- Joined

- Jul 17, 2008

- Messages

- 679

- Points

- 0

Like Yong Kiat, I will bet my last dollar that many have lost money investing your CPF money and hard-earned cash.

Gender<!--Gender-->: Male

Occupation: Engineering

Risk Appetite<!--Risk Appetite-->: Moderately Aggressive

[FONT=georgia, times new roman, times, serif]

- 28 years old as of 4 Apr 08

- Working as an Engineering Asst for 4 years as my first job since Mar 04

- Started investing in unit trusts since Apr 06, but have brought ILP since Apr 04[/FONT]

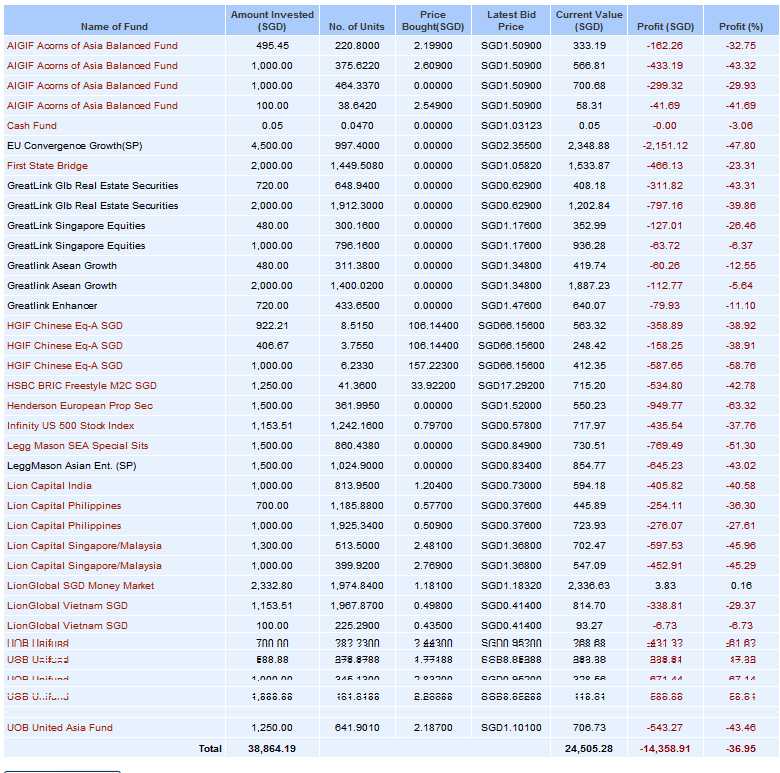

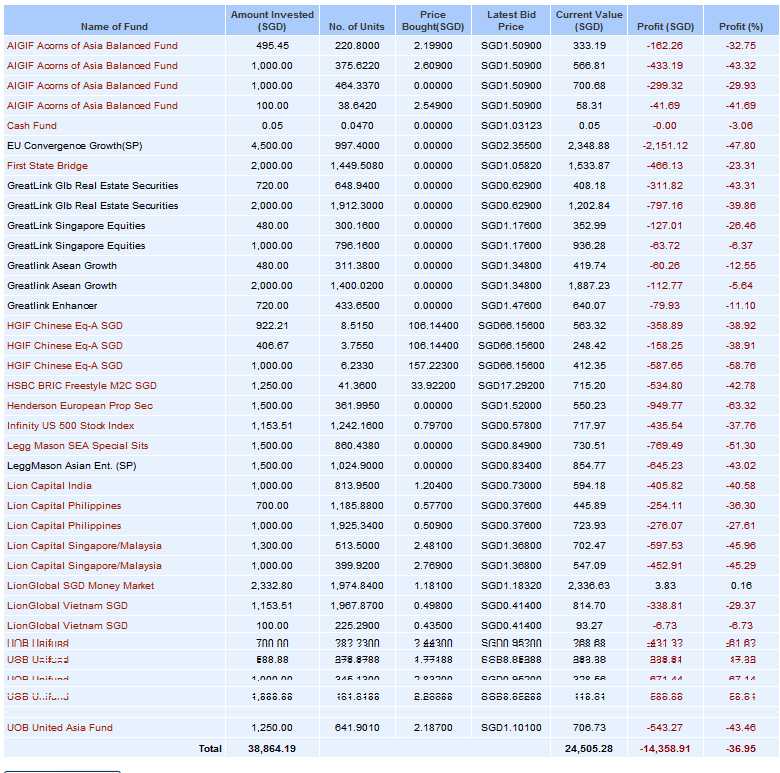

Source: http://www.fundsupermart.com/main/community/Portfolio_View.svdo?pid=P11021

Gender<!--Gender-->: Male

Occupation: Engineering

Risk Appetite<!--Risk Appetite-->: Moderately Aggressive

[FONT=georgia, times new roman, times, serif]

- 28 years old as of 4 Apr 08

- Working as an Engineering Asst for 4 years as my first job since Mar 04

- Started investing in unit trusts since Apr 06, but have brought ILP since Apr 04[/FONT]

Source: http://www.fundsupermart.com/main/community/Portfolio_View.svdo?pid=P11021