-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

You die, your business

- Thread starter LITTLEREDDOT

- Start date

Can't claim vehicle repair cost because the other driver did not report the accident?

You die, your business!

JAN 1, 2022

My car was hit from behind by another car, and the accident was recorded by my in-vehicle camera. I made an accident report and a third-party claim.

Despite having video evidence that the accident had been caused by the other party, my third-party claim was unsuccessful because the other party did not make an accident report.

Even after reminder letters were sent, the other party refused to report the accident. Reminders with no legal consequences seem ineffective.

Engaging a lawyer to sue the other party is an option but this may be more costly than the repair work.

This leaves me with only the option of making a claim on my own insurance. This would affect my insurance premiums and my no-claims discount.

Searching online, I have found many others caught in the same predicament and feeling helpless.

It does not make sense to me that those who cause accidents with no injuries can get away scot-free by not reporting the accident.

The General Insurance Association of Singapore has published a set of guidelines on its website on what should be done in this scenario. However, these have no legal weight.

It is time to fix this motor insurance loophole.

Lim Gee Wee

You die, your business!

Forum: Unsuccessful motor insurance claim because other party did not report accident

JAN 1, 2022

My car was hit from behind by another car, and the accident was recorded by my in-vehicle camera. I made an accident report and a third-party claim.

Despite having video evidence that the accident had been caused by the other party, my third-party claim was unsuccessful because the other party did not make an accident report.

Even after reminder letters were sent, the other party refused to report the accident. Reminders with no legal consequences seem ineffective.

Engaging a lawyer to sue the other party is an option but this may be more costly than the repair work.

This leaves me with only the option of making a claim on my own insurance. This would affect my insurance premiums and my no-claims discount.

Searching online, I have found many others caught in the same predicament and feeling helpless.

It does not make sense to me that those who cause accidents with no injuries can get away scot-free by not reporting the accident.

The General Insurance Association of Singapore has published a set of guidelines on its website on what should be done in this scenario. However, these have no legal weight.

It is time to fix this motor insurance loophole.

Lim Gee Wee

Can't afford a $250 ambulance ride?

You die, your business!

Jan 11, 2022

I had five molars extracted at the National Dental Centre Singapore (NDCS) on Dec 29 last year, after which I developed severe reactions, namely high fever, excruciating pain, breathlessness and uncontrollable shivering.

The dental surgery team decided I should be taken by ambulance immediately to Singapore General Hospital's (SGH) accident and emergency (A&E) department for further investigation and treatment.

My daughter and I had to wait about 40 agonising minutes for me to be transported by a private ambulance. The five-minute trip from NDCS to the A&E cost $250.

Was my case not considered an emergency? We were not even consulted on whether we were willing or able to pay for a private ambulance. What if we couldn't afford it?

SGH should be able to manage its own patient conveyance facilities within the hospital instead of using an outside contractor which helps little in patients' comfort and health.

Tan Pin Ho

You die, your business!

Forum: Hefty bill for five-minute ambulance trip within hospital grounds

Jan 11, 2022

I had five molars extracted at the National Dental Centre Singapore (NDCS) on Dec 29 last year, after which I developed severe reactions, namely high fever, excruciating pain, breathlessness and uncontrollable shivering.

The dental surgery team decided I should be taken by ambulance immediately to Singapore General Hospital's (SGH) accident and emergency (A&E) department for further investigation and treatment.

My daughter and I had to wait about 40 agonising minutes for me to be transported by a private ambulance. The five-minute trip from NDCS to the A&E cost $250.

Was my case not considered an emergency? We were not even consulted on whether we were willing or able to pay for a private ambulance. What if we couldn't afford it?

SGH should be able to manage its own patient conveyance facilities within the hospital instead of using an outside contractor which helps little in patients' comfort and health.

Tan Pin Ho

Can't afford a $250 ambulance ride?

You die, your business!

Forum: Hefty bill for five-minute ambulance trip within hospital grounds

Jan 11, 2022

I had five molars extracted at the National Dental Centre Singapore (NDCS) on Dec 29 last year, after which I developed severe reactions, namely high fever, excruciating pain, breathlessness and uncontrollable shivering.

The dental surgery team decided I should be taken by ambulance immediately to Singapore General Hospital's (SGH) accident and emergency (A&E) department for further investigation and treatment.

My daughter and I had to wait about 40 agonising minutes for me to be transported by a private ambulance. The five-minute trip from NDCS to the A&E cost $250.

Was my case not considered an emergency? We were not even consulted on whether we were willing or able to pay for a private ambulance. What if we couldn't afford it?

SGH should be able to manage its own patient conveyance facilities within the hospital instead of using an outside contractor which helps little in patients' comfort and health.

Tan Pin Ho

How could SGH have afforded to build a shiny new hospital campus without scamming money that way?

Lim Gee Wee is an idiot.Can't claim vehicle repair cost because the other driver did not report the accident?

You die, your business!

Forum: Unsuccessful motor insurance claim because other party did not report accident

JAN 1, 2022

Lim Gee Wee

Cant he afford a lawyer?

Joke copied from Reddit

chrimminimalistic

·3 days ago

Criteria for a partner: Taller than 1.63m, $8,000 monthly salary

"Harlow madam, I found one suitor. The good thing is, He exceed 25% on one of your criteria but only hits half of the other."

"Ha? You mean he's 2m tall but only $4000 salary?"

"No, ma'am. His salary is $10,000."

chrimminimalistic

·3 days ago

Criteria for a partner: Taller than 1.63m, $8,000 monthly salary

"Harlow madam, I found one suitor. The good thing is, He exceed 25% on one of your criteria but only hits half of the other."

"Ha? You mean he's 2m tall but only $4000 salary?"

"No, ma'am. His salary is $10,000."

Can't claim vehicle repair cost because the other driver did not report the accident?

You die, your business!

Forum: Unsuccessful motor insurance claim because other party did not report accident

JAN 1, 2022

My car was hit from behind by another car, and the accident was recorded by my in-vehicle camera. I made an accident report and a third-party claim.

Despite having video evidence that the accident had been caused by the other party, my third-party claim was unsuccessful because the other party did not make an accident report.

Even after reminder letters were sent, the other party refused to report the accident. Reminders with no legal consequences seem ineffective.

Engaging a lawyer to sue the other party is an option but this may be more costly than the repair work.

This leaves me with only the option of making a claim on my own insurance. This would affect my insurance premiums and my no-claims discount.

Searching online, I have found many others caught in the same predicament and feeling helpless.

It does not make sense to me that those who cause accidents with no injuries can get away scot-free by not reporting the accident.

The General Insurance Association of Singapore has published a set of guidelines on its website on what should be done in this scenario. However, these have no legal weight.

It is time to fix this motor insurance loophole.

Lim Gee Wee

Always feign injury so that reporting becomes a legal requirement.

Forum: Hospital could have helped patient's family with vaccine injury aid programme

JAN 12, 2022

I refer to the article, "296 qualified for govt financial aid due to serious side effects" (Jan 8).

My mother was hospitalised with a blood clot and skin problems from Sept 13 to 20 last year, three days after she received her second dose of the Covid-19 vaccination. She is still receiving treatment.

The family was told that this may have been caused by her vaccination.

When I received the bill, I e-mailed the hospital in October asking if my mother could be compensated under the Vaccine Injury Financial Assistance Programme (Vifap).

Despite a reminder sent in November, I have to date not received a response from the hospital.

The hospital could at least have directed me to the correct authority to make my claim.

Janis Goh

If my uncle is right this kind of case is the other party will need to absorb the cost incurred by the suing party after the court session as this is a guaranteed win case.Even after reminder letters were sent, the other party refused to report the accident. Reminders with no legal consequences seem ineffective.

Engaging a lawyer to sue the other party is an option but this may be more costly than the repair work.

My uncle encountered this kind of case before. The solution is to call a taxi. He said until so serious means the surgeon would have already activated the public ambulance and he can even wait for 40mins means he is fit to take a taxi for sure.My daughter and I had to wait about 40 agonising minutes for me to be transported by a private ambulance. The five-minute trip from NDCS to the A&E cost $250.

If got evidence by means of photo or in this case, video, the cops should be able to validate who was at fault, summon the other driver for not reporting and causing the accident and insurance company can claim ftom the other car for the accident.Can't claim vehicle repair cost because the other driver did not report the accident?

You die, your business!

Forum: Unsuccessful motor insurance claim because other party did not report accident

JAN 1, 2022

My car was hit from behind by another car, and the accident was recorded by my in-vehicle camera. I made an accident report and a third-party claim.

Despite having video evidence that the accident had been caused by the other party, my third-party claim was unsuccessful because the other party did not make an accident report.

Even after reminder letters were sent, the other party refused to report the accident. Reminders with no legal consequences seem ineffective.

Engaging a lawyer to sue the other party is an option but this may be more costly than the repair work.

This leaves me with only the option of making a claim on my own insurance. This would affect my insurance premiums and my no-claims discount.

Searching online, I have found many others caught in the same predicament and feeling helpless.

It does not make sense to me that those who cause accidents with no injuries can get away scot-free by not reporting the accident.

The General Insurance Association of Singapore has published a set of guidelines on its website on what should be done in this scenario. However, these have no legal weight.

It is time to fix this motor insurance loophole.

Lim Gee Wee

I dunno why they did not do so.

Only 112 out of 2,200 coffee shops and canteens allow groups of up to 5 to dine in

Diners at 206 Management Food Court in Toa Payoh on Jan 14, 2022. The coffee shop allows dining for only two people. ST PHOTO: THADDEUS ANG

Adeline Tan

Jan 14, 2022

SINGAPORE - Even though 2,200 coffee shops and canteens in Singapore can allow up to five fully vaccinated customers to dine in a group, only 112 of them, or about 5 per cent, choose to do so.

Coffee shop associations and stallholders said on Friday (Jan 14) that they are put off by the high cost of implementing vaccination status checks, which can cost them at least a few thousand dollars each month.

In contrast, almost all of the 110 hawker centres managed by the National Environment Agency (NEA) or NEA-appointed operators allow groups of up to five people to eat together. Hawkers do not have to foot the cost of implementing such checks as it is borne by the Government.

Logistical challenges, such as having to consider the layout of the coffee shop when cordoning off certain areas, are another obstacle.

Since Nov 23, coffee shops with the necessary control measures can allow groups of up to five fully vaccinated people to dine in.

To do so, they must control access by cordoning off areas and have dedicated entry points. At these entry points, they must check the vaccination status of all patrons, and differentiate those who are fully vaccinated and are dining in.

They also have to put up posters informing diners that only fully vaccinated people can dine in groups of up to five.

Mr Hong Poh Hin, vice-chairman of the Foochow Coffee Restaurant and Bar Merchants Association, said many of the larger coffee shops have indoor and outdoor seating areas usually separated by a corridor or a walkway, which is also used by residents in the neighbourhood.

As coffee shops are not allowed to seal off these common areas, they must cordon off their indoor and outdoor areas separately, and station someone at each of these entrances. Hiring one person would cost them about $2,000 a month.

Mr Hong said: "Some of the coffee shop operators would want to pass on some of the cost to their stallholders. But not all stallholders would agree because the zi char stalls would benefit the most from larger groups."

But these larger groups, such as families, tend to patronise the coffee shops only on weekends. Many operators feel that the uptick in business does not justify the additional cost, Mr Hong said.

His association represents about 400 coffee shops.

For coffee shops with very popular stalls, barricading the indoor seating area would also be difficult as queues for such stalls can sometimes extend beyond the area.

Mr Kenneth Lee, vice-chairman of Kheng Keow Coffee Merchants Restaurant and Bar Owners Association, said: "Covid-19 is not something that will last for a month or two. We don't know when the pandemic is going to end. So in the long run, all these extra costs will add to our operating expenses.

"Sooner or later, the operators and stallholders will not be able to absorb them and we will have to pass them down to consumers."

Coffee shops also run the risk of getting fined or suspended if safe management measures are breached. Enforcement action may be taken against diners or operators, or both.

A sign stating that only two people are allowed to dine in at Kim San Leng coffee shop in Tampines. ST PHOTO: SAMUEL ANG

With the additional cost being too much to bear, most operators have decided to wait and see if they can hold out, said Mr Lee.

But coffee shops that stick to allowing dining for only two people also have to grapple with slower business, with diners preferring to go to eateries where they can sit in larger groups.

Ms Hasria Hashim, who sells Malay food at Kim San Leng coffee shop in Tampines, said she has seen a 40 per cent drop in customers compared with when larger groups were allowed.

Ms Hasria Hashim and her partner at their stall. ST PHOTO: SAMUEL ANG

Competition is tough as there are other coffee shops, and the nearby Tampines Round Market and Food Centre allows groups of five to sit together, she said.

"We felt that it is unfair because not all coffee shops have the manpower. Many people are vaccinated, so I don't see an issue with our coffee shop allowing five people to dine in together."

Some stallholders also have to remind patrons to abide by the rules.

Ms Huang Ya Dong, a drink stall assistant at a coffee shop in Toa Payoh, said she has come across unhappy and difficult customers who do not want to follow the rules.

"There are some difficult customers who would tell us, 'Do you expect me to sit on the floor?' when we ask them to seat no more than two per table. We usually have to explain the regulations to them again, mention the fines they would incur, and take photos of them if needed."

Diners at Hai Fong coffee shop in Toa Payoh on Jan 14, 2022. The coffee shop allows dining for only two people. ST PHOTO: THADDEUS ANG

The Singapore Food Agency said that private operators, coffee shops and canteen operators can decide if they want to implement the required measures to allow larger groups to dine in, but noted that some may not choose to do so due to difficulties.

It added that it will continue to assist coffee shops and canteens when required, such as by giving advice to operators who are unsure of how to implement the measures.

Forum: Scammed of $100,000, but fault is not mine alone

JAN 15, 2022

I am Siti, a mother of seven wonderful children. A wife to a caring educator. And a victim of the recent scam targeting OCBC Bank customers.

On Dec 28 last year, at 11.47am, I received an SMS which looked very much like the other ones I have received from the OCBC SMS system, which read: "The transaction function of your OCBC account will be suspended. To prevent the account from being locked out, update it on December 28. Access bit.Iy/3q****."

At that time, I was occupied with my children and did not act upon it. At 2pm, I reread the SMS and followed the instructions and clicked on the link. It brought me to an authentic-looking site with the OCBC name.

As I was anxious about the account being suspended and I had some transactions to make to my children's accounts later in the day, I did not think further, and keyed in my username and password and other relevant details and checked into my account.

A few moments later, I received a notification stating that my transfer limit had been increased to $100,000. When I noticed that, I immediately called OCBC as I had not approved this.

However, OCBC's hotline is not equipped to immediately handle scams which are in progress.

I had to navigate an automated system for a long time before reaching a person.

By this wasted time, I had already received multiple notifications stating that monies were transferred out of my savings accounts and six of my children's savings accounts.

In just a few minutes, almost $100,000 was gone.

We have since made a police report but we have been told that even though accounts are insured by up to $50,000, we are unlikely to have any of our funds returned to us as it was my mistake for clicking on the link.

How can the blame be pinned entirely on me when OCBC's scam prevention measures are poorly equipped to urgently deal with a case as it is happening?

Siti Raudhah Mohd Ali

Australian Woman’s Fight to Prove Singapore Fraud

Harassed and vilified by unknown parties, she continues to press case despite bank’s explanations

| John Berthelsen

|

For six years, an Australian woman named Julie O’Connor (above) has vainly been tilting against the Singapore establishment in an effort to raise claims of fraud and what she calls a cover-up by powerful people over the acquisition of the Singapore and Vietnam assets of an Australia-based firm, Strategic Marine Pty Ltd. She alleges her husband Terry O'Connor, a shareholder, was thwarted in his attempts to acquire a controlling interest via pre-emptive rights he possessed.

For her efforts, O’Connor says she has been vilified on social media, publicly referred to online as a cockroach, obese, her photographs have been doctored into news articles which falsely showed her family members as being convicted pedophiles, all while she says she has otherwise been ignored by Singapore officials, all of whom repeatedly argue that evidence of any crime in Singapore is lacking.

Facebook attack

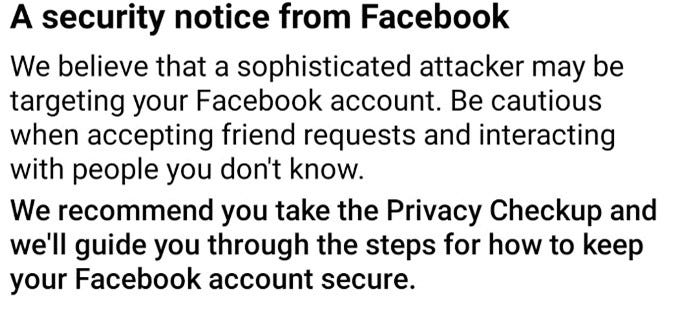

O’Connor says she has recently been notified by Facebook (below) that she has been targeted by sophisticated spyware not normally used by individuals but rather intrusive states, along with several other Singaporeans at odds with authorities including independent journalists Terry Xu and Kirsten Han and others. There is no indication of where the attacks are coming from.

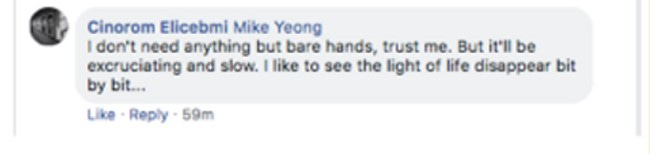

Attempts also have been made to hack O’Connor’s website, www.bankingonthetruth.com, and intimidating messages have been posted threatening that someone would fly to Australia to kill her, as the screenshots below show.

As far as O’Connor knows, these online attacks/emails have never been investigated by Singapore police, even though some have been sent to her husband and daughter at their place of work. Senior figures from DBS, Singapore Police, and the Singapore Government were copied in, she says.

O’Connor has bombarded DBS Bank, Southeast Asia’s and Singapore’s largest in terms of assets, with emails and letters and has sought help from Marcus Lim, manager of the DBS account for the Monetary Authority of Singapore, Tharman Shanmugaratnam, a Senior PAP minister and chairman of the MAS, Lucien Wong, Singapore’s attorney general, K Shanmugam, the Singapore law minister, and Prime Minister Lee Hsien Loong himself, to no avail.

Enquiries by Asia Sentinel to the Monetary Authority of Singapore, the Ministry of Law, and other agencies were met with minimal comment. A spokeswoman for the MAS said ‘MAS takes all allegations of fraud seriously, and had responded to Ms. O’Connor earlier and followed up on her concerns. Our engagements with members of the public and financial institutions are confidential, and the details of such interactions are not shared with third parties.”

The office of Prime Minister Lee Hsien Loong told Asia Sentinel by email that the office has “corresponded directly with Ms. Julie O’Connor regarding her allegations, and will continue to engage her as necessary. We will not be commenting further on the matter, or responding to the questions you have posed, as it is inappropriate for us to discuss such matters with third parties.”

Allegations against tycoon

O’Connor’s allegations involve Lionel Lee Chye Tek, who at the time was managing director of Ezra Holdings and chairman of its subsidiary Triyards, which were involved in offshore services, ship construction, global offshore, and marine industries. The group at that time was aiming to consolidate its position as one of the largest offshore services players in the Asia-Pacific region and was, at that point, darling on the Stock Exchange of Singapore

Lionel Lee was alleged by others to have caused four forged signatures to be affixed to legal documents on behalf of a no-longer-operating Bahamas company, documents which related to Strategic Marine, the firm Lionel Lee’s company was attempting to acquire. An associate of Lee, the then-CEO of KTL Global, Tan Kheng Yeow, was allegedly enlisted to enter into an irrevocable option deed to acquire power of attorney for the company. O’Connor charged that was an attempt to defraud her husband by persuading him his claim was worthless and that he should sell his 4 percent shareholding for A$1.

After Lee’s initial attempt to acquire Strategic Marine through Tan – for A$7 – was frustrated due to allegations of forgery, DBS would enter the arena. At issue with DBS, she said, were two letters purportedly from bank officials that were used to downgrade Strategic Marine’s week-old independent valuation by A$30-40 million and retroactively strip away O’Connor’s exercised pre-emptive right, prior to Lee’s attempt to acquire the firm for just A$1.265 million. A request to the DBS law firm Wong Partnership to explain the valuation downgrade was not answered.

DBS’s legal staff, O’Connor alleged, was asked by Australian legal firm Minter Ellison to authenticate the two letters, which she displayed for Asia Sentinel and which she describes as littered with errors or irregularities that banks aren’t supposed to make, including lack of a bank address on the stationery, absence of reference, and missing or duplicate bullet points. After eight weeks, she says, during which time Lee completed the acquisition, DBS refused to authenticate the letters, citing banking secrecy obligations.

DBS, through Wong Partnership, says its investigations “confirmed that the two letters in question are authentic and originated from our clients. Further, the results of these investigations were provided to Mr. & Mrs. O’Connor on previous occasions and that the O’Connors refused to accept the findings.”

Lee, acting on behalf of Triyards, ultimately acquired the Strategic Marine assets despite the Triyards Board’s awareness of O’Connor’s husband’s exercise of his pre-emptive right, the O’Connors charge. Lee at the time was represented by the high-profile Singapore law firm Allen & Gledhill, which was headed by the current Attorney General Lucien Wong. Lee's personal lawyer was said to be Edwin Tong, now Singapore’s second law minister.

Lee empire capsizes

Lee’s own empire was headed for a figurative iceberg. KGI Securities Singapore analyst Joel Ng in a research note wrote that Ezra Holdings had been reporting negative free cash flows in the previous 10 years, even when oil prices were above US$100 a barrel.

"Ezra leveraged up too much during the oil boom years, and the low oil price environment over the past two years dealt the final blow," he wrote, adding that the group's persistently weak free cash flows had resulted in a "highly unsustainable" balance sheet.

"Ezra basically wanted to compete against its peers funded with debt rather than equity. I would say it was blinded by its ambition and the fact that credit was readily available during that time," Ng said.

Study highlights mismanagement

According to an exhaustive, five-part analysis of Ezra Holdings and its subsidiaries by National University of Singapore Professor Mak Yuen Teen, titled EZRA and the Tri-tanic: “Based purely on public information, there were arguably failure to disclose material information on a timely basis, false or misleading disclosures, failure to disclose interests in transactions, insider trading, and failure to discharge directors’ duties.”

There were other questions, Mak wrote, “whether contract wins announced by the companies and the secondary listing of EOL just 15 months before it started reporting quarterly losses lured investors into buying notes, convertible bonds, and shares of the companies.”

Mak, in an email, said he was aware of O’Connor’s objections and said there was good cause to investigate them. Lim Tean, a lawyer and founder of the opposition People’s Voice political party, said O’Connor’s allegations are well known in the opposition political community and bear looking into.

Lee Unreachable

Attempts by Asia Sentinel to reach Lee through an associate got no response. By one report, he has moved to Thailand although that has not been verified.

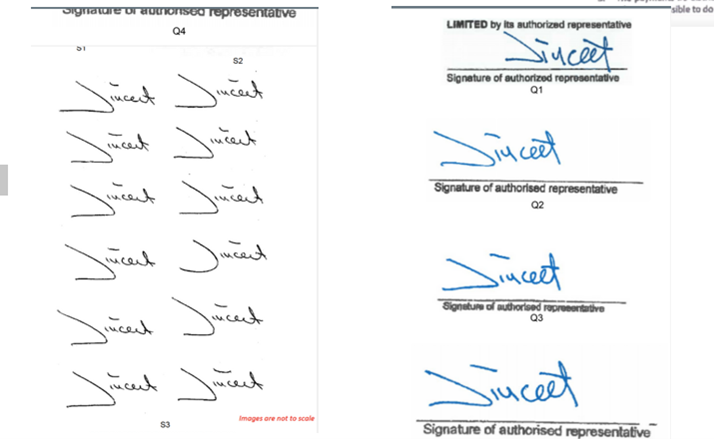

Having paid more than A$300,000 for the shareholding only to be told all other SM shareholders had agreed to sell their shares to Lee’s acquaintance Tan for $1, O’Connor says she became suspicious and began digging. She says she found evidence of four forged signatures on Strategic Marine documents. A handwriting expert hired by the O’Connors analyzed the alleged forged signatures below. The supposedly actual signatures are on the left and alleged forged signatures are on the right. Vincent Lau told the O’Connors he hadn’t signed the documents.

O’Connor possesses a sworn statement from Vincent Lau that he had never seen, signed nor authorized anyone to use his signatures on documents, on behalf of the Bahamas entity which had been wound up 18 months before.

Furious DBS response

DBS Bank answered Asia Sentinel’s queries about the matter with a bristling letter from Wong Partnership, in which the law firm, which represents the bank, demanded that Asia Sentinel repeat the law firm’s letter verbatim in its story and reserved the right to sue.

O’Connor, the letter said, has not been ignored and the couple have raised the matters repeatedly with them. The central issue, according to the law firm, “pertains to the authenticity of the two letters, and investigations confirmed the letters are authentic. The contemporaneous record shows the circumstances under which these letters were sent fully justified their existence. There is no evidence of wrongdoing on the part of DBS or its employees.”

The bank, according to the law firm, “had constantly engaged with Mrs. O’Connor as well as Mr. O’Connor and other third parties. It is unfortunate that Mrs. O’Connor has since been attempting an ex post facto criticism of our client’s investigations as she has simply refused to accept any of the conclusions. Our client, therefore, saw no further purposes in continuing to engage with her.”

Bank refuses further response

A follow-up email with more questions elicited the response that “Unless you are able to furnish any new and relevant information and/or documents to substantiate the allegations made in your emails of 10 December 2021 and 24 December 2021, our clients do not see any purpose in further engaging with you.” It added that Mrs. O’Connor had acted with malice, which seems far-fetched but in legal terms would appear to be preparation for a lawsuit.

O’Connor’s crusade may or may not be valid. The documents show irregularities although even banks could commit errors. At the very least, there is no reason those irregularities and the many other serious concerns she raises shouldn’t be explained by DBS, the Singapore regulators, and legal bodies.

As she says, “Who is being protected and why?” she asked. “Is it Lee, DBS, Allen & Gledhill, the regulators who failed to act, the Audit Committee who stood down and not up? Who failed to look out for the Ezra Holdings and Triyards shareholders?”

Forum: Legal route expensive even if successful

Jan 18, 2022

My husband and I found that the used car he bought had had its odometer tampered with.

When we reached out for help, the Land Transport Authority said it was not a road-related matter, and the Traffic Police did not respond.

We won a verdict of negligent fraud against the car dealer for tampering with the odometer, yet found ourselves unable to receive any form of compensation without first footing a legal bill that would cost more than the compensatory value of the car. Four years on, we eventually scrapped the car.

Civilians cannot do the job of reining in the cheats that linger in our midst via exorbitant legal means. I urge the Traffic Police to take a firm stand against motor-related fraudulent actions of all kinds.

Eva Wong

Forum: No way to recall funds after job scam

JAN 24, 2022

I am an undergraduate and a victim of a job scam.

During my recent year-end school holidays, I found out via Telegram about an online job with flexible working time. The job required me to "click and submit orders". I also had to top up my account with my own money to complete "missions" before I could retrieve all my commissions and top-ups.

On the first day I managed to get all my top-ups, including the commission. The next day, I realised that the amounts needed for the top-ups were increasing.

I then contacted the "agent" about this and was told to ask for a refund from the "customer service".

I lodged a police report an hour after failing to get a refund. The police told me I would get a preliminary update within seven working days.

I also tried calling my bank, OCBC Bank, to report the scam and ask for a recall of the funds transferred via PayNow.

I couldn't get through after several attempts, and tried again the next day. I had to navigate the hotline for a long time before talking to a person.

I submitted the police report to OCBC, which said it would cooperate with the police. The police told me it is very unlikely that I will get my money back.

I lost $9,000 in a few hours. I have heard that many other students fell prey to such job scams during the holidays.

Early this month, OCBC sent a letter saying that my fund recall was unsuccessful. OCBC also said that the recipient of the funds will have to permit the fund recall for my request to be successful.

With the prevalence of e-payment methods these days, it is possible to make mistakes when transferring funds.

In such cases, does it mean it depends entirely on the recipient to decide whether one gets his money back, even when a police report is lodged?

What, then, is the role of the police in such cases?

Yap Yong Xian

Because of the lack of consumer protection. Singkieland is a haven for cheats n crooks

Forum: Airlines can do more to help when border rules change

Jan 26, 2022

Travelling during the Covid-19 pandemic is challenging, as one has to grapple with, among other things, documents, insurance and border restrictions.

It does not help when airlines do not address booking issues.

In mid-December, I booked a flight to Western Australia for Feb 5 on Scoot.

However, the state's border restrictions changed recently, closing it off to non-Australians.

I have tried calling and e-mailing Scoot to ask for a refund but its phone line is always busy. I have been on hold for more than an hour, with no success.

I have filled up online forms, but, apart from an automated acknowledgement, there has been no reply to date.

Singapore Airlines has announced that all eligible passengers affected by the new border restrictions can have their tickets refunded if they wish.

I hope Scoot, which operates under the umbrella of Singapore Airlines Group, can uphold the image of the group and improve service standards.

Anita Thaver

that is the setback of technology, too much of anything is a bad thing,

scammers if caught, 24 strokes mandatory, will solve the problem to a certain extend

scammers if caught, 24 strokes mandatory, will solve the problem to a certain extend

Similar threads

- Replies

- 6

- Views

- 126

- Replies

- 1

- Views

- 212

- Replies

- 0

- Views

- 395

- Replies

- 0

- Views

- 391