USD500M of SIA 3.0% bonds.

I want to enquire if the acclaimed US$2.85B demand is just fake news, since dunno if have a minimum bid for the bonds (e.g. what if most of the bids were too ridiculously/ meaninglessly low, like 10-20¢ only?).

Obviously SIA overestimated the demand for its bonds, that is why they priced the interest rate unattractive low, resulting in lack luster response in terms of price bid (e.g. the cut off threshold to own the bond came in at below $1, which means that investors value the SIA bond at below the value that SIA priced them).

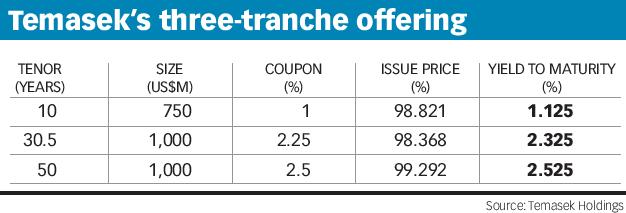

If the interest rate were sufficient, then successful people would have all bid more than $1 for the $1 par value bond (just like mkt is today paying $1.06 for the Temasek 2.7% 231025XB bond now). As it is, now the USD SIA bond will end up beginning trading BELOW par value (IPO at 99.573¢ (or 99.573% of par value according to BT report)) , which is a negative publicity for the airline concerned.

And I just wonder if people are allowed to say bid 10 or maybe 50¢ for this bond, since adding such very very low ball bids and then saying that the auction was oversubscribed is just pure nonsense, since I too can easily place a humongous sized bid at say fractions of 1¢ a piece, just with some spare change in my pocket.

TLDR: There was actually lackluster demand for SIA USD denominated $500M worth of SIA bonds as evidenced by fact that they were issued below par value.

Correct?

https://www.businesstimes.com.sg/co...us500m-in-oversubscribed-us-dollar-debt-debut

I want to enquire if the acclaimed US$2.85B demand is just fake news, since dunno if have a minimum bid for the bonds (e.g. what if most of the bids were too ridiculously/ meaninglessly low, like 10-20¢ only?).

Obviously SIA overestimated the demand for its bonds, that is why they priced the interest rate unattractive low, resulting in lack luster response in terms of price bid (e.g. the cut off threshold to own the bond came in at below $1, which means that investors value the SIA bond at below the value that SIA priced them).

If the interest rate were sufficient, then successful people would have all bid more than $1 for the $1 par value bond (just like mkt is today paying $1.06 for the Temasek 2.7% 231025XB bond now). As it is, now the USD SIA bond will end up beginning trading BELOW par value (IPO at 99.573¢ (or 99.573% of par value according to BT report)) , which is a negative publicity for the airline concerned.

And I just wonder if people are allowed to say bid 10 or maybe 50¢ for this bond, since adding such very very low ball bids and then saying that the auction was oversubscribed is just pure nonsense, since I too can easily place a humongous sized bid at say fractions of 1¢ a piece, just with some spare change in my pocket.

TLDR: There was actually lackluster demand for SIA USD denominated $500M worth of SIA bonds as evidenced by fact that they were issued below par value.

Correct?

https://www.businesstimes.com.sg/co...us500m-in-oversubscribed-us-dollar-debt-debut