- Joined

- Aug 8, 2008

- Messages

- 6,070

- Points

- 83

https://sputniknews.com/radio_double_down/201903121073151796-negative-rates-coming-got-gold/

Negative Rates Coming: Got Gold?

Double Down

12:40 12.03.2019Get short URL

Max Keiser, Stacy Herbert

0 20

On today’s episode of Double Down, Max Keiser and Stacy Herbert talk to Craig Hemke of TFMetalsReport.com about negative interest rates on the horizon.

00:00 / 14:47

In a seemingly coordinated media campaign, the US Federal Reserve and the European Central Bank indicate more negative rates are on the horizon, which would be the first time they are tried in the US. How will you protect yourself from wealth confiscation? The historical safe haven from such confiscation is gold and now there is bitcoin as well. Craig responds to claims from a UK publication that gold is a right-wing thing and gives the liberal case for owning gold. Tune in to hear more.

We'd love to get your feedback at [email protected]

https://www.bloomberg.com/news/arti...tive-rates-denmark-may-be-the-first-to-try-it

economics

A Decade of Negative Rates? Denmark May Be the First to Try It

By

Nick Rigillo

January 8, 2019, 10:45 PM GMT+8 Updated on January 9, 2019, 4:05 PM GMT+8

Copenhagen Photographer: Luke MacGregor/Bloomberg

SHARE THIS ARTICLE

Share

Tweet

Post

Email

In this article

DANSKE

DANSKE BANK A/S

132.35

DKK

+3.20+2.48%

EUR

Euro Spot

1.1309

EUR

+0.0005+0.0442%

DKK

Danish Krone Spot

6.5984

DKK

-0.0033-0.0500%

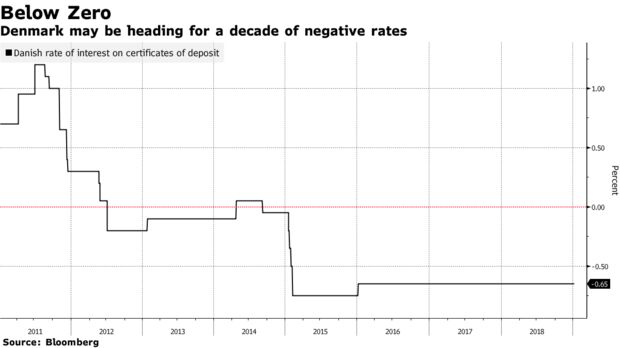

The world’s longest experiment with negative interest rates may end up lasting an entire decade.

Not until 2021 at the earliest will Danes have a chance to see positive rates again, according to Danske Bank. The country’s policy rate first dropped below zero in 2012.

Danske Bank senior analyst Jens Naervig Pedersen says last year’s pattern of krone depreciation, which had some economists predicting rate hikes, won’t continue. In fact, he expects the Danish currency to appreciate in 2019. And with the central bank’s sole purpose being to defend the krone’s peg to the euro, a stronger exchange rate makes monetary tightening in Denmark less likely.

Nowhere else have people lived with negative interest rates as long as in AAA-rated Denmark. The policy has protected the currency peg, but it’s also turbo-charged the mortgage market and pushed those trying to save money into riskier assets. Meanwhile banks have done a bit less traditional lending and a lot more wealth management.

Read about the latest development in credit standards in Denmark

The jury is still out on the extent to which negative rates are a useful policy, especially in economies in which the central bank targets stable prices rather than fixed exchange rates. This week, former U.S. Treasury Secretary Lawrence Summers threw his hat into the ring, criticizing the policy because of its apparent failure to stimulate bank lending “due to a negative effect on bank profits.”

A Patient Bank

Even if the Danish krone does weaken this year, Pedersen says the central bank will be more patient with raising rates than it’s been in the past. That’s because the economic environment is uncertain and because the bank has a large stock of foreign currency reserves on which it can draw before needing to touch the interest-rate lever.

Danske predicts that any solitary rate increase would only come after central bank interventions of at least 50 billion kroner, or almost $8 billion, to support the Danish currency.

“We expect the krone to strengthen over the course of 2019 and the need for FX interventions to recede,” Pedersen said. Denmark’s benchmark deposit rate, now at minus 0.65 percent, won’t be raised until the end of this year, following an expected hike from the ECB, he said.

The Background:

Have a confidential tip for our reporters?

GET IN TOUCH

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

by Taboola

Sponsored Links

From The Web

https://internationalman.com/articl...erate-as-negative-interest-rates-come-to-the/

Expect the War on Cash to Accelerate as Negative Interest Rates Come to the U.S.

by Nick Giambruno

AddThis Sharing Buttons

Share to Facebook

FacebookShare to Twitter

Twitter

Like an ambush, it has to come by surprise…

Whenever you hear a central banker or politician say something won’t happen, you can almost be certain it will happen. And probably soon.

Coming from a bureaucrat, the real meaning of “no, of course not” is “it could happen tomorrow.”

It’s like the old saying: “Believe nothing until it has been officially denied.”

These deceptions have a purpose: Politicians and central bankers have to surprise the public to get the results they want.

In the past couple of years, this has happened over and over again…

In January 2015, the Swiss National Bank (SNB) emphatically denied it was even considering letting the Swiss franc stray from its fixed exchange rate of 1.2 francs per euro. Then, days later, the SNB let the exchange rate appreciate 20% over the course of minutes, causing an earthquake in the currency markets.

In June 2015, Greece’s government spent weeks saying it wouldn’t impose capital controls. Then, one Sunday morning, the Greek Finance Ministry repeated the denial. Mere hours later, the Greek government declared a week-long bank holiday and announced it would impose capital controls after all.

The same pattern played out in Cyprus during the country’s 2013 banking crisis. On an otherwise ordinary Saturday morning, the government declared a surprise bank holiday. Then it imposed capital controls and confiscated bank deposits.

Cyprus slammed the trap shut without warning. It happened despite repeated promises from the highest Cypriot politicians that bank deposits would be safe.

By now, this pattern should be seared into your memory.

Last week, it happened again…

Negative Interest Rates—Spreading Like a Bad Rash

For the past few weeks, Haruhiko Kuroda, the head of the Japanese central bank, said he had no plans to adopt negative interest rates.

Then, last Friday—just a week after his most recent denial—the Japanese central bank cut Japan’s interest rate below zero for the first time ever.

This should not have surprised anyone.

Negative interest rates mean the lender literally pays the borrower for the privilege of lending him money. It’s a bizarre, upside-down concept. The European Central Bank, Denmark, Sweden, and Switzerland also have negative interest rates.

Negative rates could not exist in a free market. They can only exist in an “Alice In Wonderland” economy created by central bankers.

Producing more than you consume and saving the difference is the basis of prosperity. However, negative interest rates destroy the impetus to save. This is why negative rates are a huge threat to your financial prosperity.

Japan’s decision shows that negative interest rates are not some European anomaly. Negatives rates are a disease that’s spreading around the world. And I think the disease is on its way to North America.

The Federal Reserve has already discussed the possibility of using negative interest rates in the U.S. So has the Bank of Canada.

We’ll know the infection is imminent when officials start denying it.

The War on Cash and Negative Interest Rates

When you deposit money in a bank, you are lending money to the bank. In return, you expect to earn some interest. That doesn’t happen with negative rates. Instead, you pay the bank.

If you don’t like that plan, you can certainly stash your cash under the mattress. As a practical matter, this limits how far governments and central banks can take negative interest rates. The more it costs to store money at the bank, the less inclined people are to do it.

Of course, central bankers don’t want you to withdraw money from the bank. This is a big reason why they are trying to incrementally eliminate cash.

It’s no coincidence that Sweden, the closest thing to the world’s first cashless society, has negative interest rates.

If you can’t withdraw your money as cash, you have two choices: deal with negative interest rates… or spend your money.

Ultimately, that’s what central economic planners want. They are using negative interest rates and the War on Cash to force you to spend and “stimulate” the economy.

Negative interest rates, the War on Cash, and financial sneak attacks are radical and insane measures. They are signs of desperation.

But desperation doesn’t mean central bankers are weak. They are actually quite powerful.

Central bankers can make or break the fortunes of anyone with a brokerage account. They have the power to create or extinguish trillions of dollars of wealth by simply uttering a few words.

Giving any group of people this much power is incredibly dangerous.

Meanwhile, the mainstream media has endless praises for central bankers. It portrays them as selfless, benign bureaucrats trying to save the economy.

In truth, central bankers are the primary cause of most of the harmful distortions in the economy.

Think unlimited money printing, interest rate manipulation, the boom/bust cycle, propping up “too big to fail” institutions with bailout funds, the War on Cash, cronyism in the financial industry, and negative interest rates… just to name a few.

I think central bankers are the biggest threat to your financial well-being. Period.

We recently released a video that shows you how to deal with this threat. Click here to watch it now.

AddThis Sharing Buttons

Share to Facebook

Negative Rates Coming: Got Gold?

Double Down

12:40 12.03.2019Get short URL

Max Keiser, Stacy Herbert

0 20

On today’s episode of Double Down, Max Keiser and Stacy Herbert talk to Craig Hemke of TFMetalsReport.com about negative interest rates on the horizon.

00:00 / 14:47

In a seemingly coordinated media campaign, the US Federal Reserve and the European Central Bank indicate more negative rates are on the horizon, which would be the first time they are tried in the US. How will you protect yourself from wealth confiscation? The historical safe haven from such confiscation is gold and now there is bitcoin as well. Craig responds to claims from a UK publication that gold is a right-wing thing and gives the liberal case for owning gold. Tune in to hear more.

We'd love to get your feedback at [email protected]

https://www.bloomberg.com/news/arti...tive-rates-denmark-may-be-the-first-to-try-it

economics

A Decade of Negative Rates? Denmark May Be the First to Try It

By

Nick Rigillo

January 8, 2019, 10:45 PM GMT+8 Updated on January 9, 2019, 4:05 PM GMT+8

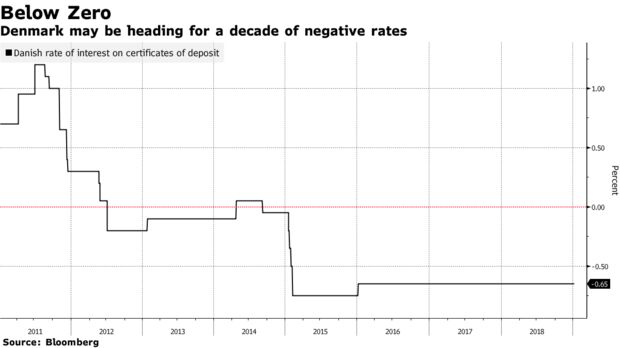

- Danske sees at least 2 more years of negative Danish rates

- No other country has had negative rates as long as Denmark

Copenhagen Photographer: Luke MacGregor/Bloomberg

SHARE THIS ARTICLE

Share

Tweet

Post

In this article

DANSKE

DANSKE BANK A/S

132.35

DKK

+3.20+2.48%

EUR

Euro Spot

1.1309

EUR

+0.0005+0.0442%

DKK

Danish Krone Spot

6.5984

DKK

-0.0033-0.0500%

The world’s longest experiment with negative interest rates may end up lasting an entire decade.

Not until 2021 at the earliest will Danes have a chance to see positive rates again, according to Danske Bank. The country’s policy rate first dropped below zero in 2012.

Danske Bank senior analyst Jens Naervig Pedersen says last year’s pattern of krone depreciation, which had some economists predicting rate hikes, won’t continue. In fact, he expects the Danish currency to appreciate in 2019. And with the central bank’s sole purpose being to defend the krone’s peg to the euro, a stronger exchange rate makes monetary tightening in Denmark less likely.

Nowhere else have people lived with negative interest rates as long as in AAA-rated Denmark. The policy has protected the currency peg, but it’s also turbo-charged the mortgage market and pushed those trying to save money into riskier assets. Meanwhile banks have done a bit less traditional lending and a lot more wealth management.

Read about the latest development in credit standards in Denmark

The jury is still out on the extent to which negative rates are a useful policy, especially in economies in which the central bank targets stable prices rather than fixed exchange rates. This week, former U.S. Treasury Secretary Lawrence Summers threw his hat into the ring, criticizing the policy because of its apparent failure to stimulate bank lending “due to a negative effect on bank profits.”

A Patient Bank

Even if the Danish krone does weaken this year, Pedersen says the central bank will be more patient with raising rates than it’s been in the past. That’s because the economic environment is uncertain and because the bank has a large stock of foreign currency reserves on which it can draw before needing to touch the interest-rate lever.

Danske predicts that any solitary rate increase would only come after central bank interventions of at least 50 billion kroner, or almost $8 billion, to support the Danish currency.

“We expect the krone to strengthen over the course of 2019 and the need for FX interventions to recede,” Pedersen said. Denmark’s benchmark deposit rate, now at minus 0.65 percent, won’t be raised until the end of this year, following an expected hike from the ECB, he said.

The Background:

- The Danish central bank has spent much of the past half decade trying to prevent investors hoarding kroner, most notably in early 2015 when it fought back a speculative attack that followed Switzerland’s decision to send the franc into a free float.

- Last year, economists started speculating the central bank would soon need to raise rates, after tighter monetary policy elsewhere and a smaller current-account surplus led to a weaker kroner. In December, the central bank bought almost $2 billion in kroner in its first such intervention in almost three years.

- The central bank defends a 2.25 percent band around an exchange rate of 7.46038 against the euro. In practice, it’s only tolerated moves within 0.1 percent, though economists have started speculating that the bank is now willing to live with a weaker krone.

- While Danske expects it to take a long time before Danish rates will rise, the prediction at Jyske Bank is for a 10 basis-point increase already this quarter.

Have a confidential tip for our reporters?

GET IN TOUCH

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

by Taboola

Sponsored Links

From The Web

https://internationalman.com/articl...erate-as-negative-interest-rates-come-to-the/

Expect the War on Cash to Accelerate as Negative Interest Rates Come to the U.S.

by Nick Giambruno

AddThis Sharing Buttons

Share to Facebook

FacebookShare to Twitter

Like an ambush, it has to come by surprise…

Whenever you hear a central banker or politician say something won’t happen, you can almost be certain it will happen. And probably soon.

Coming from a bureaucrat, the real meaning of “no, of course not” is “it could happen tomorrow.”

It’s like the old saying: “Believe nothing until it has been officially denied.”

These deceptions have a purpose: Politicians and central bankers have to surprise the public to get the results they want.

In the past couple of years, this has happened over and over again…

In January 2015, the Swiss National Bank (SNB) emphatically denied it was even considering letting the Swiss franc stray from its fixed exchange rate of 1.2 francs per euro. Then, days later, the SNB let the exchange rate appreciate 20% over the course of minutes, causing an earthquake in the currency markets.

In June 2015, Greece’s government spent weeks saying it wouldn’t impose capital controls. Then, one Sunday morning, the Greek Finance Ministry repeated the denial. Mere hours later, the Greek government declared a week-long bank holiday and announced it would impose capital controls after all.

The same pattern played out in Cyprus during the country’s 2013 banking crisis. On an otherwise ordinary Saturday morning, the government declared a surprise bank holiday. Then it imposed capital controls and confiscated bank deposits.

Cyprus slammed the trap shut without warning. It happened despite repeated promises from the highest Cypriot politicians that bank deposits would be safe.

By now, this pattern should be seared into your memory.

Last week, it happened again…

Negative Interest Rates—Spreading Like a Bad Rash

For the past few weeks, Haruhiko Kuroda, the head of the Japanese central bank, said he had no plans to adopt negative interest rates.

Then, last Friday—just a week after his most recent denial—the Japanese central bank cut Japan’s interest rate below zero for the first time ever.

This should not have surprised anyone.

Negative interest rates mean the lender literally pays the borrower for the privilege of lending him money. It’s a bizarre, upside-down concept. The European Central Bank, Denmark, Sweden, and Switzerland also have negative interest rates.

Negative rates could not exist in a free market. They can only exist in an “Alice In Wonderland” economy created by central bankers.

Producing more than you consume and saving the difference is the basis of prosperity. However, negative interest rates destroy the impetus to save. This is why negative rates are a huge threat to your financial prosperity.

Japan’s decision shows that negative interest rates are not some European anomaly. Negatives rates are a disease that’s spreading around the world. And I think the disease is on its way to North America.

The Federal Reserve has already discussed the possibility of using negative interest rates in the U.S. So has the Bank of Canada.

We’ll know the infection is imminent when officials start denying it.

The War on Cash and Negative Interest Rates

When you deposit money in a bank, you are lending money to the bank. In return, you expect to earn some interest. That doesn’t happen with negative rates. Instead, you pay the bank.

If you don’t like that plan, you can certainly stash your cash under the mattress. As a practical matter, this limits how far governments and central banks can take negative interest rates. The more it costs to store money at the bank, the less inclined people are to do it.

Of course, central bankers don’t want you to withdraw money from the bank. This is a big reason why they are trying to incrementally eliminate cash.

It’s no coincidence that Sweden, the closest thing to the world’s first cashless society, has negative interest rates.

If you can’t withdraw your money as cash, you have two choices: deal with negative interest rates… or spend your money.

Ultimately, that’s what central economic planners want. They are using negative interest rates and the War on Cash to force you to spend and “stimulate” the economy.

Negative interest rates, the War on Cash, and financial sneak attacks are radical and insane measures. They are signs of desperation.

But desperation doesn’t mean central bankers are weak. They are actually quite powerful.

Central bankers can make or break the fortunes of anyone with a brokerage account. They have the power to create or extinguish trillions of dollars of wealth by simply uttering a few words.

Giving any group of people this much power is incredibly dangerous.

Meanwhile, the mainstream media has endless praises for central bankers. It portrays them as selfless, benign bureaucrats trying to save the economy.

In truth, central bankers are the primary cause of most of the harmful distortions in the economy.

Think unlimited money printing, interest rate manipulation, the boom/bust cycle, propping up “too big to fail” institutions with bailout funds, the War on Cash, cronyism in the financial industry, and negative interest rates… just to name a few.

I think central bankers are the biggest threat to your financial well-being. Period.

We recently released a video that shows you how to deal with this threat. Click here to watch it now.

AddThis Sharing Buttons

Share to Facebook