Trans-cab Holdings IPO - Riding Beside The Big Boys Comfort Delgro and SMRT

metable

12 November 2014: Opening of the Offering

18 November 2014, 12.00 noon: Close of the Offering

19 November 2014: Balloting of applications, if necessary (in the event of an oversubscription for the Public Offer Shares)

20 November 2014, 9.00 a.m. : Commence trading on a “ready” basis

25 November 2014: Settlement date for all trades done on a “ready” basis

I don't really talk about IPOs at all as most of them are pretty speculative and definitely not recommended for value investors. However Trans-cab falls in the transport industry which got me pretty interested as I previously blogged and invested in Comfort Delgro. I had since sold for a small profit and sadly it continued raging upwards!

While transport companies such as SMRT and Comfort Delgro currently trade at excessive valuations of 20 times earnings upwards, new Trans-cab shares will be sold at just around 14 times earnings. Their core business is in the operation of taxis while branching out to other services such as repair/maintenance, diesel pump stations and call centre operations.

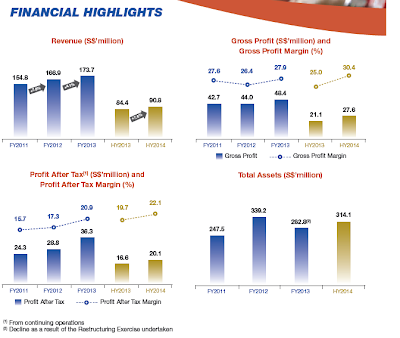

Revenues and earnings trends looks good (like in every other prospectus), however do note that in 2013 total assets took a hit due to restructuring(sale of assets and a gain which is added to earnings)

One important thing that new investors coming in should take note would be the dilution in NAV. Pre-IPO the NAV is only 14.2 cents per share! as new investors come in at 68 cents a piece, this boosts the old shareholders while diluting the new comers.

Post IPO the NAV per share would be 25.5 cents which gives it a price to book ratio of close to 2.6 times. The initial feel is that this figure seems a bit excessive, however compared to Comfort Delgro which trades at 2.5 times and SMRT at 2.8 times, this seems in line.

Lastly earnings per share comes in at around 4.9 cents, so at its IPO price of 68 cents it would trade at close to 14 times earnings. I think that the valuation is pretty reasonable, leaving it with a small upside on initial trading (probably selling for 15 times earnings upwards)

Conclusion

From a value investing point of view it doesn't really look cheap but more towards fairly priced. There's a lack of margin of safety due to the high price to book, and PE wise you really wanna just pay like 12 times or less for such a slow grower.

However from a trading point of view this looks like a good bet! With all the hype in transport stocks that had sent CD and SMRT soaring to 20 times earnings, TCH could easily fall within the 15-20 times range. I think the IPO will be heavily subscribed and lucky punters that got allocated would be happy selling out at around say 75-80 cents.

http://stockbrokerplayspoker.blogspot.sg/