-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

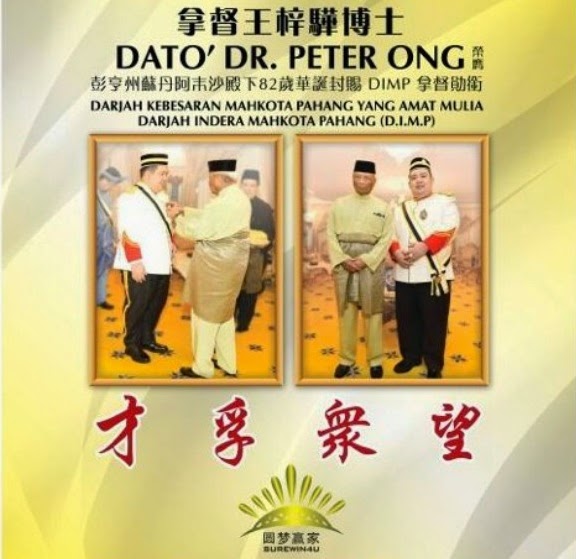

150 Sinkies Conned S$50 M By Malaysian Datuk Peter Ong

- Thread starter SallyTan

- Start date

In court documents, plaintiff Lee Hwee Yeow claimed that he had lost more than $1.6 million from the packages he purchased.PHOTO: SHIN MIN DAILY NEWS

They were promised profits from winnings of 'expert gamblers', according to court papers

Seow Bei Yi

A High Court suit yesterday has claimed that around 150 people in Singapore may have lost $50 million from investing in a company that promised profits from gambling in casinos.

According to court documents, the company SureWin4U had enticed investors to buy packages from it in exchange for returns from casino winnings of its "expert gamblers".

But after investors received some returns, its website was taken down around September 2014.

The Straits Times learnt that its chief executive officer, Malaysian Peter Ong, has been missing since.

The details emerged after diamond dealer Lee Hwee Yeow, 44, sued Mr Wan Hoe Keet and Ms Sally Ho, whom he said had encouraged him to invest in the packages.

In court documents, Mr Lee claimed that as of Jan 28, 2015, about 150 people in Singapore had lodged police reports after losing around $50 million.

Mr Lee said that he lost more than $1.6 million from the packages he purchased.

ST has learnt that Mr Lee and the defendants - Mr Wan and Ms Ho - entered into a confidentiality agreement to bring the trial to a conclusion yesterday.

Mr Lee had decided to invest after he and his family attended a "demonstration" at Marina Bay Sands in June 2013 where he saw other investors receive $300 returns in 45 minutes after giving $3,000 each to a team of professional gamblers.

He then purchased his first "platinum" package.

The company had advertised in promotional materials that its gamblers have a 99.8 per cent of winning at the casinos and that investors came from 21 places, including China, Brunei and Hong Kong.

Initially, Mr Lee and other investors would regularly receive texts informing them about the travels and casino winnings of SureWin4U's Mr Ong.

Investors would be invited to "extravagant dinners", where Mr Wan and Ms Ho would give speeches about how they rose from poor financial standing to become "millionaires" because of their investments, encouraging those present to dip deeper into their reserves.

At seminars in Singapore and abroad, the pair would also assure audiences that returns on the investments were "guaranteed" and "safe".

The company also advertised that Mr Ong and the firm had rewarded the pair with extravagant gifts. This was for their contributions to it, through their earnings on investments or introduction of new investors.

Mr Lee, represented by LVM Law Chambers, invested in six "platinum" packages, costing around $469,500 to $519,200 each, and was later persuaded to take on another package that would give him 3.3 times more than his investment.

In court documents, Mr Wan and Ms Ho, represented by Mr K. Anparasan of KhattarWong, said they were introduced to the company in 2012.

They claimed that as they were investors with the company as well, they had similarly not been able to cash out on their investments since the company's website was taken down around September 2014.

A version of this article appeared in the print edition of The Straits Times on October 21, 2017, with the headline 'Investors in gambling scheme 'lost $50m''. Print Edition | Subscribe

Court dismisses woman’s suit to recover $6m loss from ‘sure-win’ scheme against casinos

The scheme sold packages promising lucrative returns from the winnings of professional gamblers playing baccarat at casinos. PHOTO ILLUSTRATION: PEXELS

UPDATED

4 HOURS AGO

SINGAPORE - A Hong Kong woman who lost millions in a Ponzi scheme that promised investors they would win money gambling against casinos, has failed in her lawsuit to recover her losses from a Singapore couple who got her to invest.

Ms Chan Pik Sun, also known as Sandra, alleged that she invested in the SureWin4U scheme because she relied on false and fraudulent representations that induced her to spend HK$36.8 million (S$6.2 million) buying various packages.

The scheme, which started in July 2012, collapsed in September 2014, and its two founders, Malaysian brothers Peter and Philip Ong, became uncontactable.

Ms Chan joined the scheme in March 2014.

She sued Mr Wan Hoe Keet and his wife Sally Ho, alleging that they told her it was “safe and profitable” to invest in SureWin4U, which sold packages promising lucrative returns from the winnings of professional gamblers playing baccarat at casinos.

She also sued Ms Ho’s brother Sebastian and the couple’s company Strategic Wealth Consultancy, which was used to hold their earnings from SureWin4U, as well as a yacht purchased with money from Peter Ong.

She alleged that, like the couple, Mr Sebastian Ho frequently encouraged her to increase her investments and sales to other investors and told her that she was a rising star.

In his judgment issued last Friday, High Court Judge Andre Maniam found that SureWin4U was a Ponzi scheme.

Justice Maniam said: “It did not have a way of consistently winning money through gambling, let alone a ‘sure win’ way. As such, participants’ returns essentially came from the money that they and fellow participants put into the scheme.”

He also found that it was a pyramid scheme: Participants known as “uplines” received referral bonuses for bringing in new participants known as “downlines”, with the uplines getting further bonuses if their downlines bought more packages themselves or brought in others.

In dismissing Ms Chan’s case, the judge said: “It is tragic that Sandra lost millions of dollars by investing in SureWin4U, but she has no recourse against the defendants for that.”

He said the evidence did not show that she invested in SureWin4U because of any false representations made by the defendants.

Instead, the picture that emerged is that Ms Chan was attracted by the lucrative returns promised, which she had started receiving on her initial packages.

Justice Maniam found that Ms Chan believed in SureWin4U’s gambling methods, but also knew there was a risk of loss.

He noted that a few days after the collapse of the scheme, Ms Chan said in a message to an upline investor: “It’s OK, I knew the risk, I will face it.”

He added that in getting her “downlines” to invest, Ms Chan never told them about any representations made by the defendants; she told them about the returns promised by SureWin4U, its gambling methods, and her belief in the scheme.

The judge said Mr Wan and Ms Ho must bear some responsibility for exaggerated statements made in SureWin4U’s promotional booklet and brochure, as well as at a conference, that the couple’s earnings amounted to HK$201 million.

However, he found that if the earnings had been accurately represented by SureWin4U, it would have made no difference to Ms Chan’s investment decisions.

Participants in the scheme who bought packages had their money converted into a virtual currency called “yingbi”, or “winning currency” in Mandarin.

Returns were given in terms of yingbi, which they could convert into cash and withdraw, leave to their credit in the system, or use to buy more packages.

Depending on the packages bought, participants were entitled to attend classes which purportedly demonstrated a 99.8 per cent or a 100 per cent win rate.

Ms Chan said she attended a demonstration in a Macau casino which apparently proved that the 100 per cent winning formula worked.

The result of the demonstration was that out of eight teams of gamblers, seven teams won but one lost.

Justice Maniam said: “Whatever that demonstration proved, it did not prove that that 100 per cent formula gave SureWin4U a 100 per cent win rate.”

https://www.elitigation.sg/gd/s/2023_SGHC_96

This judgment text has undergone conversion so that it is mobile and web-friendly.

This may have created formatting or alignment issues.

Please refer to the PDF copy for a print-friendly version.

IN THE GENERAL DIVISION OF

… Plaintiff

And

… Defendants

JUDGMENT

[Tort — Conspiracy — Unlawful means conspiracy]

[Tort — Conspiracy — Lawful means conspiracy]

[Tort — Misrepresentation — Fraud and deceit]

[Tort — Misrepresentation — Negligent misrepresentation]

[Tort — Misrepresentation — Innocent misrepresentation]

This judgment text has undergone conversion so that it is mobile and web-friendly.

This may have created formatting or alignment issues.

Please refer to the PDF copy for a print-friendly version.

IN THE GENERAL DIVISION OF

THE HIGH COURT OF THE REPUBLIC OF SINGAPORE[2023] SGHC 96

Suit No 806 of 2018

BetweenSuit No 806 of 2018

| Chan Pik Sun |

And

| (1) | Wan Hoe Keet |

| (2) | Ho Sally |

| (3) | Ho Hao Tian Sebastian |

| (4) | Strategic Wealth Consultancy Pte Ltd (formerly known as SW4U Consultancy Pte Ltd) |

JUDGMENT

[Tort — Conspiracy — Unlawful means conspiracy]

[Tort — Conspiracy — Lawful means conspiracy]

[Tort — Misrepresentation — Fraud and deceit]

[Tort — Misrepresentation — Negligent misrepresentation]

[Tort — Misrepresentation — Innocent misrepresentation]

Similar threads

- Replies

- 47

- Views

- 3K

- Replies

- 8

- Views

- 634

- Replies

- 17

- Views

- 966

- Replies

- 2

- Views

- 569