- Joined

- Aug 12, 2013

- Messages

- 50

- Points

- 0

‘Loophole for the corrupt’: China and US worst in G20 for transparency over ‘real ownership’ of shares and companies

PUBLISHED : Thursday, 12 November, 2015, 11:19pm

UPDATED : Thursday, 12 November, 2015, 11:20pm

Mimi Lau

[email protected]

China and the United States are the two worst performers among the Group of 20 countries in terms of transparency over the ‘real ownership’ of shares and companies, according to Transparency International. Photo: Bloomberg

China has not done enough to tackle money laundering or other forms of corruption over the past three years, a leading anti-graft group says, despite campaigns that have toppled hundreds of senior officials and heads of state-owned enterprises.

China and the United States were the two worst performers among the Group of 20 countries in terms of transparency over beneficial ownership, according to a report by Transparency International released on Wednesday.

Beneficial ownership refers to the “real ownership” of funds or stocks held in trusts or corporate vehicles.

A lack of transparency in this area enables money launderers to abuse the system with secretive companies that “launder” illicitly sourced funds by transferring them into seemingly legitimate uses, according to the group, which said China had an “urgent” need to act.

“China is not fully compliant with any G20 principle,” the report said.

The report comes despite President Xi Jinping’s unprecedented crackdown against corruption, which has targeted officials in all reaches of the government, whether urban or rural.

Heads of state enterprises and operators in the financial markets have been among the latest targets of the drive.

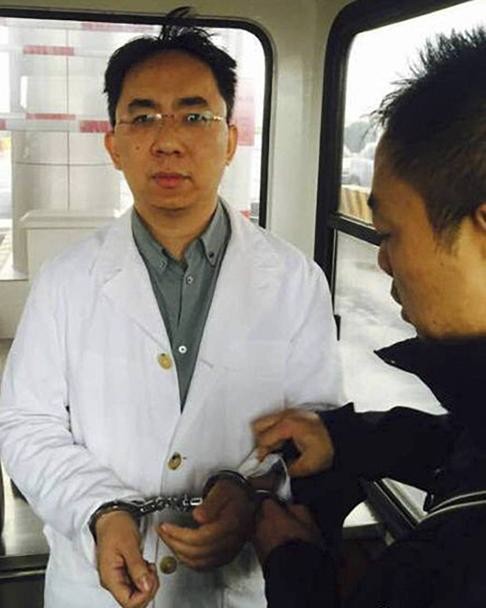

Xu Xiang, a hedge fund operator known as ‘China’s Warren Buffett’, is arrested. File Photo

Last week, Xu Xiang, a hedge fund operator known as China’s Warren Buffett, was arrested on suspicion of insider trading.

Transparency International criticised China for not requiring legal entities to collect and maintain records on beneficial ownership.

The country scored zero for “identifying and mitigating” the risk of money laundering over the past three years and its beneficial ownership records were deemed “inadequate”.

“Timely access” to beneficial ownership records by authorities in China was not guaranteed, it added.

The US, which has the largest share of the world’s offshore financial services market, was also criticised this month by campaign group Tax Justice Network for not doing enough to combat international financial secrecy.

The group said the US remained a tax evasion haven, despite its insistence that other countries hand over taxation information about US citizens.

Transparency’s report comes before this weekend’s G20 summit in Turkey, where leaders will discuss a set of beneficial ownership principles agreed last year to make it harder for people, including corrupt officials, to hide behind secret companies.

Governments and campaign groups are concerned about company ownership transparency because webs of companies in secretive locations are important vehicles for money laundering.

Up to US$2 trillion was laundered globally each year, Transparency International said.

“Pick any major corruption scandal in recent history ... and you will find a secret company was used to pay a bribe, shift and hide stolen money, or buy luxury real estate in places like London and New York,” Transparency International managing director Cobus de Swardt said.

“It makes no sense that this gaping loophole for the corrupt remains open. What is stopping G20 countries from actively shutting down this vital avenue to corruption, despite promises to do so?”

Additional reporting by Reuters