Corrects description of equity recipients in the third paragraph of a story published Jan. 24. Correction made on Jan. 25.)

Share

Print

In this article

https://tw.news.yahoo.com/女鞋nine-west宣布破產-櫃位公告goodbye-104044812.html

女鞋Nine West宣布破產 櫃位公告GOODBYE

EBC東森新聞

2.1k 人追蹤

東森新聞

2018年5月25日 下午6:40

檢視相片

美國女鞋品牌NINE WEST1978年創立,在台灣各大百貨幾乎都有設櫃,但NINE WEST卻在4月傳出破產消息,甚至百貨櫃位也打出四折優惠,要跟大家說再見。

" data-reactid="28">

檢視相片

▲(圖/東森新聞)

百貨員工對撤櫃訊息並不清楚,不過根據CNN報導,NINE WEST在全球42個國家都有設點,但去年開始已經陸續關閉7千家分店,雖然想要透過關店策略,減少行政管理費用等等止血,不過要償還高達15億美元的債務還是不簡單,

" data-reactid="47">

檢視相片

" data-reactid="64">

▲(圖/東森新聞)

" data-reactid="66">

檢視相片

▲(圖/東森新聞)

" data-reactid="84">

其實從去年開始就有部分歐美和日系品牌,從台灣百貨撤櫃主要是因為品牌代理轉換,包括ANNA SUI 、PAUL & JOE 還有LADURÉE (拉督黑),都將換為原品牌分公司經營,今年下半年ANNA SUI(swi)和PAUL & JOE就會陸續回歸,

LADURÉE(拉督黑)則預計明年,另外日本保養品牌Albion(阿魯筆甕),回歸時間點則還沒確定。

" data-reactid="87">

檢視相片

▲(圖/東森新聞)

" data-reactid="105">

同樣選擇撤出台灣的,還有這家被封為「地表上最好吃」的,芝加哥爆米花品牌,兩年前才剛風光進駐台北101一度引發搶購潮,甚至還必須限制購買數量,但官方臉書卻宣布,2家分店已經在4月底結束營業,等於退出台灣市場,

一家家國際品牌進駐後又退出,看來要完全搶攻台灣消費者的心,品牌的規劃和走向,每一步都是關鍵。

" data-reactid="108">

往下看更多新聞" data-reactid="109">往下看更多新聞

" data-reactid="110">

知名蛋糕店白木屋這個月18日突然傳出即將歇業的消息,不只消費者震驚,連員工都是當天才知道自己將失業,全台24間分店將會陸續關門。最近有網友發現,白木屋原本位在新北市頂溪某間店面,也悄悄出現在租屋網上,然而租金卻引發眾人討論,不少人一看都直呼「難怪會倒!」

" data-reactid="112">

▼(圖/東森新聞)

檢視相片

" data-reactid="130">

一名網友在《我是永和人》社團中貼出一則店面出租的訊息,原來該店原本是白木屋,因為歇業的關係,房東得重新招租。從租屋訊息上可以看到,該地位於頂溪捷運站對面,且為2層樓店面,1樓權狀為30.8坪,2樓權狀為54.48坪,而且還是個人潮滾滾的黃金店面。

" data-reactid="132">

▼(圖/截取自租屋網)

檢視相片

" data-reactid="150">

而這間店面,房東開價一個月要29萬元,另外每個月還得付2800元的管理費,許多人看到後紛紛直呼「難怪撐不下去」、「門口不能停車,附近也沒什麼車位,再看這房租…誰租誰倒…」、「如果我是房東不知道該有多好,賺翻了,都不用工作」、「只有全家和7-11能活吧!」、「這間還要繳管理費2800/月?」。但也有人認為該店面地段不錯,會租這個價不意外。

" data-reactid="152">

但其實白木屋會歇業,主要是因為其母公司景岳生技於2014年買下白木屋後,一直賺不了錢。據《自由時報》報導,前立委、景岳董事長陳根德昨表示,白木屋每月虧損近千萬元,累積虧損近5億元,即使他自掏腰包,也很難撐下去,

" data-reactid="154">

往下看更多新聞!

" data-reactid="156">

在台灣經營21年的老品牌白木屋,這個月18日宣告歇業。母公司景岳生技公司強調,從2014年買下白木屋之後,一直沒辦法轉虧為盈,因此只好斷尾求生,而旗下190名員工,會發放資遣費,但實際走訪門市,員工都說當天才知道自己即將失業的消息,至於6月後的訂單,已經開始陸續打電話退貨。

" data-reactid="158">

▼(圖/東森新聞)

檢視相片

" data-reactid="178">

對於歇業的消息,白木屋員工頗無奈,因為母公司景岳生技宣布白木屋只營業到5月31日,也就是剩下不到一個星期,自己將面臨失業。其實位在桃園的旗艦店早在三月就歇業,如今已經開始動工拆除。

" data-reactid="180">

▼(圖/東森新聞)

檢視相片

" data-reactid="198">

而觀光工廠還是有民眾在參觀,得知歇業消息也不可置信,畢竟白木屋曾榮獲經濟部台灣最具代表性15大伴手禮、台灣100大觀光特產,今年五月母親節還是購物平台最受歡迎蛋糕前五名。

" data-reactid="200">

▼(圖/東森新聞)

檢視相片

" data-reactid="218">

白木屋從1997年開始在台紮根,2014年被資本額僅6.5億的景岳生技以16.5億買下,但當時白木屋已經是虧損狀態,2017年營收1.72億元,今年半年快過去了,營收也只有0.36,等於不到去年業績的一半,景岳生技只好斷尾求生,來保住其他旗下益生菌產品,繼續幫大廠牌代工。

" data-reactid="220">

由於只營業到月底,因此各門市開始打電話退貨,至於旗下190名員工怎麼辦?景岳生技強調,會發放資遣費。創辦人簡菱臻今年2月才逝世,不到三個月宣告歇業,震驚各界。

" data-reactid="222">

【今日熱門影片】" data-reactid="223">【今日熱門影片】

" data-reactid="227">

Nine West Creditors Warn Of Fight Over $50M DIP Term Loan

By Alex Wolf

Law360 (May 7, 2018, 7:56 PM EDT) -- The unsecured creditors of Nine West Holdings Inc. could make it more difficult for the bankrupt women’s shoe and apparel company to gain access to a proposed $50 million debtor-in-possession term loan, as an attorney for the creditors complained Monday that it seemed “exorbitantly expensive” and restrictive.

The comments made by Akin Gump Strauss Hauer & Feld LLP partner Daniel Golden came during an otherwise objection-less “second day” hearing in Nine West’s New York bankruptcy case, where the wholesale and retail fashion company received final authorization...

https://www.usatoday.com/story/money/2018/05/14/rockport-shoes-bankruptcy/608071002/

Rockport shoe company files for Chapter 11 bankruptcy protection, may close stores

Nathan Bomey, USA TODAY Published 1:40 p.m. ET May 14, 2018 | Updated 5:44 p.m. ET May 14, 2018

A multitude of retailers have filed for bankruptcy this year as the industry continues to struggle. Here are some of the big names. Time

TWEETLINKEDIN 2 COMMENTEMAILMORE

Rockport Group became the latest shoe company to trip on retail's rocky terrain Monday as it filed for Chapter 11 bankruptcy protection.

The company, whose shoe brands include Rockport, Aravon and Dunham, follows Payless ShoeSource and Nine West into bankruptcy court as shoe sellers grapple with declining traffic to physical stores.

Rockport is aiming to keep its shoemaking business alive in a sale to a private equity firm. But the company warned that it may be forced to close all of its standalone retail stores, including 27 in the U.S.

Rockport partially blamed a turbulent separation from its previous owner, Adidas unit Reebok, which sold Rockport in 2015 to an entity created by shoe company New Balance and Berkshire Partners.

More Money: What does Sears have left? Amazon's in; Whirlpool, Craftsman are out; and Kenmore may go

More Money: CBS, seeking to block Viacom merger, sues Shari Redstone, family and National Amusements

More Money: With gas prices going up, what's it cost to fill up your car?

Separating from Adidas turned out to be "more complex," "meaningfully longer" and "significantly more expensive than planned," interim Chief Financial Officer Paul Kosturos said in a court filing.

The New Balance-Berkshire entity offloaded its stake in the business to Rockport creditors in late 2017, at which point the company began considering a sale of its assets, according to the court filing.

More Money: Payless emerges from bankruptcy court protection after closing more than 673 stores

More Money: Nine West files for Chapter 11 bankruptcy protection

More Money: Gibson guitar maker files for Chapter 11 bankruptcy protection

Rockport also said it faced disruptions in its global supply chain, contract disputes, underwhelming sales and intense competition, including online threats.

Founded in 1971, West Newton, Mass.-based Rockport is hoping to stay in business with a deal to sell its assets to private equity firm Charlesbank.

Rockport gets about 57% of its sales from its wholesale business, which distributes products to department stores, specialty retailers, independent stores and online sellers, according to court records.

The company also has 33 stores in Canada, sells products online and maintains relationships with 22 global distributors that sell its products in 35 countries.

Follow USA TODAY reporter Nathan Bomey on Twitter @NathanBomey.

https://footwearnews.com/2018/business/retail/rockport-bankrupt-adidas-chapter-11-1202562908/

How Bankrupt Rockport Says Adidas Separation Hurt Its Business

By Sheena Butler-Young

Sheena Butler-Young

More Stories By Sheena

- Shoe Carnival Shares Rise After Q1 Profits Top Expectations

- The Fashion Execs Who Have Stepped Down in 2018 Over Accusations of Inappropriate Behavior

- 3 Big Reasons Ralph Lauren’s Stock Is Booming

Adidas Speedfactory Pop-Up Lab in NYC

CREDIT: Adidas

In a bankruptcy declaration with the court, The Rockport Co. LLC interim CFO Paul Kosturos said a “costly and time-consuming separation” from Adidas was among the key factors contributing to the shoemaker’s need to seek Chapter 11 protection this week.

Previously family-owned, Rockport — founded in 1971 in West Newton, Mass. — came under Reebok’s ownership in 1986. Reebok and its subsidiaries were snapped by Adidas in 2005. In early 2015, New Balance Holding, the company’s investment arm, and Boston-based Berkshire Partners LLC bought Rockport from Adidas Group for an estimated $280 million.

But according to Kosturos, the latter split proved more complicated and costly than the firm had anticipated.

“Separation of the [Rockport Group’s] operations from the Adidas Networks was not completed until November 2017 and proved to be more complex, took meaningfully longer and was significantly more expensive than planned,” Kosturos told the court in the May 14 declaration. “In addition, [Rockport] encountered operational challenges during the initial development of [its] own logistics network that negatively impacted revenue.”

Related News

The Number of Amazon Sellers Making $1 Million a Year Hits a New High

ICSC to Invigorate Brick-and-Mortar Retail with Board Additions

The company — which joins an ever-growing list of footwear (and retail, in general) players such as Aerosoles, Nine West Holdings, Payless ShoeSource and Walking Co. that have recently filed bankruptcy — also cited heavy competition, underperforming stores and supply chain interruption as factors sending it to bankruptcy court.

“Over the last three years, [Rockport has] faced economic headwinds and operational challenges that significantly and adversely impacted the operating performance of [its] footwear business,” Kosturos said.

Home to the Aravon, Dunham, Rockport and Cobb Hill collections, the company — and its Canadian subsidiaries — filed Chapter 11 on Monday with a plan to turn ownership over to private equity firm Charlesbank.

The agreement with Charlesbank — which entered a stalking-horse bid as part of a court-supervised sale process — includes Rockport’s global wholesale assets, e-commerce platform and retail operations in Asia and Europe.

Rockport’s potential new owner plans to evaluate Rockport’s North American retail operations and determine whether it will attempt to acquire certain locations. Rockport is seeking court authorization to close the North American retail stores not acquired by Charlesbank or another party.

Throughout the process, customers can continue to shop the brand at department and specialty stores globally, as well as through its e-commerce platform and select retail locations. To do so, Rockport has obtained $20 million in new-money debtor-in-possession financing from noteholders in addition to its existing $60 million credit facility. It has also filed a series of first-day motions seeking authorization to pay employee wages and benefits, honor customer commitments and manage day-to-day operations through the sale process.

The company expects to pay for all goods and services delivered on or after May 14. Payments for good and services prior to the filing will be addressed through Chapter 11. Charlesbank will assume responsibility for payment of certain pre-petition obligations to product suppliers of the acquired assets.

https://www.bloomberg.com/news/arti...-to-plan-a-bankruptcy-filing-with-asset-sales

business

Nine West Plans a Bankruptcy Filing With Asset Sales

By

Emma Orr

and

Lauren Coleman-Lochner

January 24, 2018, 10:28 PM GMT+8 Corrected January 25, 2018, 12:08 AM GMT+8

- Plans call for pre-arranged Chapter 11 filing by March 15

- Unsecured term lenders would get biggest share of equity

The plan hinges on asset sales to pay off creditors, according to the people, who asked not to be identified because the negotiations are private. Nine West would seek Chapter 11 court protection with a restructuring plan agreed upon in advance by its creditors, said the people. The goal is to file before a March 15 interest payment, they said.

First-lien lenders would likely be repaid in full, with unsecured term-loan lenders getting the majority of the equity in the reorganized company, according to one of the people. A small portion of the equity would go to holders of the retailer’s bonds, the person said. Nine West’s 8.25 percent notes due 2019 traded Monday at 11 cents on the dollar, according to Trace bond-price reporting data.

A representative for Nine West and its private equity owner Sycamore Partners LLC declined to comment. Chapter 11 bankruptcy allows a company to stay in business while it works out a plan to repay its creditors.

Nine West, led by interim Chief Executive Officer Ralph Schipani, doesn’t have any debt maturing until 2019, but then it would have to refinance around $1 billion, including a term loan, an asset-based revolver and unsecured bonds. The retailer has one of the highest leverage ratios in the industry, with debt exceeding 19 times adjusted earnings, according to Moody’s Investors Service. Nine West has been negotiating with its creditors at least since last year, when lenders and bondholders organized with advisers.

Creditor Negotiations

Three groups of creditors hired their own advisers for negotiations, Bloomberg previously reported. One set of secured lenders is led by KKR & Co. and Farmstead Capital Management; a separate group of holders with both secured and unsecured term loans includes Carlson Capital and CVC Credit Partners. Brigade Capital Management, also a creditor, hired its own advisers.

The 40-year-old brand, named for its original Manhattan street address, aimed to meld comfort and fashion. The vagaries of the latter led to setbacks that eventually resulted in its purchase by Sycamore, known for turning around deeply distressed retail brands. Sycamore bought Nine West as part of its $2.2 billion acquisition of Jones Group Inc. in 2014.

Since its founding in 2011, the New York-based private equity firm has snapped up, financed or invested in struggling retailers such as Staples, the Belk department-store chain and Talbots. Some of those didn’t end well: Coldwater Creek liquidated after filing for bankruptcy in 2014, and in 2016 Aeropostale sued the firm, accusing lender Sycamore of pushing it into bankruptcy.

Nine West would be only the latest in a string of retail bankruptcies. Last year’s filings included specialty clothing chain Gymboree Corp. and toyseller Toys ‘R’ Us. Department-store chain Bon-Ton Stores is also preparing to file for bankruptcy early this year, Bloomberg reported this month.

(Corrects description of equity recipients in the third paragraph of a story published Jan. 24. Correction made on Jan. 25.)

Share

In this article

https://tw.news.yahoo.com/女鞋nine-west宣布破產-櫃位公告goodbye-104044812.html

女鞋Nine West宣布破產 櫃位公告GOODBYE

EBC東森新聞

2.1k 人追蹤

東森新聞

2018年5月25日 下午6:40

檢視相片

美國女鞋品牌NINE WEST1978年創立,在台灣各大百貨幾乎都有設櫃,但NINE WEST卻在4月傳出破產消息,甚至百貨櫃位也打出四折優惠,要跟大家說再見。

" data-reactid="28">

檢視相片

▲(圖/東森新聞)

百貨員工對撤櫃訊息並不清楚,不過根據CNN報導,NINE WEST在全球42個國家都有設點,但去年開始已經陸續關閉7千家分店,雖然想要透過關店策略,減少行政管理費用等等止血,不過要償還高達15億美元的債務還是不簡單,

" data-reactid="47">

檢視相片

" data-reactid="64">

▲(圖/東森新聞)

" data-reactid="66">

檢視相片

▲(圖/東森新聞)

" data-reactid="84">

其實從去年開始就有部分歐美和日系品牌,從台灣百貨撤櫃主要是因為品牌代理轉換,包括ANNA SUI 、PAUL & JOE 還有LADURÉE (拉督黑),都將換為原品牌分公司經營,今年下半年ANNA SUI(swi)和PAUL & JOE就會陸續回歸,

LADURÉE(拉督黑)則預計明年,另外日本保養品牌Albion(阿魯筆甕),回歸時間點則還沒確定。

" data-reactid="87">

檢視相片

▲(圖/東森新聞)

" data-reactid="105">

同樣選擇撤出台灣的,還有這家被封為「地表上最好吃」的,芝加哥爆米花品牌,兩年前才剛風光進駐台北101一度引發搶購潮,甚至還必須限制購買數量,但官方臉書卻宣布,2家分店已經在4月底結束營業,等於退出台灣市場,

一家家國際品牌進駐後又退出,看來要完全搶攻台灣消費者的心,品牌的規劃和走向,每一步都是關鍵。

" data-reactid="108">

往下看更多新聞" data-reactid="109">往下看更多新聞

" data-reactid="110">

知名蛋糕店白木屋這個月18日突然傳出即將歇業的消息,不只消費者震驚,連員工都是當天才知道自己將失業,全台24間分店將會陸續關門。最近有網友發現,白木屋原本位在新北市頂溪某間店面,也悄悄出現在租屋網上,然而租金卻引發眾人討論,不少人一看都直呼「難怪會倒!」

" data-reactid="112">

▼(圖/東森新聞)

檢視相片

" data-reactid="130">

一名網友在《我是永和人》社團中貼出一則店面出租的訊息,原來該店原本是白木屋,因為歇業的關係,房東得重新招租。從租屋訊息上可以看到,該地位於頂溪捷運站對面,且為2層樓店面,1樓權狀為30.8坪,2樓權狀為54.48坪,而且還是個人潮滾滾的黃金店面。

" data-reactid="132">

▼(圖/截取自租屋網)

檢視相片

" data-reactid="150">

而這間店面,房東開價一個月要29萬元,另外每個月還得付2800元的管理費,許多人看到後紛紛直呼「難怪撐不下去」、「門口不能停車,附近也沒什麼車位,再看這房租…誰租誰倒…」、「如果我是房東不知道該有多好,賺翻了,都不用工作」、「只有全家和7-11能活吧!」、「這間還要繳管理費2800/月?」。但也有人認為該店面地段不錯,會租這個價不意外。

" data-reactid="152">

但其實白木屋會歇業,主要是因為其母公司景岳生技於2014年買下白木屋後,一直賺不了錢。據《自由時報》報導,前立委、景岳董事長陳根德昨表示,白木屋每月虧損近千萬元,累積虧損近5億元,即使他自掏腰包,也很難撐下去,

" data-reactid="154">

往下看更多新聞!

" data-reactid="156">

在台灣經營21年的老品牌白木屋,這個月18日宣告歇業。母公司景岳生技公司強調,從2014年買下白木屋之後,一直沒辦法轉虧為盈,因此只好斷尾求生,而旗下190名員工,會發放資遣費,但實際走訪門市,員工都說當天才知道自己即將失業的消息,至於6月後的訂單,已經開始陸續打電話退貨。

" data-reactid="158">

▼(圖/東森新聞)

檢視相片

" data-reactid="178">

對於歇業的消息,白木屋員工頗無奈,因為母公司景岳生技宣布白木屋只營業到5月31日,也就是剩下不到一個星期,自己將面臨失業。其實位在桃園的旗艦店早在三月就歇業,如今已經開始動工拆除。

" data-reactid="180">

▼(圖/東森新聞)

檢視相片

" data-reactid="198">

而觀光工廠還是有民眾在參觀,得知歇業消息也不可置信,畢竟白木屋曾榮獲經濟部台灣最具代表性15大伴手禮、台灣100大觀光特產,今年五月母親節還是購物平台最受歡迎蛋糕前五名。

" data-reactid="200">

▼(圖/東森新聞)

檢視相片

" data-reactid="218">

白木屋從1997年開始在台紮根,2014年被資本額僅6.5億的景岳生技以16.5億買下,但當時白木屋已經是虧損狀態,2017年營收1.72億元,今年半年快過去了,營收也只有0.36,等於不到去年業績的一半,景岳生技只好斷尾求生,來保住其他旗下益生菌產品,繼續幫大廠牌代工。

" data-reactid="220">

由於只營業到月底,因此各門市開始打電話退貨,至於旗下190名員工怎麼辦?景岳生技強調,會發放資遣費。創辦人簡菱臻今年2月才逝世,不到三個月宣告歇業,震驚各界。

" data-reactid="222">

【今日熱門影片】" data-reactid="223">【今日熱門影片】

" data-reactid="227">