Jeffrey Gundlach says the coronavirus sell-off will worsen again in April, taking out the March low

PUBLISHED TUE, MAR 31 20204:58 PM EDTUPDATED 6 HOURS AGO

Yun Li@YUNLI626

KEY POINTS

- DoubleLine Capital CEO Jeffrey Gundlach said the market low reached last week will get taken out before a more “enduring” bottom.

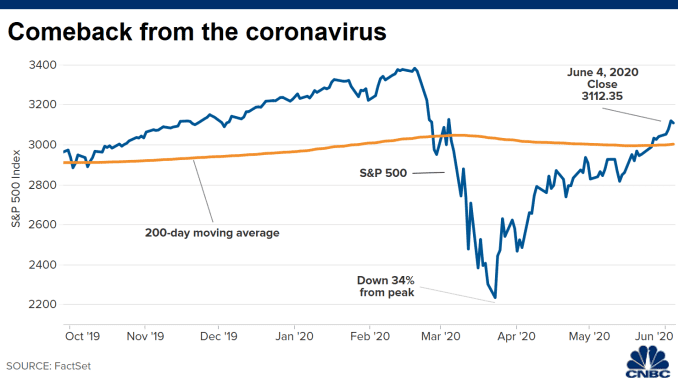

- “The market has really made it back to a resistance zone and the market continues to act somewhat dysfunctionally in my opinion,” Gundlach said. “Take out the low of March and then we’ll get a more enduring low.”

- The S&P 500 tumbled into a bear market at the fastest pace ever as the coronavirus pandemic caused unprecedented economic uncertainty.

- The equity benchmark hit a three-year closing low of 2,237.40 on March 23, more than 30% from its record high reached in February.

Jeffrey Gundlach speaking at the 2019 SOHN Conference in New York on May 6th, 2019.

Adam Jeffery | CNBC

DoubleLine Capital CEO Jeffrey Gundlach believes the coronavirus sell-off is not over yet and the market will hit a more “enduring” bottom after taking out the March low.

“The low we hit in the middle of March … I would bet that low will get taken out,” Gundlach said in an investor webcast on Tuesday. “The market has really made it back to a resistance zone and the market continues to act somewhat dysfunctionally in my opinion. ... Take out the low of March and then we’ll get a more enduring low.”

VIDEO06:35

Why now may be the time to start nibbling on beaten down stocks despite damage

The

S&P 500 tumbled into a bear market at the fastest pace ever as the coronavirus pandemic caused unprecedented economic uncertainty. The equity benchmark hit a three-year closing low of 2,237.40 on March 23, more than 30% from its record high reached in February.

Last week, the S&P 500 enjoyed its best three-day rally since the 1930s, making some investors wonder if the worse is over. Still, the market fell again on Tuesday, pushing the S&P 500′s quarterly losses to 20%, its worst first quarter ever.

The so-called bond king compared the current stock rout to the ones in 1929, 2000 and 2007. He said during 1929 sell-off, the market “went sideways” for almost a year and then the economy worsened again.

Some on Wall Street are calling for a “V” shaped recovery in the U.S. economy — a sharp drop in GDP in the second quarter and a swift snapback in the third quarter. Gundlach believes those estimates are “highly, highly optimistic,” adding GDP forecasts that don’t show negative growth for this year are “outrageously improbable.”

Gundlach said earlier this month that there’s a 90% chance

the United States will enter a recession before the year is over due to the coronavirus pandemic.

DoubleLine had $148 billion in assets under management as of the end of 2019, according to its website.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.